Fraud. It is omnipresent and everchanging. Rising to an unstoppable force, we can only slow it, not eliminate it.

“It cannot get worse”, we say. And yet it does. Becoming more elusive. Invading every facet of our lives. And mutating faster and faster.

Welcome to 2024, folks – The Year of “Fraud At Full Throttle“ ⚡??

So buckle up and focus; it could be a wild ride.

What Can We Expect In 2024? The Fraud Compadres Unite Yet Again To Imagine It

My fraud-fighting friends, Mary Ann Miller and Karrisse Hendrik, and I mind-meld each year to imagine the year ahead.

A flurry of text and Zoom calls goes on for weeks. Out of that process, we create ten predictions we think will come true in the next 12 months (or perhaps beyond).

You can find our predictions for 2018 , 2019 , 2020 , 2021 , 2022 , 2023 right here.

We hope you enjoy The Fraud Compadres predictions for 2024 and beyond. ?

But First, A Look Back At 2023. It’s Shocking, But We’re Not Shocked

A billion record breach here, a billion record breach there, it’s commonplace. Another startup unicorn dissolves into a mound of fraud rubble. A friend loses their life savings in a scam. It’s shocking, but we’re not shocked. The chaos of fraud has seemingly become routine for us.

Is it a war we are winning? Regrettably no. As the Head of Fraud for CBA says, it’s just an “arms race” at this point, pitting fraud fighters against fraud doers.

And 2023 was another year of whopping frauds, unbridled scams, and the emergence of tech that changed everything.

And here is what we saw;

In 2023, ChatGPT Opened A Pandora’s Box Never To Be Closed

Suddenly, we entered the Age of AI, and the rule book changed. ChatGPT launched, and it was off to the races.

New powerful AI available to anyone with an internet connection gave fraudsters more powerful tools than most fraudfighters. And now, we had to rethink everything we knew about controlling fraud.

It was the year of deepfake everything causing much fear in the public imagination. From voice cloning to deepfake videos and imposter scams to flawless catfishing.

It’s a world fraud fighters never thought would happen in their lifetime.

In 2023, The Bubble Burst Exposing Massive Founder Frauds

The Fed raised interest rates eleven times, drying up all that easy money for startups. But, unlike the last time the Fed jacked up rates in 2008, there wasn’t a mortgage crisis that tanked the economy, but another crisis – the founder fraud crisis.

Founder fraud from startups like FTX, Frank, Nikola, Centricity, OzyMedia, Slync, Rumby, and Tingo all left investors reeling from the audacity and blatant fraud that happened under their noses. $12 billion in losses from these cases alone.

In 2023, A First Party Fraud Awakening Began

First-Party Fraud is fraud.

How long have fraud fighters been saying it? This year, big companies, law enforcement, and big banks started making bold strikes against fraudsters masquerading as “customers.” Professional refunders, money mules, fake account creators – all were in the crosshairs as big companies struck back. We no longer have to assume these fraudsters won’t have consequences for their actions.

In 2023 Scams and Checks Doubled Down

When the dust settles in 2023, check fraud will have doubled, and scam losses (since banks are refunding more with liability shifts) will likely have doubled too. It’s a confounding problem for banks – how do you control fraud that starts with the customer?

Customers actually write most fraudulent checks (but they are altered by criminals). And customers actually send the fraudsters money (but they are fooled by criminals). To make matters worse, an aging population is more likely to succumb to these types of fraud.

In 2023, Data Breaches and Ransomware Smashed Every Record

Ransomware is a national crisis, disabling big companies for days and weeks while causing countless losses. The collateral damage? The people and the data those companies keep. While most instances don’t make front-page headlines like the MGM crisis did, ransomware reports will exceed 4,000 in 2023, eclipsing the 2,670 reports last year.

And data breaches? Those will likely hit over 2,800 for the year, dwarfing the 1,800 reported last year.

The massive amounts of data obtained from data breaches & ransomware attacks fuel the fraud fire that we, as fraud fighters, try to extinguish with the tools we do have.

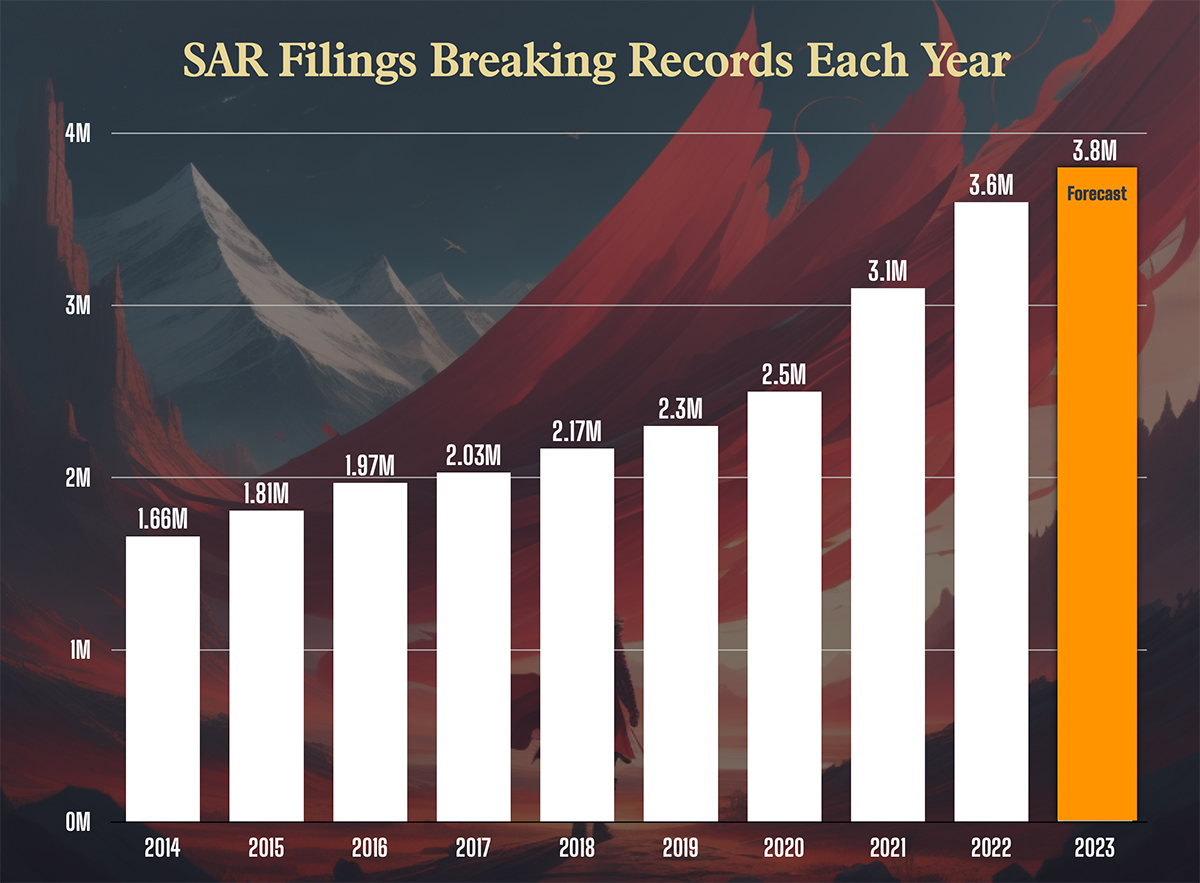

In 2023, SAR Filings Will Have Hit Historical Highs

SAR filings paint the picture of the rise in fraud. While they aren’t one and the same, they go hand-in-hand, like oxygen and heat.

This year, filings will have increased by 65% since the pandemic. The cause? Stimulus fraud, pig butchering, romance scams, elder abuse, and check fraud.

So, how will these trends impact us in 2024? Let’s get to that now.

Prediction #1 – A Wave Of Inny Fraud Is Revealed

In 2024, a new wave of “Inny” perpetrated fraud will be realized at banks, lenders, telecom providers, online retailers, and shippers. The word “Inny” has been popularized on social media fraud forums to sell insider access to do everything.

From sim swapping at phone stores to facilitating professional refunding syndicates at online merchants to cashing fraudulent checks at the teller window. Inny fraud is a hidden crisis that will manifest itself this year.

The recruiting of insiders has been steadily growing due to the booming secondary market for their services on Telegram and social media.

And most insiders are in low-paying roles within large companies, lacking loyalty and financial stability.

Prediction #2 – Scam Reimbursement Kicks Off First Party Fraud Bonanza

Last month, the UK took bold steps to reimburse victims of APP scams by compelling banks to reimburse them for up to £415,000. Unless the customer is grossly negligent or vulnerable, 99% of claims will be paid minus a small £100 holdback.

In the US, Zelle announced in June that banks would also begin reimbursing imposter scam victims.

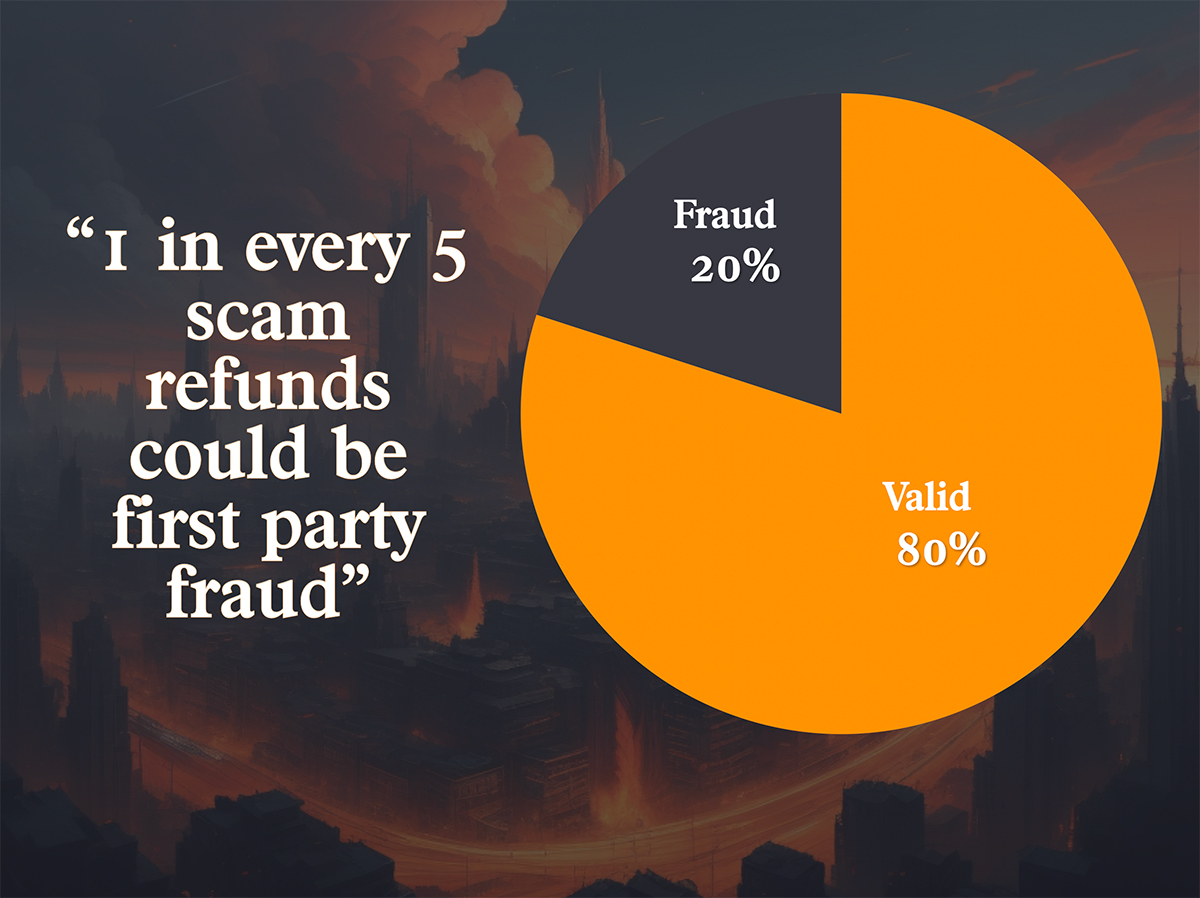

This year, fraudsters will take advantage of more consumer-friendly scam refunds by collaborating with account holders to file false claims and split the proceeds.

We can also expect buyer’s remorse to tempt consumers to claim victimhood to a scam when they were not coerced or conned into authorized push-payment scams. This is not fantasy. These are reportedly already happening today.

To understand the level of first-party fraud, you only need to look at credit card claims, where Visa says 20% to 30% of claims are friendly fraud perpetrated by customers.

If it is even close to this rate, scam refunds will certainly be a first-party fraud bonanza.

Prediction #3 – Digital Doppelgangers, Ransom, and Extortion

It wouldn’t be 2024 without a prediction about the impact of AI and deepfakes. And we believe these two things are in store for the year.

#1 True MultiModal AI Cloning Models Give Rise To Digital Doppelgangers

Multimodal AI cloning models will emerge for voice and real-time video over the next 12-15 months. This means that combined real-time deep fake video and voice cloning will become a reality. These won’t be those manipulated talking photos Nigerian romance scammers use; they will be true cloned videos and voices.

With this technology, every person could have a nearly identical digital doppelganger giving impersonation scammers the ultimate tool for video catfishing or other payment scams.

#2 AI Extortion and Ransom Scams Proliferate

Deepfake nudes and AI voice cloning will result in a rapid increase in extortion and ransom scams. These are already occurring infrequently but will quickly accelerate dramatically in 2024. These AI clones may even be fuel to the fire of disturbing “cyber kidnapping” scams that are starting to take root here in the US.

We may not be ready for this new wave of deeply sophisticated scams.

Prediction #4 – Zombie Offices Expose Massive Commercial Real Estate Fraud

Remember the mortgage fraud crisis of 2008? As interest rates rose, property values collapsed and all that fraud was exposed. The main culprits? People lied about their income, and the property values were wildly overinflated by appraisers.

There is no question that a financial crisis is looming for commercial real estate. Approximately 14% of properties are underwater, and experts predict that 20% of commercial properties could soon default.

This year, we will likely see a commercial real estate fraud crisis emerge, which will be eerily similar to what we saw in 2008 in residential lending. The culprit this time? Inflated income claims from commercial properties and massively inflated collateral.

Prediction # 5 – A Big Account Purge Hits Full Stride

The US has a big hangover from the pandemic – bad customers and outright first-party fraudsters that infiltrated the financial system. And it’s time for a purge.

This includes:

- Synthetics (Socure says up to 3% of bank accounts are).

- Fake Accounts (E-commerce and Fintechs like CashApp have millions)

- Money Mules (Biocatch says 2 million have bank accounts)

- Exploiters (Navy Fed reportedly closed 50,000 last month)

And let’s not forget about all those exploitative credit repair fraud schemes like authorized tradeline abuse, credit washing, use of zombie tradelines, and use of CPN’s. That abuse has permeated every aspect of lending and finance.

We predict 2024 will be a year that some companies purge their portfolios of risk. This will include a big cleanup of their existing customers to root out mules, synthetics, and exploiters. Those accounts will be closed en masse.

There are reports that this has already begun with credit unions like Navy Fed, which reportedly closed 50,000 account exploiters.

But that will not be it entirely. Expect banks to take a harder line in rejecting high-risk customers during originations.

However, let’s not fool ourselves. We know that not all companies will purge accounts. Those who could experience a consequence for leaving open such large amounts of fake accounts (like a credit union or bank) may elect to proactively close these accounts to avoid future losses on their books (once these accounts were sold and/or actioned upon).

But, there will also be many companies that will elect to leave these “zombie” accounts open for fear of losing out on the customer counts that might have been helping to keep the valuations high.

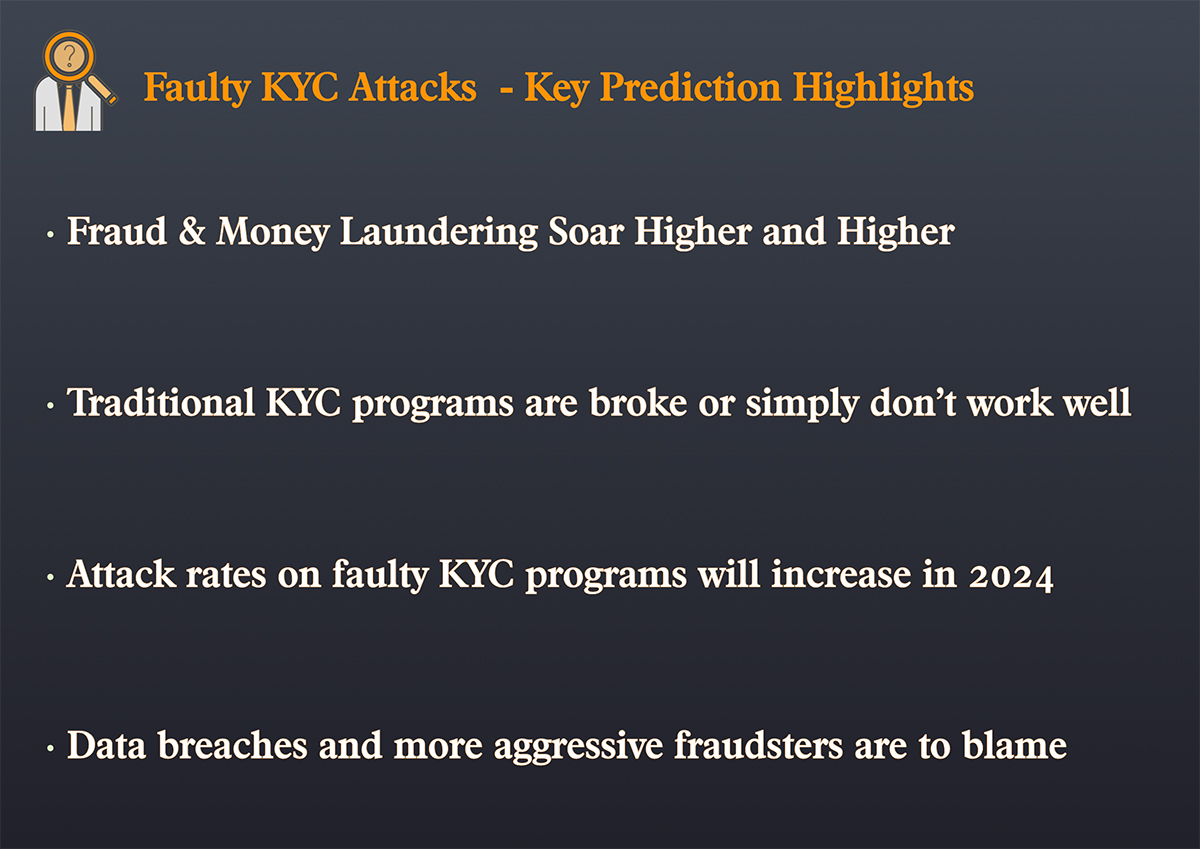

#6 – Faulty KYC Will Strain As Attack Rates Increase

Traditional KYC processes are broken or, in many cases, don’t work.

Criminals still launder an estimated $300 billion here in the US and $2 trillion globally. Identity theft is still rampant, with over $43 billion in annual losses. TransUnion reports that synthetic identity has hit an all-time high this year. And giants like Binance have been able to operate filing zero SAR’s and opening accounts with virtually no KYC program whatsoever.

In 2024, these fragile KYC processes will be further strained. We expect higher attack rates on companies in every sector, including finance, banking, marketplaces, social media platforms, and e-commerce.

The culprits for this attack? 1) Accelerating data breaches (virtually every single person’s data is for sale now, 2) the millions of new fraudsters on social media (they are hell-bent on exploiting any KYC hole they can find, and 3) Many KYC tools are not as effective as they used to be since fraudsters can outsmart them.

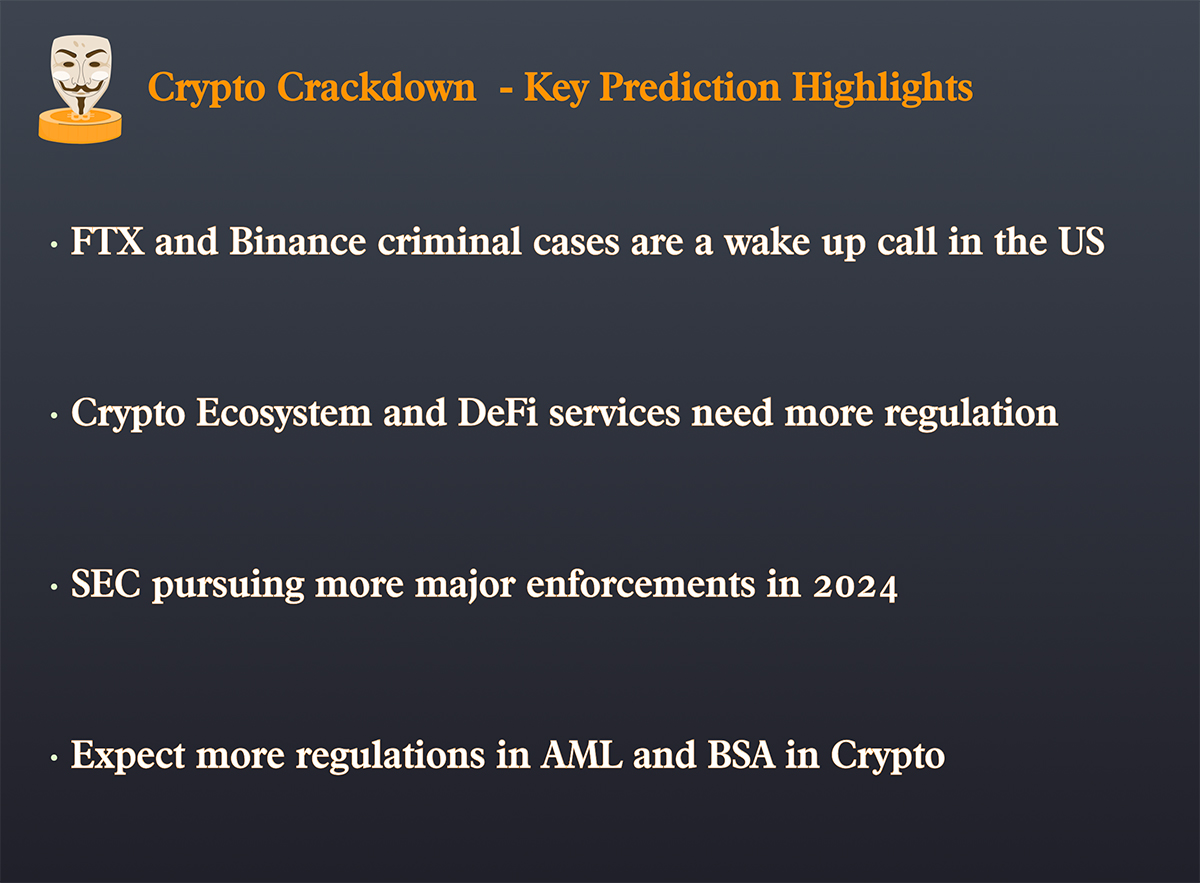

Prediction # 7 – Crypto Crackdown Heats Up

Crypto is under fire, and a political storm is brewing. Nineteen countries have banned it, and even Jaime Dimon says he would ban it if he had his way.

Industry heavyweights like Changpeng Zhao of Binance are headed to jail for blatantly ignoring US laws. Even for companies that seem to follow the few US regulations that exist for crypto right now, there is simply too much fraud, crime, and money laundering for it to remain a mainstream currency.

According to Mary Ann Miller, things are going to change quickly. “Regulators will begin to put legislation in place to further hold the Crypto ecosystem legally to BSA and AML rules and requirements,” she says. “Some of this has been expected, but recent events will push this to reality in 2024.”

The SEC, in particular, will be very busy driving forward with enforcement actions against Kraken, Binance, and Coinbase. Each of these will be a wake-up call for the government to push the crypto ecosystem to adopt stronger and clearer regulations.

But, because many existing crypto companies have benefited from little oversight and regulations over the last several years, we may see the overall use of crypto in the US recede greatly.

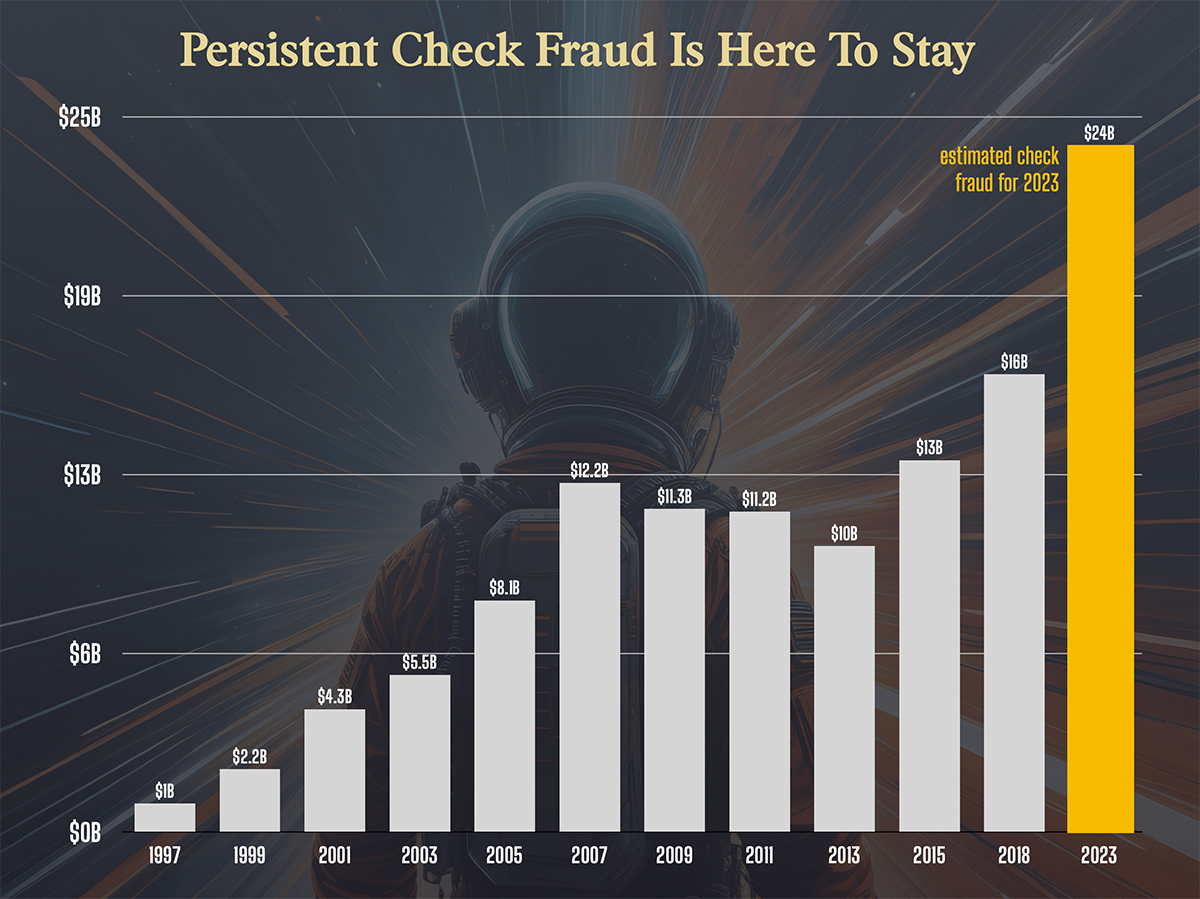

Prediction # 8 – Banks Will Battle Back Against Persistent Check Fraud Practically

Sorry. Check fraud isn’t going away. In fact, it might even go up. Check fraud has been soaring since 2021 and is estimated to hit $24 billion in 2023. SAR reporting this indicates that we will likely be at 672,000 check fraud reports – nearly identical to the 680,000 reports last year.

And for some banks, it’s accelerating. Regions Bank reported a 400% increase in check fraud in the second and third quarters of 2023 due to a fraud attack.

We consulted with experts and tech providers like Mitek and predict that banks will get practical about check fraud in 2024. This will be a major focus of banks this year

Some of the more promising tactical and practical improvements include:

#1 Text Validation – The Credit Card Approach

Borrowing from the credit card approach and perhaps using the same alerting technology, banks will adopt SMS text to validate checks before they are posted to bank accounts. This could be targeted based on check risk or on all high-dollar checks.

#2 Name Check Payee – Positive Identification To Accountholder

Believe it or not, most banks still cannot validate that the name on the check matches the depositing account. By deploying image analytics, banks can match the check’s payee to bank accounts or even validate the name with customers via text.

#3 – Telegram and Dark Web Interdiction

Companies like Dark Tower and Mitek collect check images from Telegram and alert banks before those checks hit the customer’s accounts.

#4 – Leveraging FedNow Rails

Jake Emry of NICE Actimize suggests a novel approach of using FedNow rails to narrow the settlement window and reduce the impact of check fraud.

Prediction # 9 – The Jigs Up On Social Media Skirting Accountability

In 1848, with the gold rush just beginning, a smart man named Sam Brannan opened up a mining supply store in Sutters Fort. He bought up every shovel, pick, and pan in the area (investing about $70,000 at the time) and then sold that equipment to the flood of 49ers who arrived to find gold. He made $4.2 million and never mined a speck of gold.

Meta and Telegram are to the new fraud gold rush what Sam Brannan was to the original. They are making billions while scammers and cons overrun their platforms.

In 2023, the first steps towards accountability were finally taken. Eleven big tech companies (including Meta) signed the UK Online Fraud Charter, pledging to step up their efforts to stop online fraud on their platforms. Perhaps this was just a tactic to avoid regulations but it was a start.

But this is certainly not the end of the road. ?

We Predict Mounting Regulations Will Push Social Media To Further Accountability

We predict regulators will mount up this year, pushing even further accountability. The DSA in Europe (Feb 2024) and The Inform Consumers Act (June 2023) in the US are regulations to watch in this space. Two-sided marketplaces like eBay and Etsy are preparing for this with more data verification tools and processes. However, social media platforms like Telegram, TikTok, and Facebook may not be ready. Perhaps they don’t realize they are the actual target of these laws.

We Predict More Social Media Takedown Activity

In addition to mounting regulations, look for a wave of Telegram and Facebook group takedowns. Fraud Fighters can try to do this today simply by reporting violations of terms to Telegram, Facebook, and others (with varying levels of success).

Not all fraud fighters see this kind of takedown of activity as helpful, however, as it rarely reduces the instances of cybercrime more than removing the transparency of how & where the crimes are taking place.

Prediction #10 – Fraudsters Attack The Supply Chain

A supply chain attack is a cyberattack targeting a trusted third-party vendor offering services or software vital to the supply chain. Well, this same attack is being used against fraud vendors too.

The supply chain attacks take the form of AI Bots. The bots are driven by artificial intelligence, and they have the ability to self-learn and adapt their scheme to get transactions through. By swarming a merchant relentlessly for 24-48 hours, the bots learn the best ways to circumnavigate the controls they rely on their 3rd party vendors for.

We predict supply chain attacks will continue to develop, becoming a major force in fraudsters’ arsenal not only for more e-commerce merchants, but we expect AI Bots to start deploying against 3rd party system integrations between banks and fintechs as well.

While merchants and banks must invest in multi-system back-ups & redundancies, Fraud solution companies must realize they are not infallible and could be exploited. Vendor Companies should re-invest in R &D and collaborate with clients and competitors to fortify defenses.

Prediction #11 – The Stealthy Scammer ShapeShift

For every action, there is an equal and opposite reaction. As Erin West and her band of crime fighters dismantle pig butchering operations, banks reimburse more scam victims, and law enforcement cracks down on how scam proceeds move through crypto platforms, you can expect a massive reaction from scammers.

And you are 100% correct. It is going to happen.

In 2024, we predict scams will shapeshift as operators seek to protect and grow their revenue

#1 – Pig Butchering Migration

The heat is on. Fraud fighters, law enforcement, and the Chinese government are cracking down on Southeast Asian scam compounds. Because of this, we expect to see migration and trafficking of slaves forced to scam to other parts of the world, including South America to Europe, as scam lords try to maintain their empires.

#2 – More Stealthy Victim Assisted Scams

As the liability of consumer-focused scams shifts to banks, causing them to invest in more scam detection technology, expect the fooling of consumers to increase dramatically. More sophisticated victim-assisted scams will evolve, such as walking a victim through how to set up call forwarding on their phone to route MFA and other contact attempts to fraudsters.

#3 – Gift Cards become more favorable than Crypto

Closed Loop/private label Gift cards will continue to be used instead of crypto for anonymous, untraceable funds involved in scams and money laundering. Will regulations ever catch up? Or, instead, will more illicit funds be routed to these payment methods to avoid detection. We think that will happen.

Our Recommendations To You In 2024

We leave you with these parting thoughts for this next year.

Mary Ann Miller – Focus on KYC, Get It Right

Mary Ann says, “KYC is the very cornerstone of your fraud defenses, don’t assume they still work just because they did last year.”

“Count on PII data validation at onboarding as an important step, but only one step. There are many digital attributes, reason codes and scores that are critical for onboarding decisions. A few examples of those that are very predictive include phone possession validation, phone trust scores and reason codes, device reputation, synthetic indicators, risky line type detection, biometric indicators, bot detection, email risk are table stakes to ensure safer onboarding.”

Frank McKenna – Fight On, Time Proves Fraud Fighters Right

My advice for 2024? Don’t get discouraged when people don’t listen. It might take years before you are proven correct.

Karisse Hendrick – Beware of Supply Chain Attacks This Year

Karisse Hendrick says, “One downside of privacy laws like GDPR is the requirement that companies doing business online disclose every company that will come into contact with their customer data. This includes disclosing vendors used for fraud prevention. (Cybercriminals have started taking notice of these 3rd party vendors. -Who they work with, how they work, how they’re integrated, and how to exploit those connection points.)”

Thank You Fraud Fighters

Thank you for taking the time to read our predictions.

A special thanks to these fraud fighters with whom we have worked over the past year. We actually had a list of over 100 people that we wanted to thank here but we know most fraud fighters prefer to be incognito and remain unsung heros. ?

Just know we appreciate you all! Thank you for all you did for us and what we know you will accomplish this year.