It’s baack. Synthetic Identity has returned with a vengeance.

That, according to a newly released report by TransUnion that claims that lenders’ exposure to synthetic identity has exploded to $3 Billion.

We are now at an all-time high, according to the credit reporting giant.

From $855 to $3 Billion In Last 2 Years

In 2021, TransUnion reported a relatively low $855 million in synthetic balances on banks credit portfolios.

At the time, they cited the pandemic and reported that synthetic identity was falling.

The pause in synthetic identity however was short-lived and this represents the second consecutive year of increasing synthetic identity losses in the US.

Auto Lenders Are Taking The Brunt of The Abuse

Face it, at the core of synthetic identity is the abuse of the credit system. Synthetic identity is all about hiding your real credit profile so you can get new loans with a stolen social security number.

And no industry is taking on more abuse by these shady fraudsters than the auto industry.

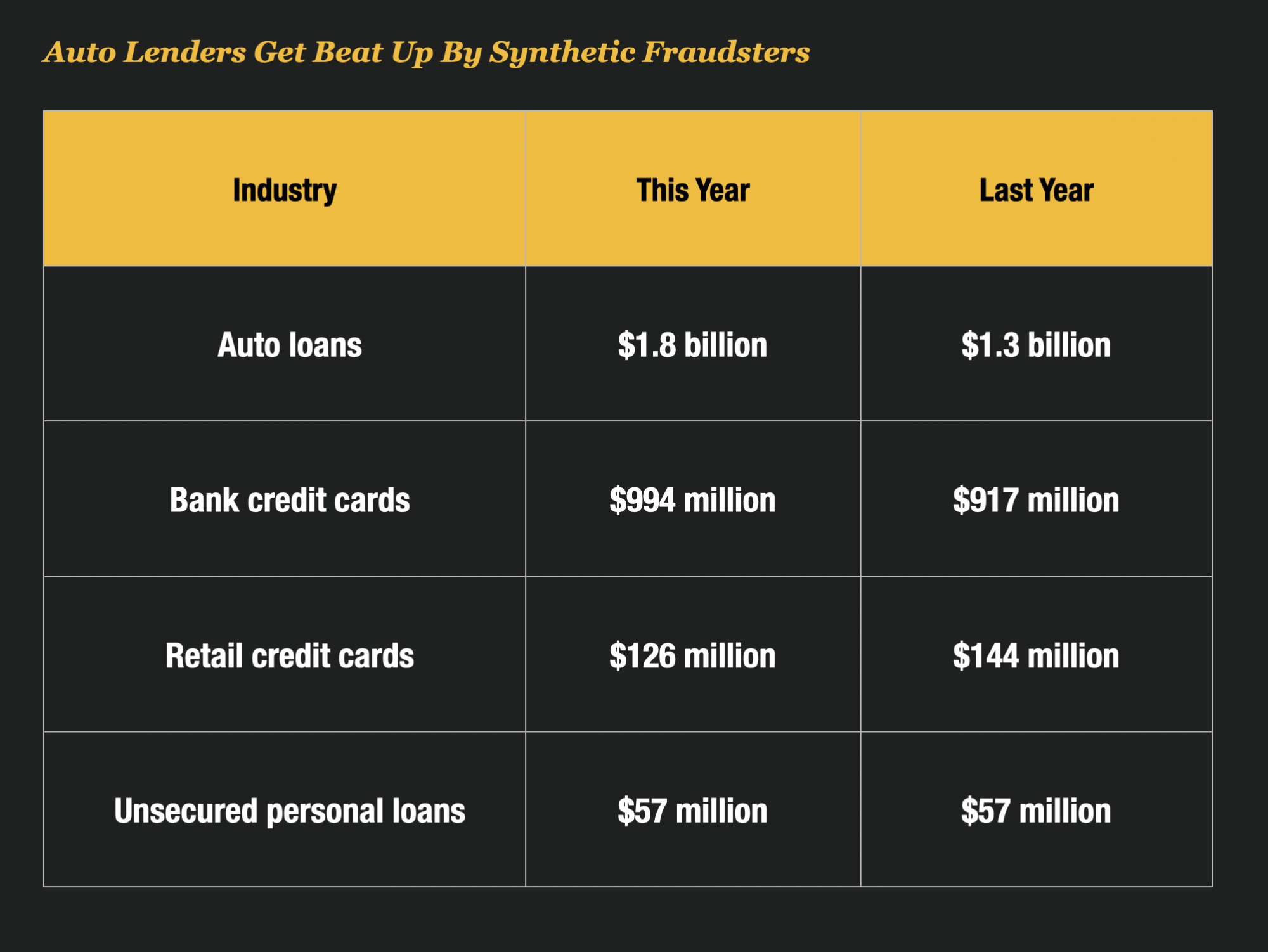

According to TransUnion, 60% of all synthetic balances are held by auto lenders. It’s now totaling $1.8 Billion according to the report.

The outsized role of auto finance was pointed out by TransUnion as part of their study.

“Trade incidences and lender exposure associated with synthetic identities are both at all-time highs, and auto finance is the driving force of that growth,” according to Shai Cohen, the senior vice president and global head of TruValidate™ fraud solutions at TransUnion.

Point Predictive Analysis Suggest The Trend Has Been Evident for Years

Point Predictive manages and runs the largest auto lending fraud consortium in the US. Oh and by the way, I work there too.

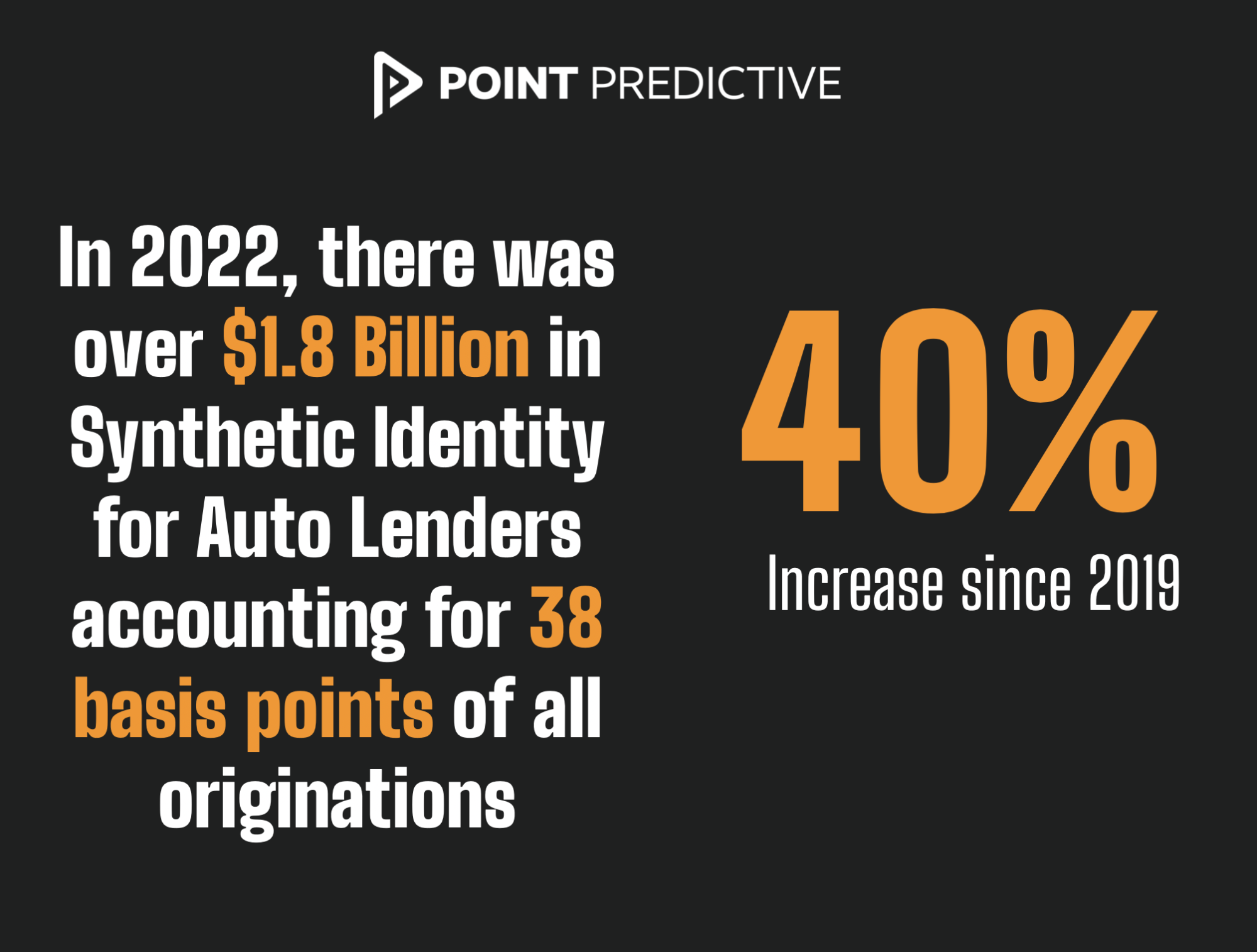

We’ve been tracking synthetic identity attempts for years, and the rate of synthetic fraud has been building for a long time.

The rate of synthetic identity peaked in 2021 at 68 basis points for all auto loans and returned to approximately 38 basis points in 2022, accounting for a massive $1.8 billion against auto lenders alone.

What’s Driving The Increase In Synthetic Identity Attempts?

So what’s driving the increase in synthetic identity in auto finance ever higher? There are some interesting data points I want to share with you.

#1 – Covid Fraudsters Shifted To Auto Loans To Use Their Fake Identities

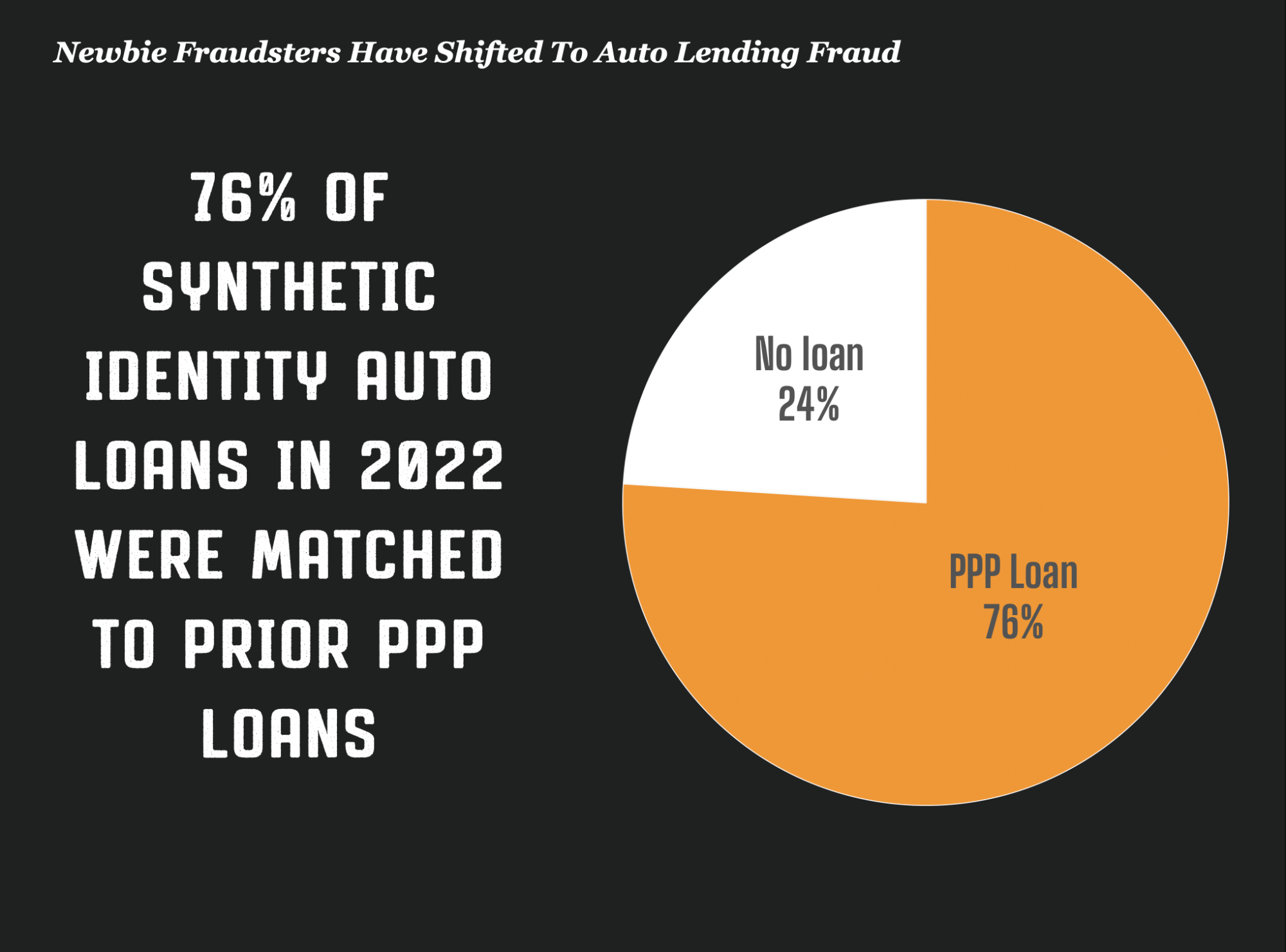

Point Predictive believes that up to 1 million new fraudsters became active in 2020 after launching economic stimulus programs.

After those stimulus programs ended, those same fraudsters shifted their efforts to steal cars through fraudulent financing of vehicles.

In fact, fraud investigators at Point Predictive could tie about 76% of the synthetic identity auto loans in Chicago back to PPP loans that were taken out the prior year. These fraudsters are shifting to auto now.

#2 – Use of Fake Employers Make Synthetic Identities A Cinch With Dealers and Lenders

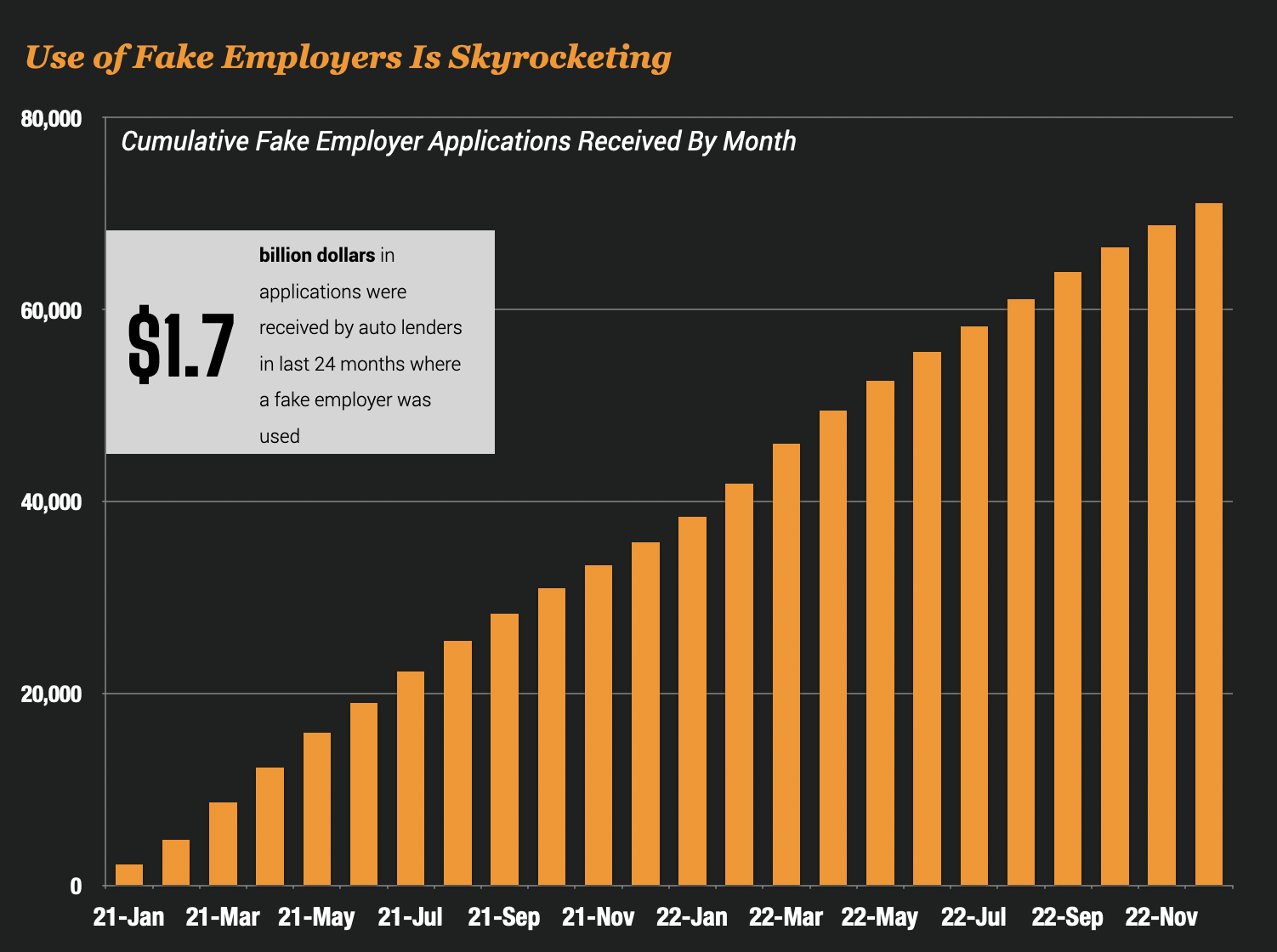

Synthetic identity fraudsters will often use shell companies tied to fake paystubs, websites and employment phone numbers that can be used to create falsified verifications of employment.

Synthetic identity fraudsters will often use these shell companies, and Point Predictive fraud analysts have identified more than 10,000 shell companies being circulated across the industry that have submitted over $1.7 billion in applications.

#3 – Shady Credit Repair Schemes Are Running Amok Driving Synthetic Ever Higher

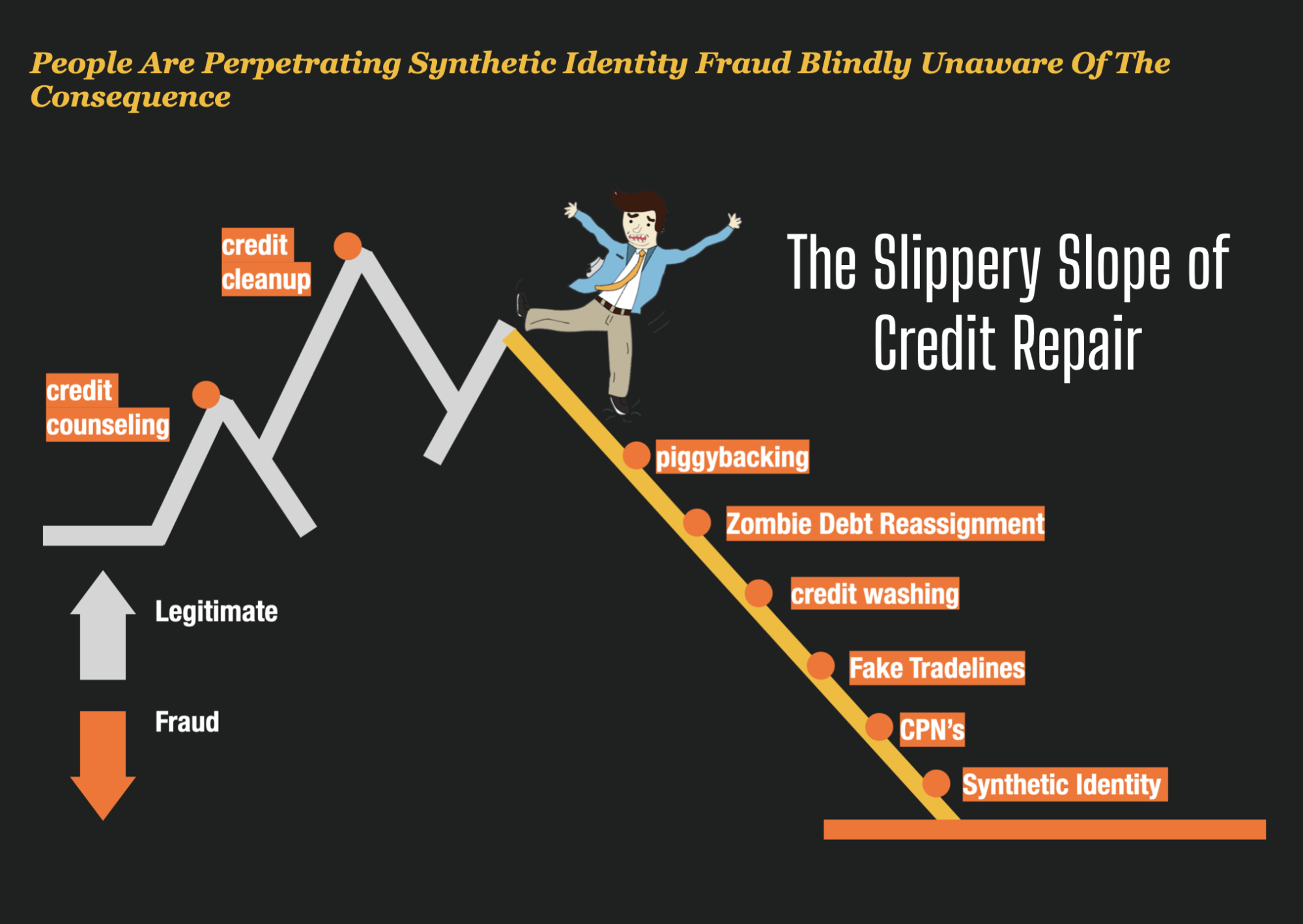

The sale of CPN’s or Credit Privacy Numbers is the greatest scam ever perpetrated by some shady characters in the credit repair industry.

CPN’s are nothing more than a clever marketing scheme devised by a fraudster to sell an unsuspecting victim a stolen social security number.

Couple that with other shady practices like credit washing, piggybacking, selling fake tradelines and you have a billion dollar fraud problem being perpetrated against auto lenders.

No Signs Of Abating Anytime Soon

I see no slowdown in synthetic identity anytime soon, if anything it is just ramping up.

Check out social media, telegram and everywhere else. The proliferation of advertisements that lure consumers into this rabbit hole of fraud is just getting started.

Buckle up.