Socure made an interesting announcement this week, vowing to take a bite out of the “explosive uptick” in synthetic identity sweeping across US banks.

The company committed to eliminating 100,000 synthetics from the system this year and then eliminating all synthetic identities by 2026.

They plan to do it by partnering with government agencies and financial institutions. One of their first projects will be by performing a “Synthetic Portfolio Scrub” to help identify synthetics lurking in banks’ existing portfolios.

Socure also scores new applications that come through the door which help financial institutions close the door on new synthetic identities that might be entering portfolios.

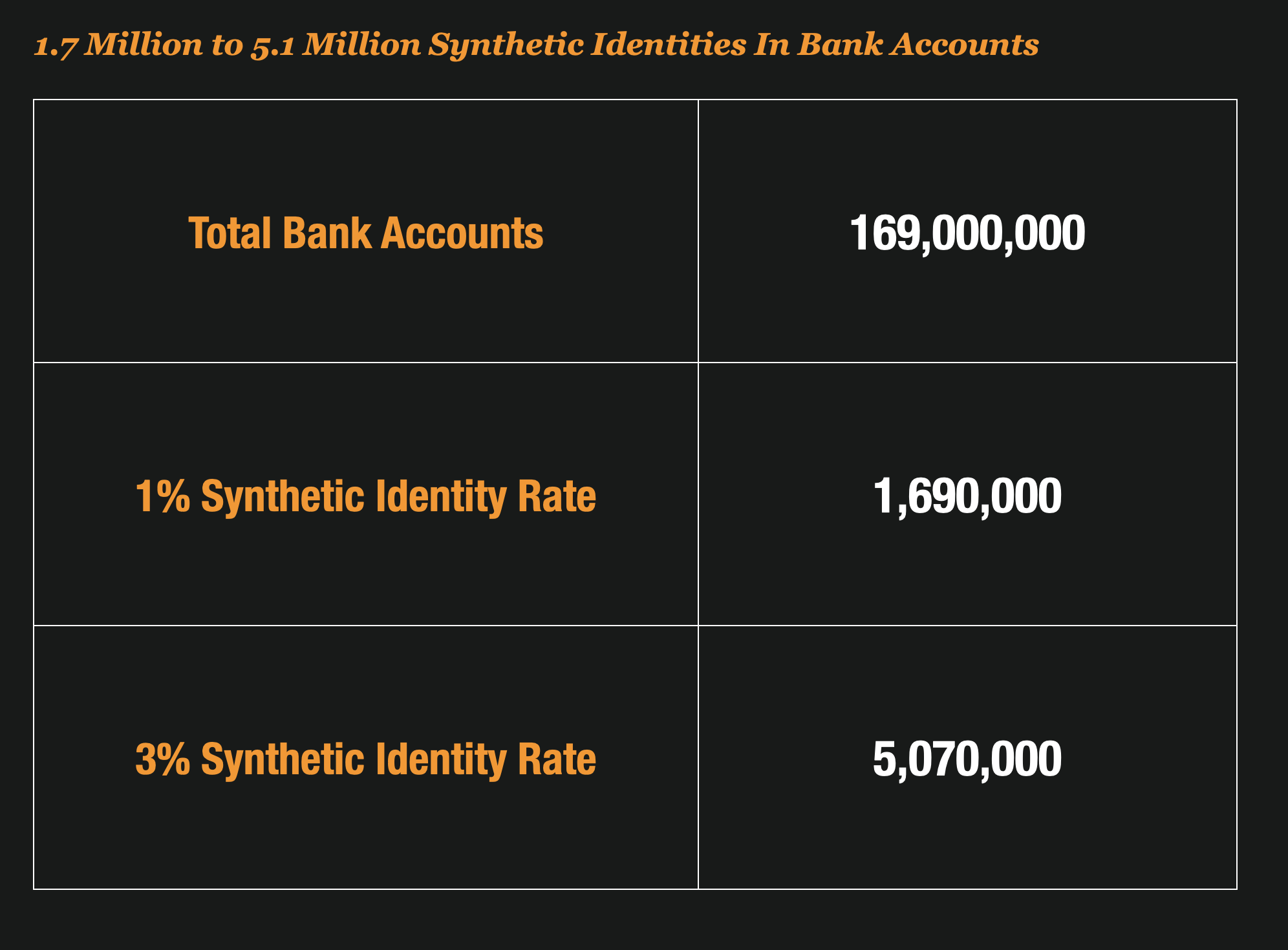

Up To 5 Million Synthetic Identities May Be Lurking In Bank Portfolios Right Now

Socure’s research found that anywhere from 1-3 of every 100 of the 169M bank accounts opened in the U.S. belongs to a synthetic identity.

If you do the math, that means there are anywhere between 1.7 million to 5.1 million synthetic identities in a sleeper or active mode in bank accounts right this very minute.

Mike Cook Says Pandemic Released A Wave Of Synthetic Identity Money Mules

One of the key players behind the initiative is Mike Cook. If you know Mike, you will know that he coined the term “Synthetic Identity” back in 2004. He was up late watching Aliens and saw the correlation between “Lance Bishop” a synthetic humanoid and a problem that he saw bubbling up in credit card originations at the time.

And now he is piping mad at what he sees as a wave of synthetic that are hitting bank accounts – spurred on by the easy money days of COVID.

“Synthetic fraud behaviors have changed drastically following the pandemic. They are now attacking deposit accounts at higher rates than any other time in history, where they are being used as money mules to fuel fraudulent money movement.

“Bad actors have been given free rein for too long, and it is high time to eliminate these mules,” said Mike Cook, vice president of fraud solutions at Socure. “Our goal is to completely eliminate synthetic identities from the U.S. financial system by 2026. This is an eminently achievable goal by partnering with the industry and government agencies. Today’s target of 100,000 synthetic identity takedowns is just the beginning.”

Will Banks Want To Know?

The big question is if banks will want to know about these synthetics, and if they do, will they be willing to take action to eliminate them from their portfolios?

With no positive feedback loop from a victim, banks will be required to make decisions based on a preponderance of the evidence.

Financial institutions will have to figure out how they untangle the mass of hidden synthetics from their portfolios, whether that is information directly from the SSA on social security ownership, Socure insights, or internal risk analysis.

And that could be a daunting task that banks may not want to undertake.

A Necessary Step In Eliminating Synthetics

Whether banks will, or will not is the question, but one thing is for certain. It will continue to perpetrate until the US institutions get serious about collectively eliminating the problem.

It’s like the old adage “Ants at a picnic”. If you don’t stop the first ant from getting a piece of your food, they will just go back and tell the whole colony and pretty soon your picnic is overrun with ants.

What is your take on this mission? I think its pretty cool and a great rallying cry to change things.