2025 was the year that broke our trust.

It was the year fraud went “invisible.” We knew AI would change everything. We didn’t expect it to erase the line between real and fake so thoroughly and with such force.

Global scam losses crossed $1 trillion. Deepfake attacks surged 3,000%. Millions of people suffered. Some even died. All because evil people wanted to steal money.

Now here we are standing at the edge of 2026: The birth year of autonomous fraud attacks that will go beyond anything we have ever seen. The year when a single person can launch 30 million AI-created scam messages a minute from their one-bedroom apartment and run a fraud empire.

It will be a year with no brakes. The guardrails are gone now. So are the speed limits. We’re all just passengers now. 💥

The Fraud Compadres Unite Yet Again With A Secret Masked Guest 🎭

Mary Ann Miller, Karisse Hendrick, and I are back for our eighth year of fraud predictions. This time, we brought a secret guest – a masked compadre who we will reveal later. We are all drawn together by our love of fraud.

Mary Ann is an expert in cyber, identity, and fintech. Karisse is an expert in merchant fraud. My expertise is in banking and scams, and our secret new compadre is an expert in the dark web and AI Fraud Agents!

We spent days and hours combing the dark web, analyzing patterns to identify predictions we believe will come true this year.

If you want to take a step back in time, you can find our predictions for 2018, 2019, 2020, 2021, 2022, 2023, 2024, and 2025 right here.

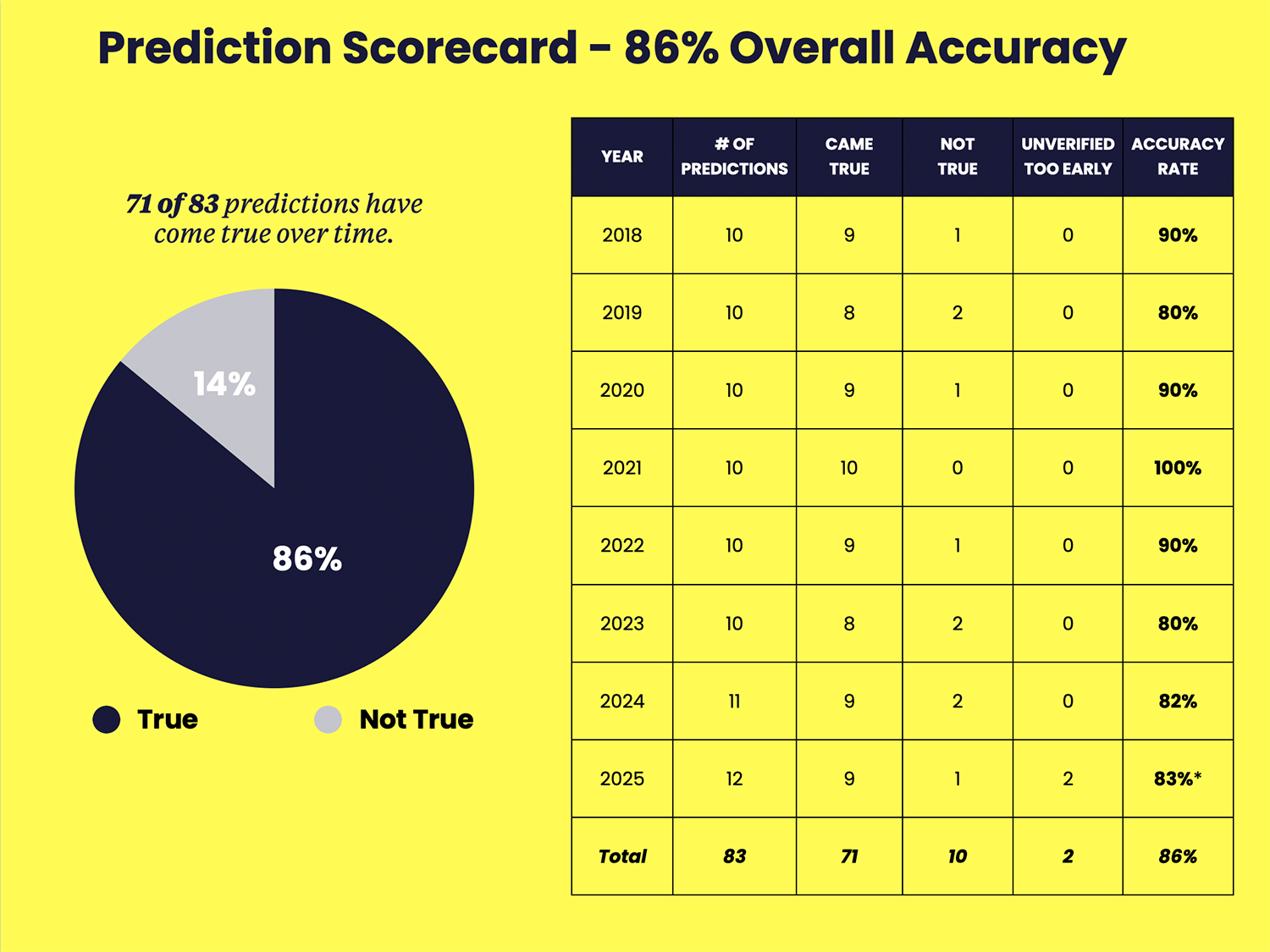

This year, we decided to have a little fun and see how accurate our predictions have been over the years. Surprisingly, we did pretty well! Of the 83 predictions we have made over the years, about 71 of those have come true – that’s about 86% accuracy.

That gives us a B+, which is pretty good!

First, Let’s Look Back At 2025 – It Was A Year Dominated By AI, Glitches, And Scams

When you look back at 2025, it was a year that made it crystal clear where we are headed – a fraud and scam landscape dominated by AI.

And it was these six trends that defined the year.

In 2025, The Deepfake Dam Broke And Flooded The World

AI and Deepfakes were the story of the year. And for good reason. Because AI became the de facto tool. We learned that 100% of scam workers now rely on it for all of their communications with victims.

If it wasn’t Haotian AI helping them with deepfake video calls, it was SuperAI helping them carry on conversations with victims in any language in the world.

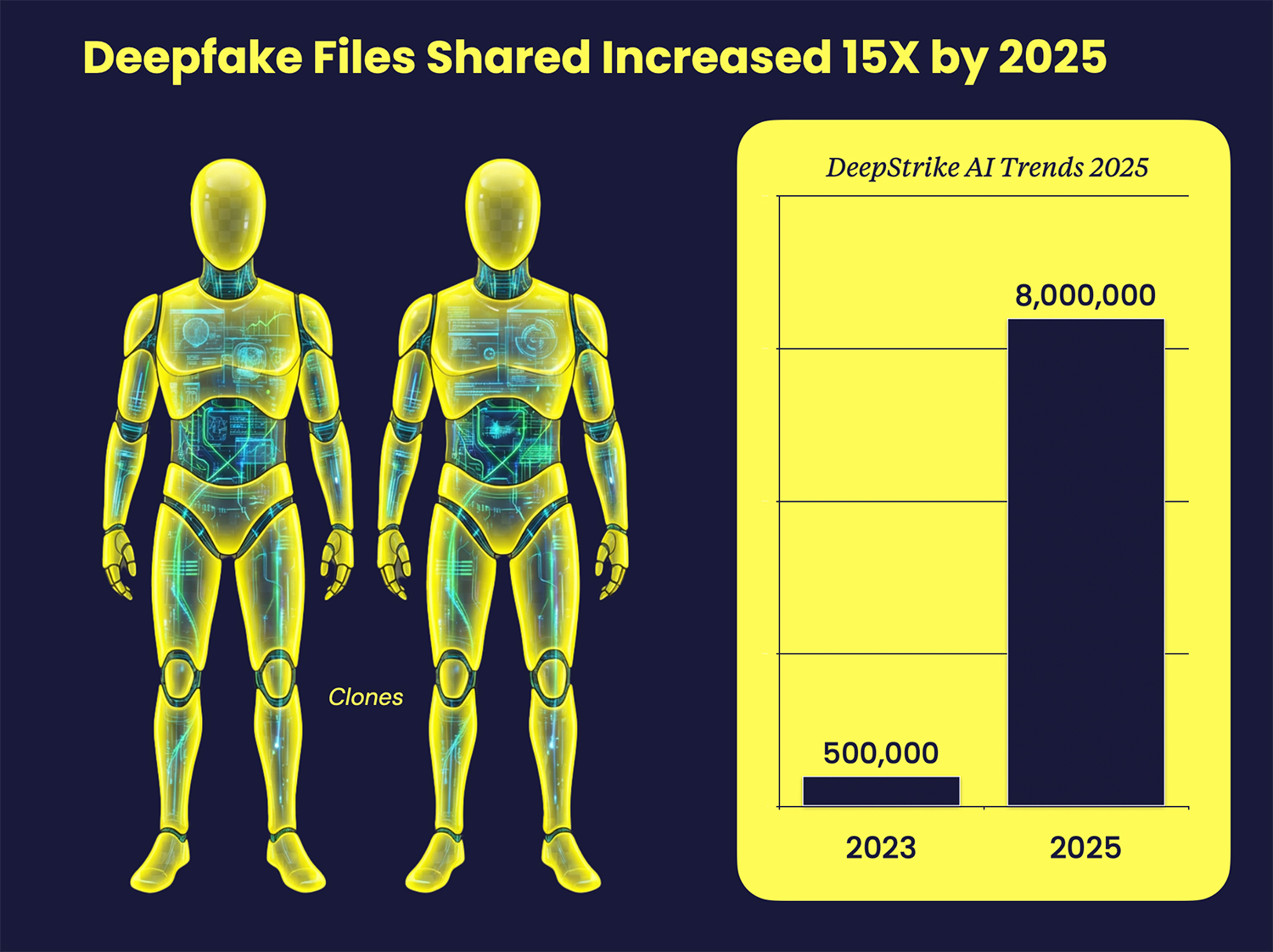

And the future is grim. Security firm, DeepStrike, estimates that over 8 million deepfake files were shared in 2025 – that’s up 15 times from the level seen just two years earlier.

In 2025, Pig Butchering Hit Industrial Scale And Became The Next Global Humanitarian Crisis

“It’s really the most compelling, horrific, humanitarian global crisis that is happening in the world today,” says Erin West of Operation Shamrock.

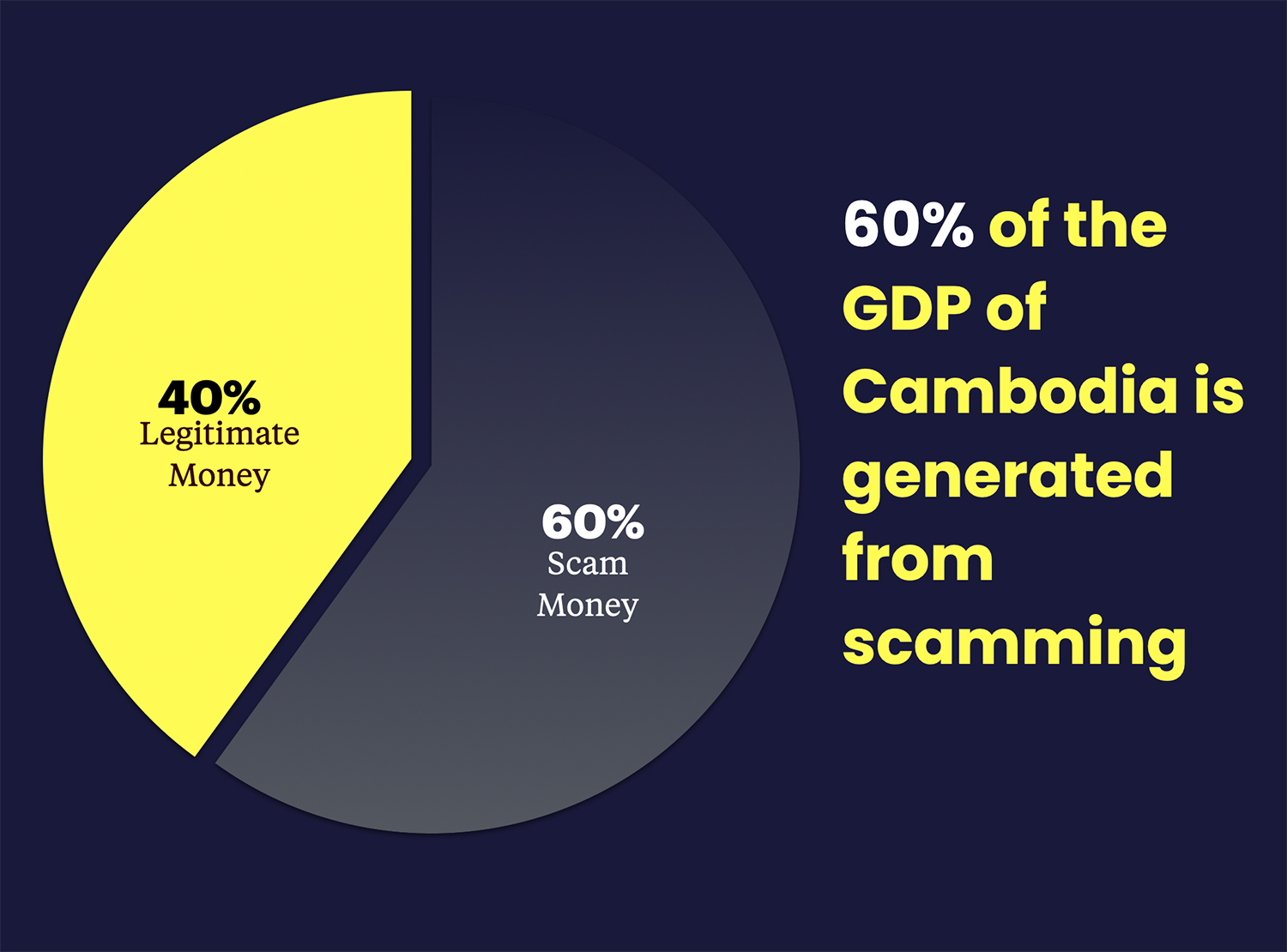

At the epicenter of that crisis is Cambodia, where billions of dollars of scam money flows into the country and has transformed the country into a literal scam state where scam kingpins run the country like the Narco bosses of Mexico.

Shockingly, 60% of Cambodia’s economy now runs on scam money.

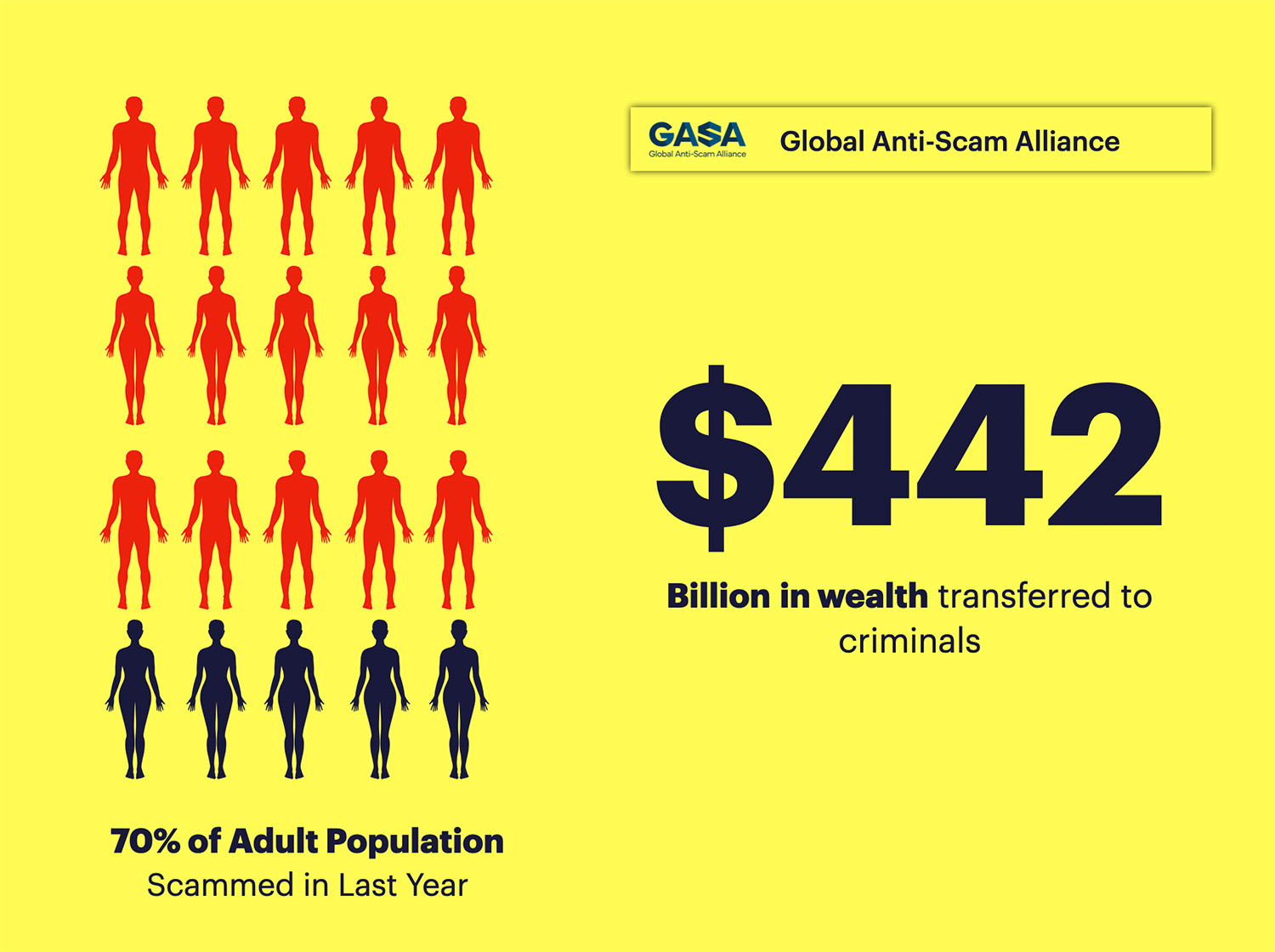

In 2025, 70% Of The Adult Population Of The World Was Scammed

Every day, millions of people are scammed. More than any other time in history. GASA estimates that 70% of adults globally experienced a scam in the last year, with 1 in 4 of them actually losing money – about $442 billion in total.

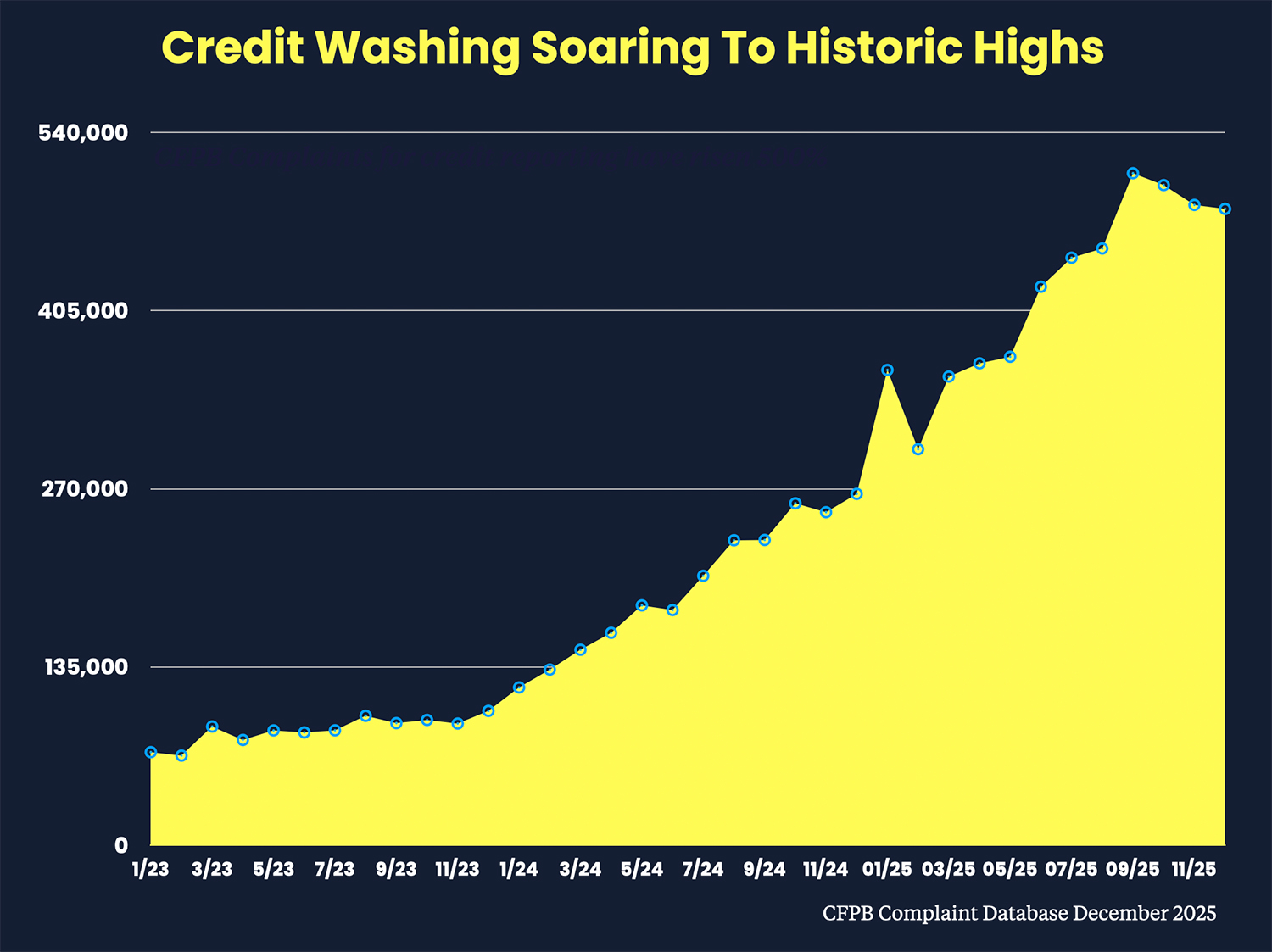

In 2025, Credit Washing Went Absolutely Ballistic, Turning Into $10 Billion Problem.

Could credit washing get any worse? Yes, and it did. TransUnion now estimates that 1 in 20 consumers show signs of credit washing, erasing over $10 billion in bad debt to increase their credit scores.

Point Predictive estimates that Auto Lenders are bearing the brunt of that, with a 162% jump in auto loans tied to credit washers.

In 2025, Glitches Had Your Neighbors and Friends Hopping On The Fraud Train For Free Money

Ever see an Instagram influencer make a new bagel place go viral by posting a single positive review on social media? The next day, lines will go around the block for that bagel.

In 2025, influencers had people lining up to try out the latest fraud glitches. There was the Target Loan Glitch, the Klarna Glitch, the TransUnion 7 Day Hack, the viral New York SYEP Glitch, and the Infinite Car Glitch.

Did we miss any? Probably, because they were everywhere and it was hard to keep up.

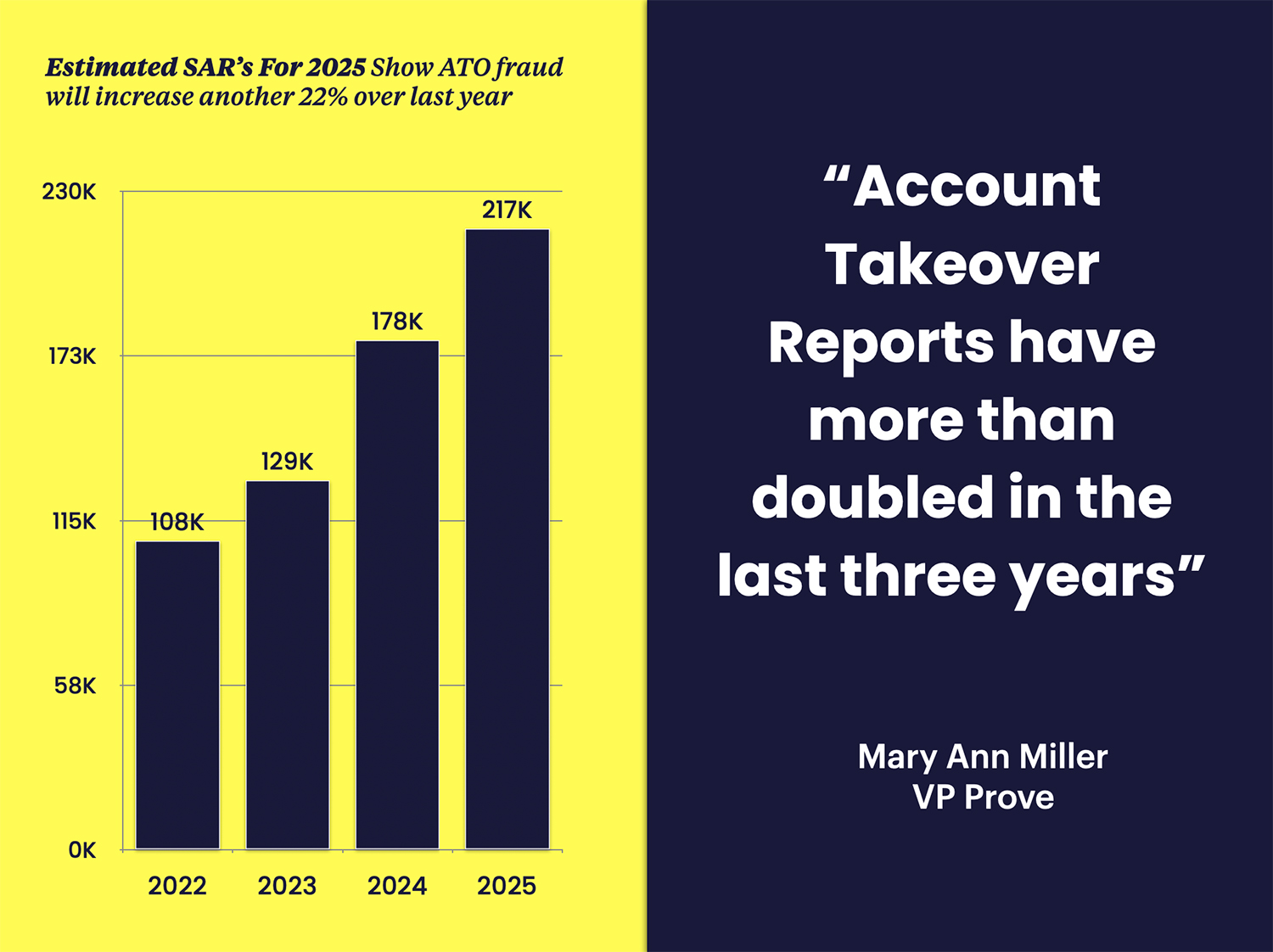

In 2025, Account Takeover Hit Highest Level In History

ATO attacks reached a peak in 2025. According to American Banker, ATO grew by over 250% since January, and SIFT projects ATO losses will hit $17 billion, up 33% from last year $13 billion in losses.

Mary Ann Miller points to SARs. By her estimate, when the final numbers are released, reports to FinCEN will total 217,000 for the year, indicating that ATO will increase by 22% over last year.

“Data breaches, credential stuffing, session hijacking, and more bank impersonation schemes are driving ATO losses ever higher”, she says.

These trends have set the stage for what we will see in 2026. Now, let’s dive into our predictions.

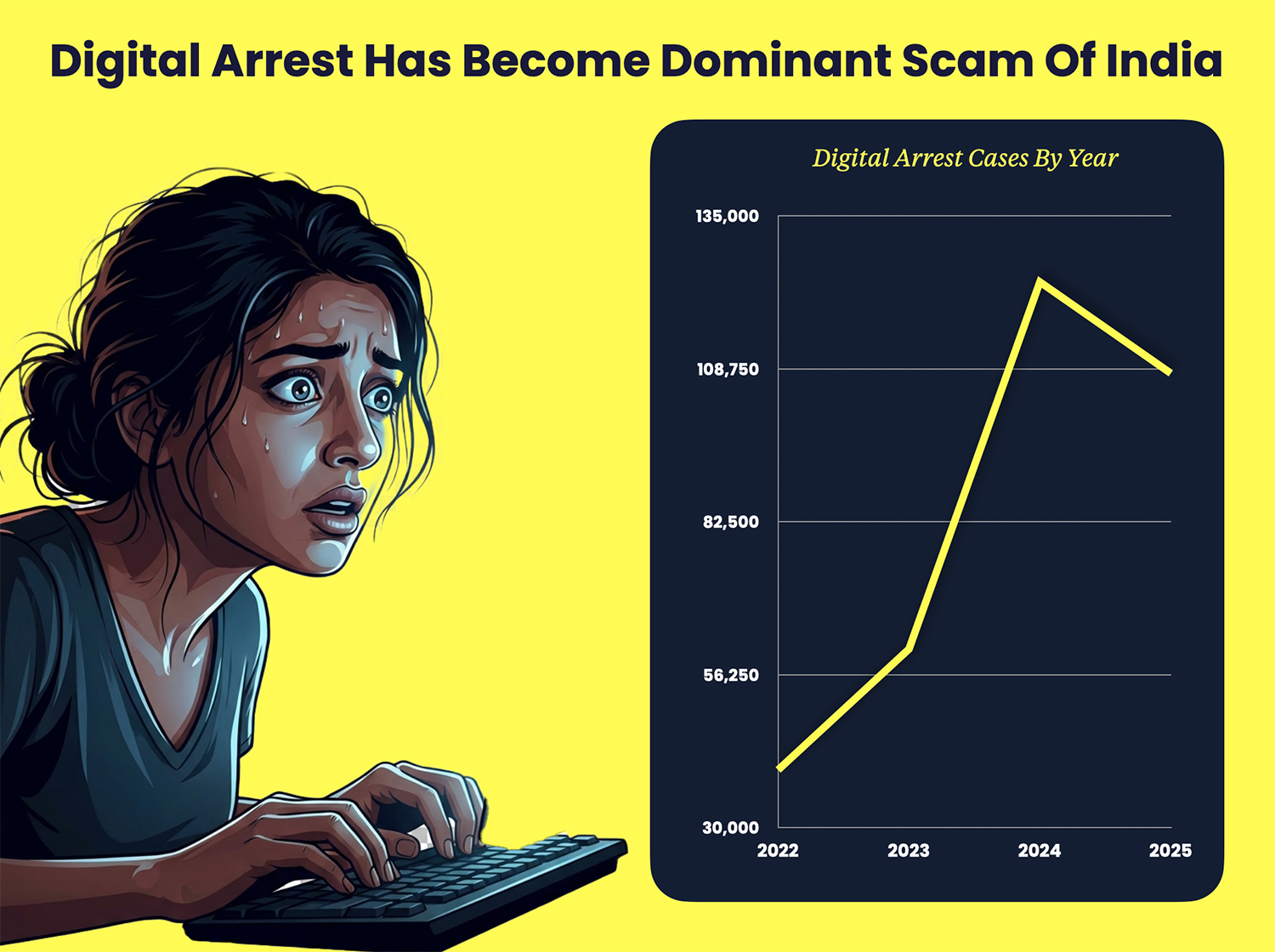

Prediction # 1 – New “Digital Arrest” Scams Will Terrorize The US, Creating A National Security Threat

A new wave of extremely brutal and virulent scams, called “Digital Arrest,” will arrive in the US as Pig-Butchering scammers shift their tactics.

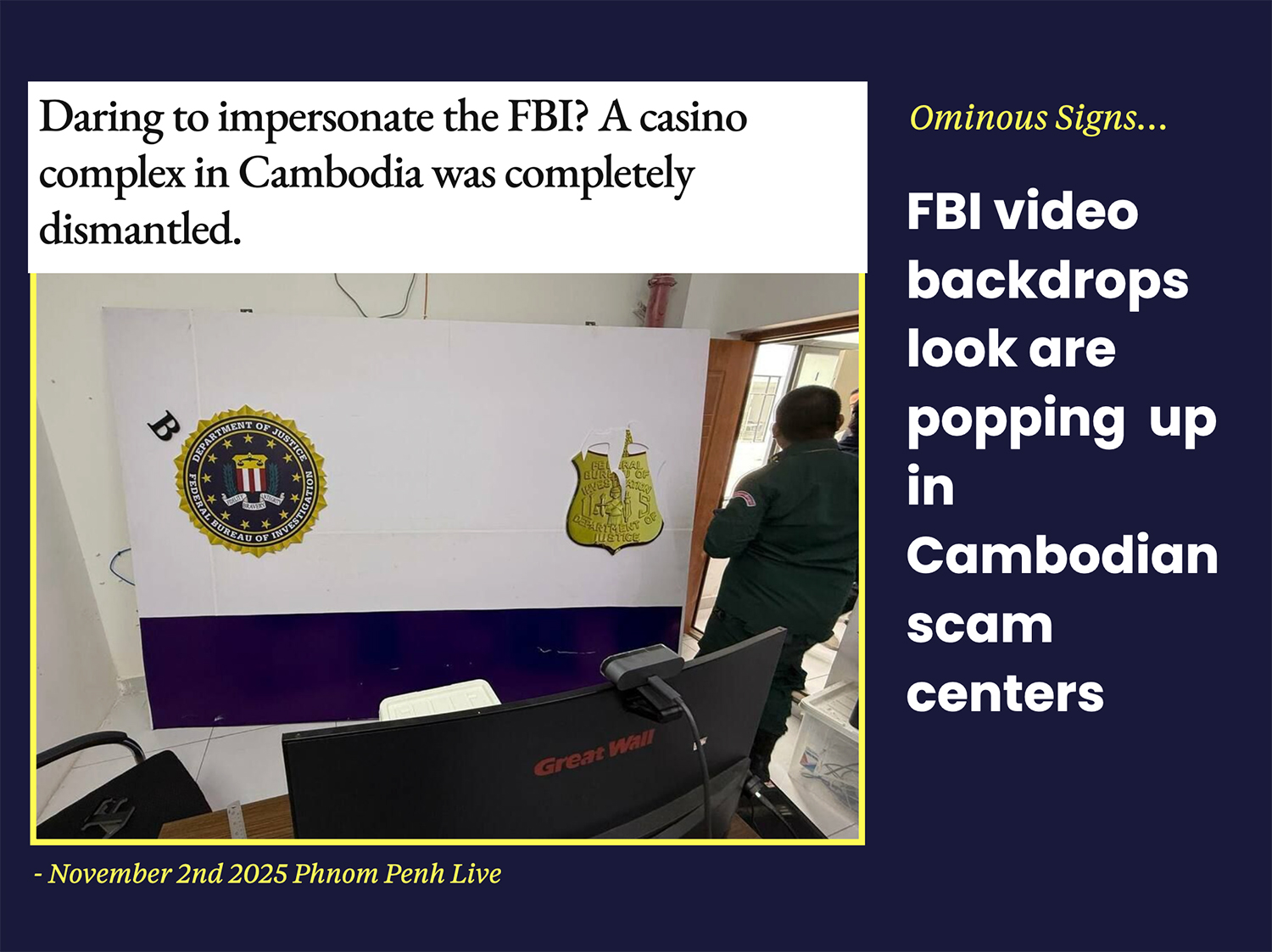

This extortion scheme, where criminals impersonate law enforcement via video calls and hold victims under virtual “arrest” for hours, days, or even months, has swept over India in the last three years, and now it is headed here.

Read more about Digital Arrest here.

Scam compounds in Laos, Myanmar, and Cambodia are already linked to about 46% of the cases in India. And just this year, police in Cambodia have begun locating “FBI studios” in scam compounds – telltale signs that impersonation attempts have already started.

Prediction #2 – Pig Butchering 2.0 Begins: The Machines Run The Scam Factories

Picture a scam factory run by three people in a back room somewhere in Southeast Asia. No guards. No barbed wire. Just a bank of servers running AI agents that never sleep, never eat, and never try to escape.

In 2026, these automated scam centers will start to become a reality.

Research of 145 scam compounds in December 2025 identified that 87% of the workforce handles repetitive, text-based “Hook/Line” conversations that could easily be automated with AI. That same report found that 100% of scammers now use AI for those texts and conversations.

Pig Butchering operations may operate with as few as three to five workers, yet launch scam attacks on 50,000 targets daily.

Read here how we think they might work, or check out this infographic we created that visualizes it 👇.

Prediction # 3 – Ghost Tap Fraud Adds $1 Billion In Losses To “Card Present Fraud” At Merchants

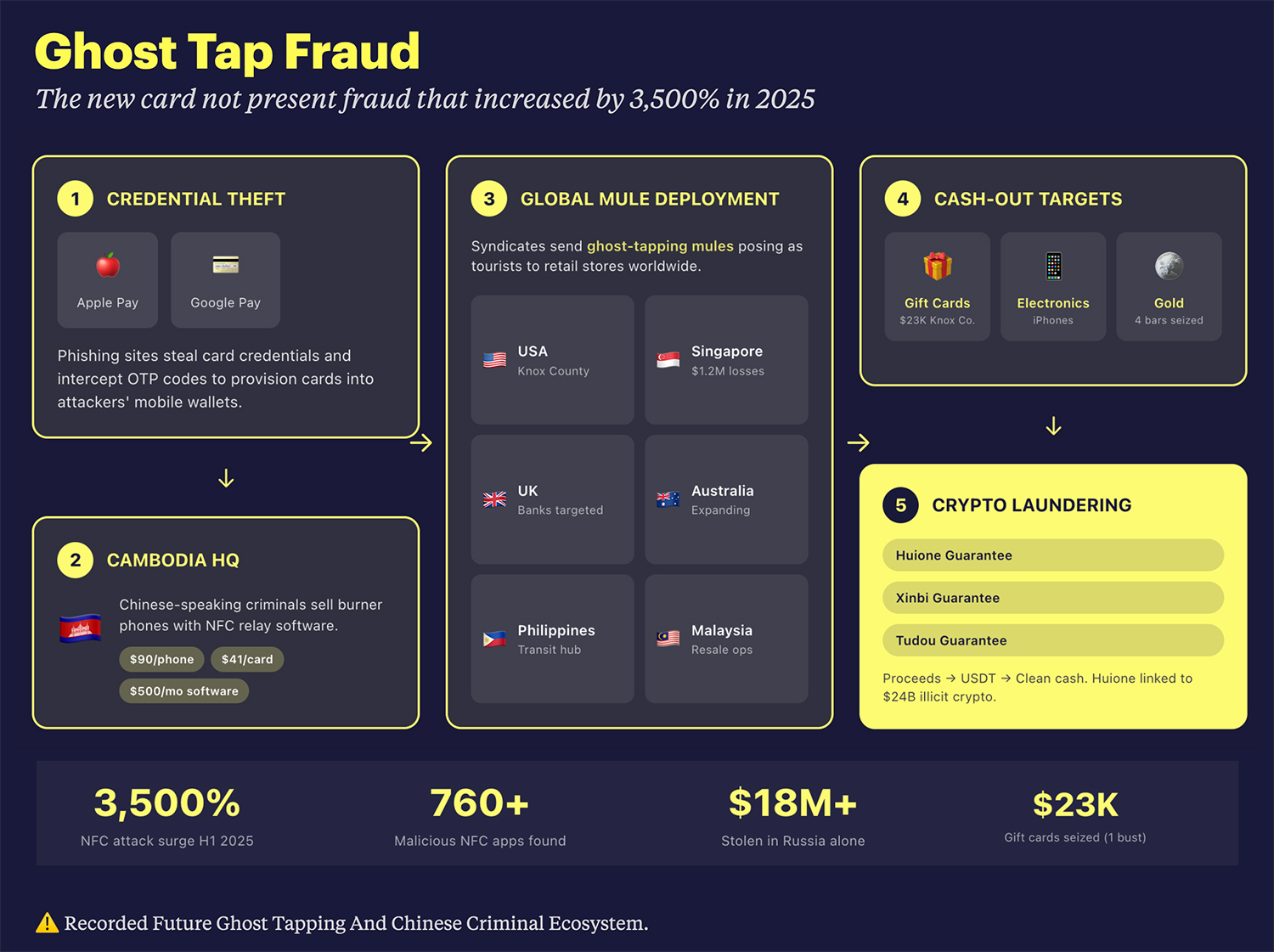

Ghost Tap is a new cash-out method that allows criminals to use stolen cards from thousands of miles away without ever being near the victim. Fraudsters load stolen card details captured from toll phishing scams or malware into Apple Pay or Google Pay, then use NFC relay software to transmit the tap-to-pay signal to a mule at a store checkout.

To the merchant, it appears to be a card-present transaction. In reality, the fraudster could be in China using a stolen card.

In 2025, it grew by over 3,500%. Karisse Hendrik reports that retailers are seeing an influx of international mules moving from store to store to buy luxury goods, electronics, and gift cards, using tap-to-pay with stolen cards.

With 112 million Americans using mobile wallets and Chinese syndicates selling ready-to-use burner phones for $90 on Telegram, we project US issuers and merchants will lose up to $1.5 billion to Ghost Tap fraud in 2026.

Prediction # 4 – Sim Farm Nation – The Smishing Industrial Complex Takes Over

The convergence of SIM farm technology and artificial intelligence represents one of the most significant threat escalations in the history of fraud.

And it has arrived in the US. The Secret Service discovered a New York-area SIM farm in September 2025 capable of sending 30 million text messages per minute – enough to text every American within 12 minutes.

The demand for these Smishing machines is insatiable – 500+ SIM Box factories are advertised on Made-In-China.com alone, and technology like “Instagram Automatic Fans” can now power those SIM farms at scale.

Mary Ann Miller predicts these SIM Farms will become “Industrial Smishing Complexes” that scam consumers on a whole new level thanks to artificial intelligence.

In 2025, we caught glimpses of what SIM farms could do. In 2026, we’ll see them operate like factories.” She says, “One AI agent, a thousand phone numbers, ten thousand victims. The scale just got terrifying.”

Prediction #5 – New VAMP Program Creates A Flood Of Merchant Refugees

Visa’s VAMP program, which drastically reduces allowable fraud thresholds for merchants and acquirers, has fully launched. While it promises to crack down on fraud, it will also be disruptive.

And the fallout has already started, with reports that Stripe and ShopPay are terminating a steady stream of merchants with high fraud rates and expectations that up to 250,000 merchants could be terminated before the end of the first quarter alone!

Karisse Hendrick, who has warned of this very thing for years, says 2026 will be the year “merchant refugees” emerge – merchants with higher levels of risk find themselves terminated by their processor and looking for a new home.

“Legitimate businesses in high-chargeback categories like subscription services, drop shipping, supplements, dating services, and online education will be the most likely to get terminated,” Hendrick says. “These ‘refugees’ could land with offshore acquirers, or turn to crypto payment rails with less consumer protection.”

But it isn’t just high-risk merchants that will be shifting. Some will actively switch because they are upset with the new fines. “Every acquirer is reacting to VAMP differently,” says Karisse, “Some are jacking up fees, others aren’t touching them. Enterprise merchants are already comparing notes and collecting data to switch to friendlier terms.”

Prediction # 6 – Self-Adapting AI Fraud Agents Shapeshift Methods Mid-Attack

Less than 90 days ago, threat researchers discovered the first autonomous, automated AI attack that successfully carried out a cyber espionage campaign against 30 companies.

As Jamie Dimon would say, “when you see one cockroach, there are usually many,” and that is precisely why 2026 will be the year AI fraud agents go on the attack.

Matt Vega (our secret fraud compadre) predicts that AI Fraud Agents will be ruthless in 2026.

“The attacks will be fast, flexible, self-replicating, and will no longer follow pre-defined adaptive pathways associated with polymorphic malware”, he says, “Instead, these agents will take in the response, feedback, and the trial and errors from declines or approvals to autonomously shape-shift into a new attack based on what they learn”.

So what are some ways we could see these devious agents operating?

Perhaps it’s voice-cloning scams that impersonate your business associates and try to scam you into wire transfers. Or maybe synthetic identity-generating machines that identify non-issued SSNs and create synthetic identities at scale.

Prediction #7 – Fraud Dust Trails Emerge: AI Scatters Digital Evidence Trails Complicating Investigations

Fraud rings will take a page from the money-laundering playbook: make the investigation more expensive than the crime itself.

For years, advanced AML teams faced “dust” attacks where criminals moved money in such small amounts across so many accounts that tracking became economically unfeasible. The technique never scaled to address fraud because it required too much human coordination.

Matt Vega has witnessed this firsthand at his company, Sardine.AI. Starting on December 8th 2025, fraud fighters identified over 30 rings using fully autonomous systems to execute horizontal attacks across hundreds of merchants and thousands of accounts simultaneously.

“Instead of stealing $50,000 from one victim, they might steal $50 from 100 victims across 100 merchants,” he said, “This new playbook is going to completely change the way companies have to manage their fraud as well as their investigations.”

Prediction # 8 – Stablecoin Reality Check – They Won’t Be That Stable Or Fraud-Free As Banks Think

Stablecoins are going mainstream. Stripe paid $1.1 billion for Bridge; PayPal launched its own stablecoin; and major banks such as JPMorgan, Citi, Bank of America, and Deutsche Bank are actively exploring the use of stablecoins for faster payments.

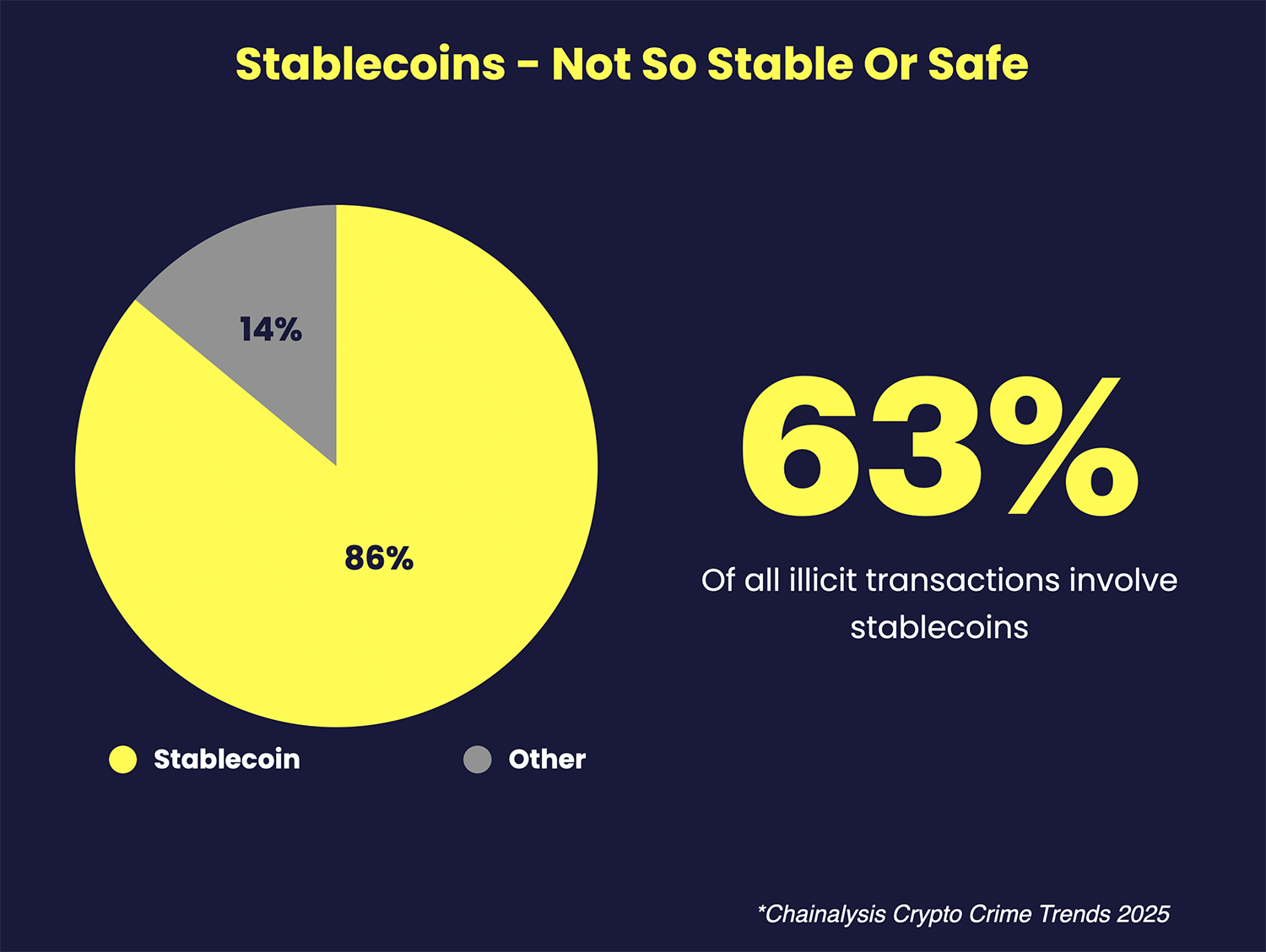

Every bank seems to want stablecoins, which is ironic because every fraudster does too. Stablecoins account for 63% of all illicit transactions related to money laundering, scams, and fraud.

We predict a reality check in 2026. Stablecoins are not as stable as their name suggests, and they will remain scammers’ first choice for money transfers.

Stablecoins, like all cryptocurrencies, have always been a fraud disaster. We’re not buying the hype and still think this won’t end well for consumers.

Prediction # 9 – AI Shopping Agents Will Get You Tricked And Scammed

Call us crazy, but we think your AI Agent is probably going to get you scammed.

Why do we think this? Because an AI shopping agent prompted to find the best price will naturally gravitate toward suspiciously cheap offers, and fraudsters will take advantage of that.

We predict an influx of realistic-looking e-commerce sites that scammers seed with “too good to be true” deals designed to attract AI Agents. Agents will add items to shoppers’ carts, use the stored payment credentials, and complete the checkout before a human can review it.

This isn’t hypothetical either. In August 2025, security researchers created fake Apple Watch and Walmart storefronts and tricked AI agents into falling victim for phishing scams.

What does this mean to banks and card issuers? You will see an increase in “friendly fraud” as consumers attempt to avoid paying for mistakes their AI agents make!

Here are a couple of real-world examples of how AI Agents will get you scammed. 👇

Prediction # 10 – Back To The Branch: Banks Demand You Show Up In Person

Deepfakes, voice clones, near-perfect AI-generated documentation, and soaring scams have completely eroded our trust. And that is why 2026 is the year that in-person verification could become the next big thing.

Is it right? No. Is it inconvenient? Yes. But what other choices are banks left with? Gartner now estimates that 30% of enterprises don’t trust biometrics alone to stop fraud.

The trend has already started. The USPS has quietly transformed into the nation’s largest identity proofing network, with 18,000+ locations now offering proofing services.

And the SSA abruptly eliminated phone verification last year, requiring people to appear in person at one of its 1,230 locations to prove their identity.

Mary Ann Miller thinks banks need to be prepared for the shift.

“Banks spent years training customers to avoid the branch. Now they need those branches, but tellers are still reviewing driver’s licenses as if it’s 1995” she said.

“That doesn’t work when a fraudster walks in with a synthetic identity and perfectly forged, AI-generated documents from a $300 printer. Make sure that tellers have tech behind them; otherwise, you’re just adding friction without adding security.”

Our Recommendations To You In 2026

Karisse, Mary Ann, Matt, and I will leave you with these parting recommendations for the year.

MaryAnn Miller – Fraud Fighters Get Your Innovation Engines Running

Mary Ann Miller of Prove says, “Fraud Fighters start your innovation engines, this is the year of no brakes, and no limits!”

Karisse Hendrick – Get Ready To Adapt To AI And Ask Your Leadership For Resources You Need

Karisse believes we are in for faster, more adaptable fraud in 2026. She thinks fraud fighters will need to be just as adaptive and make sure leadership knows what they need to fight these new fraud schemes effectively.

Matt Vega – This Is The Year We Will See New Attack Vectors Weekly

Matt Vega says they will identify at least 10 new attack vectors each quarter this year, with one highly complex AI scheme each month, requiring companies to continuously update their fraud approach.

Frank McKenna – Don’t Be Afraid To Speak The Truth

No more than ever, fraud fighters become the voice of truth. Even when it’s an unpopular opinion, you might be the only one who is willing to fight for what is right.

Fraudsters Have No Brakes, But Neither Do Fraud Fighters

The fraud ghosts will be everywhere in 2026. AI agents that never sleep. Ghost Taps that turn stolen card numbers into budget-breaking losses. Credit washing schemes that make billions in bad debt disappear like a magic trick. 🪄🎩

The fraudsters have no brakes and no limits. Neither do you.

Keep sharing intelligence with your peers. Trust your instincts when something seems off. And remember, billions of people are counting on you!

See you in the trenches. 💪

Frank, Mary Ann, Matt, and Karisse