It was one for the history books. As expected, 2024 was “Fraud At Full Throttle” as fraudsters upped their attacks.

But it was the breakneck speed of everchanging scams that surprised us most. Just when we thought they could not get worse, they did. And when we felt that AI deepfakes were years away, they happened.

Scams ruin lives, tear families apart, and warp our sense of reality. But even worse, they poison our trust. Trust is the invisible glue that holds our society together. And here we are, watching it quickly fade away as scammers steal it from us.

Welcome to 2025, The Year of “A Big Collapse of Trust💥”.

The Fraud Compadres Unite Yet Again To Predict The Future

It’s a tradition. Each year, Mary Ann Miller, Karisse Hendrick, and I collaborate to predict the future of fraud.

It works because we are all different. Mary Ann is an expert in cyber, identity, and fintech. Karisse is an expert in merchant fraud. And my expertise is in banking and scams.

Despite our different experiences, we share one thing in common – our love of fraud prevention ❤️ . So we get together on Zoom calls, send hundreds of text messages, and spend many hours exploring trends we think will most impact fraud fighters this year.

And man do we have a list this year! We think 2025 will be a little wild, so get ready.

If you want to take a step back in time, you can find our predictions for 2018, 2019, 2020, 2021, 2022, 2023 and 2024 right here.

First, Let’s Look Back At 2024 In Fraud – It Changed Everything

When we look back on 2024, one thing is clear. It was an explosive year of fraud that changed everything.

But it was these six things that defined the year.

In 2024, Glitch Culture Showed How Mob Mentality Has Taken Over Fraud

If 2021 was the era of FOMO for PPP funds, 2024 ushered in a new era of FOMO with people lining up for free money from ATMs compliments of “glitches.” First, there was the Chase Glitch, then Fidelity and others.

Fraud Fighters realize that these glitches marked an ominous shift in first-party fraud. According to Mary Ann Miller, this happens when first-party fraud is unchecked.

In 2024, Social Media Was Exposed In A Big Way

2024 was a great awakening for Meta and Telegram.

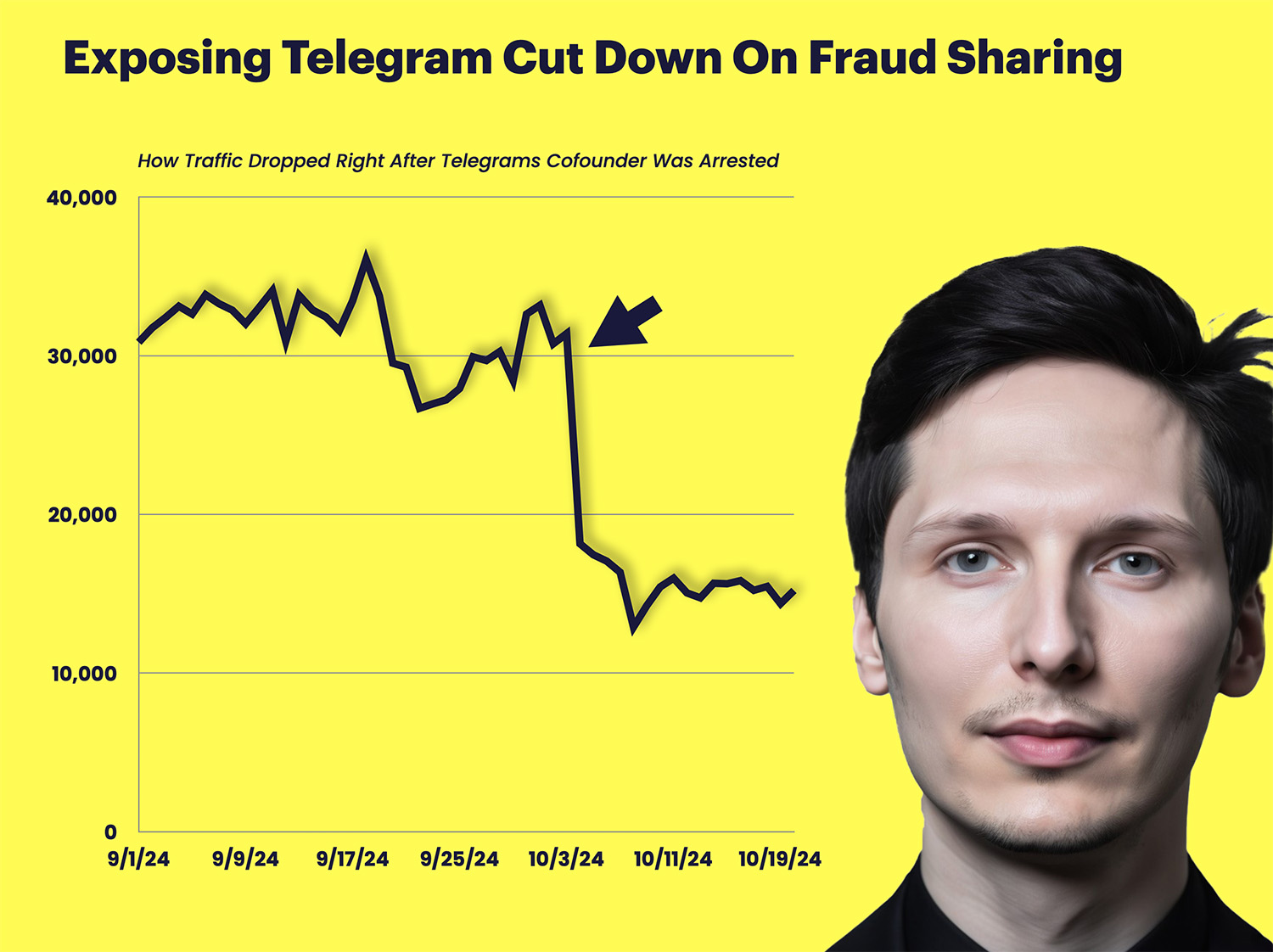

First, UK Banks exposed Meta, citing that 80% of scams can be tied back to their platform. Then, French Police exposed Telegram, arresting Pavel Durov for complicity in enabling a host of crimes on his platform. And Paul Rafille, a whistleblower, famously exposed Meta for their role in sextortion. We all cheered.

Did exposing them work? Kind of. Meta shut down 63,000 accounts for sextortion and another 2 million accounts for criminal activity, and Telegram shut down tens and thousands of criminal channels forcing criminals back underground.

Sadly, it was a blip in the road for fraudsters, but it showed us that shaming social media into action is the only way to accomplish anything.

In 2024, AI and Deepfakes Suddenly Got Real

It will mark the most significant shift in the trajectory of fraud and scams in history. And if you were a fraud fighter or a scam victim, you witnessed its birth in 2024.

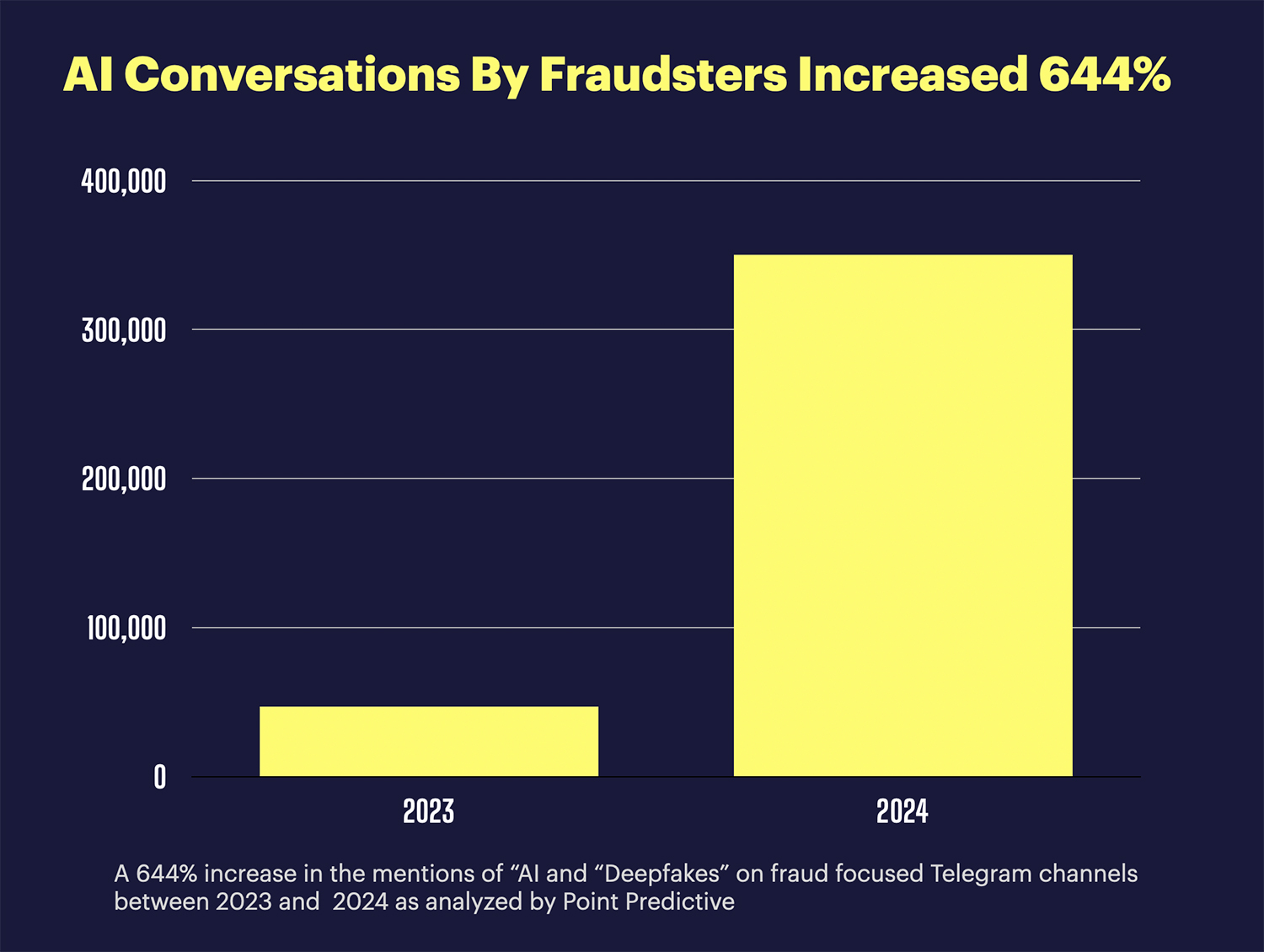

AI and Deepfakes were popping up everywhere, and for good reason. Fraudsters began sharing how to use it for everything from bypassing KYC to scamming victims increased over 644% on Telegram and other fraud forums.

In 2024, Scams Resulted In A $1.3 Trillion Transfer Of Wealth To Criminals

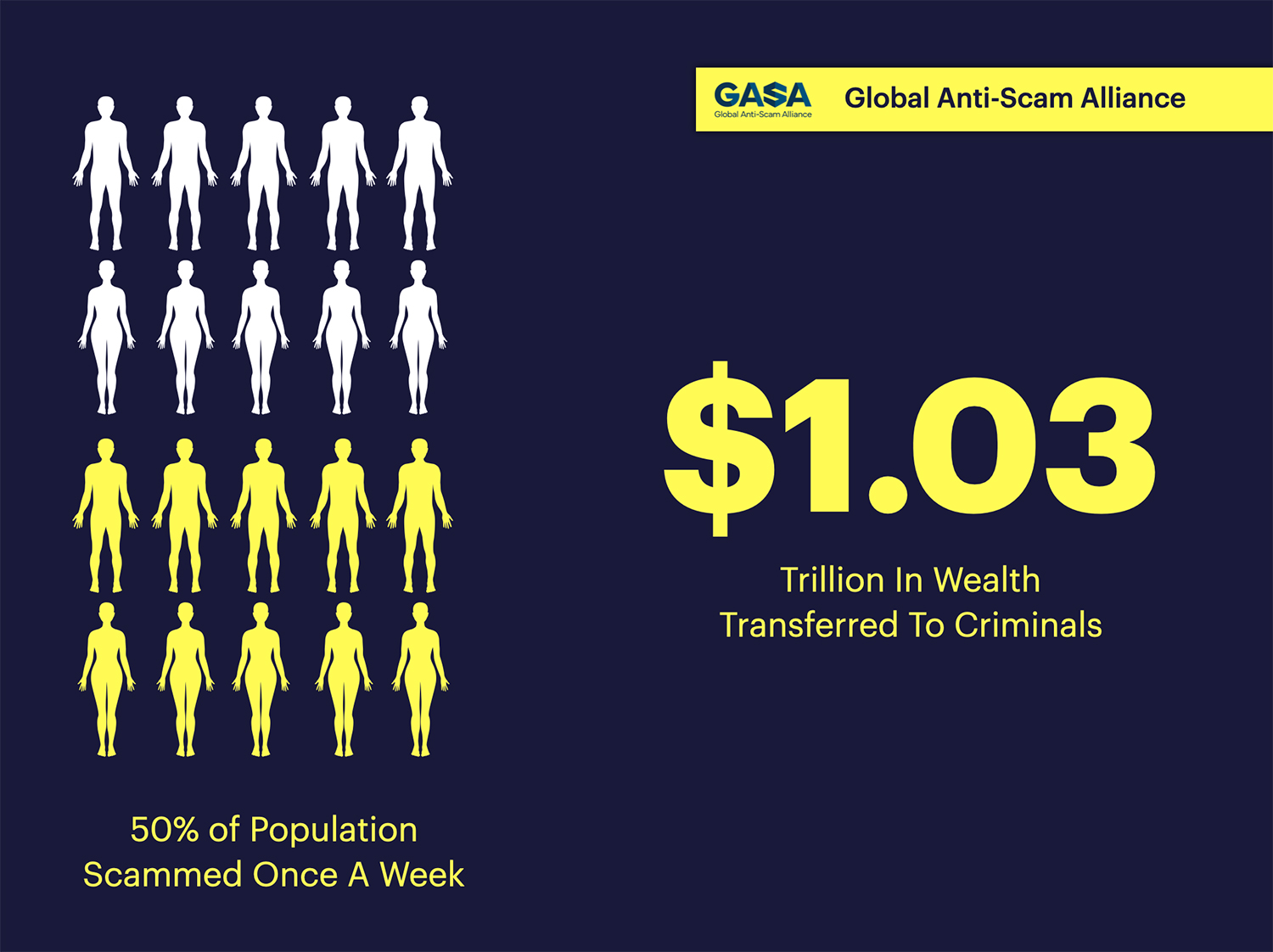

We are witnessing the most significant transfer of wealth to scammers in history. According to the Global Anti-Scam Alliance, “Scammers have siphoned away over $1.03 trillion globally in just the past year”.

It is so bad now that half the world’s population reports experiencing at least one scam attempt a week. That means that three billion people are experiencing scam attempts every single week.

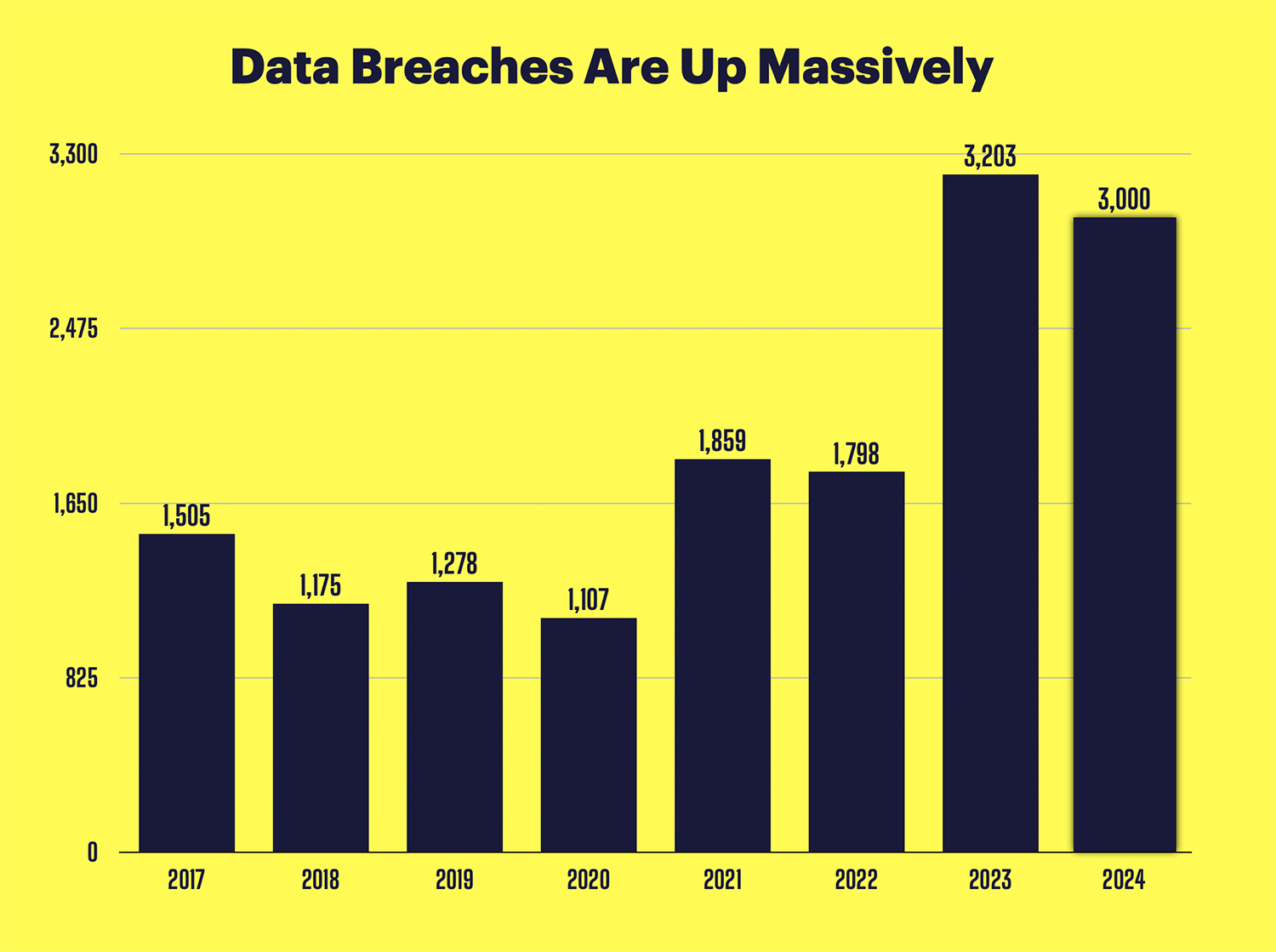

In 2024, Data Breaches Were Up Massively – No One Is Safe Anymore

2024 was a terrible breach year, but it won’t be the worst. According to the latest stats from the ITRC, the number of data breaches will be 3,000 this year, down from 3,200 last year.

Here is the kicker, though. Breaches in 2024 were up 66% since 2022; don’t forget over 1.4 billion people were victimized by breaches this year.

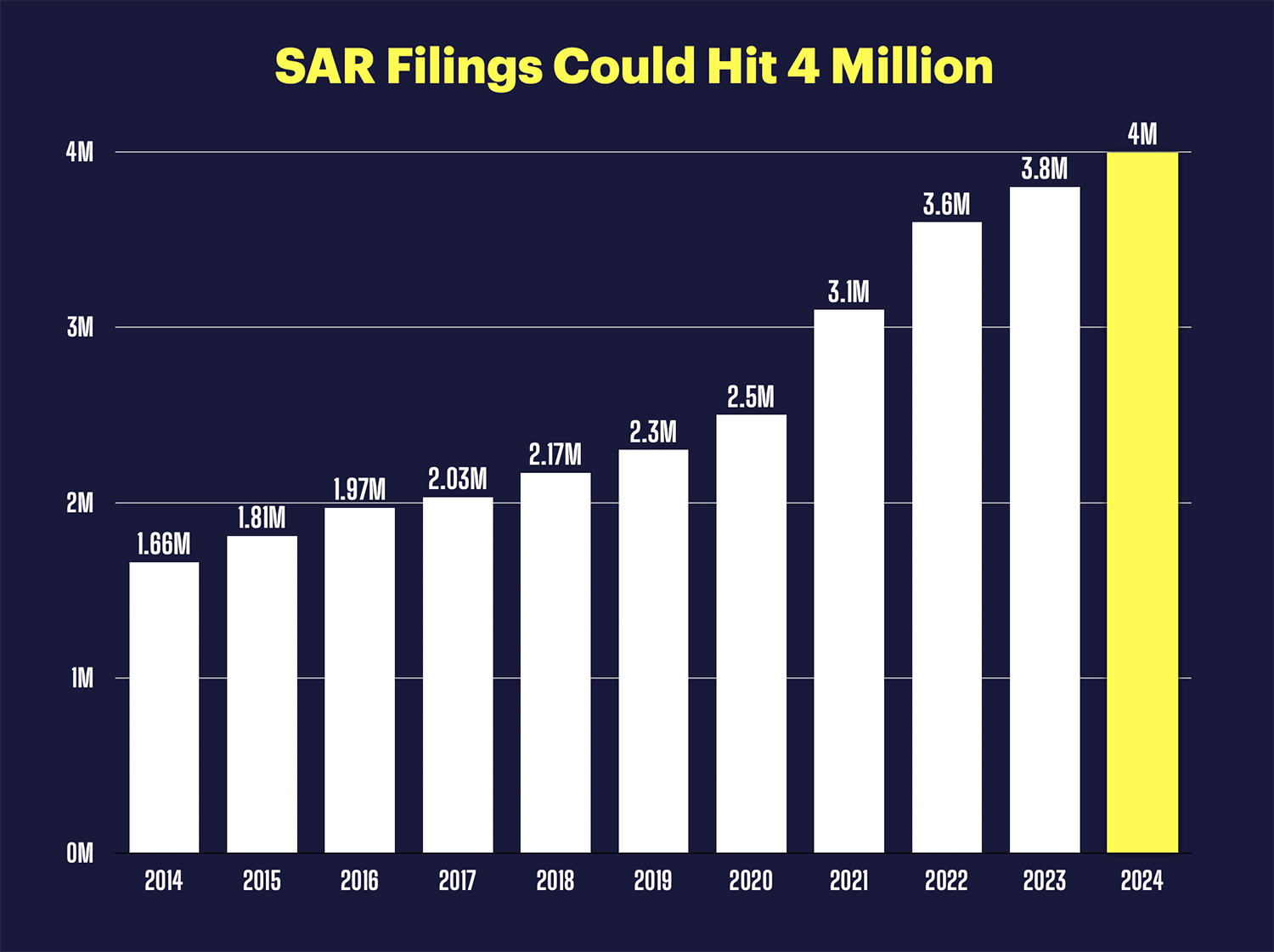

In 2024, SAR Filings Will Hit New Records Showing Fraud Is Only Going Up

Suspicious Activity Reports are always a great benchmark for assessing the state of fraud. And 2024, while it will be one for the record books, only indicates a modest increase.

While the final numbers have yet to be tallied, experts predict we could hit over 4 million filings. Pig Butchering, romance scams, and check fraud are the likely culprits.

These trends have set the stage for where we are headed in 2025. Now, let’s dive into our predictions.

Prediction #1 – Nigerian And Pig Butchering Scam Kingdoms Will Converge

Asia, India, and West Africa are hotspots for massive scam operations. In Asia, scammers have perfected Pig Butchering. In West Africa, scammers have optimized romance scams. And in India, impersonation scams are the specialty.

In 2025, we will see a significant shift by Nigerian scammers to Pig Butchering. Experts saw glimmers of the shift this last year.

In speaking to Wired, Sean Gallagher with Sophos believes it already happening, “You’ve got a lot of people who have seen this as a way to make a living, especially in Nigeria. And the technology is easily transferable.”

Look for large increases in Pig Butchering attempts as the Yahoo Boys adopt these sinister tactics.

Prediction #2 – A Majority Of Scams Will Incorporate AI And Deepfakes By End Of 2025

The killer app for AI isn’t fraud. It’s scams. And in 2025, the target of malicious AI will not be companies, it will be people.

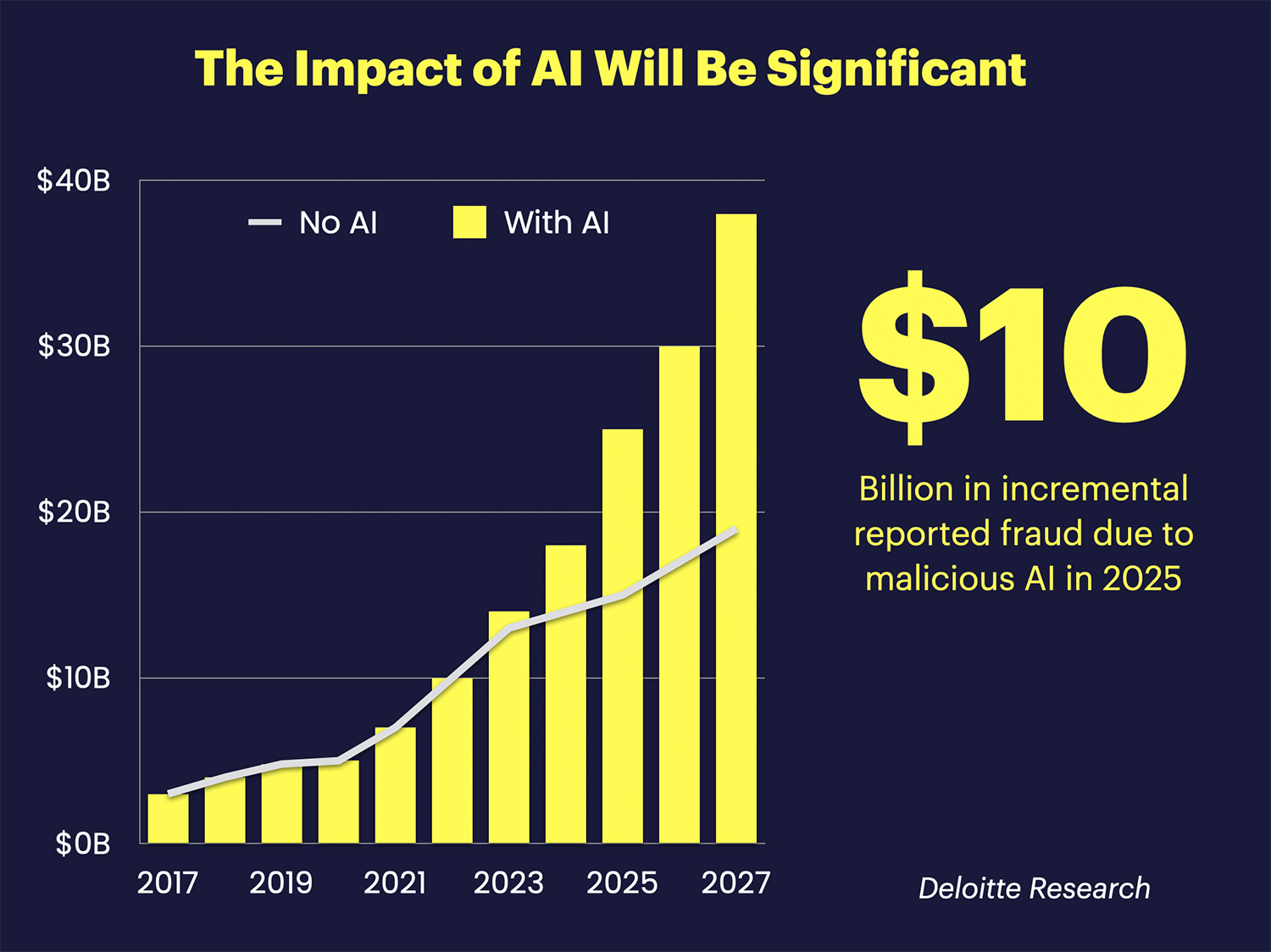

According to Deloitte , AI will enable an incremental $10 billion in reported fraud by the end of 2025. Our prediction is that most of those losses will hit consumers, not banks.

While fraudsters are not using AI extensively, scammers are. Because it works like magic works – making people believe something that is not real.

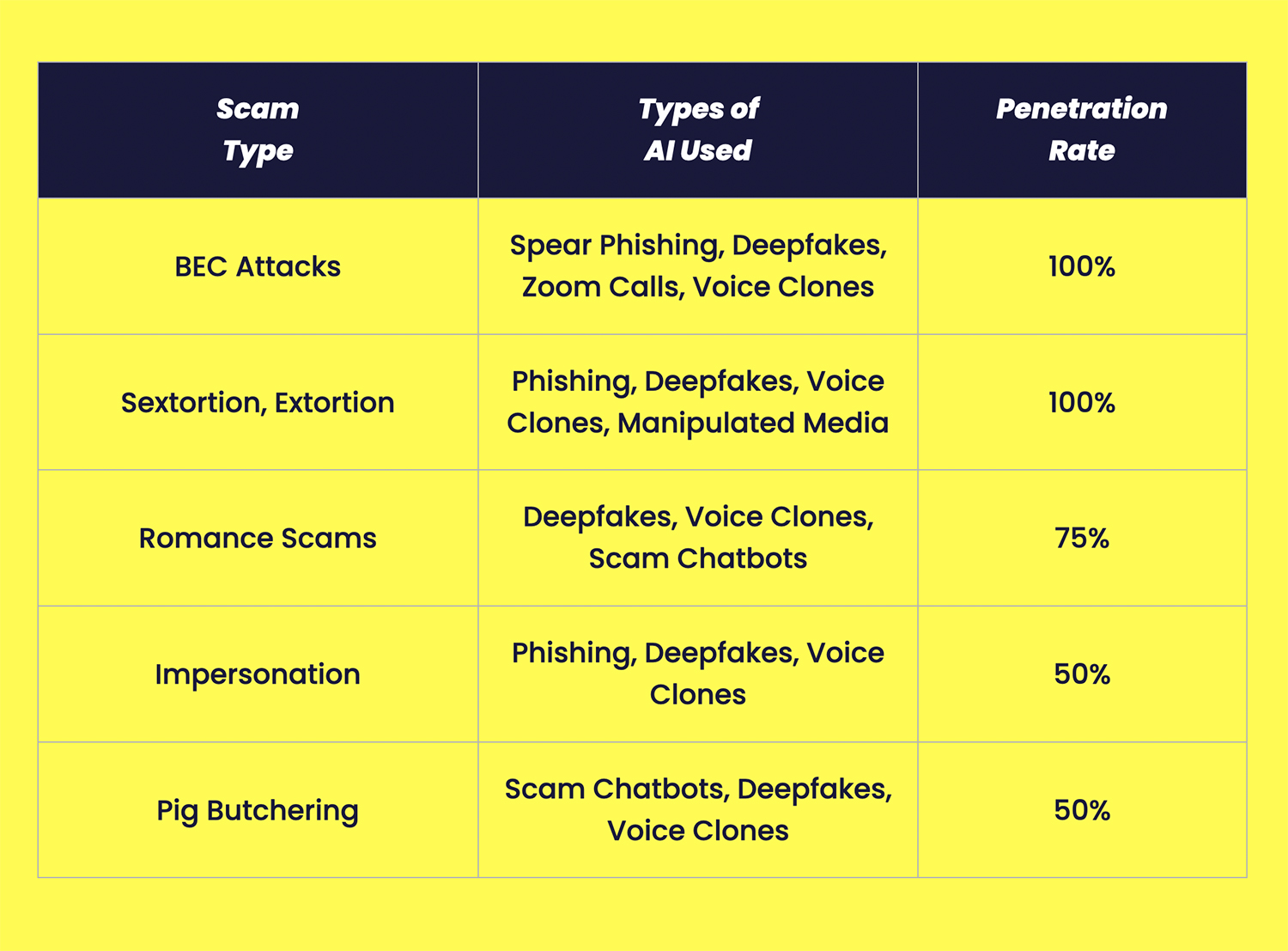

In 2025 AI will be used extensively by scammers for phishing, voice clones, deepfakes, zoom calls and scam chatbots and will extend to most scams.

These scams however will be the most impacted.

Prediction #3 – Regulators Lose Authority Resulting In Fraud Spikes

We predict that 2025 will be a year of far more relaxed regulations and even some rollbacks that will impact fraud and scams. The FTC, SEC and CFPB could all be in the cross-hairs.

CFPB leadership will change, and much of their agenda will drastically change too. The new administration will likely relax AI regulation and focus on innovation.

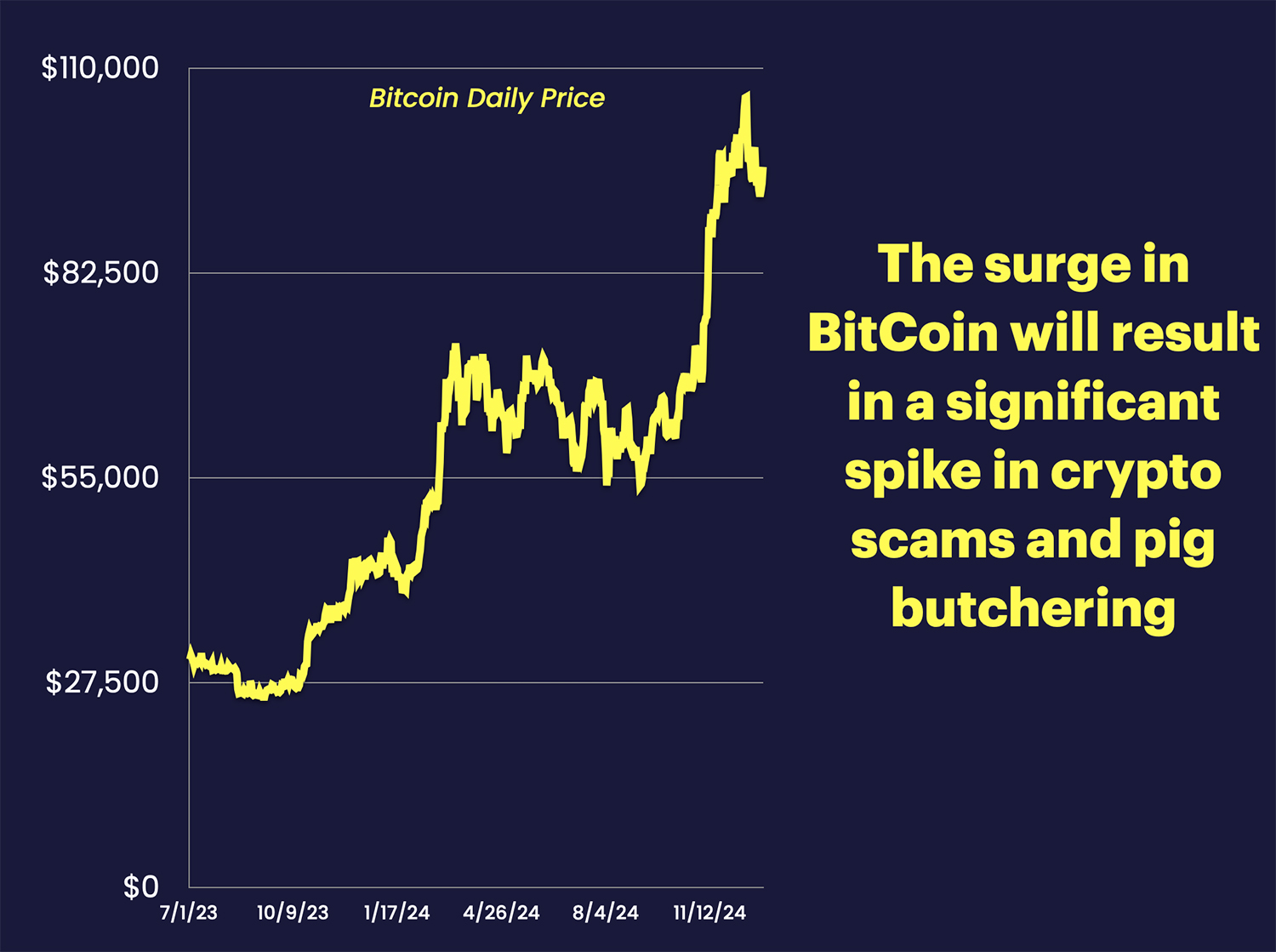

And as for Crypto, Trump has promised he is a “Crypto President” and wants the US to take a leadership position in innovation. This has sent Bitcoin to the stratosphere which is an early indicator of where we are headed.

While the regulatory pullback could spur more innovation and growth, there will new risk that emerge.

We predict more crypto scams, rug pulls and pig butchering losses. The spike in Crypto will only make those scams more believable as people have a fear of missing out.

Prediction #4 – Public Record Contamination Will Test Banks Fraud Defenses

Public records, credit bureaus and search engines like Google are increasingly contaminated with false information tied to fake identities.

Contamination occurs when fraudsters or credit repair companies insert fake information into the public domain through the use of CPNs, fake tradelines, false businesses, and bogus claims of identity theft.

Since June of 2024, there has been a 300% increase in conversations related to CPNs on Telegram channels which we believe is an early indicator that public record contamination is set to rise.

In 2025, we predict a significant increase in fraudster activity tied to CPN’s, synthetic businesses, and other credit repair schemes. Mary Ann Miller warns, “Just because something shows up on public records in 2025, doesn’t mean it’s real”

Prediction #5 – Scams Will Take Dark Turn As Terror-Based Extortion Schemes Proliferate

An insidious scam bubbling to the surface in India and China that has all the makings of the next big Pig Butchering trend. It’s called “Digital Arrest” in India and “CyberKidnapping” in China.

Digital arrests occur when scammers seize total control of a person through constant video surveillance and psychological manipulation. Victims become virtual hostages, forced to comply with fraudulent investigations while criminals drain their accounts.

With over 92,000 deepfake digital arrest cases reported in the last year alone, Indian authorities are struggling to contain it. According to an article that appeared in BBC, Indian authorities have been able to trace 40% of the new wave of digital arrests to Southeast Asia.

We predict Pig Butchering scammers will shift to terror-based schemes like digital arrest and extortion in 2025 and the US will experience a wave of new attacks.

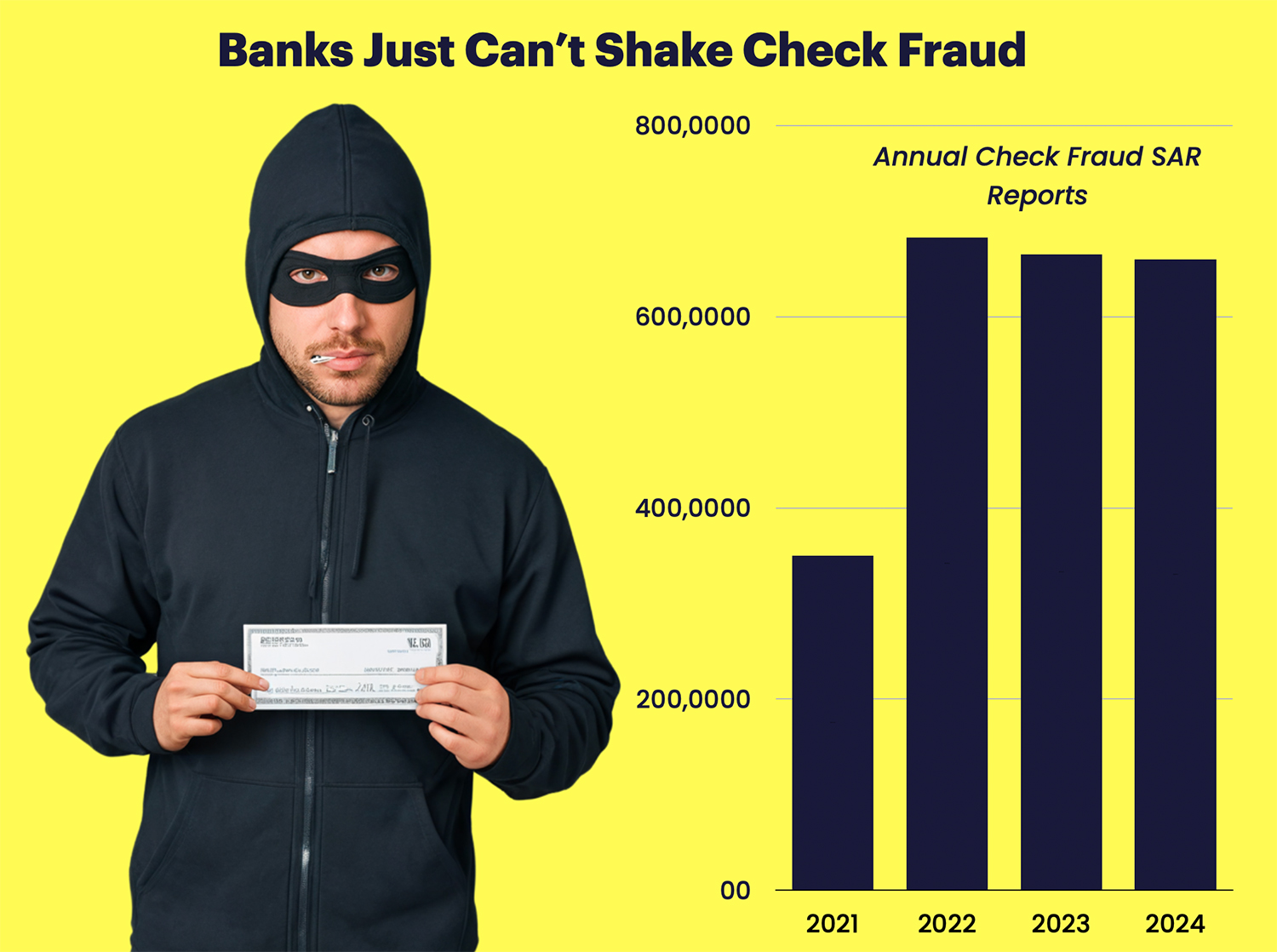

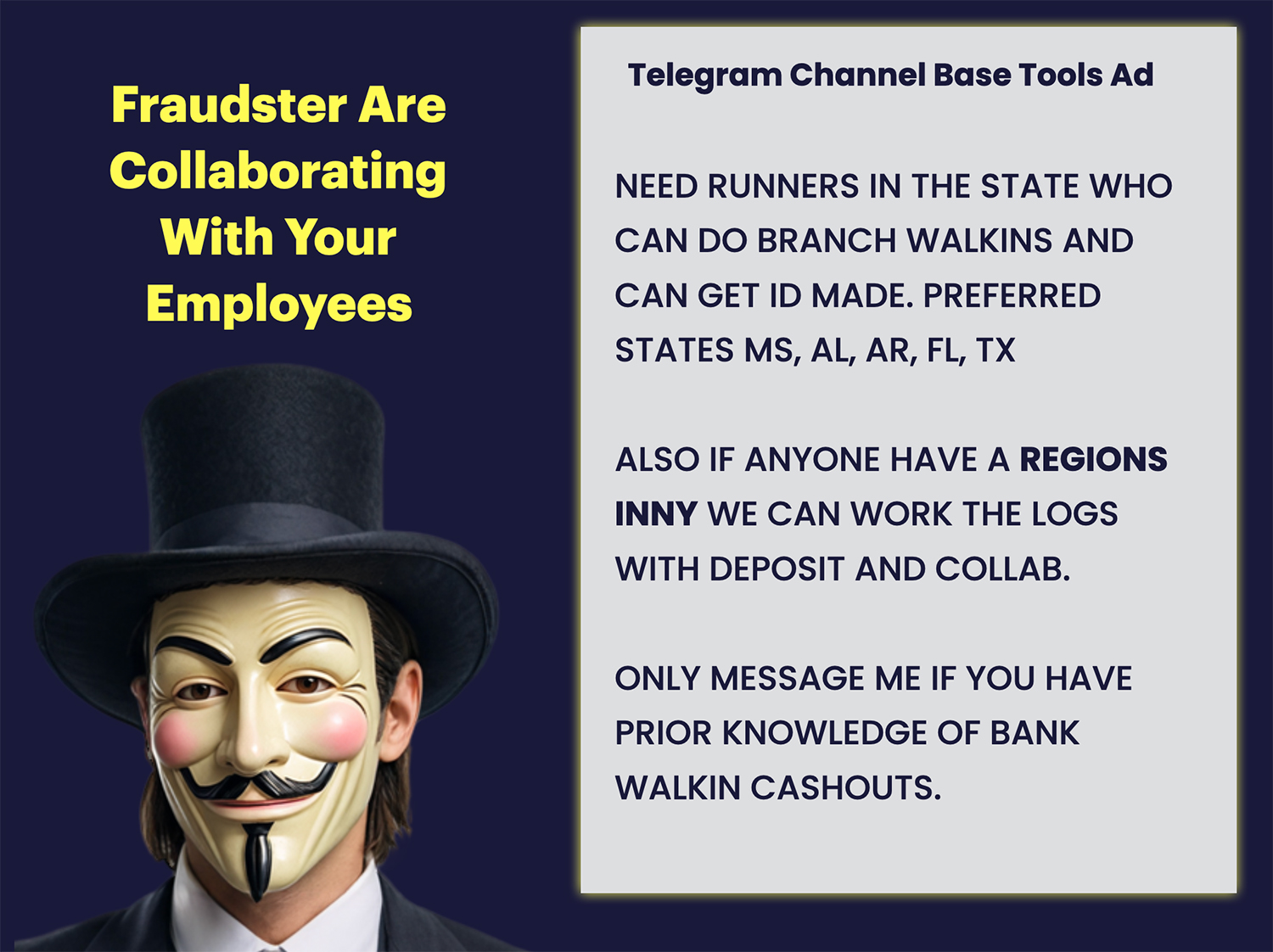

Prediction #6 – Insider Fraud And Corruption Will Push Check Fraud Levels To New Highs

Check fraud remains stubbornly high. Banks just can’t seem to shake it off. SAR reports for 2024 will likely end at 660,000 – almost identical to the number of fraud reports for last year.

In 2025, we predict insider fraud will push check fraud to new records, with SAR reports potentially exceeding 680,000 incidents.

As I reported to Mitek, criminal rings will significantly increase their recruiting of banking associates, postal employees and insiders on social media, Telegram, and on the streets.

The primary targets will be bank tellers, branch personnel and corrupt postal employees. They will be promised thousands of dollars in additonal income each month for helping pass bad checks, opening mule accounts, passing identity information to fraud rings or turning over arrow keys to fraudsters.

Prediction #7 – Faster Payments Will Significantly Slow Down As Banks Fight Scams

It’s happening worldwide, and now it may be coming to the US. It’s not scam reimbursement, its something better and more effective. It’s called scam Interdiction. A growing number of banks are pausing payments and holding wire transfers to stop customers from losing money.

Its a tough love approach, but it may be the only way to protect customers from themselves.

Revolut is a good example of how well this approach works, they reported a 30% reduction in scam related losses immediately after they begin to restrict payments to high risk platforms.

In the UK banks were given the power to hold payments for up to 72 hours, and in Australia banks are in talks to hold funds on payments when a new payee is added.

We predict that banks in the US will begin to follow suit, holding payments on the most suspicious requests including new payees, international transfers and when abnormal account activity is present.

Prediction #8 – A Wave Of High Risk Merchant Terminations Will Take Place

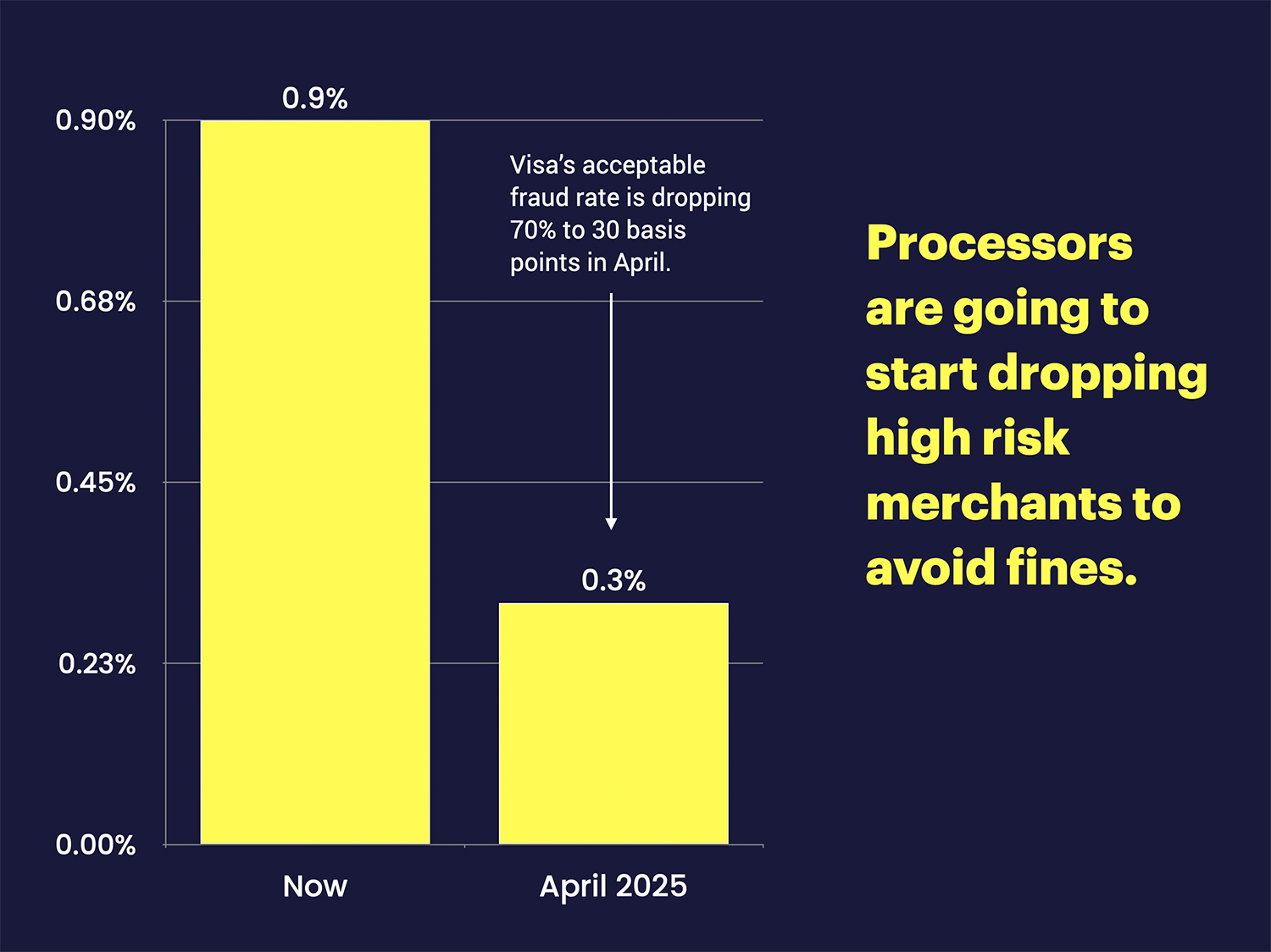

In April of 2025, Visa will implement a new program called Visa Aquiring Monitoring Program (VAMP). We predict the program will result in a wave of high risk merchants being kicked off their payment platforms for exceeding acceptable fraud levels.

There are two types of merchants that will be impacted by these terminations : Black Hat merchants, and Gray Hat merchants.

Black hat merchants are shell companies processing payments for banned industries such as gambling, drugs, or fake companies processing payments on stolen credit cards.

Gray hat’s are online merchants with high chargebacks. These merchants might have bad customer reviews, or their products don’t ship quickly or they make their subscription services too hard to cancel.

So why are these merchants going to get terminated? “Because payment processors are going to be forced to monitor their high risk merchants more carefully to avoid fines” says Karisse, “Because oversight is moving closer to the merchant relationship with the processor, we expect to see payment processors discontinuing relationships with their riskiest merchants.”

Prediction #9 – Refund Fraud and Loyalty Fraud Will Emerge As Biggest Merchant Challenges of The Year

We predict merchants will wage a fierce battle on two fronts this year; refund fraud and loyalty program fraud. This was revealed after Karisse Hendrick surveyed dozens of retailers in recent weeks.

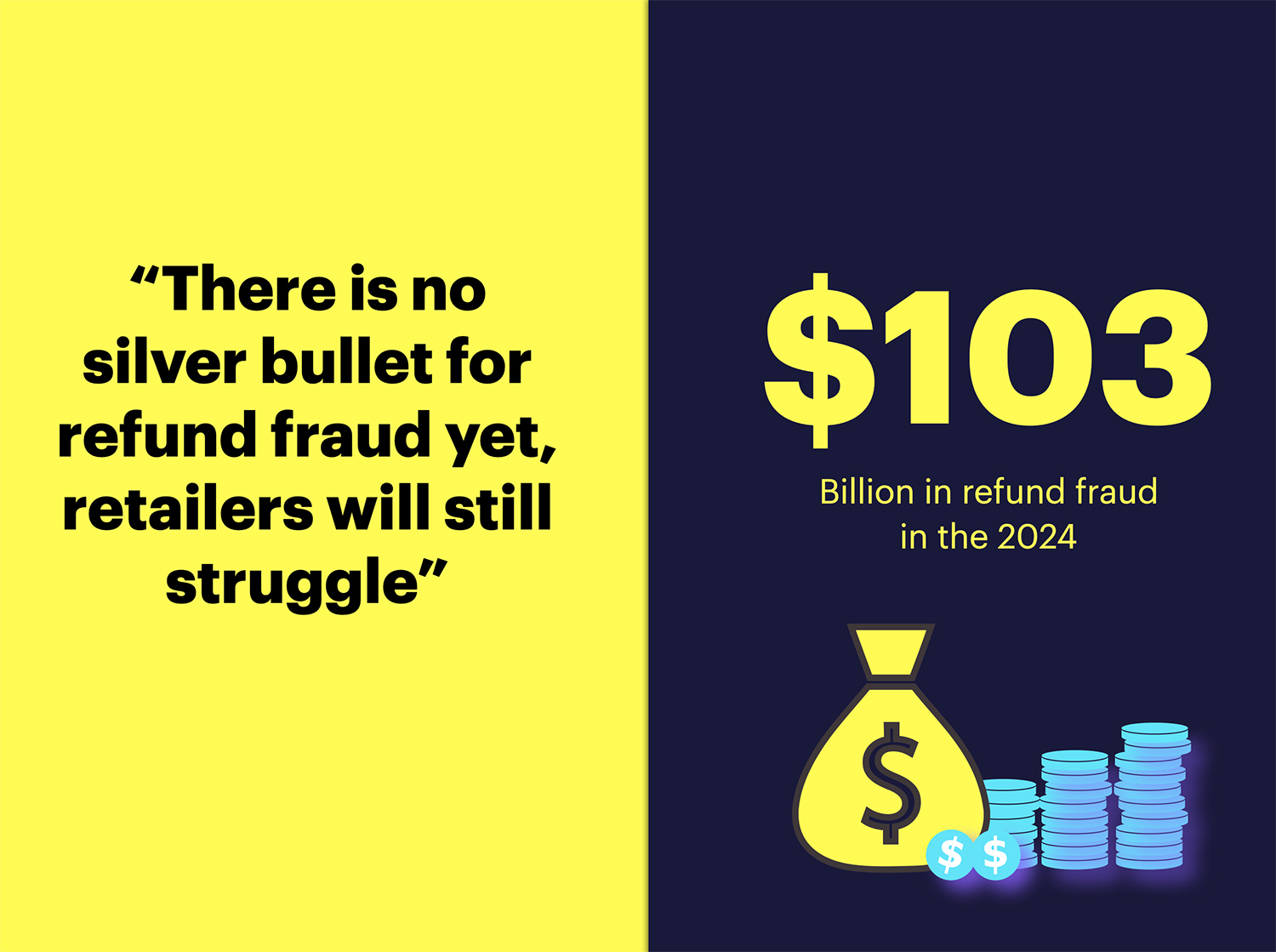

Refund fraud, which surged during the pandemic, is showing no signs of slowing down. In fact a recent report suggest retailers lost $103 billion last year to the exploit last year alone.

“While some software and best practices have worked to identify fraudulent claims over legitimate ones, this is still a battle where there is no clear silver bullet”, says Karisse. “Merchants are still struggling to find the balance between stopping it and not impacting customers”.

Loyalty fraud happens when loyalty points for credit cards or online companies are swiped from the customer. It can happen when someone hacks into a customers account, and sometimes it can happen when someone simply types the customers phone number in at the register.

“Blame it on the black market where these hacked accounts are sold”, says Hendrick, “Hotel chains, airlines, department stores and bespoke retailers, along with credit card companies and banks are all being pummeled by this fraud and it is not letting up anytime soon.

Prediction #10 – Troves Of Breached Data Will Fuel New DataSniper Scams

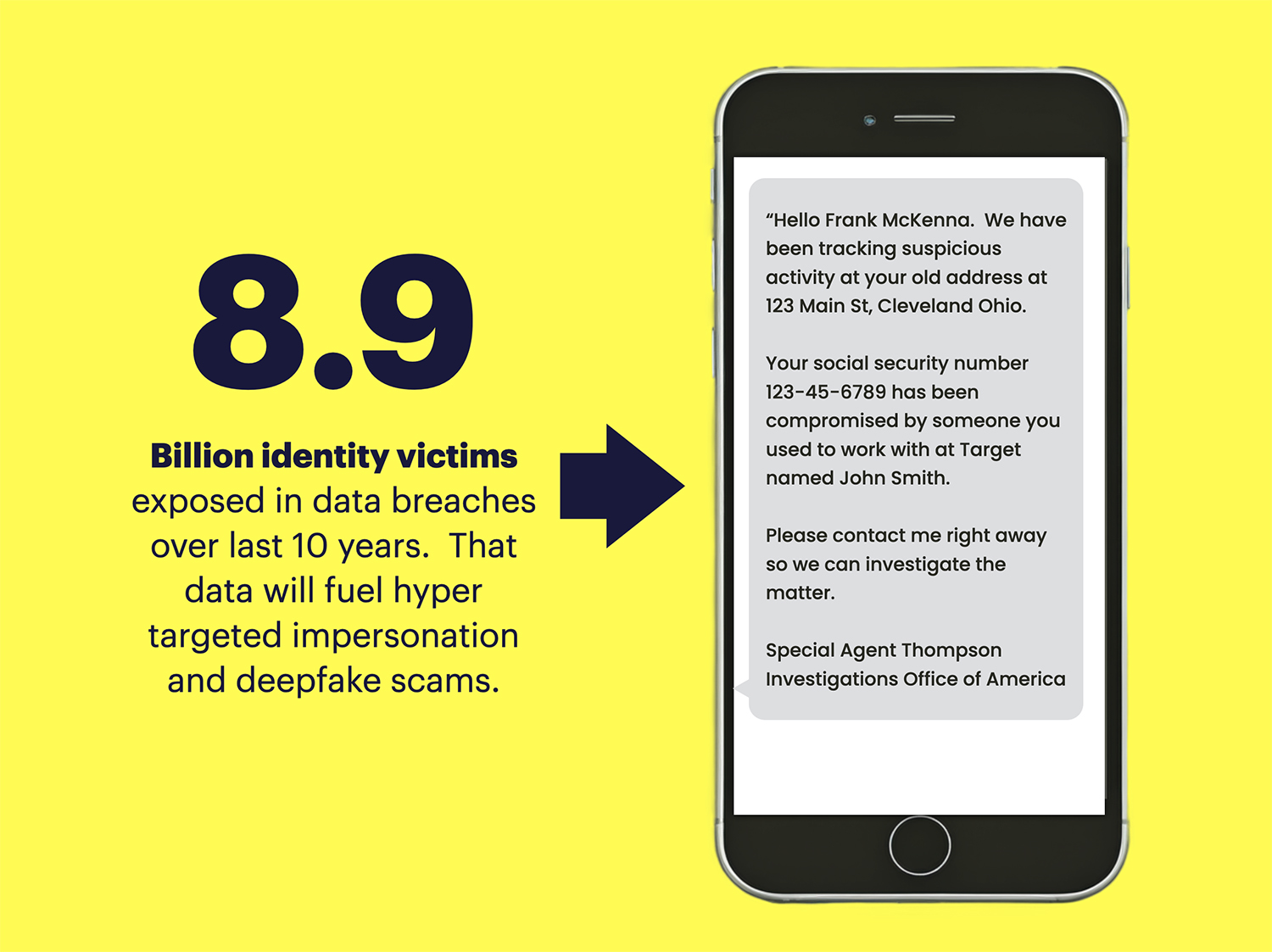

In the last ten years data breaches have impacted close to 9 billion victims worldwide with some of those victims impacted hundreds of times.

In 2025, those billions of pieces of identifying information will be used to initiate hyper-targeted deepfakes and scams that will blur the reality between reality and fiction. We call these new scams “DataSniper” scams because they leverage stolen breached data to precisely target a victim.

Glimpses of this trend emerged in 2024 with the Gmail search history extortion scam. In that scheme, scammers send victims a photo of their home with the subject line “I am watching your dirty behavior online”

Look for hyper-targeted scams that reference more real personal information, and information on relatives and acquaintences in 2025.

Prediction #11 – Autonomous AI Scam Agents Will Emerge As Significant New Threat

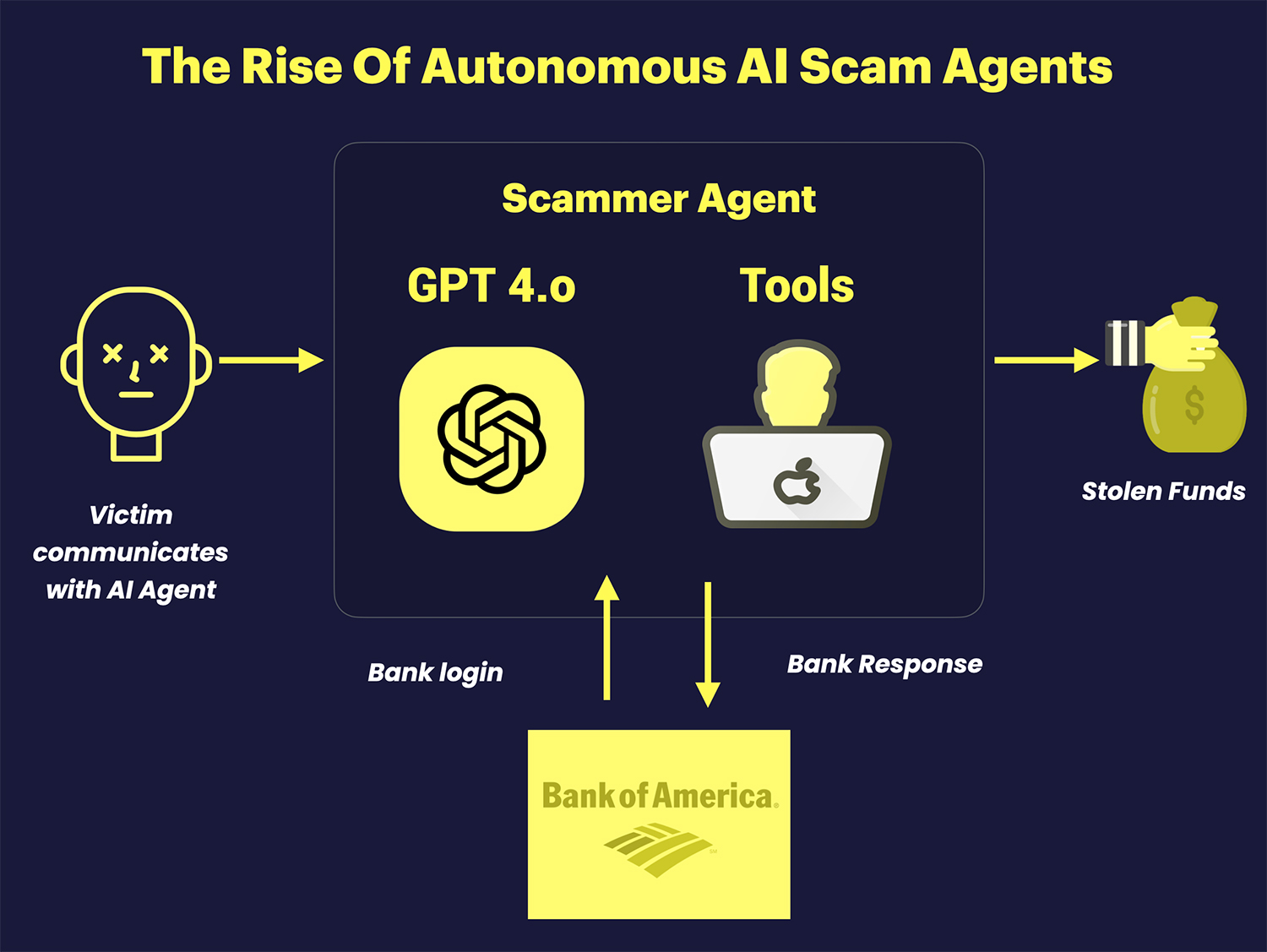

Evidence is mounting that Autonomous AI Scam Agents are emerging as a significant new threat.

First there was this video which showed a Nigerian romance scammer using a bot to talk to his victim. Then there were these videos showing pig butchering scammers using Instagram automatic fans. And finally, researchers were able to program AI agents to autonomously carry out scams like bank transfers with remarkable success.

We predict autonomous AI scam agents will emerge as a new and potentially significant threat in 2025. From romance scams, to crypto scams, to bank transfer and credential stealing, companies should be prepared for a new generation of autonomous threats.

Prediction # 12 – AI Fraud Agents Will Change How We Think Of Fraud Analyst

Yes fraudsters are using GenAI, but we can too. 💪

We predict a significant shift in GenAI in 2025. While there was initially hesitation around security and privacy of Gen AI, most companies are finding ways to make it work.

Payment companies Mastercard and Visa publically adopted Generative AI in 2024. Visa uses the approach to identify enumeration attacks, while MasterCard used it to double the detection of compromised cards.

But it’s small upstarts like Inscribe.AI , that just might be on to the killer app for fraud – AI Agents. AI agents are Automous AI bots that can be programmed to automate any task. They partnered with Claude in 2024, and created an innovative AI Agent that reduced fraud review times by 20X!

AI agents will begin to completely transform the fraud detection landscape in the next 24 months. They will not replace fraud analysts, but they will transform their jobs into something more spectacular.

Our Recommendations To You In 2025

Karisse, Mary Ann and I will leave you with these parting recommendations for the year.

MaryAnn Miller – Fraud Fighters Your Voice Matters

Click to play a video message from Mary Ann on why your voice matters.

Karisse Hendrick – We Need To Work Together and Collaborate

Click to play this video message on how we need to work together and trust each other.

Frank McKenna – The Future Of Trust Is In Our Hands

Click and play this video message on how we have to fight to keep trust intact.

Join The Fight Against Scams

Are you a fraud fighter that wants to volunteer your time and expertise to stop scams and the impact of financial crimes? If you are, please consider joining forces with these two groups.

Operation Shamrock – Join Erin West in her mission to end cyber enabled crime like Pig Butchering.

The Knoble – Join thousands of other fraud fighters, law enforcement, regulators and NGO’s who are working together to end human crime.

Thank you fraud fighters for all you do. We appreciate you taking the time to read our predictions for 2025.