It’s mass hysteria. It’s like PPP Fraud all over again. People fear missing out on some free money, and it’s nuts.

The Viral Chase Bank Glitch Is Rolling on Social Media

If 2021 was the era of FOMO for PPP funds, 2024 is ushering in a new era of FOMO with people lining up for free money from ATMs compliments of “glitches”.

Remember when people lined up at Bank of Ireland by the hundreds recently to score free cash? It wasn’t free; people exploited a gap, allowing them to overdraw their accounts by over $1,000.

This weekend, people are reportedly lining up at Chase Bank ATM Machines in New York to try a new “Viral Chase Money Glitch.”

The term “glitch” is often used on social media to indicate when someone finds a software issue that, if exploited, can result in free money.

Pictures on social media show people lining up at ATMs in New York attempting the glitch.

The money glitch, however, is not a glitch at all. It’s an old fraud that has been around for over 100 years—check Fraud.

The “glitch,” as far as I can tell, is simply depositing a fake check in the ATM that will never clear and withdrawing the money before the check bounces. Banks usually hold funds for up to 3 days before releasing money, but some users claim that they were able to get funds and big loans immediately, which kicked off the viral frenzy on social media.

Chase bank glitch explained pic.twitter.com/C8LJtxGo9O

— Champagne Sloshy (@JoshyBeSloshy) August 31, 2024

Many speculated that people who tried the glitch would be in big trouble. One user commented, “Chase is going to arrest so many people for this “S&^T”.

It was unclear, however, if a glitch ever gave people access to free money or if it was just a made-up social media hoax to get something viral.

A spokesperson for Chase Bank told The New York Post yesterday that they knew about the glitch.

“We are aware of this incident, and it has been addressed. Regardless of what you see online, depositing a fraudulent check and withdrawing the funds from your account is fraud, plain and simple,” the spokesperson added.

Watch People Line Up Outside ATM’s To Try Check Fraud

One X user, Ryan, posted this video of people trying the glitch to get quick cash. Most were unaware that they were just about to try Check Fraud, instead thinking they would get in on a new way to get free money.

people are currently lined up outside a Chase bank in New York trying to do the new viral glitch to get free money ??pic.twitter.com/V49JpVu9iq

— ryan ? (@scubaryan_) August 31, 2024

The videos bring back memories of PPP and EIDL loan fraud schemes, in which thousands of people in the US applied for loans with fraudulent information, hoping to receive free money from the government.

It also shows the power of social media to get people to engage in activities they would typically not even consider.

Deepfakes Compound The Glitch

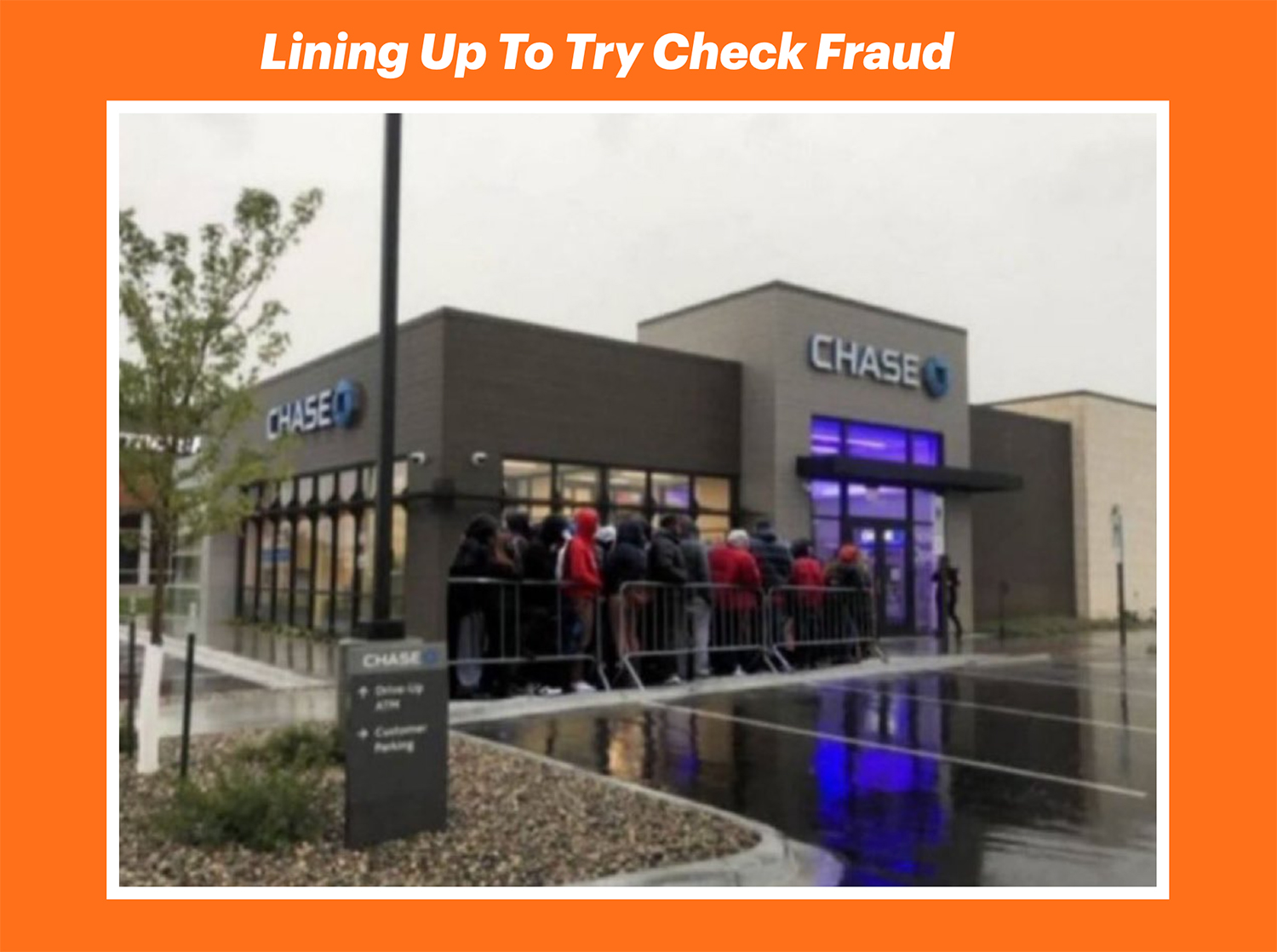

Check out this photo. It was making the rounds over the weekend to show just how many people were attempting the glitch.

One reader commented to me that it looked fake. Indeed, the appearance of people huddled so close behind a barrier doesn’t look like something Chase would temporarily erect for an ATM line. The fact that the barrier seems to melt into the building suggests it could be AI-generated.

A close examination of the photo reveals it is a deepfake. A reverse image search shows this photo of a Chase Branch in North Dakota that opened in 2021.

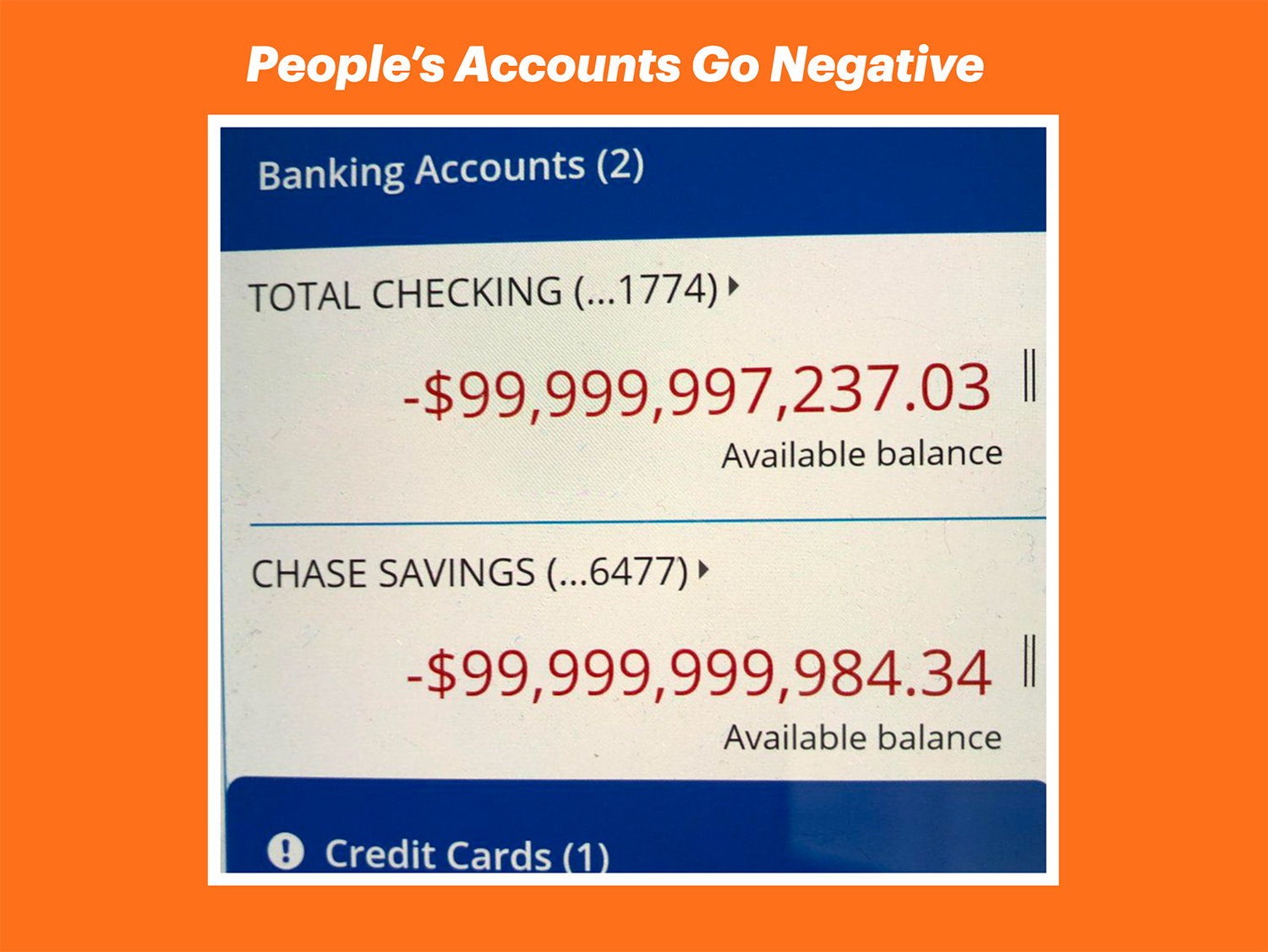

Negative Balances And Holds Are Hitting People’s Accounts

People are finding out the hard way that the glitch doesn’t work and that their accounts are being hit with extremely negative balances and account holds after the checks are deposited.

One X user posted a screenshot showing an extremely negative balance on their banking accounts after they tried to make fraudulent deposits.

Spotted By David Maimon On Telegram

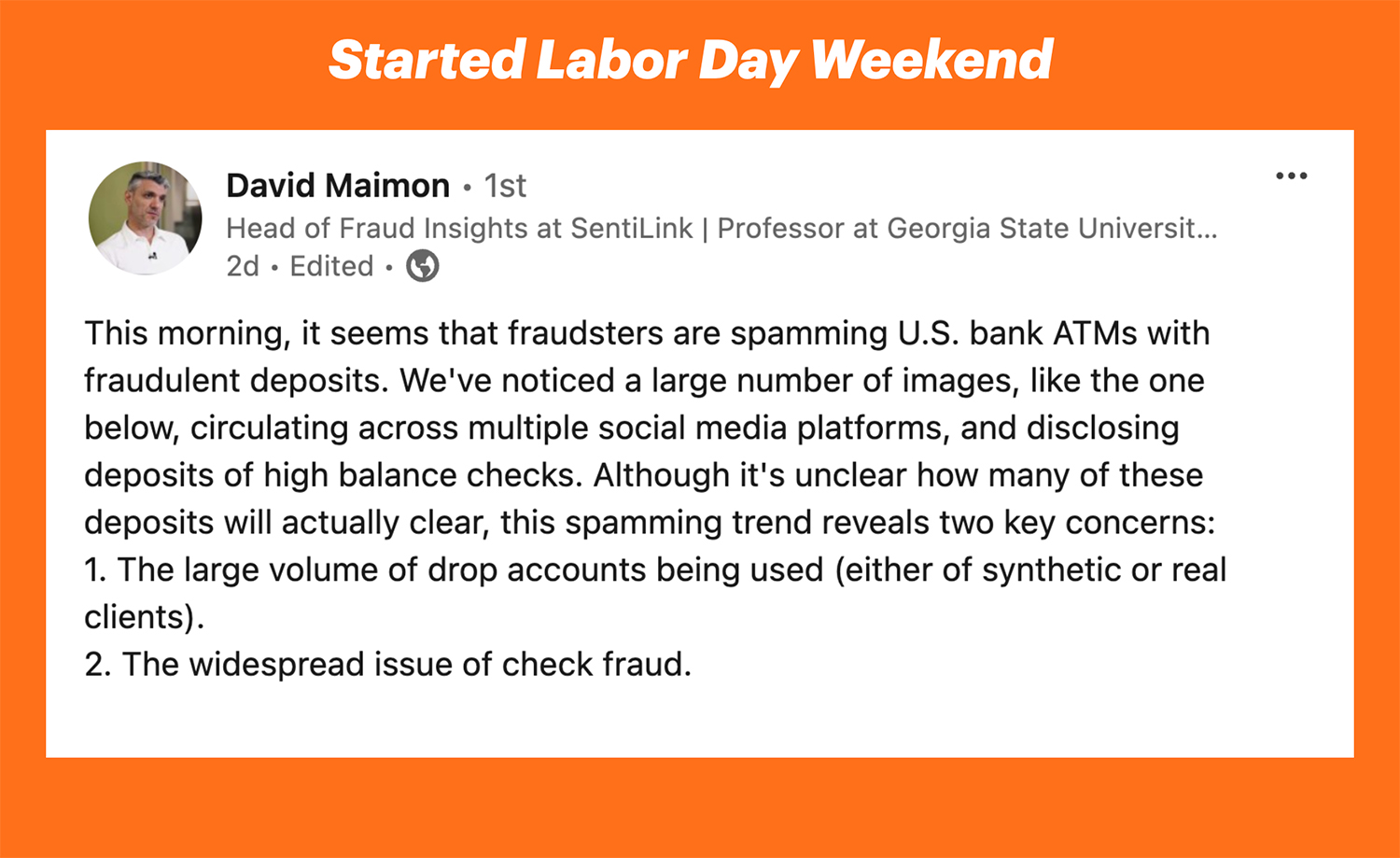

David Maimon, head of Fraud Insights for Sentilink, first spotted the viral activity before Labor Day weekend.

Mary Ann Miller, a fraud executive with Prove, also notified me on Saturday that the scheme was trending on social media, which was unusual.

Maimon initially noticed a high rate of people spamming US Bank Accounts with fraudulent deposits on Friday, a trend Miller saw hit widely hitting social media by Saturday.

Shortly after, videos of people giddy with their cash haul on Telegram emerged. In this post, he showed a video of a car full of people and loads of cash on hand.

The Scheme Comes To Light

By Sunday, the scheme was trending on news outlets who had picked up the story.

According to Maimon, “It appears the high volume of ATM deposits I reported on Friday stems from an elaborate scam that was heavily promoted on social media.” he said,

“Specifically, social media platforms have been buzzing with rumors about a glitch in Chase Bank’s ATM and online banking systems, allegedly allowing customers to withdraw large sums of cash without authorization. This likely explains the surge in check deposits before the weekend.”

Banks Need To Watch for Mule Activity – There is Intentional Fraud Here

According to Mary Ann Miller of Prove, the viral activity may be more intentional. Mule accounts are often used to facilitate first—and third-party fraud with synthetic or stolen identities. It’s pretty probable fraudsters too rushed in to exploit the glitch.

In addition to carefully monitoring hold policies during deposit activity, she believes banks also need to examine their front-end controls to ensure bad accounts don’t enter the system.

“Ensuring your bank has updated your account onboarding controls is critical to prevent mule account creation. Mule accounts are used for deposit exploitation and ATM free for alls”, she says.

Think Twice If You’re Thinking About Trying The Glitch

If you’re thinking about trying the “glitch”, think twice. Not everything you read on social media is true and you can get arrested if you knowingly commit check fraud against a US bank.