Credit repair is a massive $4.4 billion annual revenue industry.

And some of the shadier players seemed to have tapped into a very lucrative new market.

Selling fraudulent primary tradelines which are virtually undetectable from the real thing.

The Jig Is Up on Authorized Tradelines, So Now The Scheme Is Shifting

Authorized user tradelines are recorded on consumers’ credit reports when someone else adds them as an authorized user on their credit card account.

Tradeline companies have been brokering these authorized user tradeline accounts for years. In fact, the process has become so exploited by CPN users and synthetic identity fraudsters that most banks and lenders now flag excessive authorized tradelines as a major fraud flag.

The jig is up when it comes to authorized tradelines or, as many fraudsters would say, “the method is burnt”.

In the last year, some shadier credit repair companies have shifted their focus to posting new tradelines that are more well-hidden and offer far more score-boosting power than authorized tradelines.

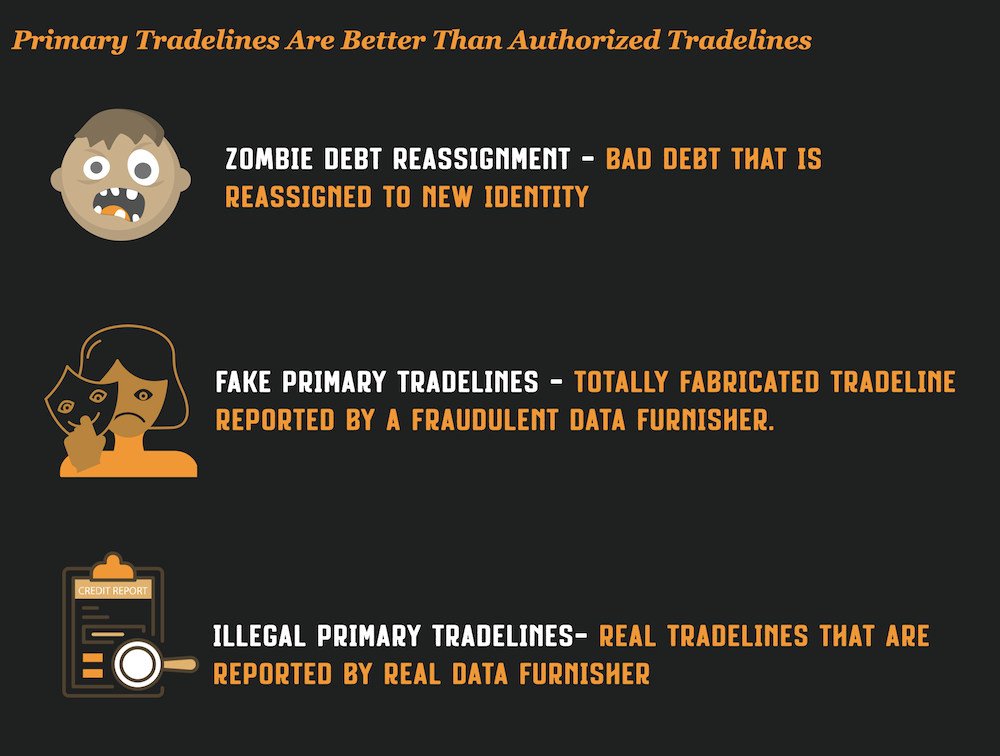

- Illegal Primary Tradelines – real tradelines that are posted to consumers’ credit reports illegally.

- Fake Primary Tradelines – fabricated tradelines posted by bad data furnishers

- Zombie Debt Primary Tradelines – charged of debt that is reassigned to a consumers credit report

I have already written extensively on Fake Primary Tradelines and Zombie Debt Primary Tradelines in the past.

Lately, the “illegal primary tradelines” have become popular among less reputable credit repair circles.

And that is what I am focused on here.

There Are Legal Primary Tradelines That Are Exploited By Synthetic Identities

There are lots of legitimate primary tradelines that consumers can acquire online. And many of these are exploited by synthetic identities. However, they are completely legal. Some of these include;

- Self Lender

- Kikoff

- National Credit Direct

- Crown Credit Jewelers

- OX Publishing

These tradelines often involve the customer making a deposit or purchasing something from a website and then paying off the debt slowly.

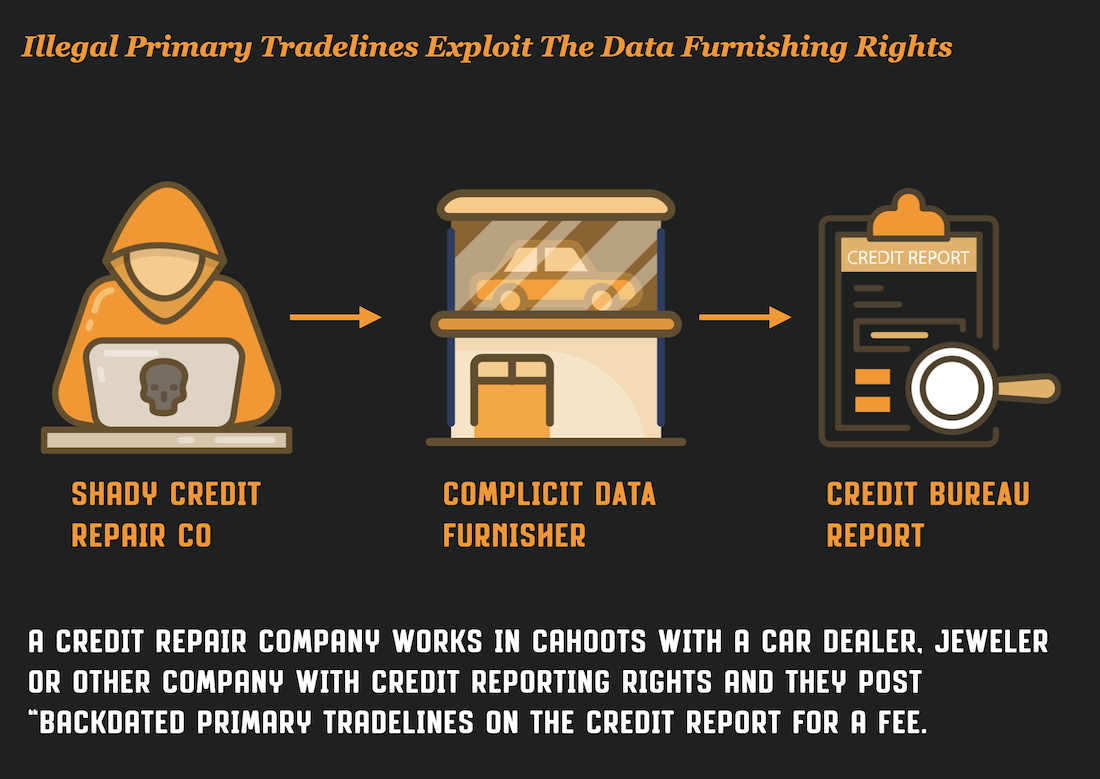

Illegal Primary Tradelines Are Different And Involve Data Furnishing Exploitation

Illegal primary tradelines are quite different and involve exploitation by a data furnisher.

A credit repair company works in cahoots with a data furnisher to post “backdated tradelines” to a consumer’s credit profile even though credit was never granted.

The cost of purchasing these tradelines is far higher and can $2,000 to $3,000 per successfully posted tradeline.

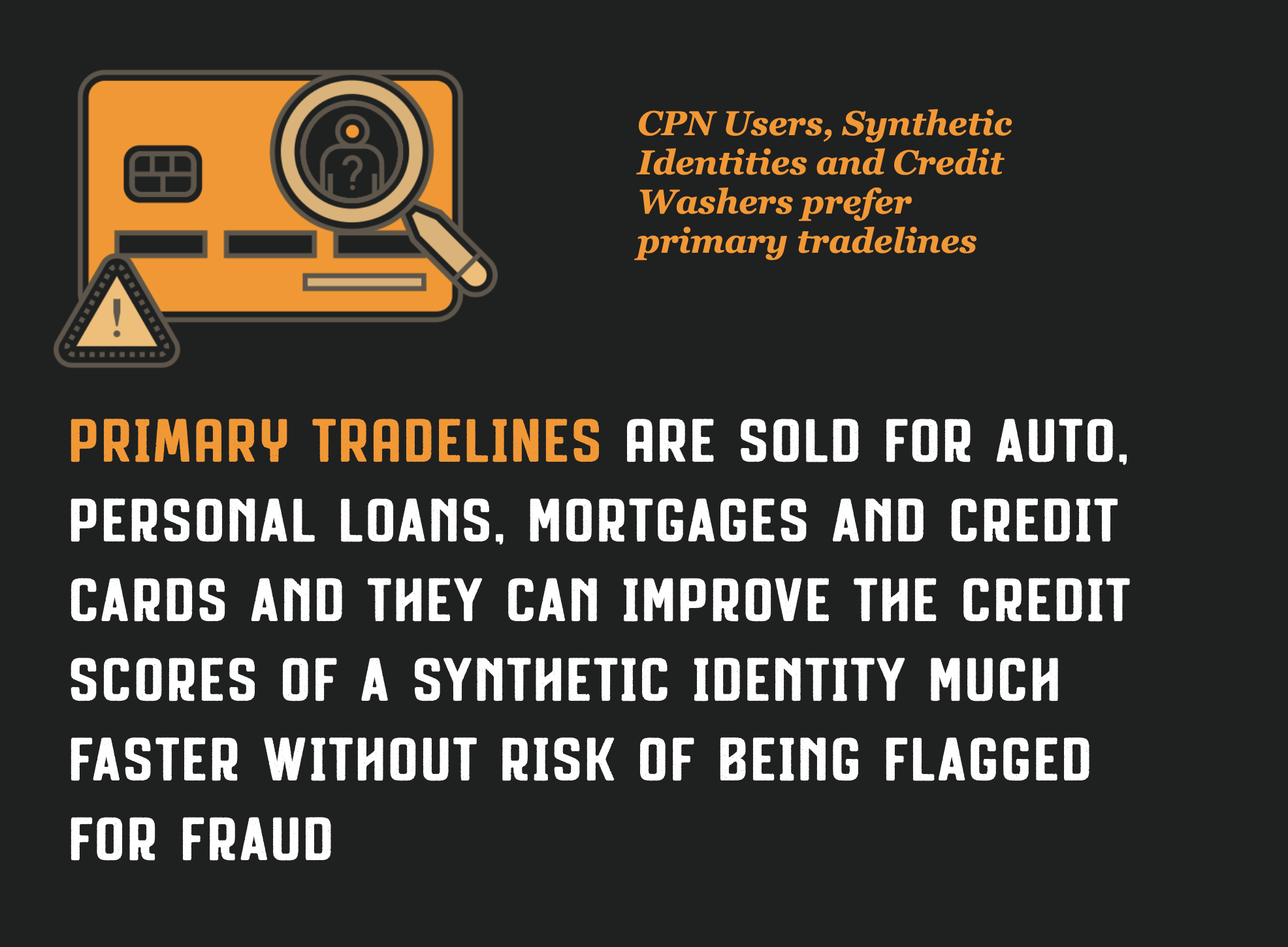

Illegal Primary Tradelines Are Far Superior For Exploitation By Synthetic Identities

Primary tradelines are lines of credit – auto, mortgage, credit cards, and personal loans that report under the consumer’s own credit and that they are responsible for.

For CPN users, synthetic identities and credit washers’ buying primary tradelines are far superior to buying authorized tradelines for many reasons;

#1 – They Can Get High Limit Loans

Authorized user accounts are only available for credit card accounts. With a primary tradeline, a high-limit installment loan, a mortgage, or a luxury auto tradeline can be purchased and posted to an identities credit bureau. And if that loan is reporting as completely satisfied or almost paid off, its even better.

#2 – They Can Improve Score Faster

Authorized user tradelines are not weighted very heavily in more recent FICO scores because they have been exploited so much. When a consumer buys a primary tradeline, it can improve their credit score far more.

#3 – Lenders don’t flag them

Authorized tradelines are often flagged for a fraud review. But most primary tradelines are nearly undetectable by underwriting systems.

#4 – They can report much longer on their credit reports

Authorized tradelines are often rented for a short time period – 30 to 60 days. When primary tradelines are purchased, they can report for years giving the synthetic identity more time to bust out.

Hundreds of Domains Selling Tradelines To Consumers

There are over 580 domains registered that appear to be set up for the purposes of selling tradelines to consumers.

Many of these tradeline companies actively target people using CPN’s (aka stolen social security numbers) that are trying to build credit scores on their synthetic profiles.

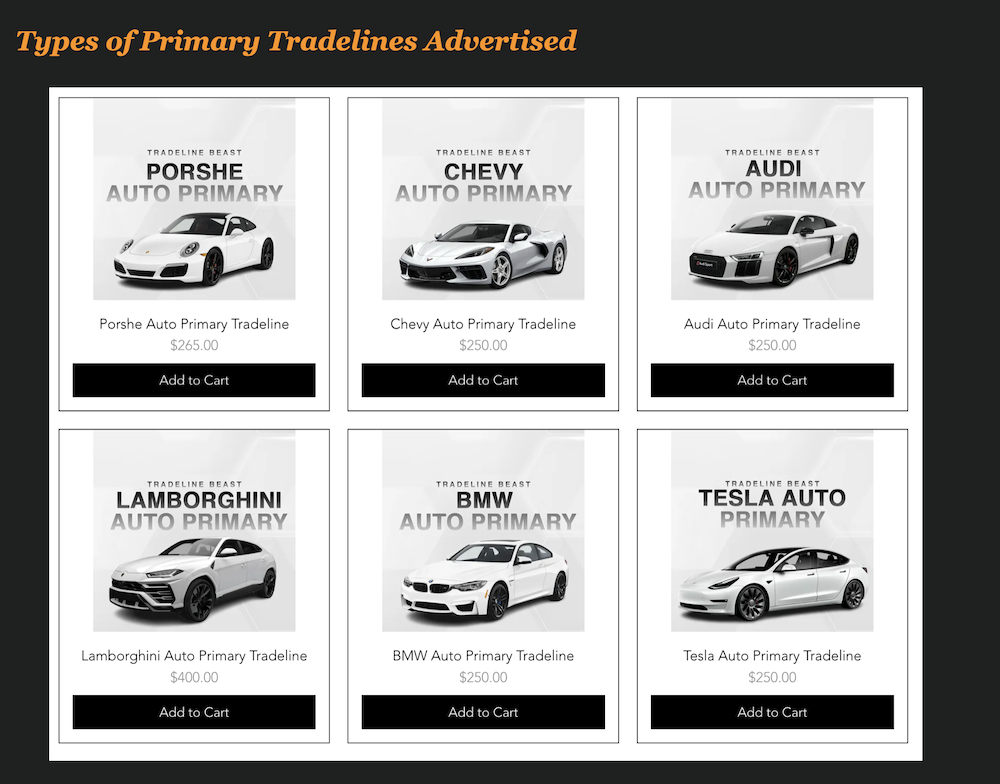

Dealers, Credit Repair Companies, And Scammers Sell Primary Tradelines

If you want to find primary tradelines, it’s very easy. There are thousands of advertisements on Telegram, Instagram, and Youtube.

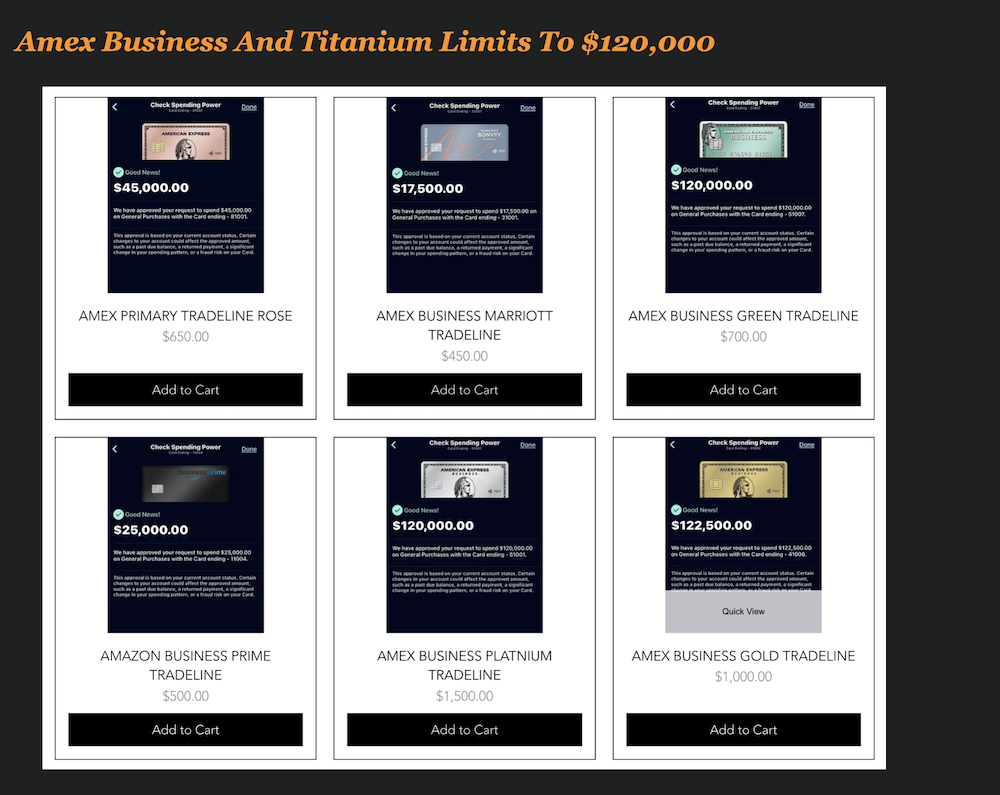

They advertise the primary tradelines like trading cards.

They also offer primary Amex tradelines with limits up to $120,000 that can be backdated onto a credit report.

There are even advertisements for Tesla tradelines. This seems a little far-fetched and maybe too good to be true. There certainly could be a flood of scammers taking advantage of people offering to sell tradelines that the could not possibly post.

This post appeared on TradelineKarma.com but I have serious doubts if it is real.

Do you want a mortgage to post to your credit? Apparently, they have that too.

Check out this post that appeared on Telegram.

HoodRich Credit Tells You How It’s Done

One expert in the scheme is HoodRich Credit, a young credit repair entrepreneur that offers advice on Youtube.

He claims to have direct relationships with the credit reporting agencies where he can report whatever he wants to a persons credit report.

What do you think of these primary tradelines? This is really taking off and could become a serious issue for lenders and banks.