Core Logic, the mortgage analytics and research firm has published their latest updates on Mortgage Fraud in the US and Florida continues to be the epicenter of fraud.

The CoreLogic Mortgage Fraud Index tracks application characteristics in their consortium, scores each application for risks of fraud and then aggregates those statistics to analyze the macro climate of fraud here in the US.

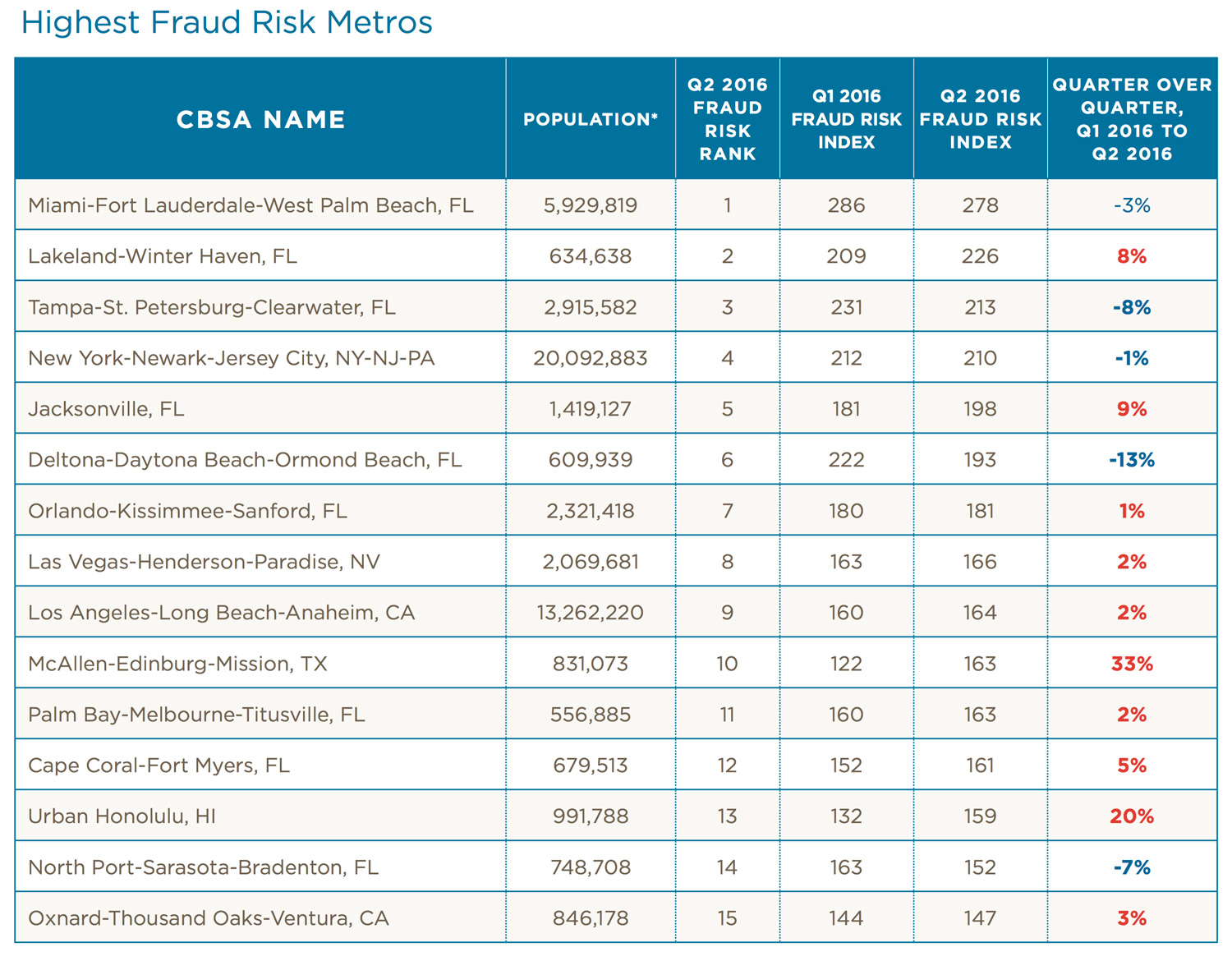

Of the top 15 most risky areas of the United States, Florida counties make up 9 of those most risky areas.

Why is Florida so Risky?

Why do counties in Florida continue to dominate the fraud index each year. There are a few reasons for this

- LTV – more loans have high LTV in Florida which is a key determinant of fraud risk

- Investor Activity – Investor loans are fraught with fraud, Miami and other areas have high concentration of investor properties

- Purchase Activity – more loans are purchase loans in Florida than other states

- Income – Incomes in Florida and patterns on applications may demonstrate high risk of income fraud.

- More Reported Fraud – More banks report higher levels of fraud than in any other state. These higher reported levels of fraud contribute to higher application risk

- Escalating Property Values – Property values in Florida are escalating faster than other parts of the country leading to more risk of bubbles and fraud.

All of these factors are possibly contributing to the higher levels of index fraud as reported by CoreLogic.

The combination of risky loan factors when aggregated up suggests that the highest risk state for Mortgage Fraud consistently ranks Florida as #1 in the nation.