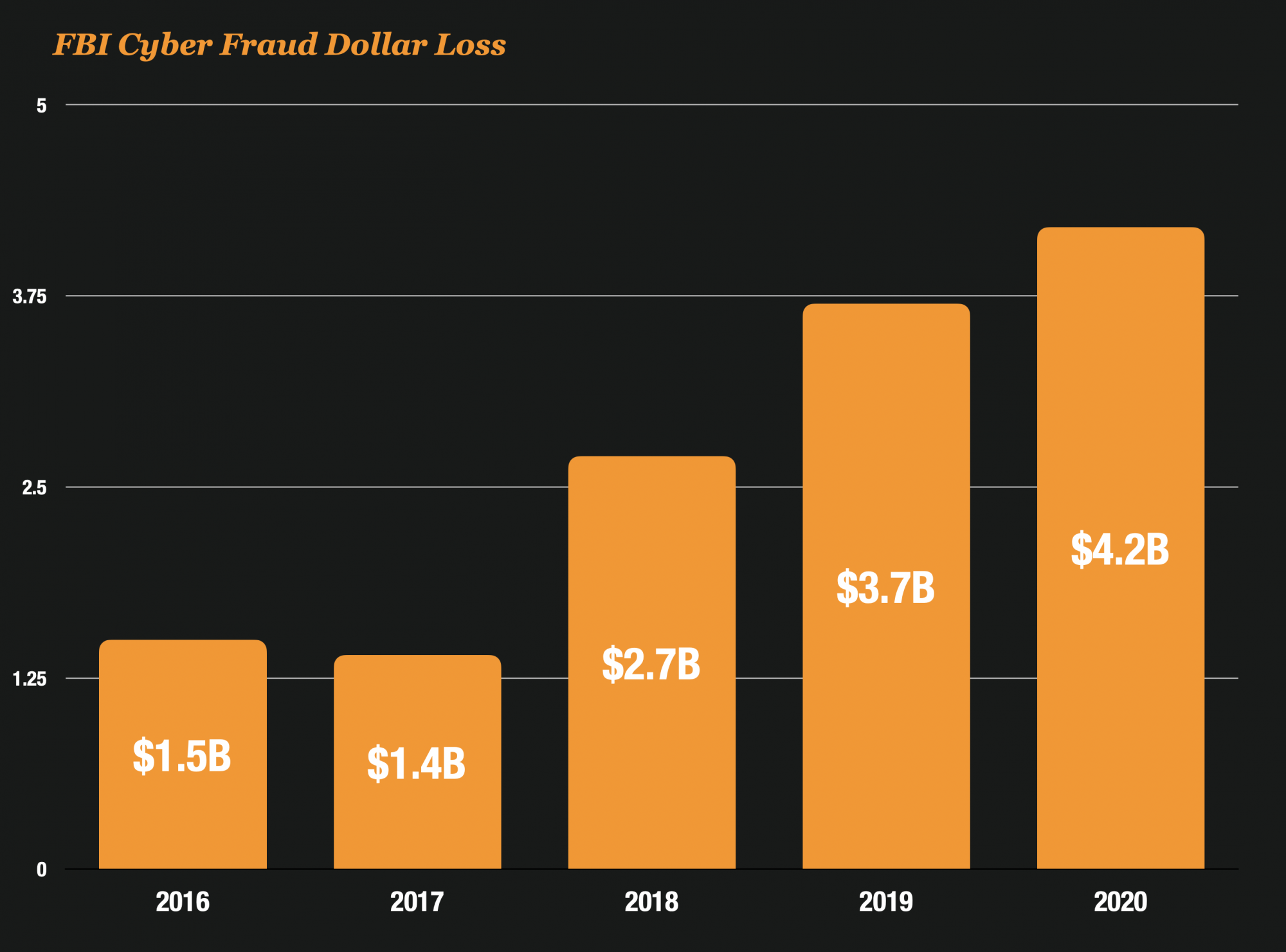

The FBI Released their annual report on fraud, and as we all expected the numbers showed a surge in reported fraud and scams for 2020. The FBI received a record number of complaints from the American public in 2020: 791,790, with reported losses exceeding $4.1 billion. That’s a 69% increase over 2019, and a doubling of reported fraud since 2018.

Fraud Reports Doubled in 2 Years

The number of reported frauds, which had been tracking at close to 300,000 a year, now seems on a path to hoover between 700,000 and 800,000 a year.

And the losses to consumers are mounting too. Consumers have reported $4.2 billion in losses during the pandemic, as compared to 2019 when consumers reported only 3.7 Billion in losses.

Scams Against Consumers Are Driving The Upward Trend in Fraud

BEC Scams drove roughly half of the losses consumers reported. Business E-mail Compromise (BEC) schemes continued to be the costliest: 19,369 complaints with an adjusted loss of approximately $1.8 billion. Phishing scams were also prominent: 241,342 complaints, with adjusted losses of over $54 million. The number of ransomware incidents also continues to rise, with 2,474 incidents reported in 2020.

BEC fraud gained more ground due to cryptocurrency scams. In 2020, the FBI observed an increase in the number of BEC/EAC complaints related to the use of identity theft and funds being converted to cryptocurrency. In these variations, we saw an initial victim being scammed in non-BEC/EAC situations to include Extortion, Tech Support, Romance scams, etc., that involved a victim providing a form of ID to a bad actor.

That identifying information was then used to establish a bank account to receive stolen BEC/EAC funds and then transferred to a cryptocurrency account.

The FBI Is Helping BEC Victims

The FBI established a team to help consumers. The Recovery Asset Team (RAT) was established in February 2018 to streamline communication with financial institutions and assist FBI field offices with the freezing of funds for victims who made transfers to domestic accounts under fraudulent pretenses.

The RAT team worked 1,303 cases in 2020 and was able to freeze approximately 380 million in funds before they were able to be taken by the fraudsters. They have an amazing 82% success rate.

The FBI has advice for consumers that have been victims of BEC scams, and in some cases if you report it early enough, they can help you recover your money.

- Contact the originating financial institution as soon as fraud is recognized to request a recall or reversal and a Hold Harmless Letter or Letter of Indemnity.

- File a detailed complaint with www.ic3.gov. It is vital the complaint contain all required data in provided fields, including banking information.

- Visit www.ic3.gov for updated PSAs regarding BEC trends as well as other fraud schemes targeting specific populations, like trends targeting real estate, pre-paid cards, and W-2s, for example.

- Never make any payment changes without verifying the change with the intended recipient; Verify email addresses are accurate when checking email on a cell phone or other mobile device.

Some Examples of Successful BEC Cases The FBI Helped Make Recoveries in 2020

St. Louis

In June 2020, the IC3 received a complaint filed by a victim company regarding a wire transfer of $60 million to a fraudulent overseas bank account in Hong Kong. The reported transaction date fell outside of the International Financial Fraud Kill Chain (FFKC) time frame for action; however, The IC3 RAT notified the Legal Attaché of Hong Kong and the St. Louis Field Office of the large dollar loss. Through the collaboration efforts of the IC3 RAT, the Legal Attaché of Hong Kong, and Hong Kong banking and law enforcement partners, the wire was located and immediatelyblocked from entering the beneficiary account in Hong Kong. The St. Louis Field Office quickly contacted the victim of this incident to initiate a recall letter with the originating bank and Hong Kong Police. Through these efforts, the full amount of $60 million was returned to the victim.

Chicago

In June 2020, the IC3 was notified of two fraudulent wires totaling $977,411 sent by a victim company specializing in hand sanitizer. The money was intended for an investment in ventilators due to the COVID-19 pandemic. Upon receipt of this notification, the RAT initiated the domestic FFKC to request the recipient financial institution freeze the associated account and any remaining funds. Collaboration with the beneficiary bank resulted in the more recent of the two transfers being frozen in full. The older transfer had already been depleted via wire to a cryptocurrency exchange at another financial institution. Collaboration with the bank, which housed the cryptocurrency account, and with the cryptocurrency account holder company resulted in tracing the wallet path of the funds upon being converted into Bitcoin.

Houston

In April 2020, the IC3 received a complaint from a health care victim regarding five wire transfers sent totaling more than $2 million. The RAT Team initiated the FFKC and, after collaboration with the financial institution, holds were placed on the funds to allow the victim time for the indemnification process. Later inquiries into the recipient account number by the IC3 RaID Team found additional suspicious activity information from financial databases on the possible money mules involved with the account. This information was then compiled into two targeting packages and forwarded to the Houston Field Office for case enhancement purposes.

It’s great to see the FBI helping so many victims of scams.