Cheats, scammers, and liars. Fraudsters are all of those things. And they are defrauding consumers at record levels. 2021 is going to be a record year for fraud – particularly against consumers.

Thanks to epically horrible data breaches, heightened fraud perpetrated by scammers during the pandemic and high rates of identity theft – no one is safe. All of our information has been exposed and we are all more vulnerable than ever.

It’s an all-out war

It’s an all-out fraud war. And fraudsters are winning. They’re winning because they are organized, faster and more nimble than banks.

But there is a way we can change that. We need to ENLIST AN ARMY to help us. We need millions of people to help us.

And that army is consumers – the people we do business with. Rather than preventing fraud by hiring a few fraud analyst to look at high high-risk accounts, why not enlist all of your customers to join us and stop the fraudsters. Let’s empower the consumer!

Who agrees with me? I think we can do this if we work together.

10 Ways to Raise An Army of Fraud Fighters

The empowered consumer is your best chance in the fight against fraud. You can hire 100 more fraud analyst or buy a multi-million dollar fraud-fighting technology but nothing is more powerful than getting your millions of customers to work with you.

Here are 10 ways that you can empower consumers to work with you, to be your Army of Fraud Fighters.

#1 – Give Consumers Control Of Their Debit Cards

Why not let customers turn their cards on and off? Wells Fargo did it. It protects me and makes me feel safe. If I am going out of the country and don’t plan on using my debit card, I can turn it off until I return.

If I can’t find my card and I don’t think it is stolen, I can turn off my card until I am sure. It’s brilliant!

#2 – Get Consumers to Install A Call Blocker

Robocalls, spammers, and fraudsters are contacting customers directly and scamming them out of billions of dollars. Once they reach a customer, they con them into sending large wire transfers or Itunes gift cards and the customers have no recourse.

There is a simple answer. Get consumers to protect themselves by putting a call blocker on their phone. I use ATT Call Protect, and I stop hundreds of IRS fraud attempts on myself a year from even getting through to me. It works!

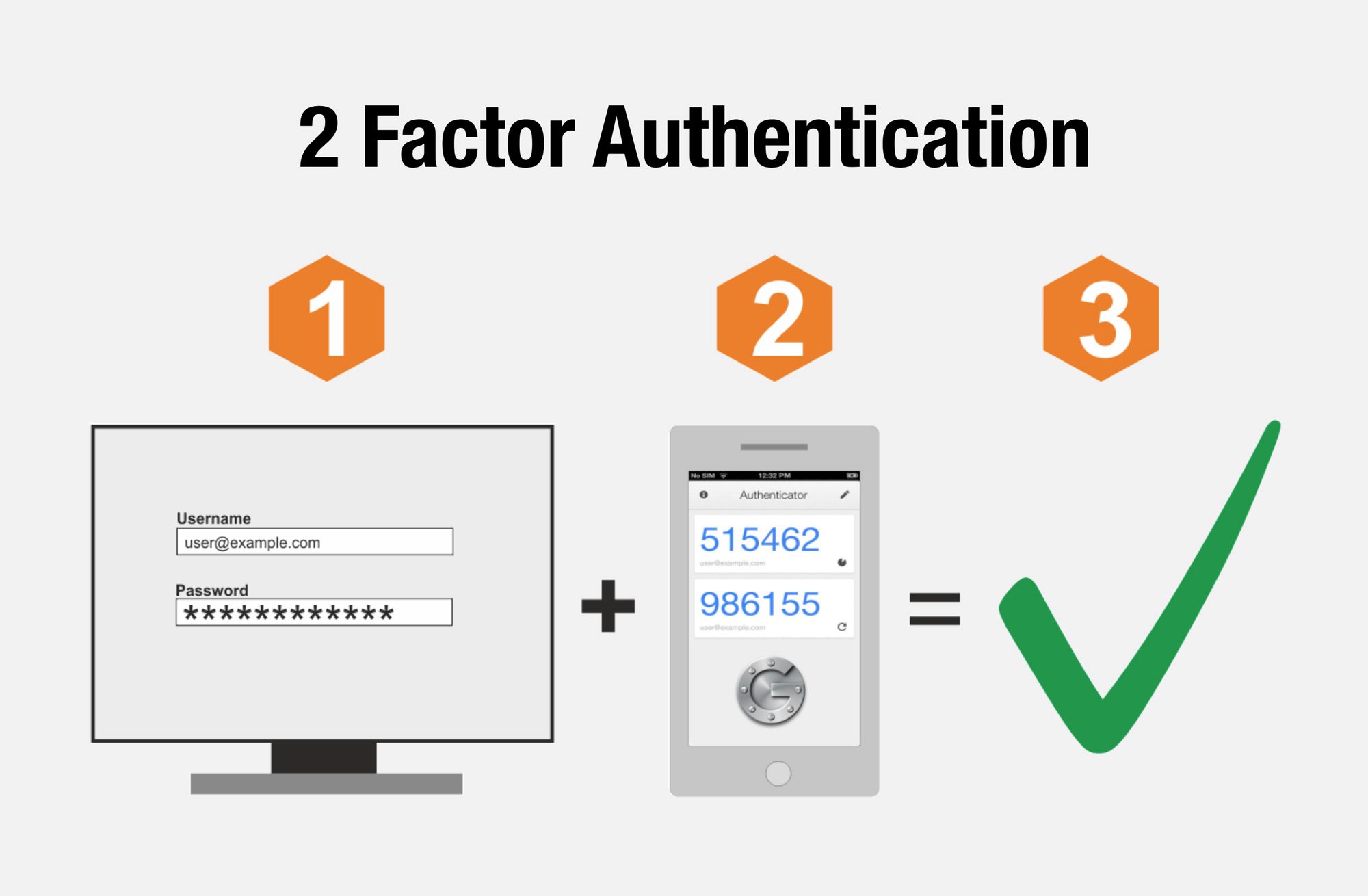

#3 – Train Consumers to Use 2 – Factor Authentication Any Chance They Get

Everyone knows 2 Factor Authentication is a big pain in the butt. But do you know what is even more of a pain in the butt? – FRAUD. And losing all your money. Yeah, that is a real big pain the butt.

I use 2 Factor Authentication on everything I can. It has become a habit. It makes me feel safe because I am safer. I know it is not 100% foolproof but I know for a fact it makes me a harder target than someone that doesn’t have it.

Make your customers the victim of last resort. Everyone wins.

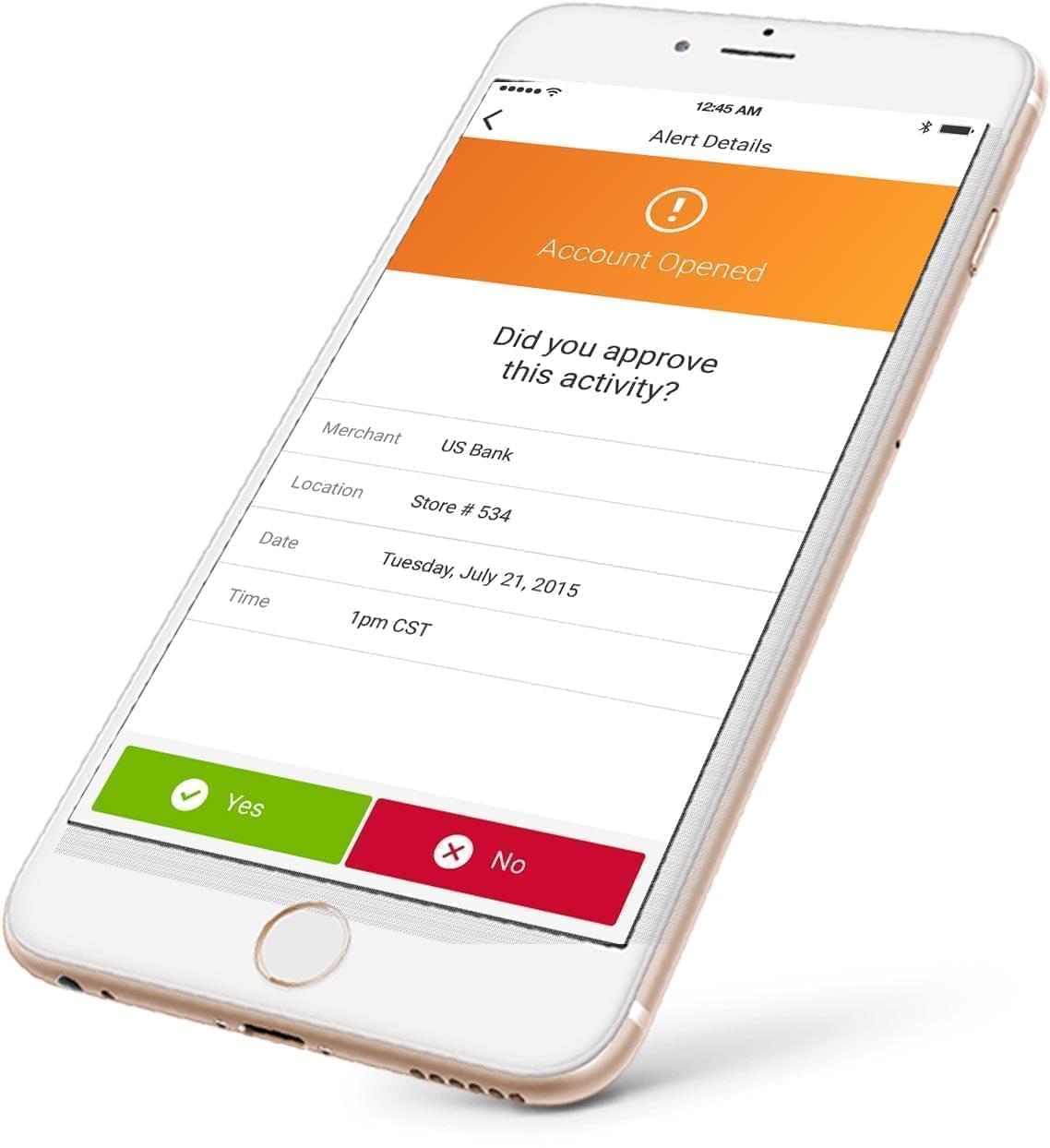

#4 – Get Consumers to Sign Up For Text Alerts And Spend Control Apps

Put more control in your consumer’s hands by letting them dictate what kind of information they receive about activity on their accounts.

There are some fantastic solutions out there that do just that very simply. It’s called CardValet from Fiserv and it puts total control in the consumer’s hands. They control the alerts, the way their card is used and how much information they receive.

# 5 – Educate Your Consumers Of The Most Common Scams

Education is power. And education is the key to stopping consumers from being scammed. Most consumers don’t even have knowledge of the most basic scams like Fake IRS Agents, or Romance Scams. And they lose billions to the same scam over and over.

Banks don’t take losses for scams. Customers do. But I believe banks of the future will look past this and help consumers anyway. Create an initiative. Educate your consumers with compelling and interesting materials on your website, in emails, and at the ATM machines. Tell them how to spot fraud so they don’t become a victim.

You can use this as a start.

#6 – Have Consumers Freeze Their Bureaus If They Are Worried

Brian Krebs recommends freezing your credit bureau. And Brian Krebs is the leading authority on cybersecurity. If he says it. I listen.

Consumers can freeze their bureaus. It puts them in control and with a PIN number, they can unlock it anytime they want credit.

If they don’t want to do that, I highly recommend a service such as LifeLock which can put the power into consumers hands. Is LifeLock Worth It? I think so – read here.

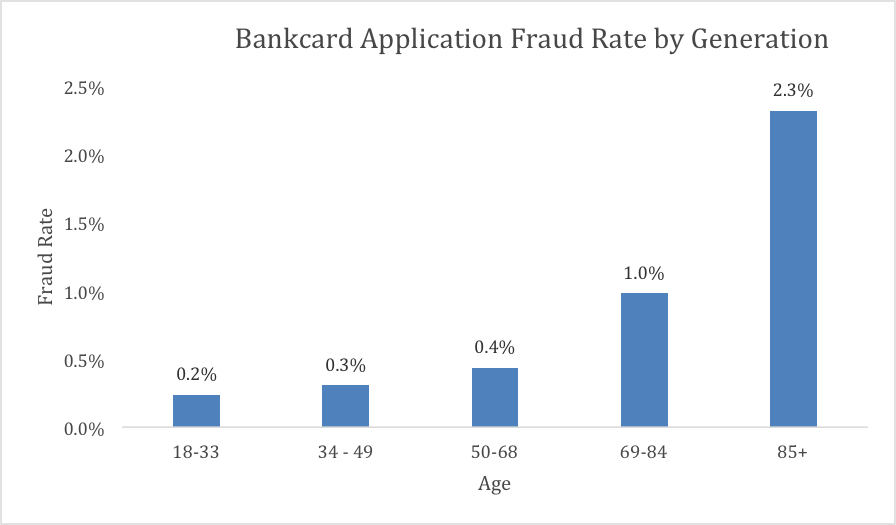

# 7 – Provide Extra Assistance To Former Victims and Elderly People

History shows, that your highest risk populations of being defrauded are people that have been defrauded before and elderly people.

So these are the most important people you need to enlist in your army. Check this out. According to ID Analytics people over 69 are 5 to 10 times more likely to be victims of fraud.

Set up a program to help people that have been defrauded before or who are at risk. Monitor their accounts more carefully. If they are not using their accounts, perhaps it is better for them to close the account completely or lock it to further activity.

#8 – Setup A Dedicated “Is This A Scam?” Hotline

In surveys, 50% of consumers that have been scammed advise that they felt like they were being scammed before they sent money to a fraudster.

They do it because they simply don’t have anyone to turn to ask a very basic question, “Is this a Scam or Not?” A dedicated scam line is like an emergency lifeline for customers. They can ask a professional whether or not something is suspicious.

A Scam Hotline could reduce fraud considerably by stopping scams before money is sent.

#9 – Educate Consumers on Password Protection

50% of consumers use the same password on their Facebook accounts, that they do on their Linkedin accounts and other services such as Uber, Amazon, and Netflix.

This is a really bad idea. A horrible idea actually, which puts consumers at heightened risk of identity theft, banking fraud, and online fraud. How bad of an idea is it? I would suggest you read this excellent article by Naked Security that analyzes the risk that consumers take on when they engage in this practice.

Setup an education program and monitor your own accounts to make sure consumers are not using dumb and common passwords across their accounts.

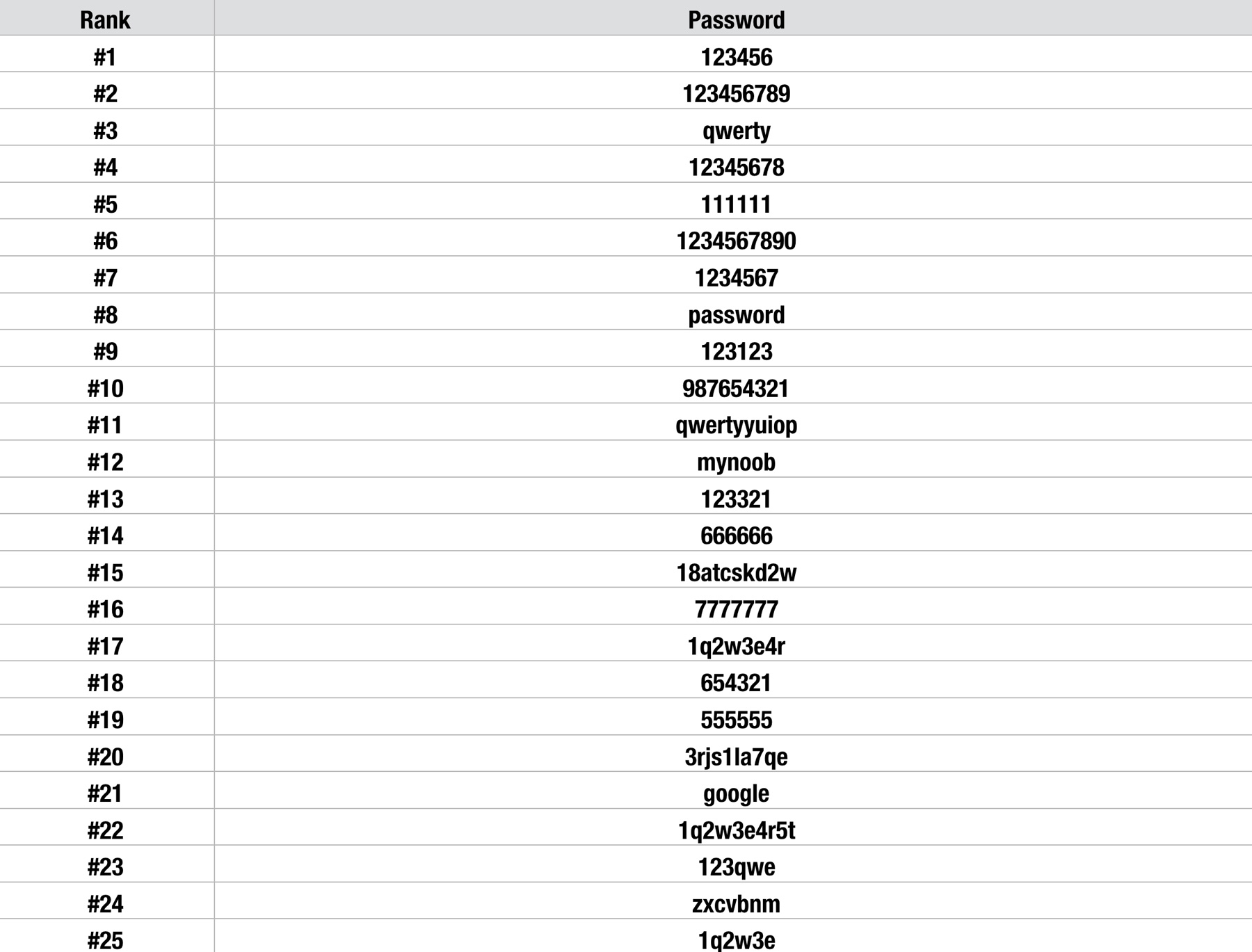

Here is a list of the 25 most common passwords based on billions of breached accounts. Make sure your customers are not using any of these.

# 10 – Help Consumers on Zero Balance Fraud Reports

Consumers get frustrated. They call the bank after they have been a victim of fraud but banks will tell them, there is nothing they can do if there is not a fraud loss.

Consumers feel helpless because they want to explain the fraud to someone and they want help figuring out who did it.

Setup a policy to listen to your customers, to explain how fraud cases work. Put them in touch with local law enforcement, postal inspectors or federal agencies. Make consumers feel like you appreciate their painful experience in fraud. It’s a perfect chance to educate them at a time when they are most in need.

Help Consumers, They Just Might Help You

Help consumers help themselves, and in the process, they might just end up helping you in return.

Raise an army of fraud fighters by equipping them with tools to protect against fraud attempts. Raise an army by educating them on the most basic scams. Raise an army helping them in their hour of most need.

Thank you for reading the blog. Good luck to you all!