If you think the only people that write checks are kindly old ladies at the supermarket checkout line, think again.

Fraudsters and scammers are writing more bad checks than ever. So why is check fraud in the US is spiking to historical highs, even as check use has declined to it’s lowest levels?

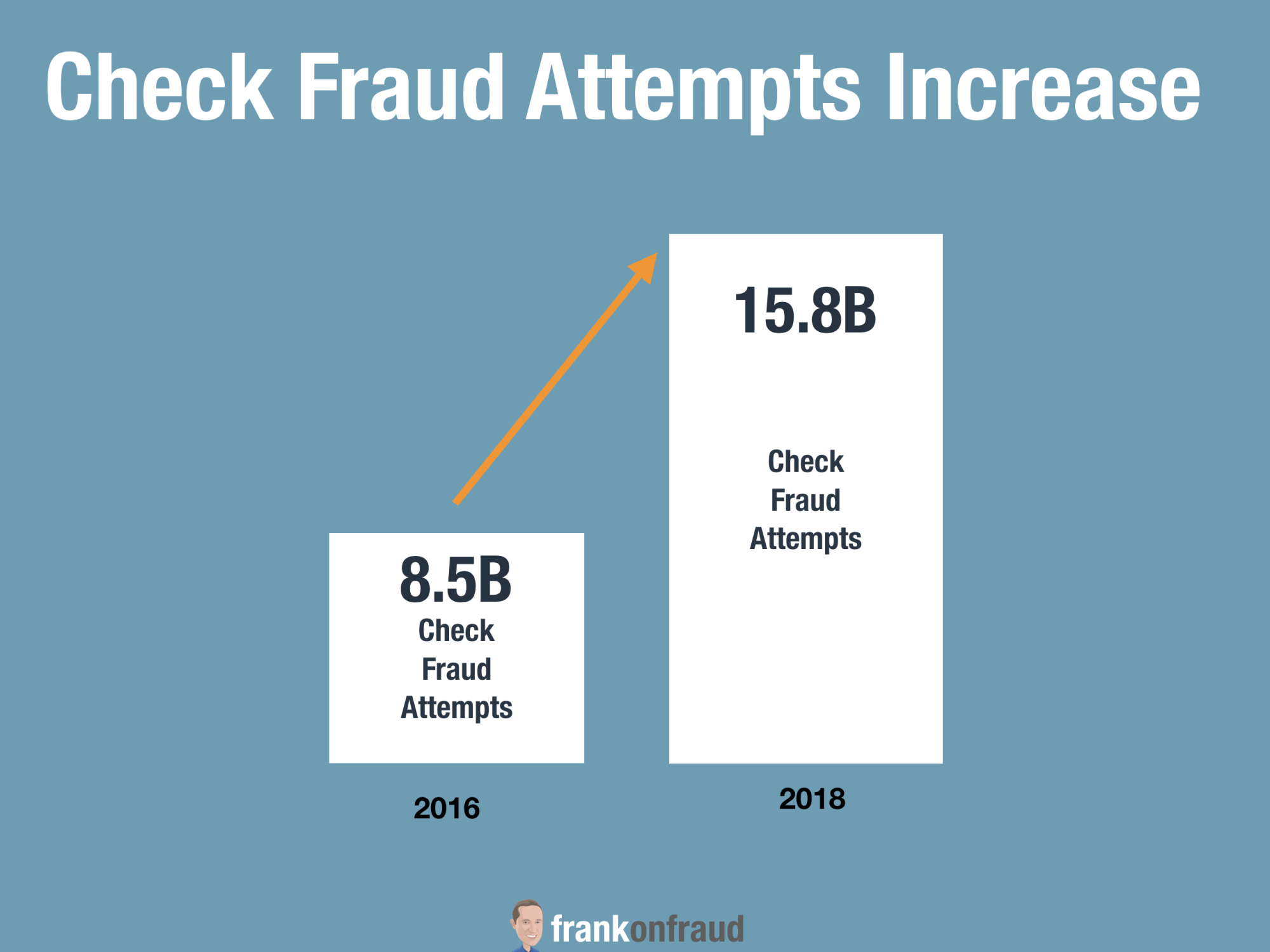

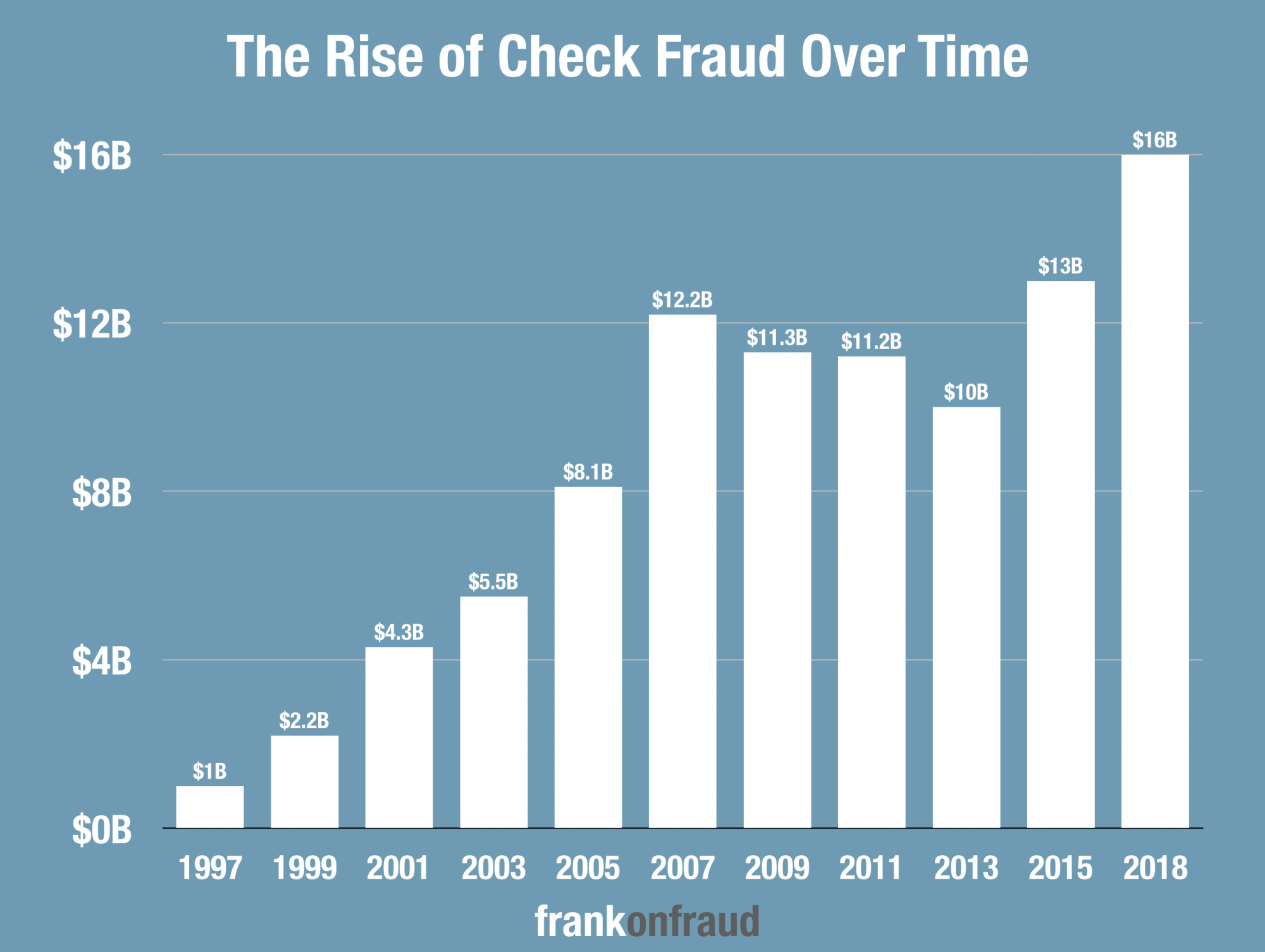

Attempted Check Fraud Hits $15.8 Billion for 2018

A new survey by the American Bankers Association (ABA) this week reports that attempted check fraud ballooned to $15.8 Billion in 2018 – close to a 100% increase over the $8.5 billion that was attempted in 2016.

Successful fraud attempts also increased from $789 Million in 2016 to over $1.3 Billion in 2018 – an increase of over 40%.

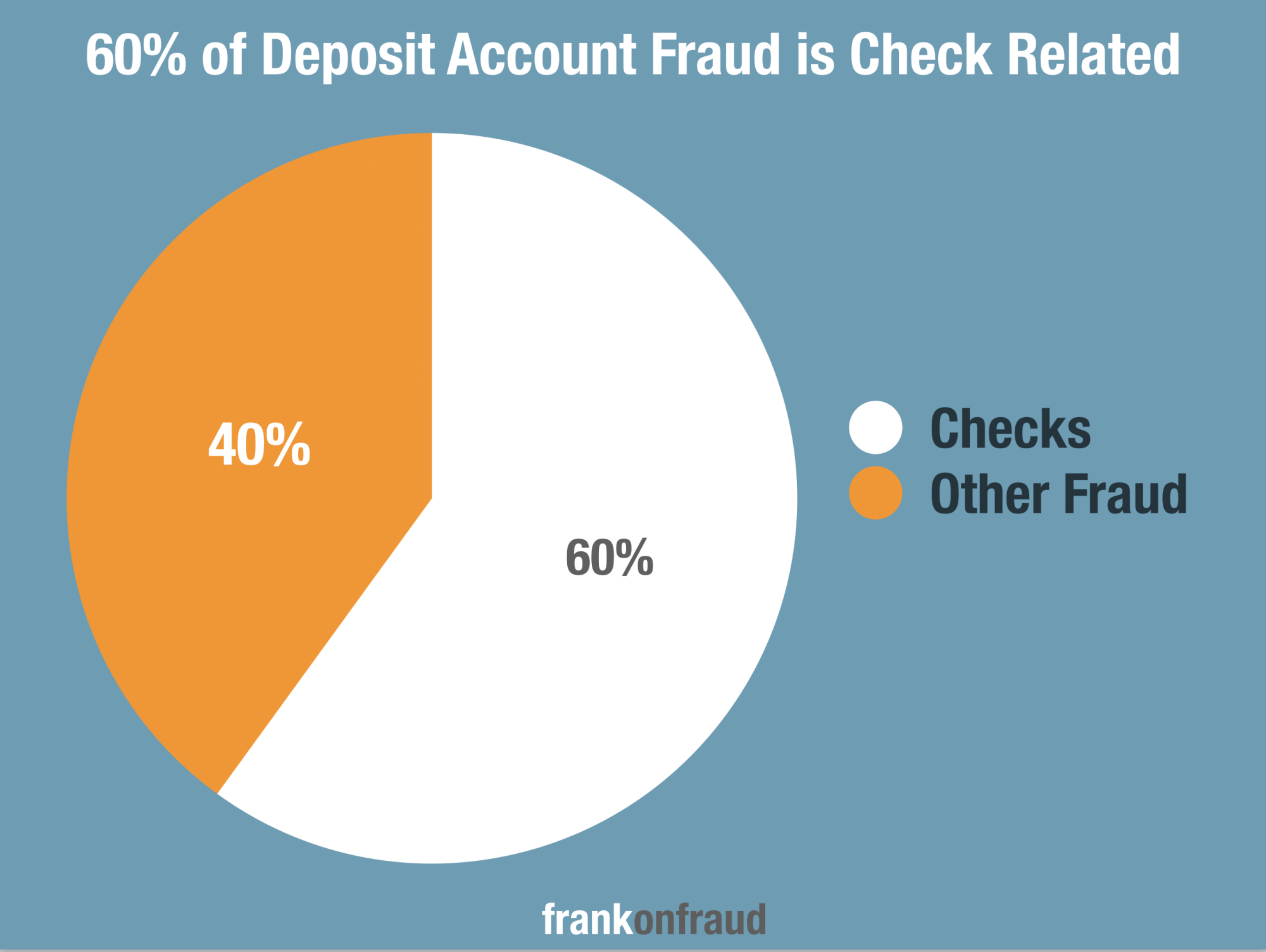

60% of Deposit Fraud Is Still Forged and Counterfeit Checks

The report, further detailed that over 60% of the fraud attempts on deposit accounts now involved fraudulent or forged checks. The lowly check still remains the largest fraud problem for banks.

Check Use Is Declining, So Why is Fraud Increasing?

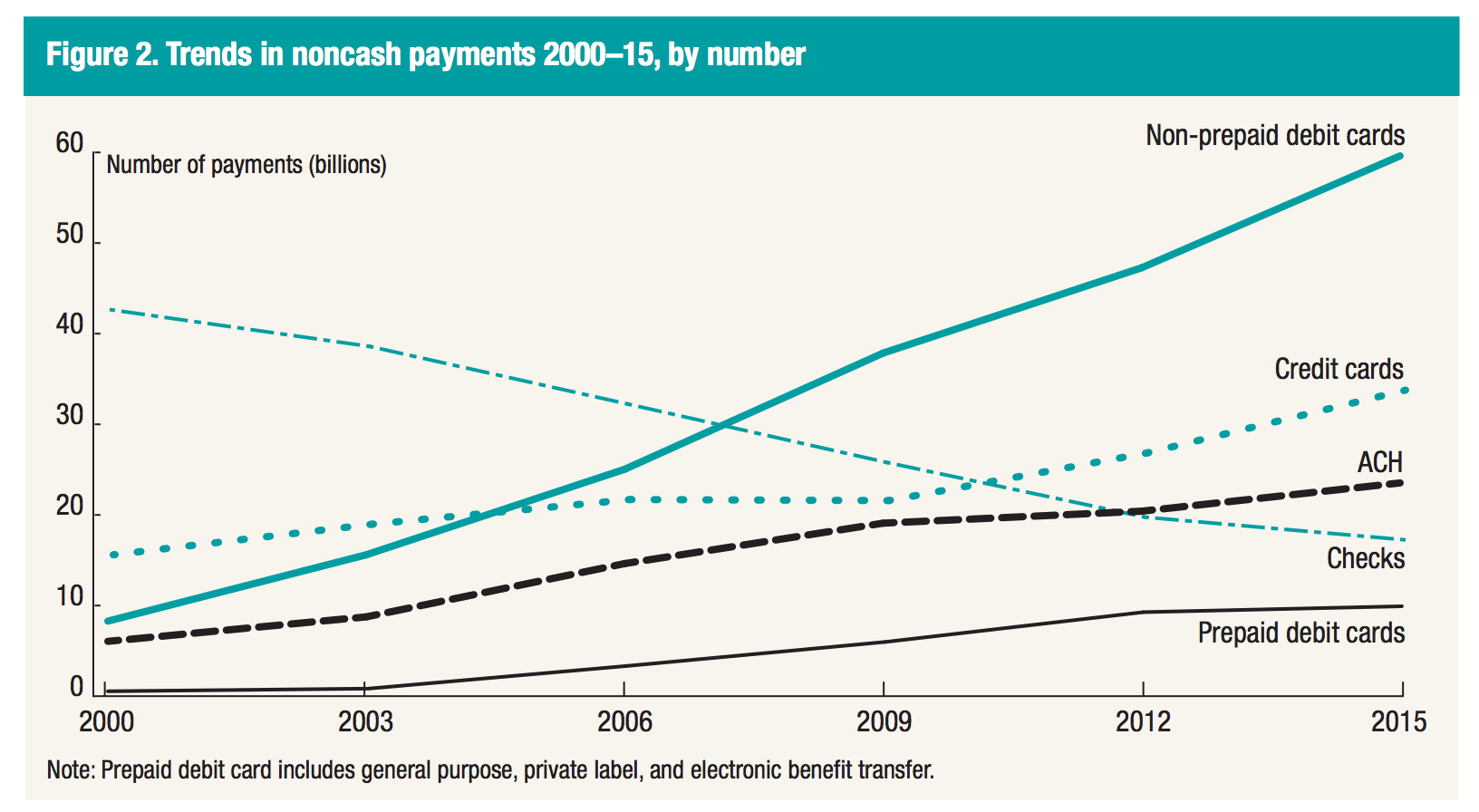

Check use is declining. Each year, the use of checks declines by about 5% and last year, that number fell to about 16 billion checks here in the US.

By comparison, Americans use their debit cards now about 70 billion times a year – about 4 times as often as they write checks. In fact, Checks are the only non-cash form of payment that is in a free-fall.

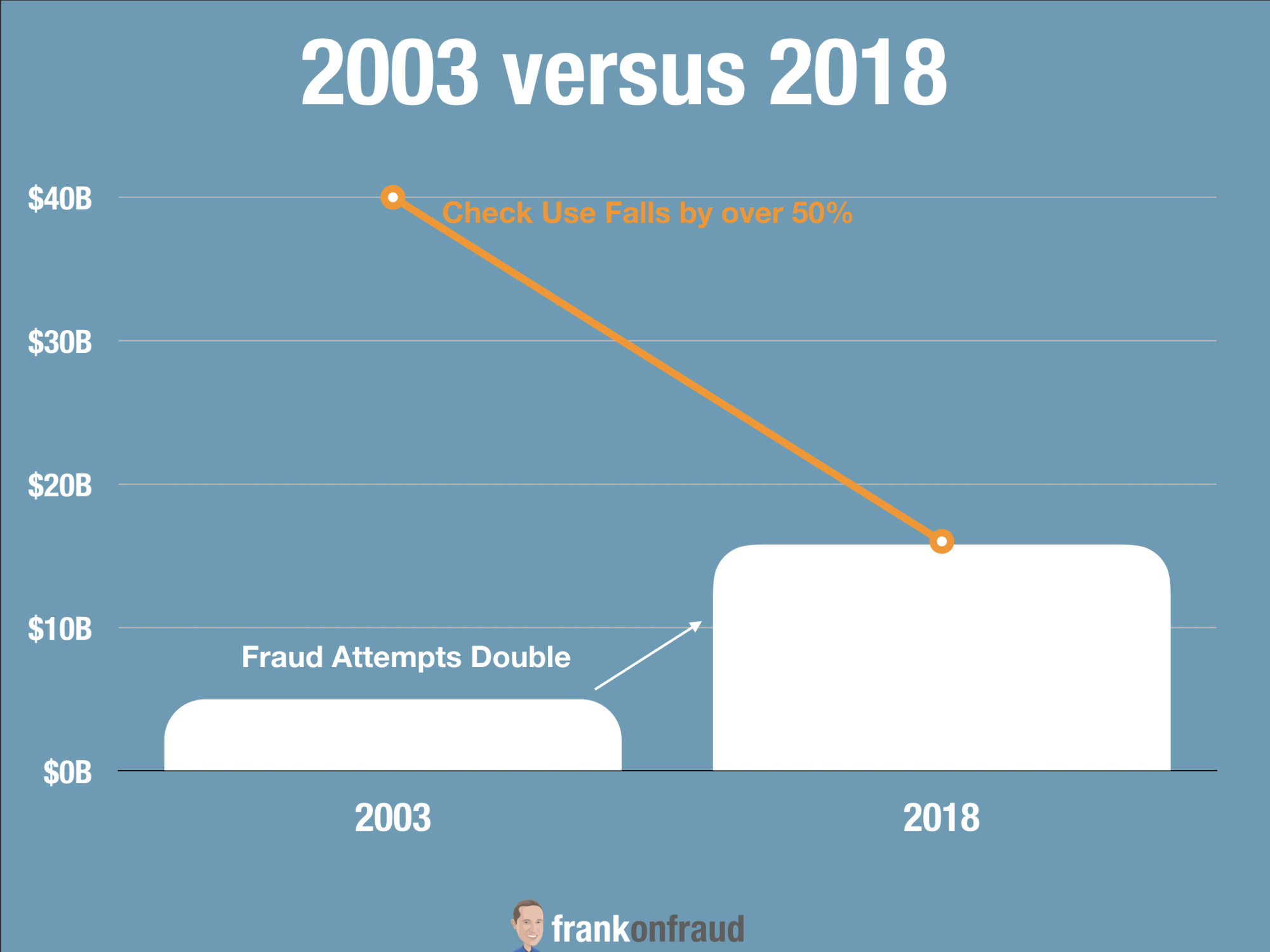

In 2003, Check Fraud was estimated to be $5 billion dollars when the number of checks written was over 40 billion – which is over twice the number of checks written last year.

But in 2018, Check Fraud spiked to over $15.8 billion dollars – close to triple the level of 2003, even though less than 16 billion legitimate checks were written.

With check use declining, many experts felt that fraud risk would decrease. That has not happened. In fact, while legitimate check use declines, fraudulent check use has been steadily increasing.

Check Fraud Has Been Steadily Increasing for the Last 30 Years

Check fraud has been steadily increasing over the last 30 years, even while check use has declined.

This years reported numbers by the ABA are the highest estimated fraud losses for checks in history. That is amazing considering the rapid decline in check use.

Scams are Fueling Check Fraud, Even While Use Declines

To understand why check fraud has risen, you need to look no further than scams. Scams against Americans have risen dramatically as more people join the digital revolution. If you want to read about the Top Scams you can do that here.

And nothing lets the fraudsters scam consumers better than fake money orders, fake cashiers checks, fake personal checks and fake corporate or business checks. They use checks to scam billions from Americans each year.

Long Float Times Enable Scammers to Take Advantage

Checks can take days to clear a bank. And during that time that it takes a check to settle, scammers can defraud consumers for thousands of dollars.

You see, most of the scams work like this, where scammers con consumers to deposit checks into their accounts and then withdraw money for them.

- Scammer Contacts Consumer with Offer Too Good to Be True – Scammers will contact a consumer with an offer too good to be true. (Big lottery win, a dream job of working from home making thousands of dollars a week, an offer to buy something for a sweet price).

- The Scammer Sends A Check – After the scammer gets the consumer to take the bait, they send a check – often a cashiers check or certified check.

- The Consumer Deposits the Check – The consumer deposits the check into their account and it seemingly clears for them to use (because the scammers keep the amounts low enough that banks often let the checks clear without collecting funds)

- The Scammer Ask for Money Back – The scammer then makes up some complex story of why they need some money back from the check. The consumer sends wire transfers of gift cards to the scammer.

- The Check Bounces – The check inevitably bounces and the consumer is left with thousands of dollars in overdrafts and fines on their checking account.

This scam repeats itself over and over again through a variety of fraud schemes; eBay buyer scams, Lotto Scams, Secret Shopper Scams, Romance Scams, and, many others. The proliferation of these scams and growth in their frequency means that we can continue to expect high check fraud losses for many years to come.

92% of Check Frauds Are Successfully Stopped But Consumers Are The Real Losers

The ABA reports that banks successfully prevented 92% of all check fraud attempts through early identification. Only about $1.3 Billion of the $15.8 Billion in attempts resulted in losses.

But that only tells part of the story. You see, behind many of those fraudulent checks an innocent victim ended up losing money. As so often is the case, the victims in most cases end up sending the scammer back the money before they are notified by the bank it is fraudulent and their account is debited.

So the real losers in all of this are the consumers that end up being victimized. Checks truly suck for just about everyone but the fraudsters.

Check fraud proves that fraud rates are rising due to a more connected world

The rise in check related fraud is proof that fraud is rising due to a more connected world.

The fact that fraud rates are rising with a financial instrument that is declining shows that fraud is on a steady climb upward globally.

A more connected world means anybody can become a victim of fraud at any time.

We need to be aware that things will probably only get worse before they get better.