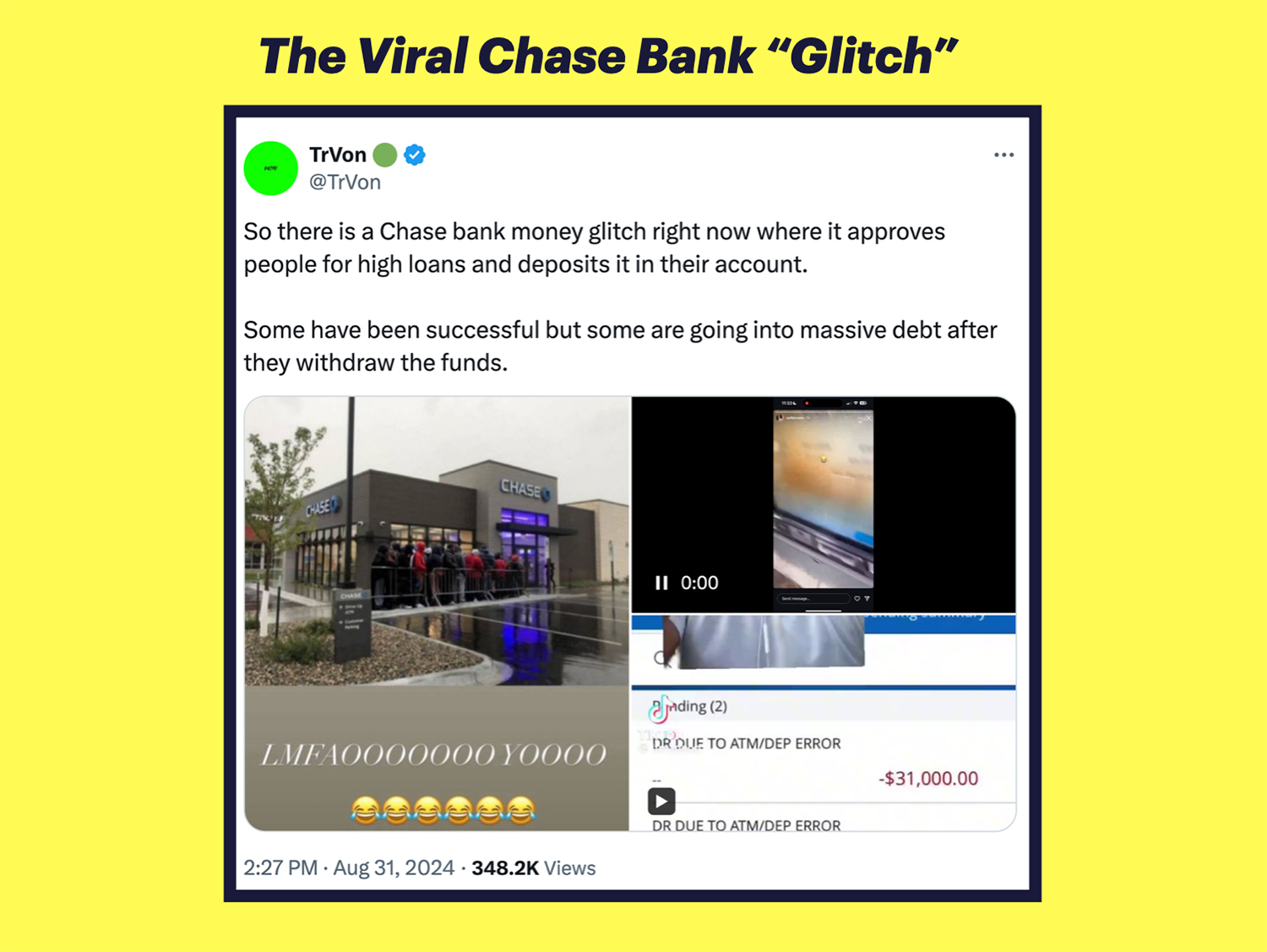

Ah the Glitches. Remember them?

It seems like it was yesterday but it’s been over six months since the Chase “glitch” swept through social media like wildfire, drawing hundreds of people to ATMs across New York City.

To many peoples surprise, it wasn’t a glitch, it was just good old fashioned check kiting and Chase wasn’t going to sit idly by.

In October 2024, the bank took a two pronged approach to punish customer that participated – first filing police reports, and secondly filing civil lawsuits against some of the worst offenders

They figured they would would both law enforcement and the legal system to make sure customers knew fraud against the bank wasn’t tolerated.

But whatever happened to the Chase Glitchers? There hasn’t been any real updates in the press, and there have been no announcements of arrest.

I decided to track down a few of the cases and get to the bottom of whatever happened to them. The results didn’t surprise me all that much.

First Glitcher – Micah Reed Facing Criminal Penalties Never Responded To Lawsuit

Micah Reed, from Los Angeles, deposited two counterfeit checks totaling approximately $116,000 into his Chase account through ATM deposits on August 27 and 28, 2024. The checks were for $59,223.45 and $56,840.10.

Chase filed a police report for criminal activity and they also sued Reed seeking to get back $90,000 for breaching his contract with the bank.

Recent court filings from April 2025 indicate Reed failed to respond to the civil complaint and so they requested a default judgment against him. That judgement was postponed because as they discovered, there is also an ongoing criminal investigation into his activity.

An arrest could be imminent. We will have to wait and see.

Read the latest court document here.

Second Glitcher – RiskBoss Musiq – Chase Got A Judgement Against Him

RiskBoss Musiq LLC is one of the more colorful cases among all of the glitchers. His name is Ryan Henry and he was accused of depositing bad checks and taking the money out immediately.

His Instagram channel shows that he is an aspiring music producer and has many followers that listen to his music.

Even though it appears that he is spending lots of time recording music and videos, it doesn’t appear that he had time or interest to fight the lawsuit.

According to recent court documents, Chase received a default judgement against him for $141,295.84. Meanwhile he continues to record music and post videos on social media.

Read the latest court document here.

Third Glitcher – Timipah Ikemi (The Masked Depositing Glitcher) Chase Got Judgement Against Him

Timipah Ikemi of Houston faces one of the most significant charges among the “glitch” defendants, with court documents revealing he deposited $335,000 counterfeit check.

On August 29, 2024, at 9:42 p.m., security cameras captured a masked man depositing the fraudulent check at a walk-up ATM into Ikemi’s account. Court records detail how he withdrew $10,000 in cash from a Houston Chase branch the next morning at 11:10 a.m., then wired $100,000 an hour later from a different location, before purchasing a $150,000 cashier’s check just two hours after that.

Despite filing a lawsuit against Ikemi, Chase received no response from him. By January 2025, Ikemi had failed to respond to the lawsuit and they requested a default judgment against him for the outstanding balance of $290,939.47.

Read the latest court document here.

Fourth Glitcher – Benjamin Rieves (The Gift Card Glitcher) Chase Got Judgement Against Him

Rieves initially deposited an $80,365 counterfeit check at Chase and rapidly withdrew the funds. His approach was more sophisticated, than the others with transactions spread across multiple Atlanta branches to avoid detection.

What distinguished him from the others was his use of gift cards. Chase said his use of gift cards was “brazen violation of state law” he wasn’t just following a TikTok trend but using well established money laundering techniques.

Rieves, like all of the other defendants never responded to Chase. Unlike the other defendants however, Chase was able to recoup over $15,000 in attorney fees in the judgement. The Northern District of Georgia federal court entered a default judgment against him on March 21, 2025, ordering him to pay Chase $91,936.23 after he failed to respond to the bank’s lawsuit.

Read the latest court document here.

The Hands of Justice Move Slowly

It’s hard to count these default judgements as a win for Chase. My guess is they will be lucky to collect a penny from the glitchers.

But even though there has not been any arrests made in the cases Chase filed, I believe its only a matter of time before something is announced.

The wheels of justice may move slowly, but they never forget.