Fintech companies could be in big trouble over PPP fraud. They are under immense scrutiny over the inordinately high level of fraud they processed over the last year.

The PPP Program was a boon for Fintech companies this last year, generating billions in profits for them, while shouldering the cost of fraud and default of those loans on taxpayers.

But, now those same Fintech companies will be forced to show whether they employed common sense fraud controls to stop the fraud.

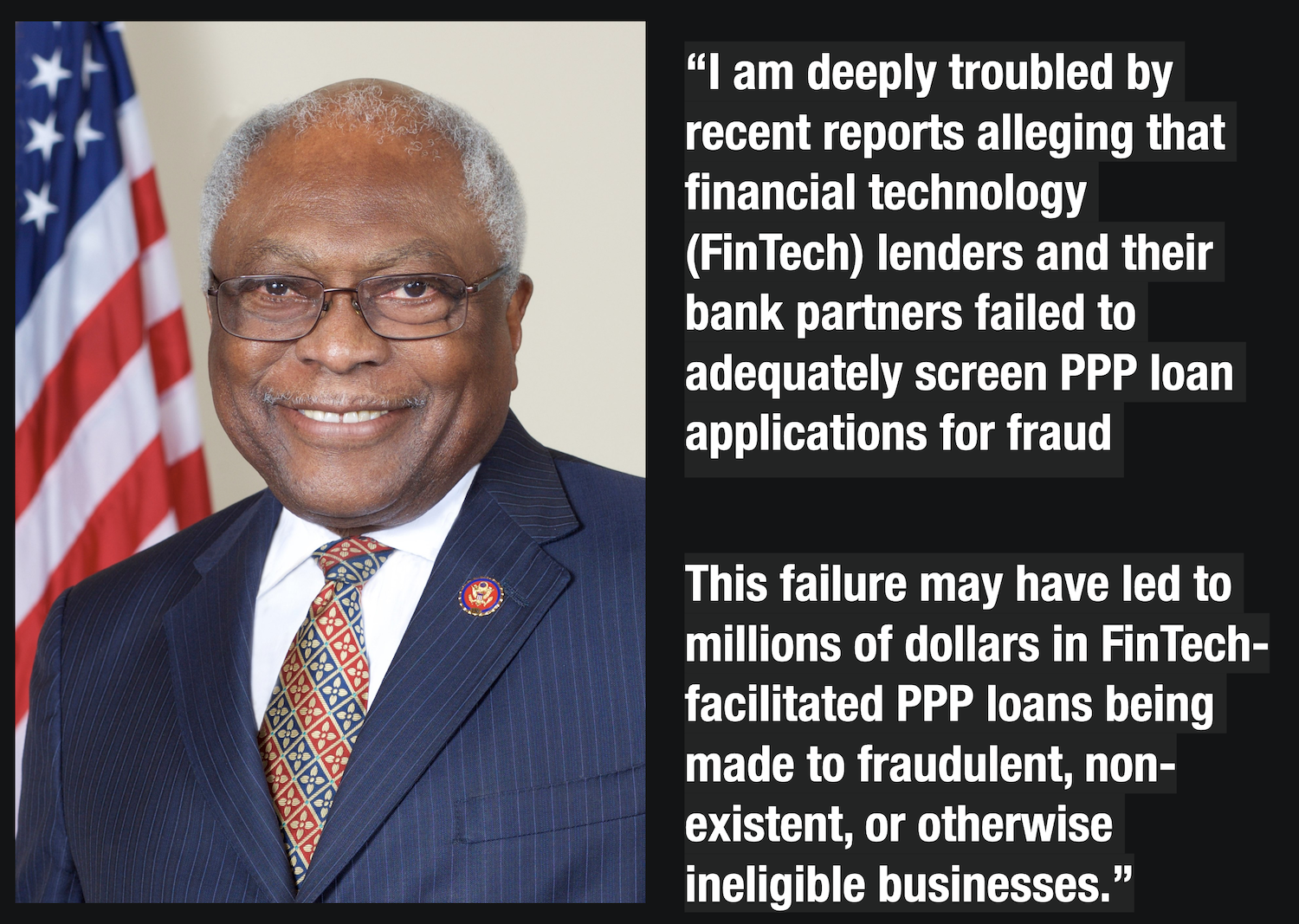

Senator Clyburn Is Deeply Troubled Over The Fraud Rates

Yesterday, Rep. James E. Clyburn, Chairman of the Select Subcommittee on the Coronavirus Crisis, sent letters to four financial technology (FinTech) firms and partner banks seeking documents and information related to their handling of Paycheck Protection Program (PPP) loans.

4 Fintech’s Have Extraordinary High Fraud Rates

The documentation requests comes after lawmakers have noticed that certain FinTech’s have very high rates of fraud which suggest their processes for approving loans were inadequate.

These companies include:

- Kabbage, Inc., a FinTech company that has processed over $7 billion in PPP loans to at least 300,000 businesses, and accounted for 20 percent of all suspicious PPP loans reviewed in one analysis, in addition to sending at least 378 PPP loans worth $7 million to likely non-existent farms.

- BlueVine, a FinTech company that provided over $4.5 billion in PPP loans to at least 155,000 businesses and is among a group of FinTechs assessed to have facilitated 75 percent of the approved PPP loans implicated in Department of Justice (DOJ) fraud prosecutions, according to one analysis.

- Cross River Bank, a bank that approved over 280,000 PPP loans worth over $6.5 billion, and was reportedly involved in over 30 percent of the approved loans issued by FinTechs or their bank partners that were subject to DOJ prosecutions.

- Celtic Bank, a bank that funded nearly 100,000 in PPP loans, totaling over $2.5 billion, and was reportedly involved in nearly 30 percent of approved loans issued by FinTechs or their bank partners that were subject to DOJ prosecutions.

Last Month, Womply Was Targeted By Fraudsters

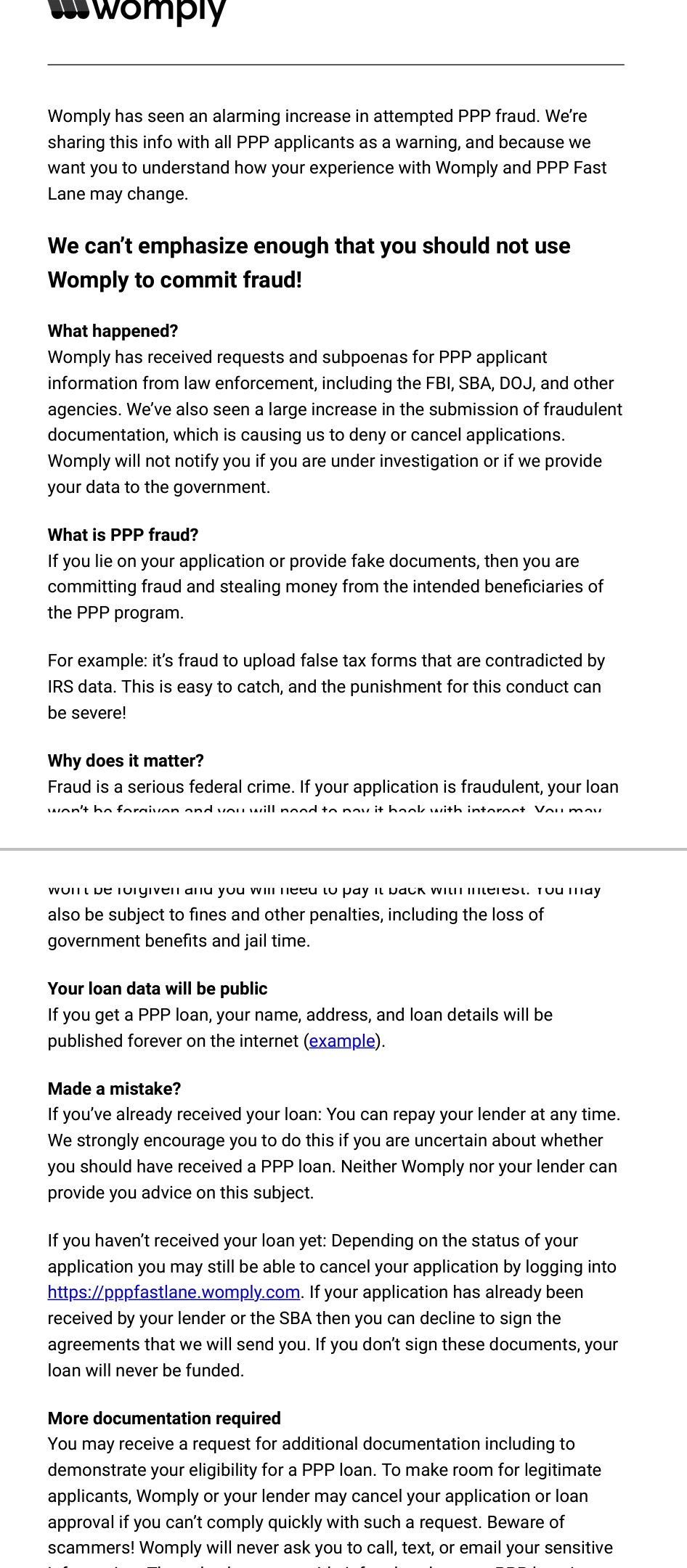

But Kabbage, BlueVine, Cross River Bank and Celtic Bank are not the only Fintech’s that were targeted by fraud. Just last month, fraudsters went ballistic on the Womply platform.

Womply was forced to alert all of their applicants not to engage in fraud against the PPP loan program with this communication.

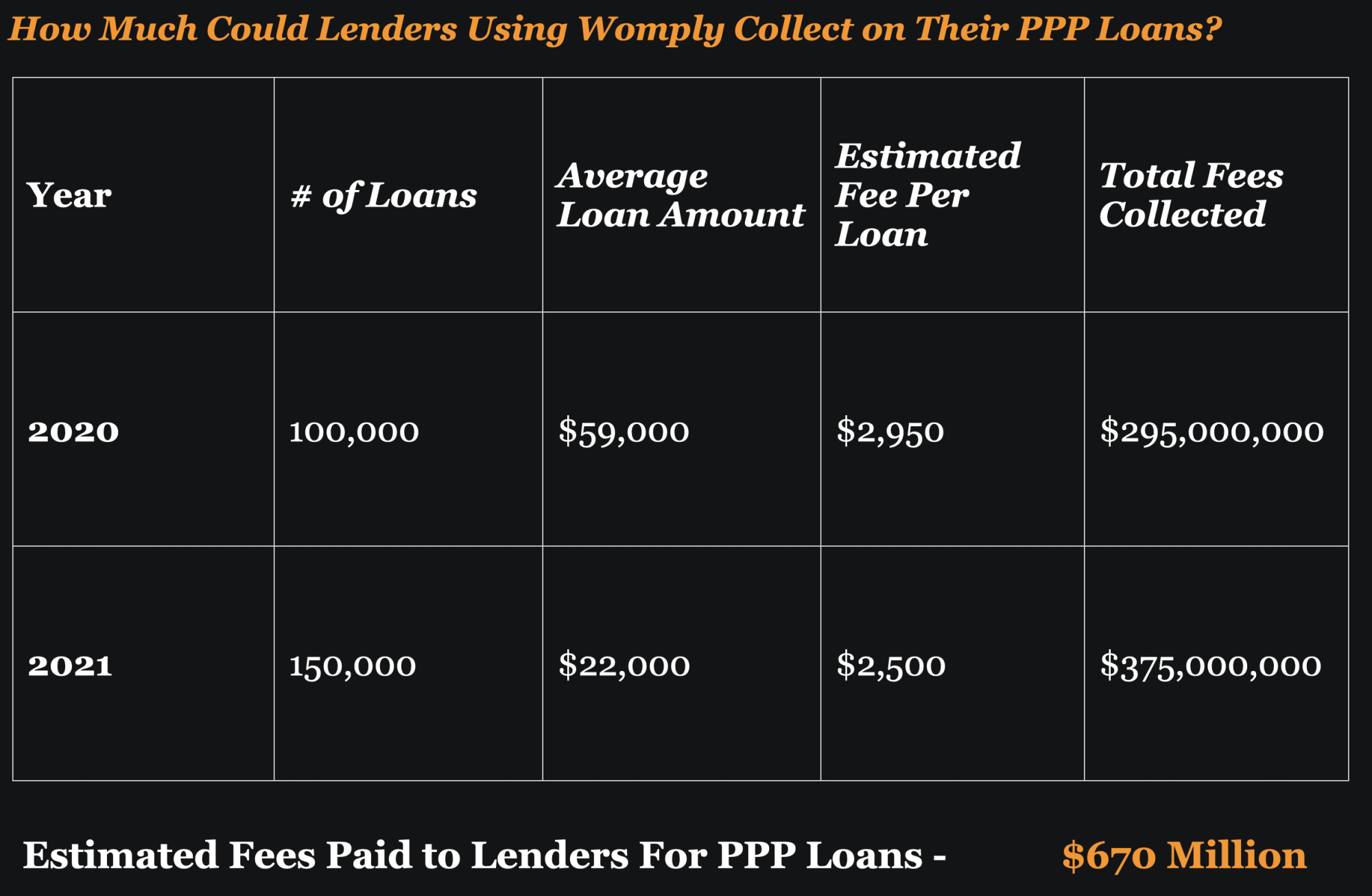

While Womply was concerned with fraud, they also stood to generate up to $670 million in fees for the banks for approving loans and getting them funded.

This is an interesting and developing story. It will be interesting to see what ramifications (if any), that these Fintechs will face for their role in the PPP fraud that occurred.