My wife thought she had found the perfect vendor for a rush order she needed at her busy coffee shop. She wanted canopies and vehicle wraps to promote her brand, and she needed them before the end of the year.

It was December 24th, so she had to move fast, and maybe that was the problem to begin with.

Instead of the perfect vendor, my wife soon learned she had stumbled on a guy who would take her money and then ghost her.

I guess no one is immune to scams these days, even a fraud fighter’s own family.

A Rushed Decision – She Needed Something For Her Business

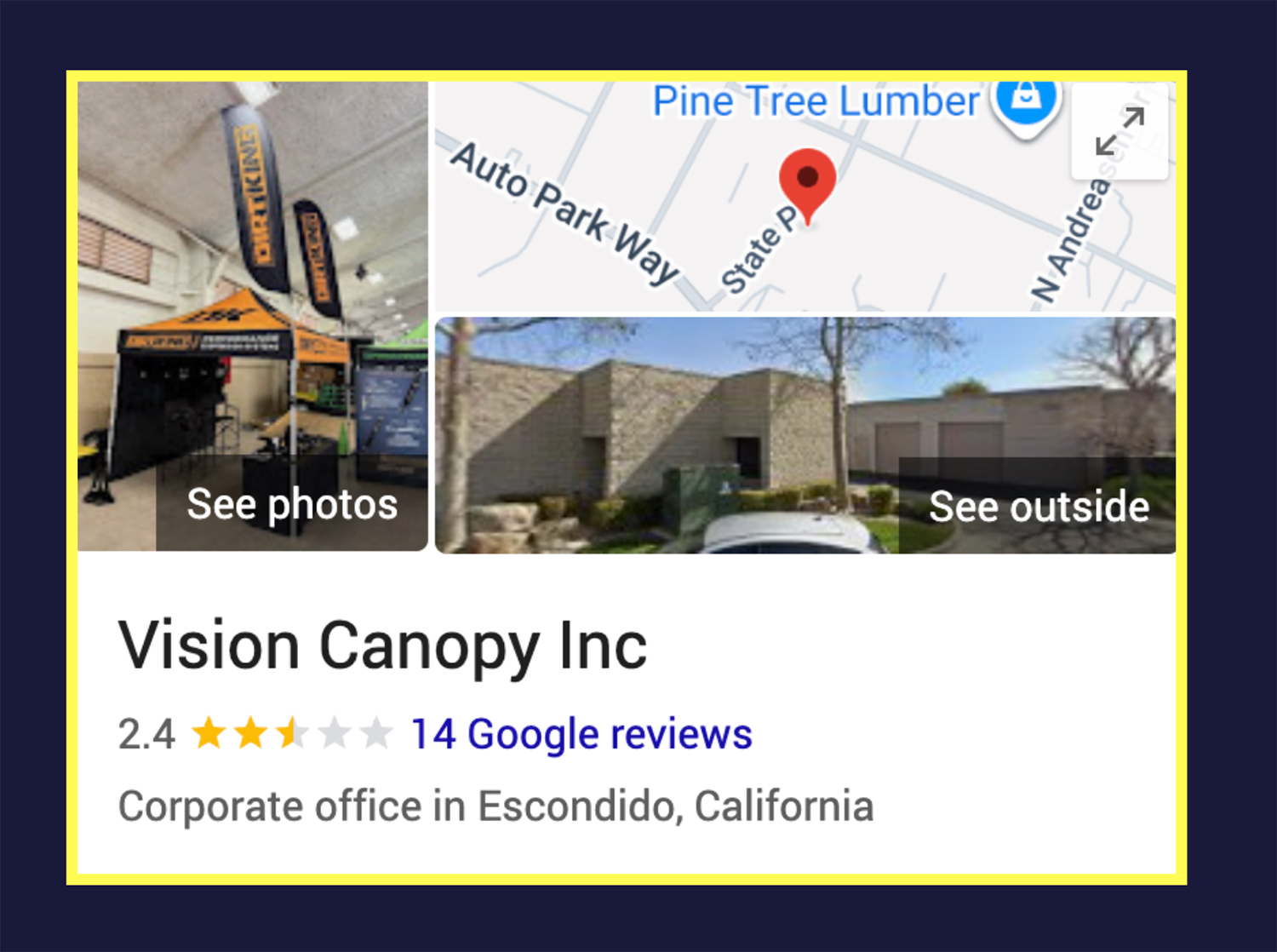

His name was Kyle Ahrensberg. He was responsive and helpful when she initially reached out to his company, Vision Canopy, for a rush order she needed right away.

When she called, he would pick up right away. When she texted, he would get back to her in minutes with what she needed. “I think I found the perfect vendor”, she said to me one night, “He is so responsive. He is even pushing me hard to get it done, I am the one usually pushing the vendors!”

Kyle knew she had a deadline, so he used it to his advantage, pushing her hard to get it done so he could collect thousands from her.

Everything Seemed Legit – It Was A Real Company

Now, my wife is normally very cautious when choosing a new vendor for her business, but this time she moved quickly. She was in a rush after all, and Vision Canopy had a great-looking website and an Instagram page with over 50,000 followers.

It looked legit, and perhaps at one time it was, but she was about to find out the hard way that not everything is what it seemed.

It Came Time To Pay, And Red Flags Start To Appear

When it came time to pay, that’s when the first red flag appeared.

He said he couldn’t take a credit card number over the phone, but he could stop by her shop and pick up a business check, or she could mail it to his home address. Why couldn’t he take a check to an actual business address? (More on that later)

Soon after agreeing to that, he contacted her again, and that’s when the second red flag popped up. He could not stop by the shop. Could she please just Venmo him $5,400?

She hesitated at first. Venmo doesn’t offer fraud protection, and the payments are instant. And it did seem odd that he had her send a Venmo to his personal account. But she went ahead anyway, perhaps feeling the pressure to just get it done.

The Ghosting Begins

After payment was made, things got ominous real fast. Her perfect vendor changed fast and became the perfect avoider.

An overwhelming feeling of dread came over her. You know that feeling you get when you realize you have been ripped off?

“I think I am getting scammed”, my wife told me about 10 days later. “I can’t get ahold of Kyle”.

Within days, Kyle went from texting multiple times a day to barely responding.

Then the excuses started. The canopies were being built in Ensenada, Mexico. There was a delivery mix-up. The delivery company forgot to call her. He was out of town. He was traveling. The excuses never stopped, the deliveries never arrived.

I even had to step in and confront Kyle myself. No one was going to scam my wife, right? I am supposed to be a fraud expert, and here is my wife getting scammed for thousands of dollars.

But it didn’t matter. Kyle had his money, and he was never going to deliver anything. He had planned it from the start. There was nothing we could do. We were out of luck.

We got scammed.

A Trail Of Victims – A Pattern Emerges

Once I started digging, I found we were not alone. I discovered many red flags that, had we looked closer, we would have spotted.

And here they are:

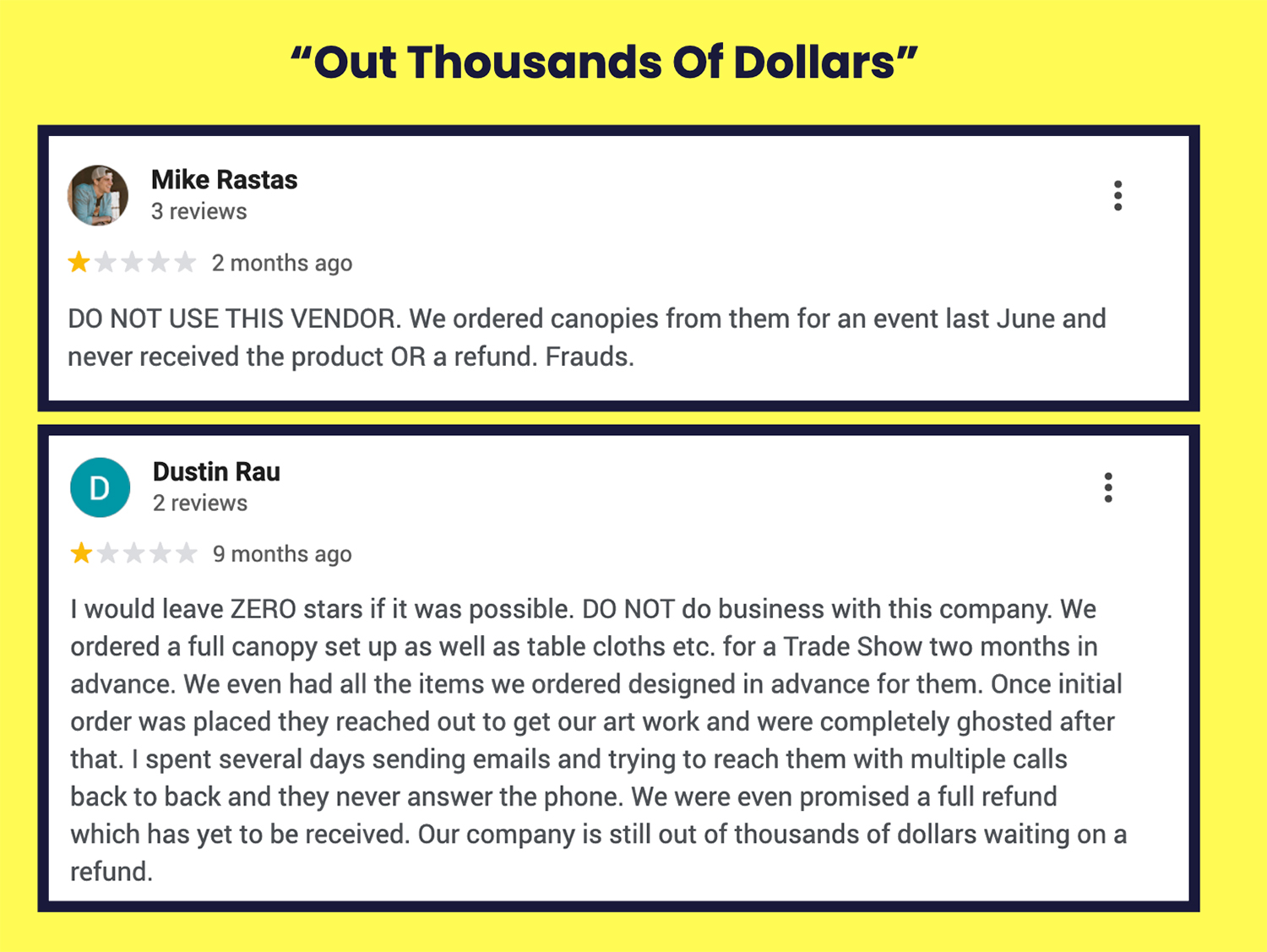

#1 – Terrible Google Reviews – People Complaining They Got Ripped Off

There it was. Right before our eyes. 2.4 stars on Google and lots of negative reviews.

Not everyone had a bad experience; some were actually happy, but many were not and that was a big red flag that we missed.

“DO NOT USE THIS VENDOR” , one reviewer warned. “We ordered canopies from them for an even last June, and never received the product, OR a refund. Frauds”

Another reviewer says, “Our company is still out thousands of dollars waiting on a refund”

A simple search of Google before we worked with this vendor would have been enough of a red flag for us to stay clear of him.

#2 – Lawsuit In Court Records Claiming “Intentional Misrepresentation”

Bad Google reviews weren’t the only thing we found. Lawsuits were getting filed – an indication that he had bigger issues than just our $5,400.

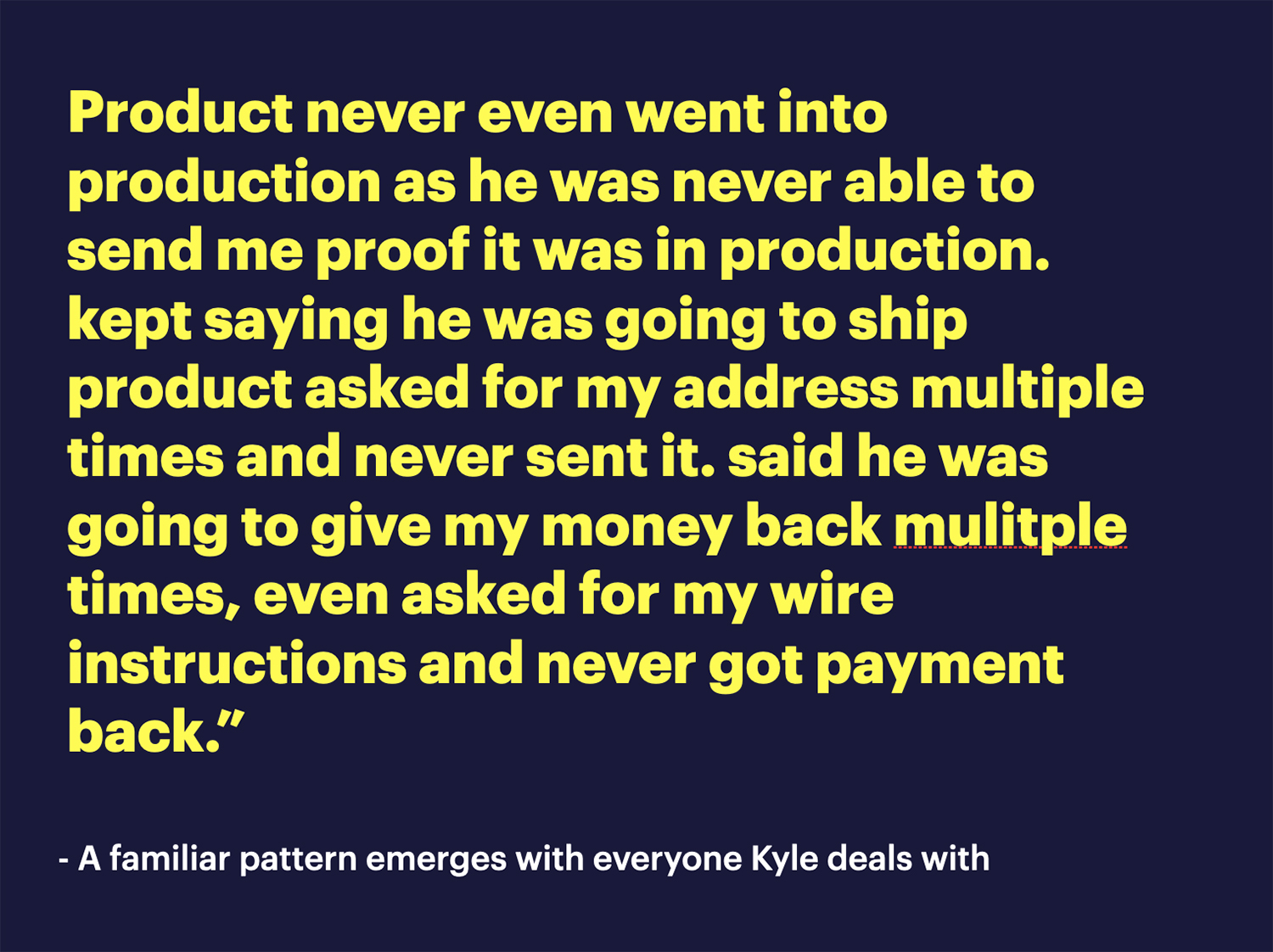

There was a pattern emerging here of someone who had done this before, again and again.

First, there was Ickler Electric, a San Diego company, that was suing him for $1.1 million in damages. They claimed “malicious, willful and oppressive misrepresentation,” saying he misled them about the inventory they purchased.

You can read the whole lawsuit here

#3 – Small Claims Court Lawsuits

It wasn’t just the million-dollar lawsuits, unfortunately. As I searched deeper, there were other small businesses that had gotten ripped off and were taking Kyle to court too.

In this small claims case, the person claims he ordered an awning for his semi-trailer and lost $6,000 when Kyle never delivered the merchandise or could not prove he even made it.

Read the small claims lawsuit here.

But that wasn’t the only small claims lawsuit; there were others.

Like this one here. This software vendor claimed he got ripped off, too, and sued Kyle.

Read the small claims lawsuit here.

#4 – His Office Was Closed, And LandLord Is Even Suing Him for $12,000

The final shocker to us was that his business address appeared to be closed. A lawsuit filed by State Place Partners, his landlord, alleged that he owed back rent and may not have occupied his business address since 2023.

You can read that lawsuit here.

Fighting Back The Way We Know How

Fraud loves the darkness. It likes to stay hidden, which is why, as fraud fighters, we have to address it when we see it. We have to bring the fraud to light to help others, too.

So here is what we are going to do.

#1 – We Are Filing A Complaint To The San Diego District Attorney’s Consumer Protection Unit

With others coming forward with stories similar to ours, it’s important that we protect other consumers and businesses. So we filed a complaint to document our experience and hope to help others avoid becoming victims.

#2 – We Will Notify Venmo Of The Theft Of Our Money Via Deception

Venmo has a system for reporting if you are scammed. Again, they might not do anything, but a repeated pattern might raise a red flag, prompting them to take action.

Red Flags We Missed Can Help Others

As small business owners, we are often subjected to scams that threaten to steal our hard-earned money.

We have to be vigilant and identify red flags that could cost us money. Here are the red flags we should have spotted sooner.

As for Kyle, well, he still has not delivered anything, nor will he ever, as far as we can tell.

The last text message we received? “Your package just got picked up from the Ensenada Brokers For Delivery”.

That’s a one-hour drive from our shop, and that was sent a week ago.

Important Disclaimer

This article reflects my personal experience with Vision Canopy Inc. and Kyle Ahrensberg, along with information gathered from publicly available court records and Google Reviews posted online by others.

Some reviews of the company are positive, and your experience may differ from mine. I encourage you to conduct your own research before doing business with any company.