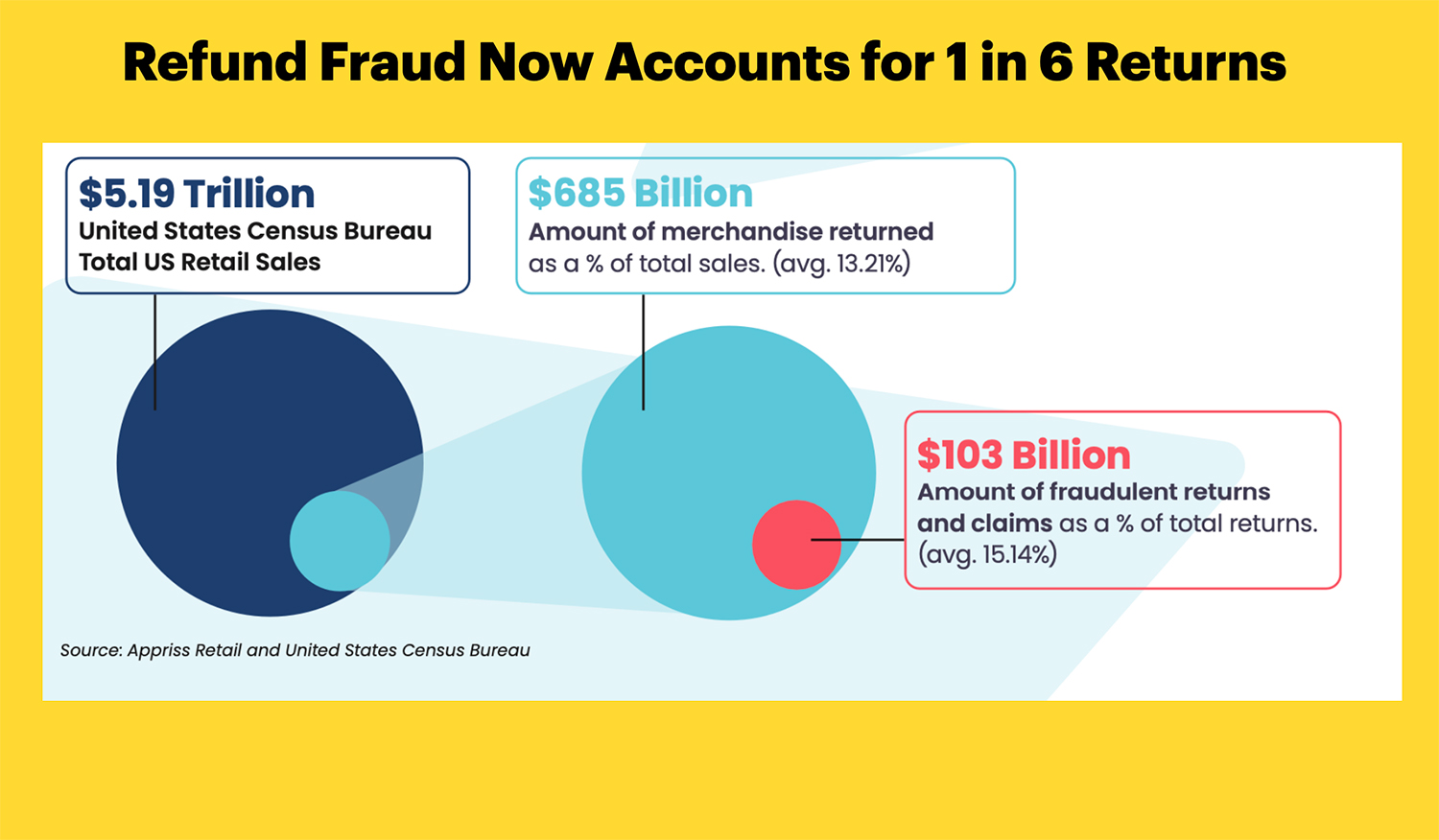

Merchants are struggling to keep up with the influx of return fraud. A new report released by Deloitte and Appriss suggest that fraudulent and abusive returns have hit a staggering $103 billion for 2024 which equates to about 15% of all customer refunds.

The unprecented level of fraud has merchants trying to figure out better ways to stem their losses while not infringing on customer convenience.

84% of merchants advise that they changed their return policies to counter rising fraud in the last year, but many are reporting that it is having some adverse consequences. For example, 55% of consumers indicated that they decided not to buy from merchants with restrictive return policies.

A Perfect Storm For Refund Fraud

Return fraud has gone far beyond simple schemes into far more organized and professional social engineering tactics.

It’s no secret that Professional Fraud Refunders that operate freely on Telegram and social media have been a catalyst for skyrocketing fraud rates. They operated when most consumers shifted their patterns from buying in physical store locations to merchants online sites. It became a perfect storm for return fraud that didn’t end with the pandemic.

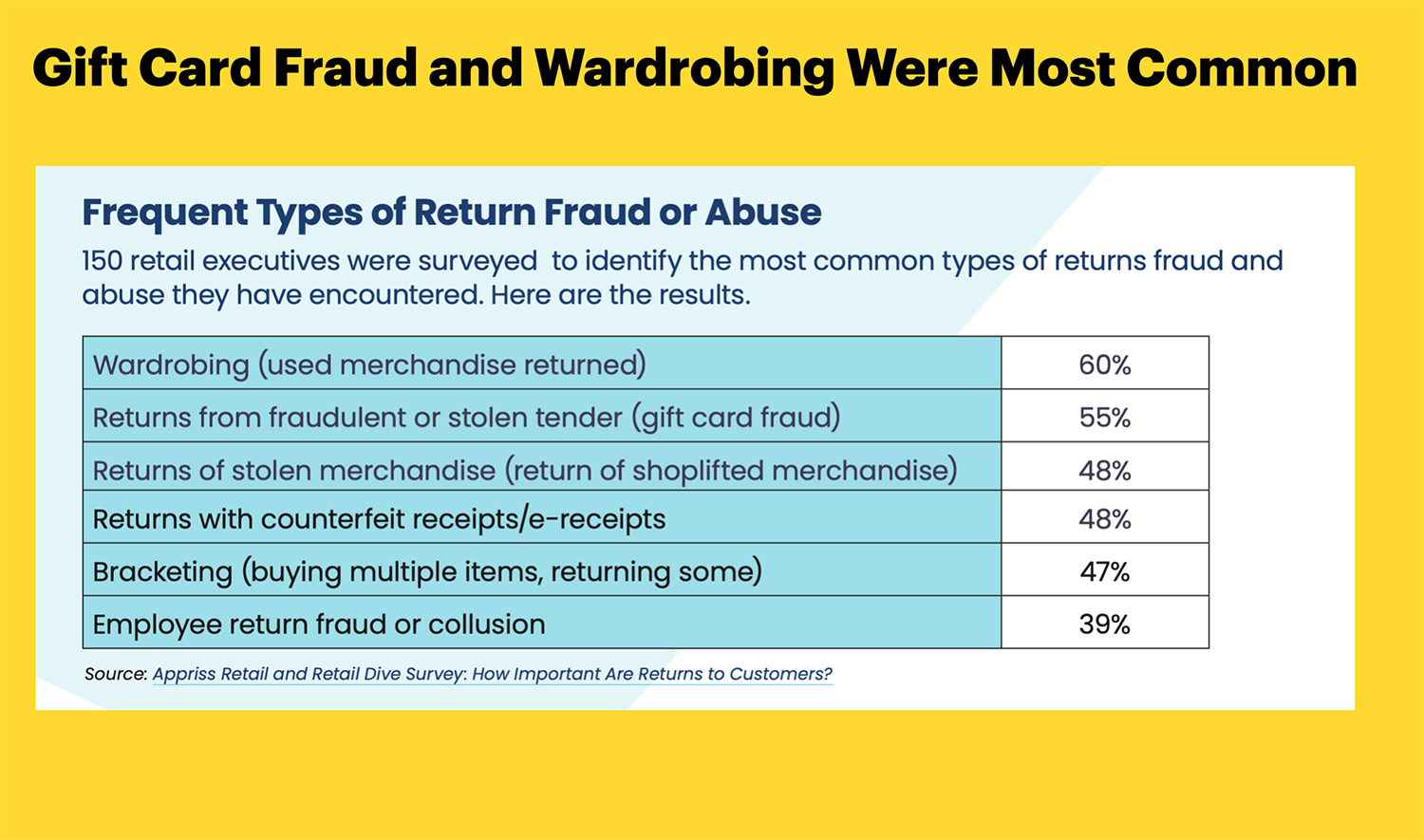

In 2024, merchants outlined the most typical types of fraud they experienced including:

- Wardrobing or wearing and returning items (60% of retailers report this issue)

- Gift card fraud through fraudulent tender (55%)

- Return of stolen merchandise (48%)

- Counterfeit receipt returns (48%)

- Bracketing – buying multiple items with intent to return (47%)

- Employee – collusive employees assist in fraudulent returns (39%)

The Customer Experience Connundrum

Retailers find themselves walking a tightrope between fraud and customer satisfaction. The report advises that while 84% of retail executives have tightened return policies to combat fraud, those changes are having unintended consequences.

55% of consumers have decided against purchasing from retailers with restrictive return policies, and 31% have completely stopped shopping at certain stores due to negative return experiences.

“It’s clear why retailers want to limit bad actors that exhibit fraudulent and abusive returns behavior, but the reality is that they are finding stricter returns policies are not reducing the returns fraud they face,” said Michael Osborne, chief executive officer of Appriss Retail. He said this in a statement to Fairchild Media earlier this week.

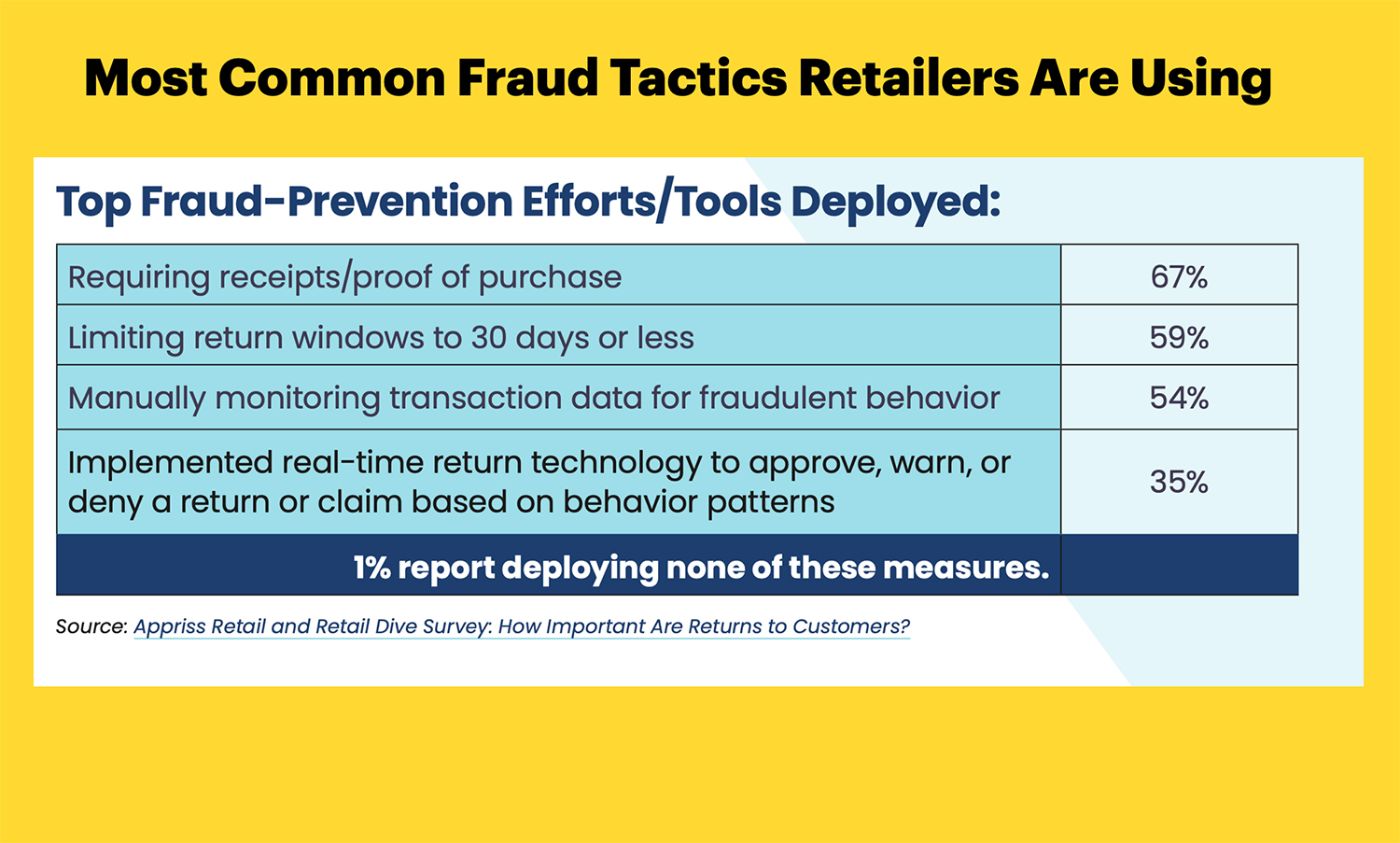

According to Appriss, those methods that retailers are employing include requiring receipts, limiting returns windows, manually monitoring high risk transactions and realtime alerting technology.

Appriss indicated that policy changes are not having an impact because they are subject to human error and biases.

What Retailers Can Do To Prevent Fraud

The report outlines several strategic approaches that retailers can take to curb their fraud.

They include a few good recommendations.

- Implement sophisticated return authorization systems that can detect patterns of abuse while maintaining customer service levels.

- Develop omnichannel visibility to track return behavior across all purchasing and return channels.

- Train staff to identify and handle potential fraud without compromising the customer experience.

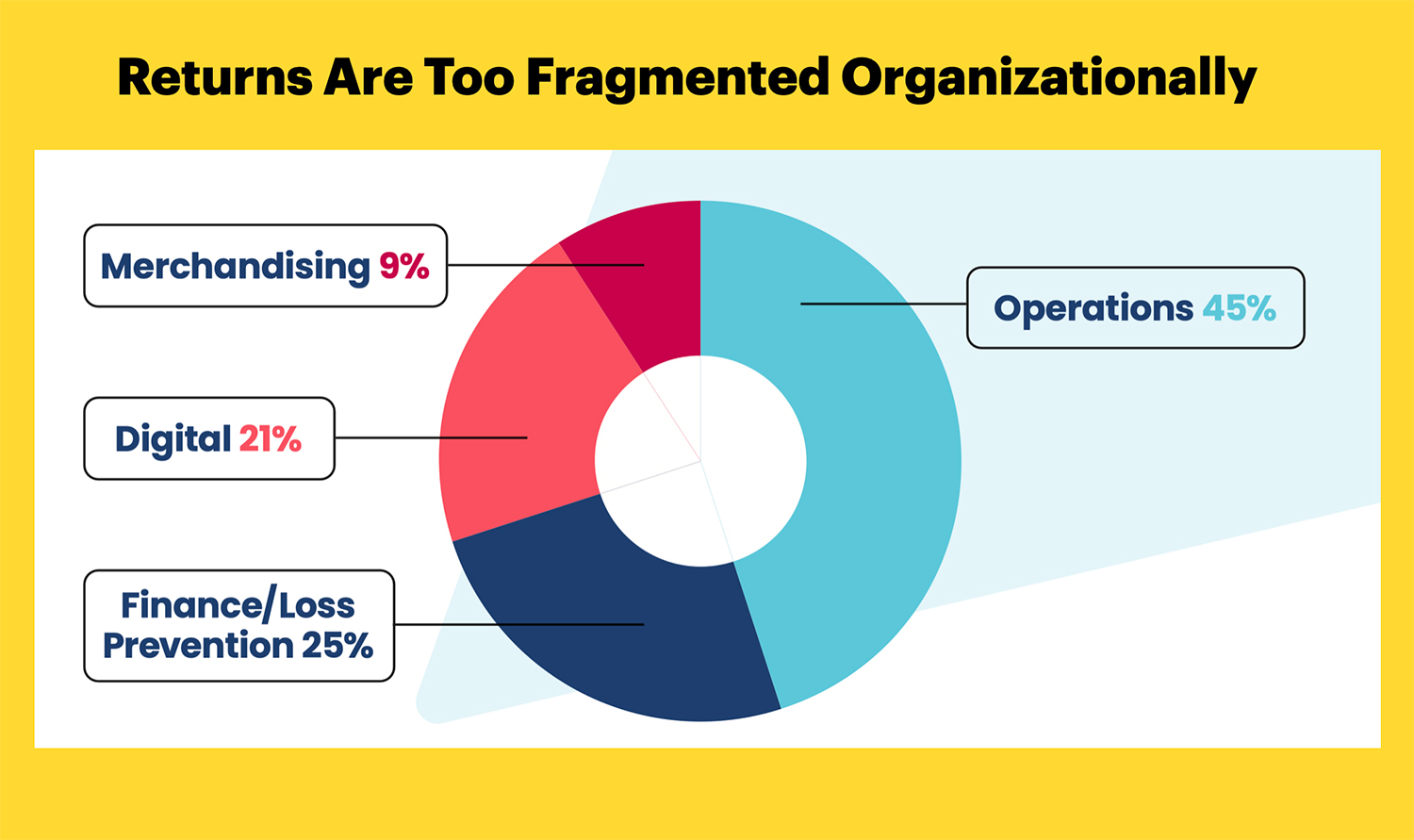

- Consider establishing dedicated return management roles – currently, responsibility is fragmented across operations (45%), finance/loss prevention (25%), digital (21%), and merchandising (9%).

“Returns can no longer be thought of as part of doing business,” the Appriss report concludes. With $685 billion in total returns and $103 billion lost to fraud, retailers must find innovative ways to protect their bottom line while preserving the customer experience that drives long-term success.