Greg Pearre never expected to be escorted out of his office by security guards. But that’s exactly what happened after the senior Social Security Administration exec objected to the plan to place thousands of living immigrants social security numbers on the Death Master File (DMF).

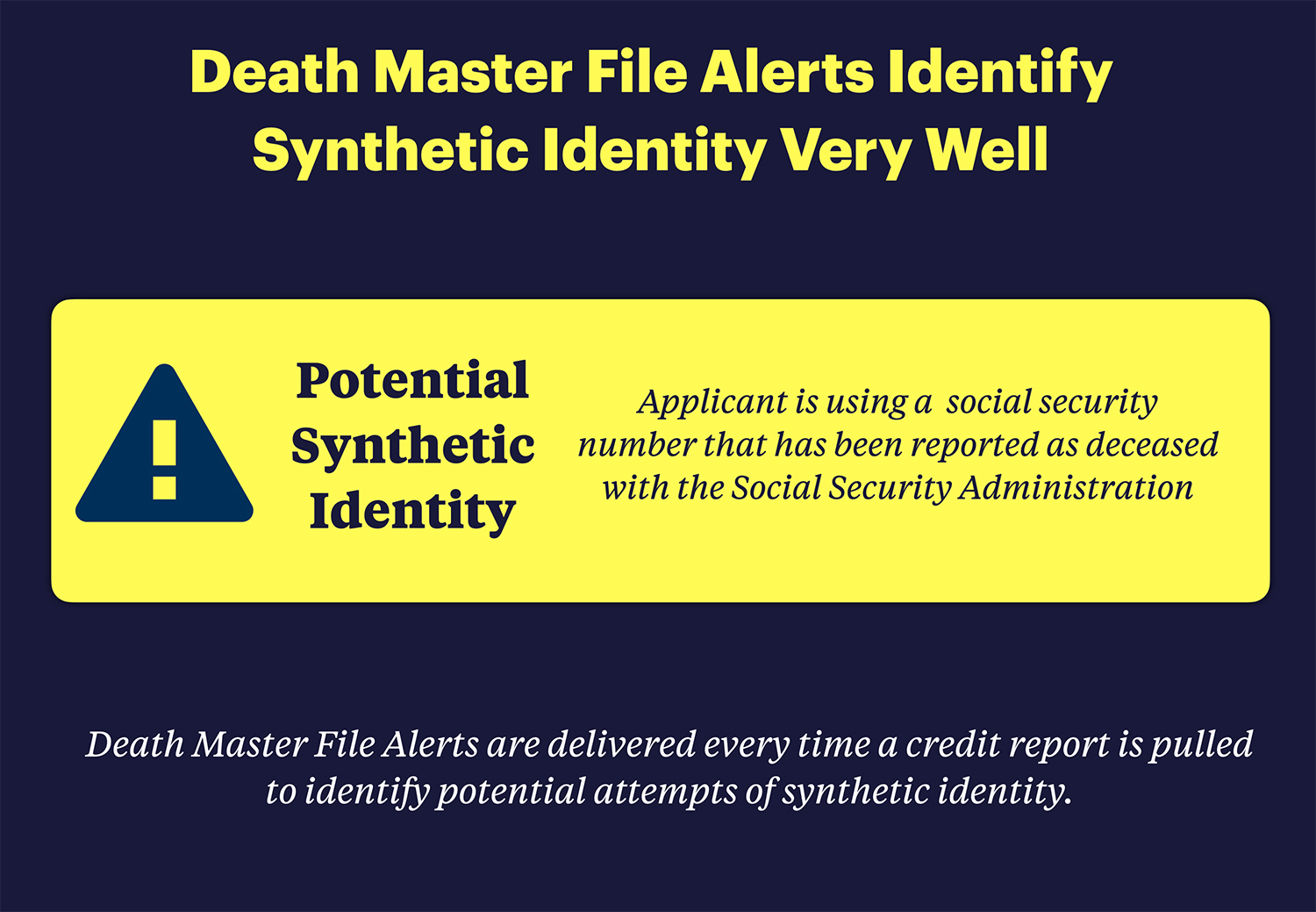

The file which contains 94 million records of deceased people has been a core database to detect and prevent synthetic identity fraud at banks and finance companies. Now many of them will need to rethink those fraud checks.

The Death Master File now contains social security numbers of the living.

6,300 Living People Added Some As Young As 13

This week, the US added 6,300 names and social security numbers to the DMF for immigrants that were given legal status that was recently revoked. The immigrants added to the death database include a 13-year-old, a 14-year-old and two 16-year-olds—as well as one person in their 80s and a handful in their 70s, according to The Washington Post.

The reason? They wanted to financially terminate the immigrants ability to financially survive in the US so they would “self deport” themselves.

Dead People Don’t Apply For Loans

For decades, banks and credit unions have relied on a simple principle: dead people don’t apply for loans. When someone uses a Social Security number belonging to a deceased person, it immediately raises red flags.

But now, with thousands of living people now labeled as “dead” the distinction between an actual synthetic identity and a legitimate customer caught in a policy changes becomes blurred.

Interestingly enough, Social Security officials had warned years ago that the database was insecure and records could be added without proof of death. Well that fear has now become realized.

How To Prepare For Changes In Fraud Departments

Banks fraud departments and fraud vendors could now face challenges with their fraud checks. How can they determine who is a synthetic fraudster and who is just an immigrant?

They are going to have to rethink their process. Imagine if someone matches the death master file and actually provides a copy of their Social Security Card? It’s going to get much harder to tell.

Three Changes To Consider

There are five things banks can do now to account for the changes. Its important to remember that the impact is still relatively small (only 6,300 records), but remember more could be added over time as the government cracks down.

#1 Create A New Category

When a social security death master file hits a match, banks could consider using additional checks that will not rely solely on the check death check alone. This includes educating internal staff that just because something hits the death master file doesn’t mean it is a synthetic identity attempt.

#2 – Implement a Secondary Verification

Don’t rely exclusively on the Death Master File for synthetic identity detection. Cross-reference with other data sources like credit bureau information, which might help distinguish between actual fraud and politically-driven database entries.

#3 – Train Front Line Staff

Underwriters and fraud analyst need to know how to handle people who may be incorrectly labeled as deceased. Create training on how to deal with these people and make sure that they are not treated as fraudsters as they could be legitimate people.

What complicates the matter is that these people have had their Visa’s revoked so while it may not be fraud, it could represent other compliance related risks.