Newly released SAR filings data for 2024 is hot off the press. And it is revealing a troubling trend in fraud for banks; fraud is up significantly in three problem areas – account takeovers, identity theft and wire fraud.

The new data filed by US financial institutions, reveals a startling trend: reports of account takeover fraud jumped 36%, identity fraud 27% and wire fraud over 20% in 2024.

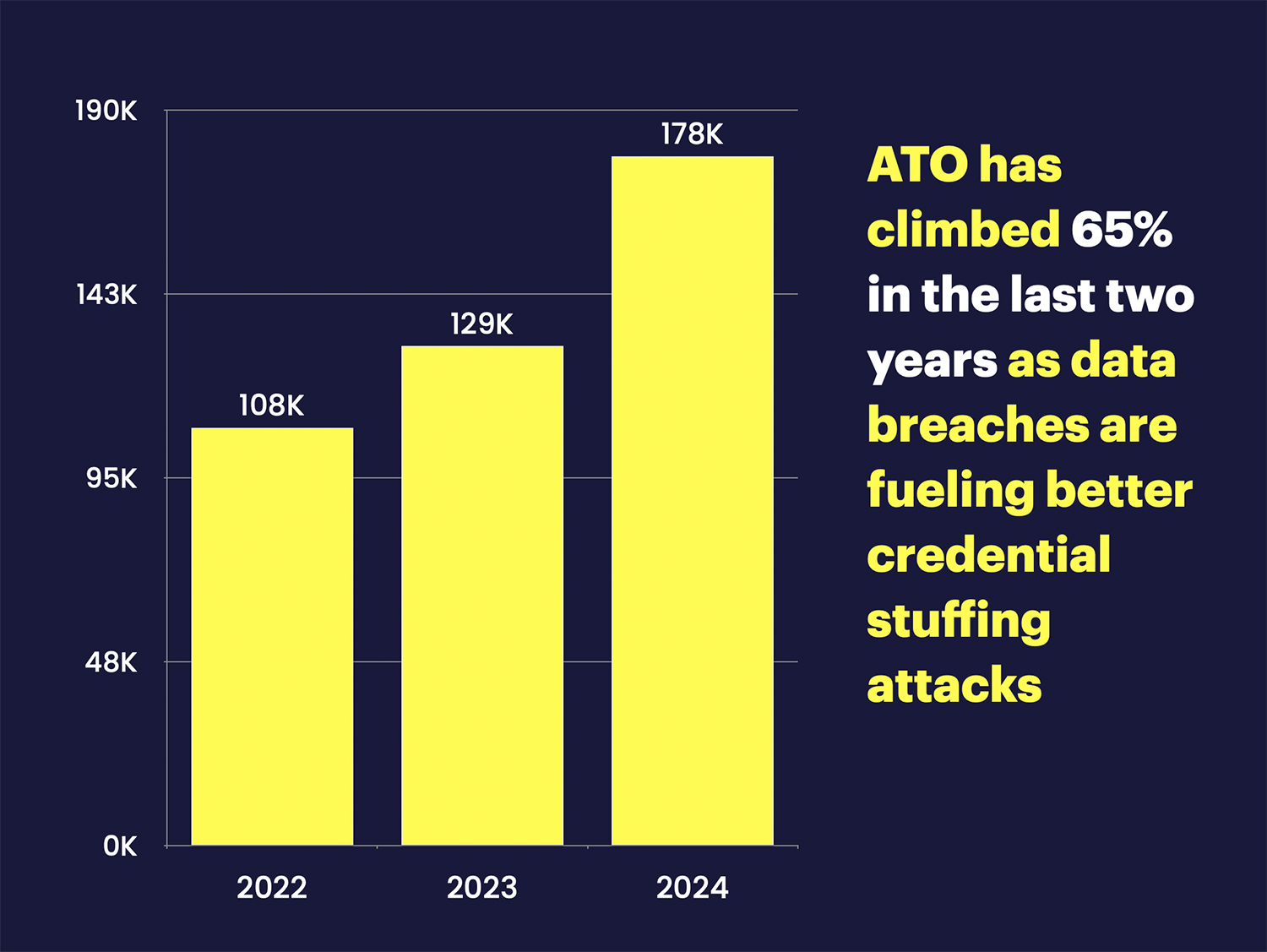

Account Takeover On A Tear – Up 65% Driven By Data Breaches

The numbers tell the story: banks filed nearly 178,000 suspicious activity reports related to account takeovers in 2024, thats an increase of more than 47,000 cases over 2023 marking a significant shift in trends.

FinCEN data showed ATO SARs already climbing (108k in 2022 to 129k in 2023). This comes as criminals are increasingly hijacking online banking and e-commerce accounts using stolen credentials and malware.

Data breaches are providing a trove of stolen credentials that these criminals are using to up their attack efficiency.

The deployment of AI tools has increased the effectiveness of ATO – for example, generative AI can automate phishing emails or even assist in bypassing verification techniques such as liveness detection.

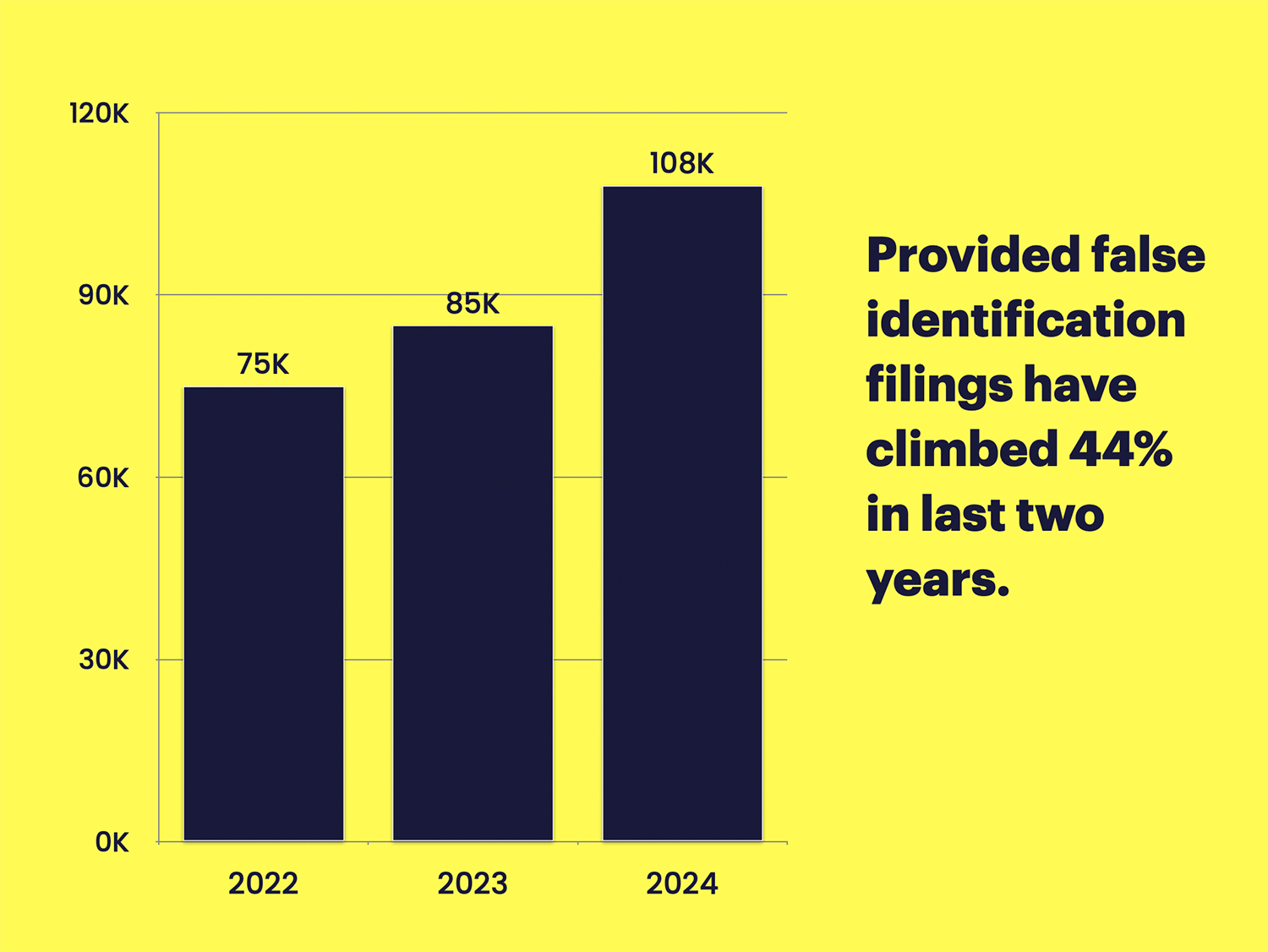

The Rise In False Identification – Over 44% Increase Since 2022

The 27% increase in “false identification” filings points to rising levels of both identity theft and forged documentation and perhaps to better recognition of synthetic identity – an issue that has plauged FI’s for decades.

And this is no blip, but a longer term trend that has developed over the last several years. False identification has climbed over 44% since 2022, despite the fact that banks are spending hundreds of millions in fraud tools.

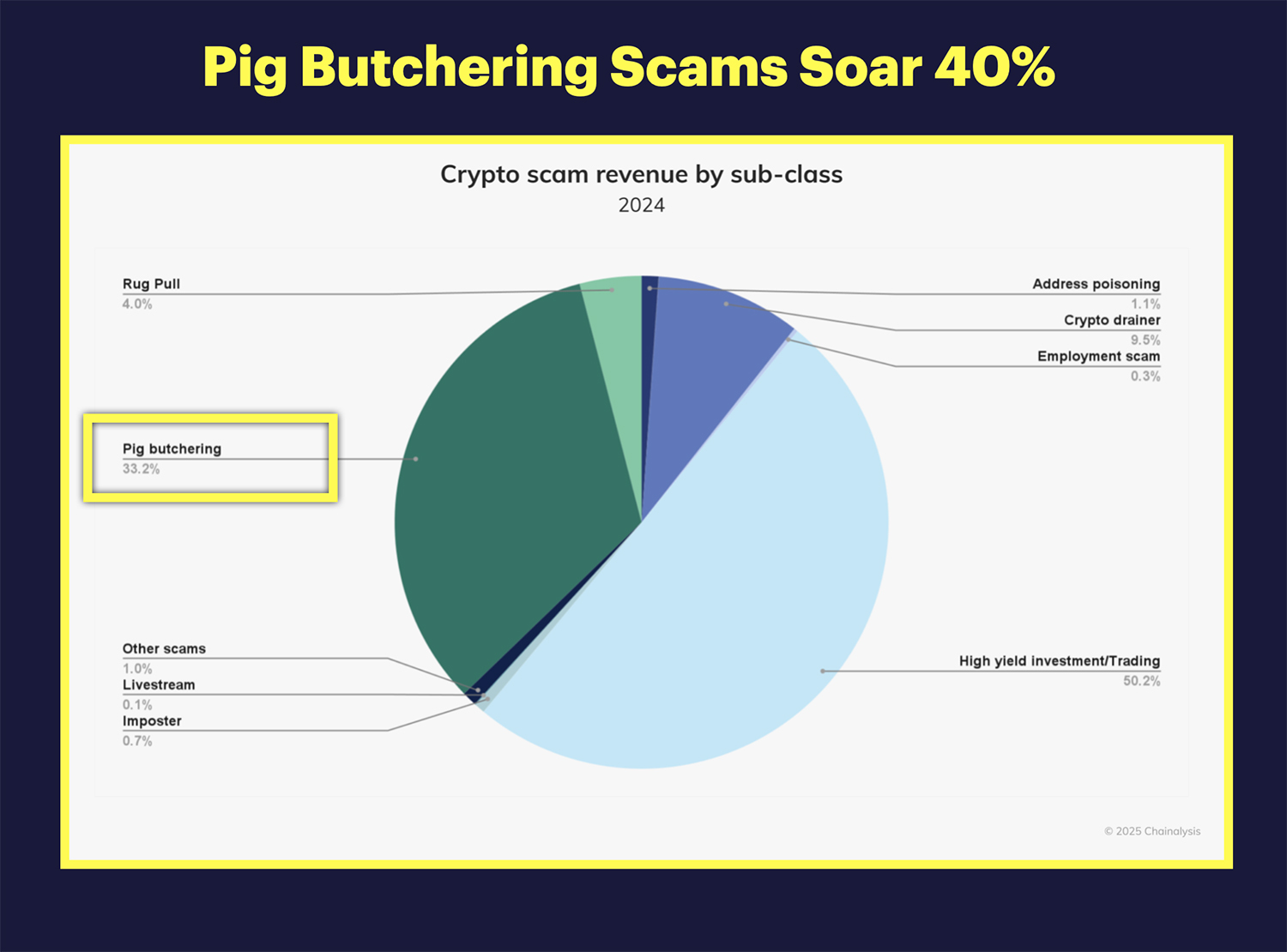

AI Fueled Scams Push Wire Fraud Up 40%

The increase in wire transfer fraud SARs (20% uptick) is closely tied to the persistence of Business Email Compromise (BEC) and Pig Butchering scams which increased over 40% last year according to new analysis from ChainAnalysis. Those scams are being fueled ever higher by AI deepfakes, voice clones and automated bots.

Wire fraud has increased 40% since 2022, increasing from 136,000 cases to 188,000 cases in 2024.

Banks will likely continue to see large increases in wire fraud as AI and deepfakes are being used as rocket fuel to improve the believability of these high profile scams.

Not All Fraud Is Rising – Mortgage Fraud Plummets 36%

What comes up must come down. And that is the case with Mortgage Fraud. Mortgage originations fraud filings have plummeted by 36% in the last year.

Why is mortgage fraud down? It’s simple, there are simply far fewer mortgages in the US. As interest rates have dropped, refinance volumes and home purchases have dropped as well. That means less potential for people to commit mortgage fraud.

Emerging Trends And My Outlook for 2025

SAR filings present us with a glimpse backwards, but also provide us with rich insights on what we can expect this year.

And that is this:

AI will flourish pushing scams up

AI will continue to drive up Wire fraud and pig butchering. We are just getting started.

ATO will remain a threat

Data breaches will continue to fuel unprecendented levels of account takeover this year. AI will only make those attempts more succesful.

Check fraud will increase

Check fraud remains stubbornly high. Check fraud will increase in 2025 based on my projections.

Identity fraud will get worse

Despite hundreds of millions spent on identity fraud, banks will continue to suffer mounting losses due to synthetic identity, forged documentation and increasing attempts.

Thanks for reading and happy fraud hunting!