What do crazy cows have to do with fraud? A lot actually. But you have to go back over 30 years to find the link between the two.

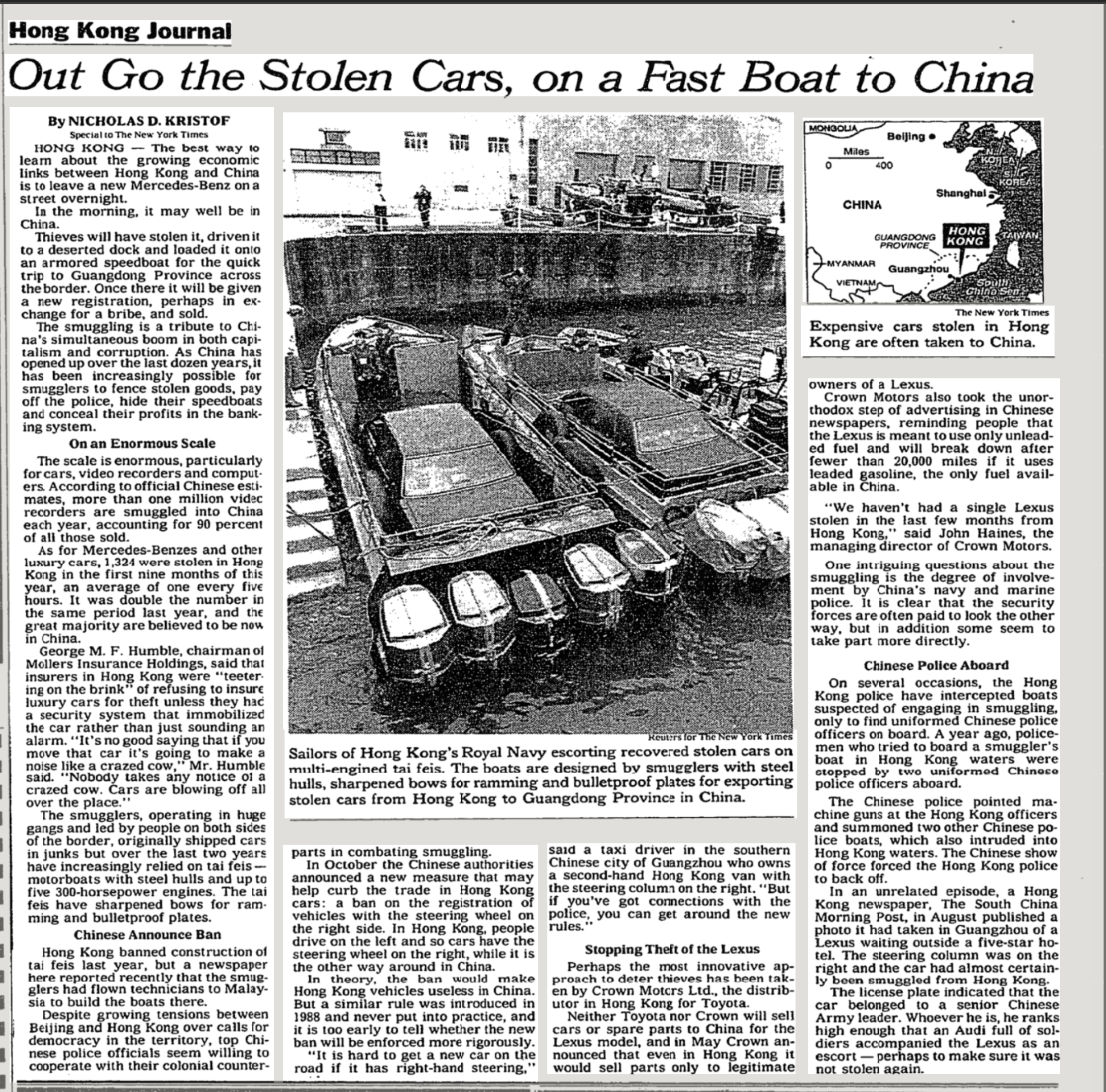

An associate of mine sent me an article that appeared in the New York Times in 1982 and it talks about the tremendous demand for stolen luxury cars in China, and how insurance companies demanded better technology to insure cars because so many were getting stolen and they were paying too many claims.

Stolen Cars on Fast Boats to China

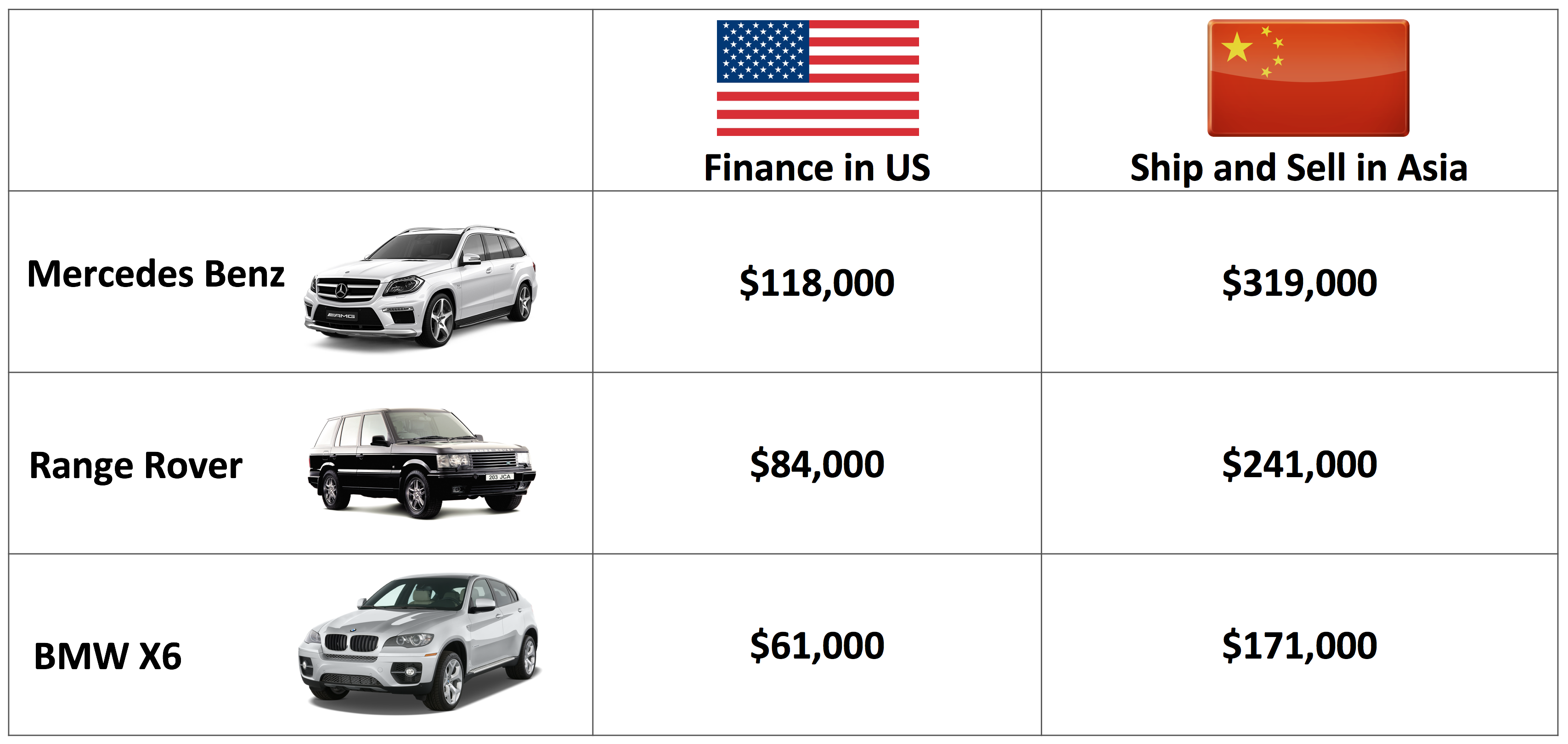

So, the more things change, the more they stay the same. A case in point. Auto lenders today struggle to stop fraudsters and identity thieves from fraudulently financing luxury vehicles and then exporting those cars to China for huge profits. A high-end luxury Mercedes or Range Rover financed in the US, for example, can sell for as high as $300K or more if it is placed on a shipping container and sold in China.

But this isn’t something new. In fact an article appeared in the New York Times – Hong Kong Edition over 35 years ago that drew attention to the fact that luxury cars were being stolen and exported to China.

At the time, Mercedes Benz were being stolen at a rate of 1 car every 5 hours in Hong Kong and those cars were placed on speedboats which would shuttle the cars to China where they were sold.

Crooks were making tons of money selling these cars. You can read the article right here.

Preventing Car Theft With Crazed Cow Noises

So how did creative car owners try to prevent their cars from being stolen? Somebody had the bright idea that if they could make the cars make strange noises when they were stolen, it would deter car thieves.

So someone cleverly rigged the cars with alarms that made crazy cow-like sounds if someone broke into the car. By playing loud crazy cow sounds, everyone would know the car was in danger so they could call the police.

But obviously alarms had limited success and one insurance company had this to say about it.

George M. F. Humble, chairman of Moller’s Insurance Holdings, said that insurers in Hong Kong were “teetering on the brink” of refusing to insure luxury cars for theft unless they had a security system that immobilized the car rather than just sounding an alarm. “It’s no good saying that if you move that car it’s going to make a noise like a crazed cow,” Mr. Humble said. “Nobody takes any notice of a crazed cow. Cars are blowing off all over the place.”

Technology Moved Beyond Cows

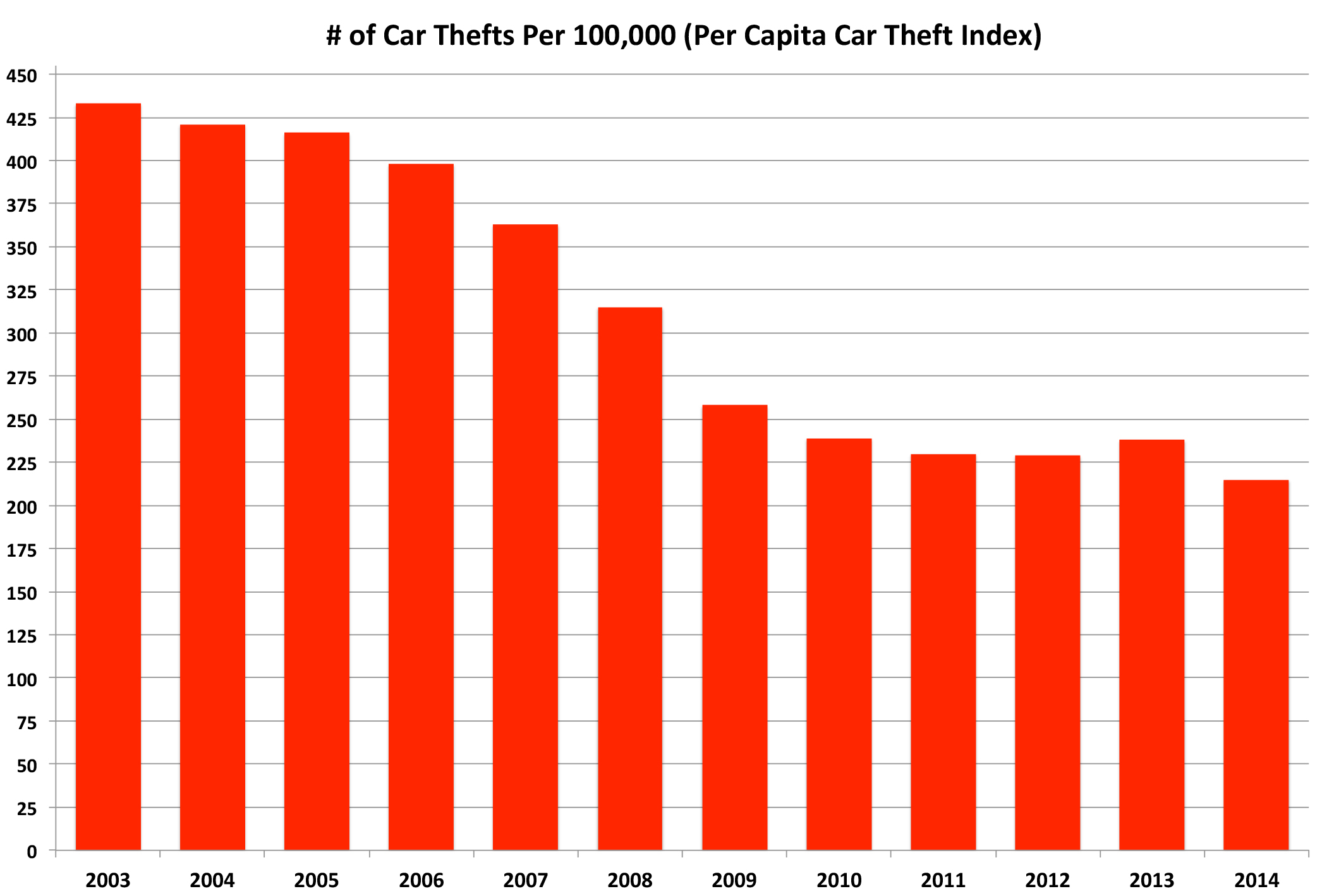

So car manufacturers did move away from alarms that sounded like crazy cows and invested in better technologies such as LoJack, GPS and keyless cars.

Their investments reduced car thefts significantly – at least here in the US. FBI reports show just how much it worked.

But Thieves Found New Ways

So did the crooks give up on stealing cars? Not a chance. They just found far easier ways to get cars than breaking windows and jimmying the locks.

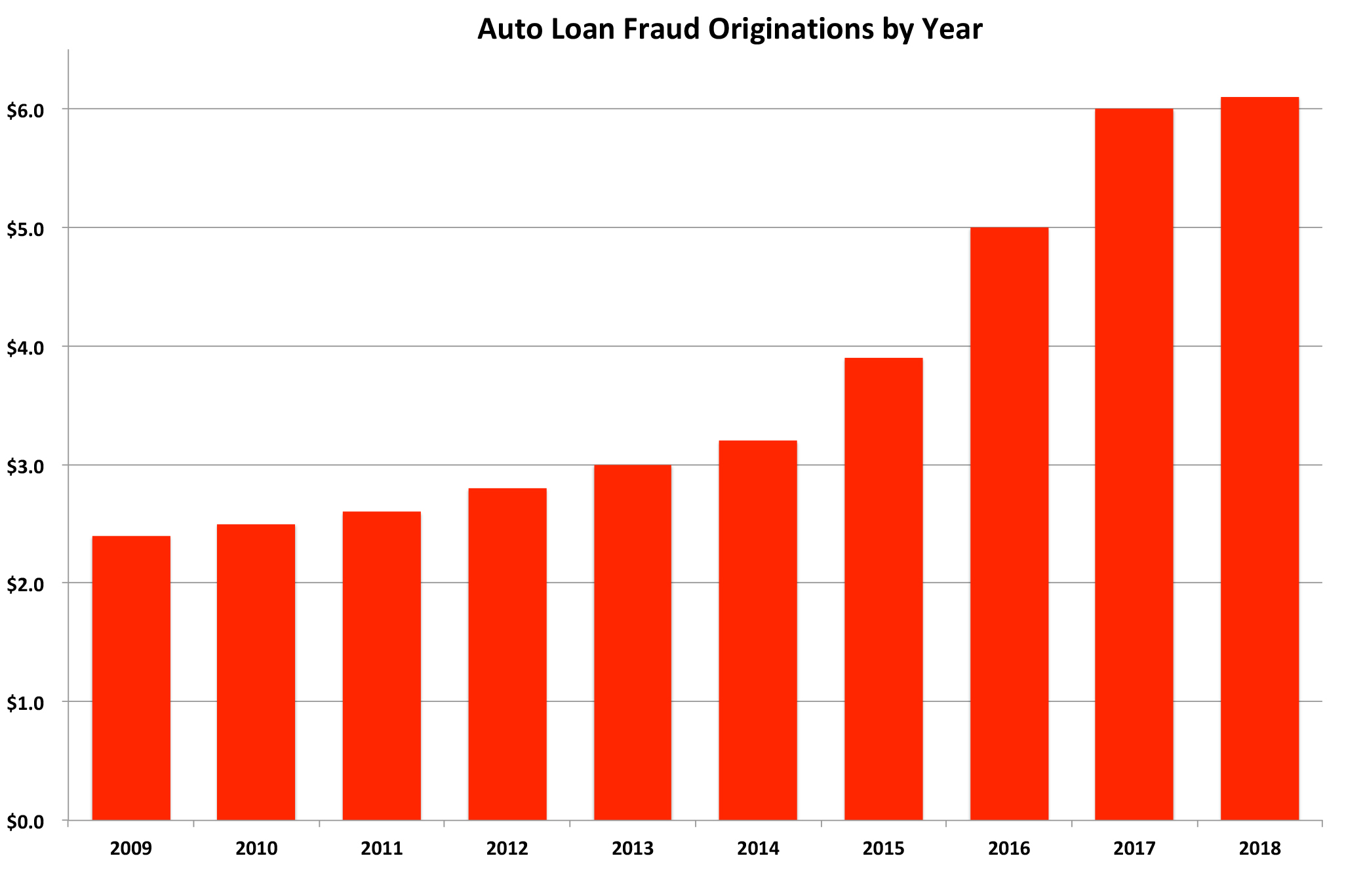

It was called auto finance fraud. They discovered that they could go to any car dealership and armed with the right data, they could walk out with the keys to a brand new car. And it’s a big problem, increasing to over $6 billion in loans originated with misrepresentation each and every year. But it hasn’t always been this bad.

Auto lending fraud loss estimates have been climbing every year since 2009. As car thefts have declined, crooks have simply found an easier way to get the keys to cars.

If companies continued to rely on crazy cow sounding alarms, we probably would not be seeing as much financial fraud because they would stick to just stealing cars because it’s easier.

The Moral of The Story

So there are a few things we can learn from this article that appeared back in the 1980’s.

#1 – Fraud is always MOOving.

Crooks and thieves are resourceful and will always change their methods. Investment in fraud controls in one area will always result in them moving to a new area. And that’s no bull.

#2 – You can’t milk your investment in fraud forever.

When you implement a fraud control or new technology, you can’t expect it will always stop your future fraud. You need to stay vigilant, take stock of the situation and constantly innovate.

#3 – In the case of fraud, its Deja Moo all over again

The more fraud changes, the more it stays the same. Schemes that occurred 40 years ago are still occurring today. To find future fraud, just look to the past. It will always steer you in the right direction.

Well, I hope this advice doesn’t go in one ear and out the udder.

Thanks for reading. I hope this blog helps you take stock of the situation and moooove you in the right direction.