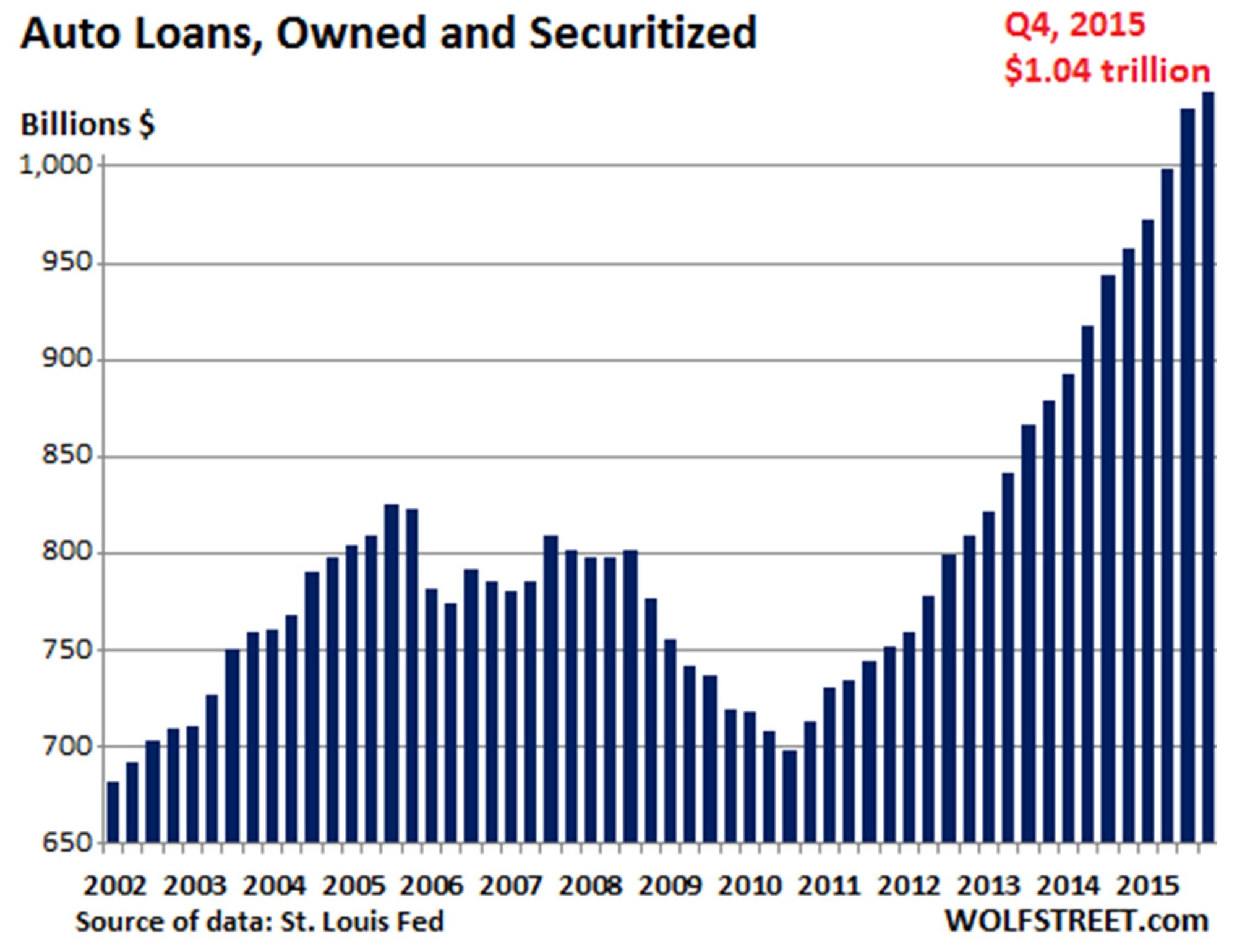

For two years, I have been watching Auto Lending go through one of biggest growth spurts in history. And it certainly looks like it is peaking. This last quarter outstanding Auto Loans increased to over 1 Trillion and marked one of the best quarters in history.

Everything is good right? Not quite. And definitely not according to Chase CEO Jaime Dimon who is sounding the warning bells.

Someone is Going to Get Hurt in Auto Lending. We don’t do much of that. Jaime Dimon

Boom Cycles Have Always Resulted in Increases in Fraud

One thing has always concerned me about Auto Lending – Fraud. In the past 25 years we have witnessed many booms and bust the lending cycles and each case there has been indications of massive amounts of fraud.

You don’t typically see massive increases in lending without some impact on fraud.

I should know. I lived through the mortgage nightmares of 2007-2009. At BasePoint, my former company we started to warn lenders about their fraud risk but to no avail. Lenders were eager to loan to just about anyone, and worse yet, investors were willing to buy those loans.

Auto Lending is not quite in the same boat but I see some indications of hidden fraud as well.

5 Warning Signs for the Auto Lending Industry

I agree with Jaime Dimon when he says someone is going to get hurt. If I was to guess (and it would not be too hard) it would probably be subprime lender that have overreached.

One of the highest growth segments of auto lending is the deep subprime with borrowers who have credit scores 500 or less. History has shown us that those loans simply don’t perform.

5 Warning Bells on Auto Lending Fraud

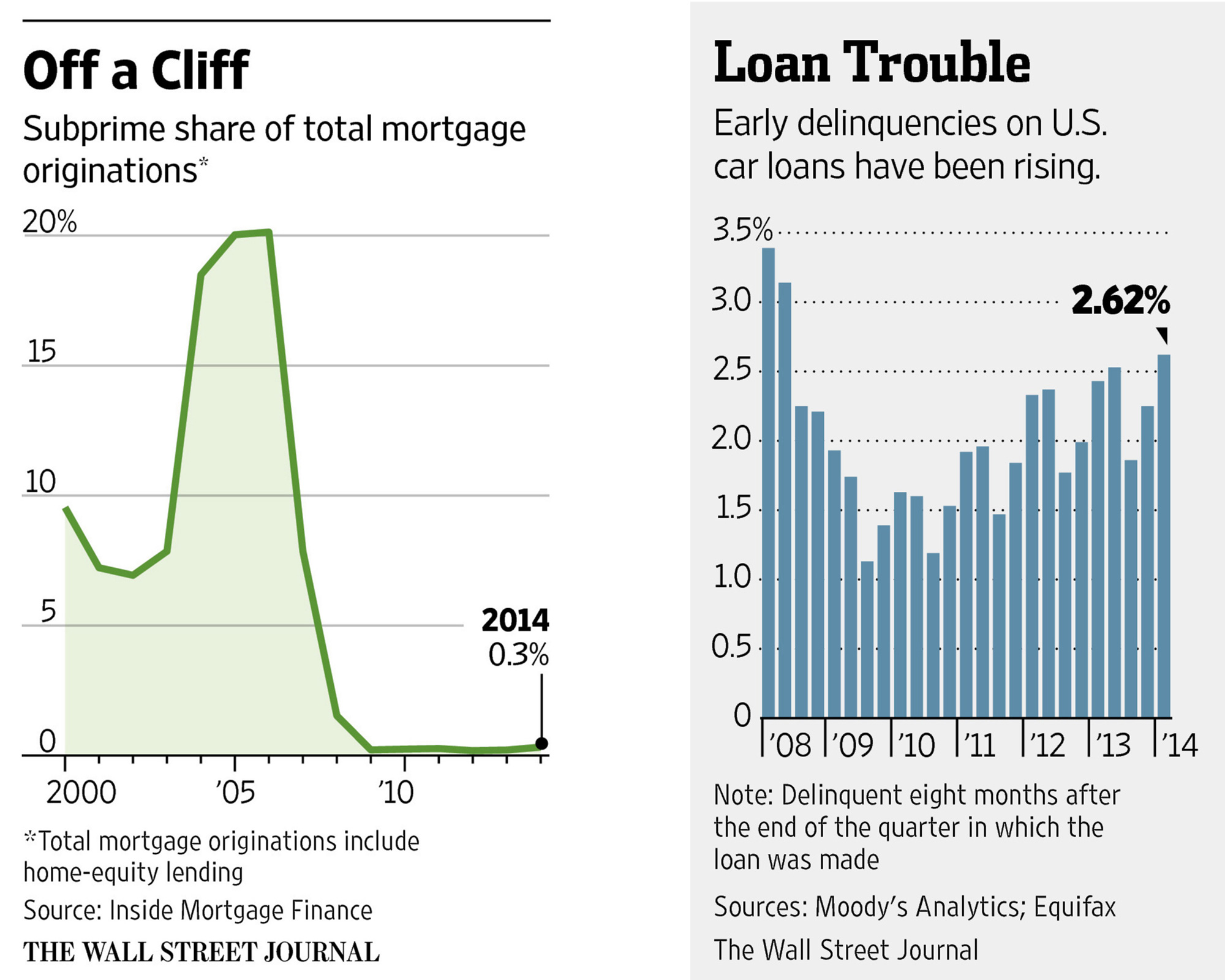

First Warning Sign – EPD Rates are Climbing Which Means Hidden Fraud is Increasing

EPD (Early Payment Default Rates) after dropping are again climbing to levels that we saw during the lending crisis of 2009. And for good reason, lenders are digging deeper into lower credit quality borrowers to keep sales high. We have done extensive analysis at various companies that I have worked with that indicates that anywhere from 30% to 70% of loans that default within the first 6 months have misrepresentations in the original application. High EPD losses are indications that fraud is playing a part in eroding loan quality.

Second Warning Sign – Subprime Lending is Increasing Which is Driving Higher Fraud Rates – The Wall Street Journal and many other publications are reporting the dramatic increase in lending to subprime borrowers. We know from history that the subprime lending boom in mortgage drove much of the fraud that eventually took the entire industry down. You can read a good article on it here – Subprime Auto Lending.

There are some indications troubles could be on the way.

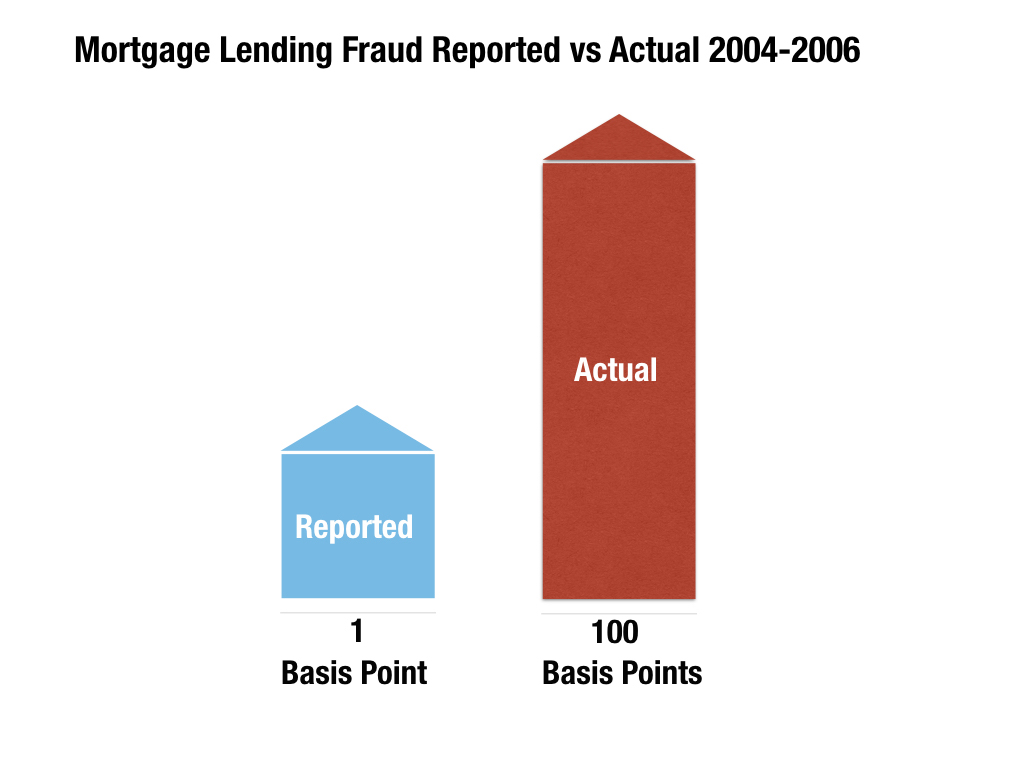

Third Warning Sign – Low Reported Rates of Fraud – In 2004 I began consulting with mortgage lenders that were all reporting less than 1 basis point of fraud loss. I didn’t believe it for a second and when we began to run pattern recognition models on the application data we noticed something strange – Fraud was hidden. Our models suggest that 100 basis points (or often more) had significant fraud on the files. Fast forward to 2016 and we are seeing a similar phenomenon with auto lenders reporting very small levels of fraud. Low reported rates of fraud are often an indicator that fraud is hidden and that is the third warning sign.

The first warning signs for mortgage problems in 2006 was low reported rates of fraud

Fourth Warning Sign – Increased Competition and Sales Cultures as Volumes begin to peak.

From lenders I have spoken with competition in auto lending is fierce and it can be seen as lenders increasingly open up their loan programs to attract more borrowers. Increased competitions lead to increased sales culture which inevitably leads to higher fraud loss rates as fraud creeps into the portfolios.

Sales dominated lending cultures inevitably lead to higher levels of fraud losses as organizations begin to ignore the risk that their fraud managers bring to their attention.

Fifth Warning Sign – Securitization is Hot

Securitization of auto loans is increasing rapidly. More loans are securitized now than ever before and there is demand in the secondary market for these types of offerings. However this is also the same pattern that we saw with mortgage lending in the early 2000’s and that lead to the eventual demise of the industry due to massive missed or ignored fraud problems. Disintermediation can and often does lead to significant problems in fraud management. A good article here that explains why all those securitized auto loans in bonds may be facing big trouble as well – Bond Trouble with Subprime Auto Loans. Is this beginning to sound all too familiar?

Auto Lending Fraud Technology

For the last two years we have been focused on building artificial intelligence technology to help auto lenders spot the problems of borrower and dealer fraud but as well to address the hidden fraud that shows up in their lending portfolios as early payment default loans. This technology was developed by fraud scientist using millions of historic loans and the patterns of underlying fraud that occurred on those loans.

You can read about the company here which is PointPredictive based in San Diego California – PointPredictive.