Zelle reports that payment volumes soared in 2023. Consumers and small businesses sent 2.9 billion transactions totaling $806 billion in 2023, Thats up 28% over last year.

That’s good news for what I think is probably the safest P2P service available. It’s safer than Venmo and light years better than CashApp in stopping scams.

But with that phenomenal growth, it’s important to remember that fraud and scam exposure are likely up, too.

There are always two sides to the coin.

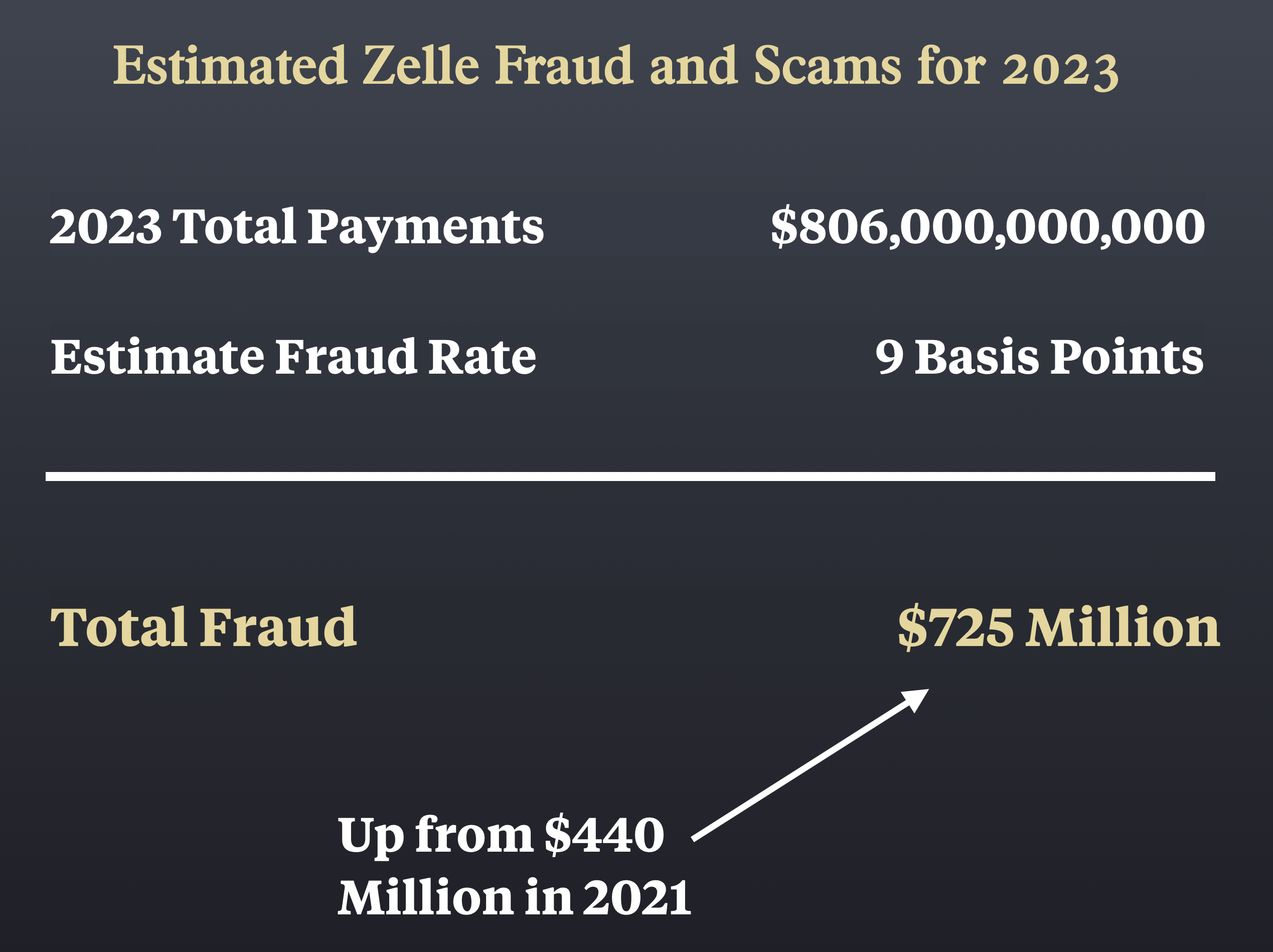

Fraud and Scams Are Likely Over $725 Million Annually, Up From $440 Million in 2021

If you do the math, as my buddy Ken Palla likes to say, you get the big picture of the impact of that growth on consumers. In many cases, they are the ones who take on those losses when they get scammed.

By my estimate, fraud and scam exposure last year increased to $725 million. That’s up from $440 million based on actual numbers reported by Zelle for 2021 last year.

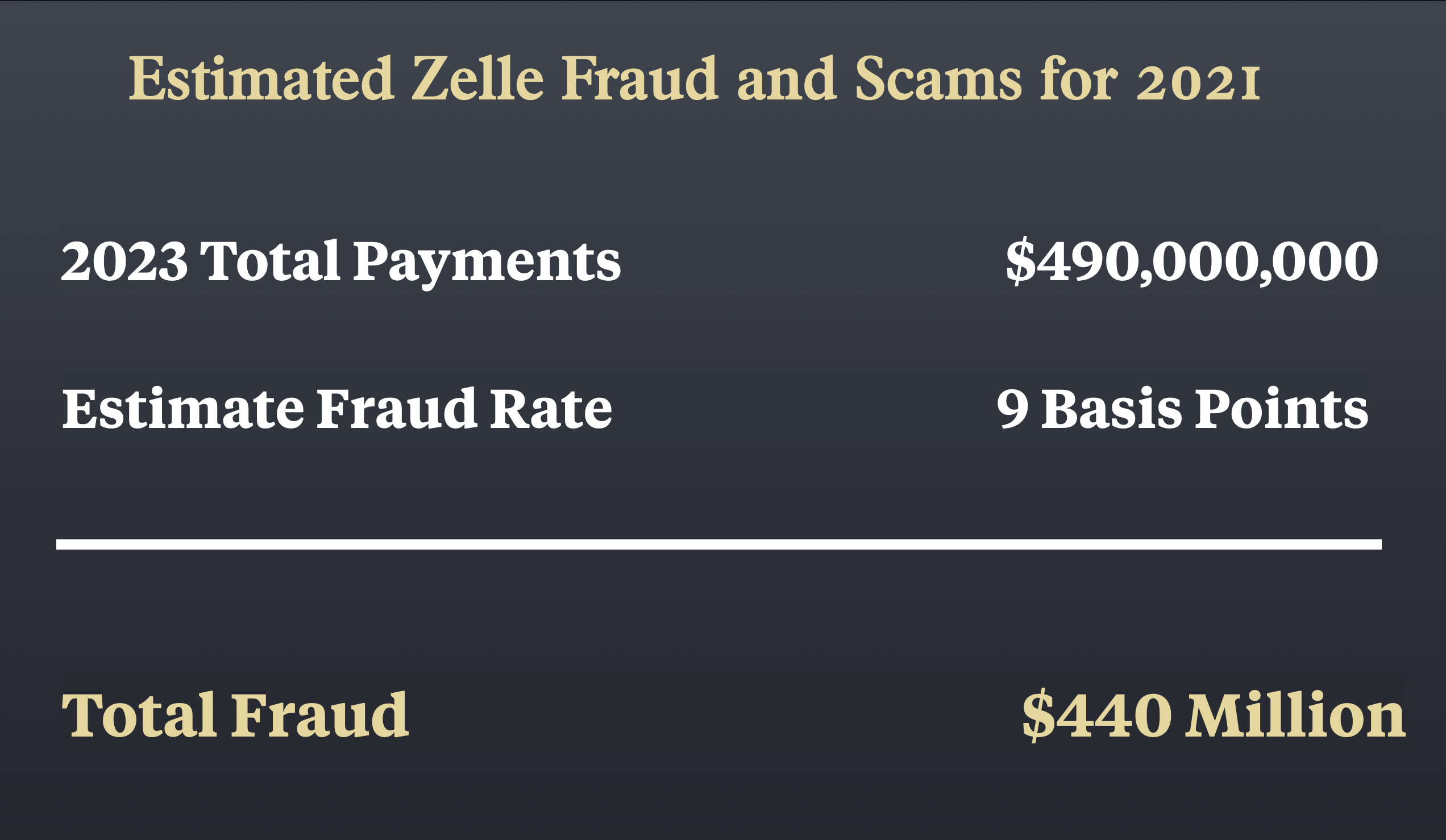

Zelle Reported 9 Basis Points Of Risk Annually Last Year

Zelle gave some insight into the average fraud risk of the P2P platform last year.

They reported that consumers sent $490 billion through Zelle in 2021, of which an estimated $440 million was lost through fraud and scams.

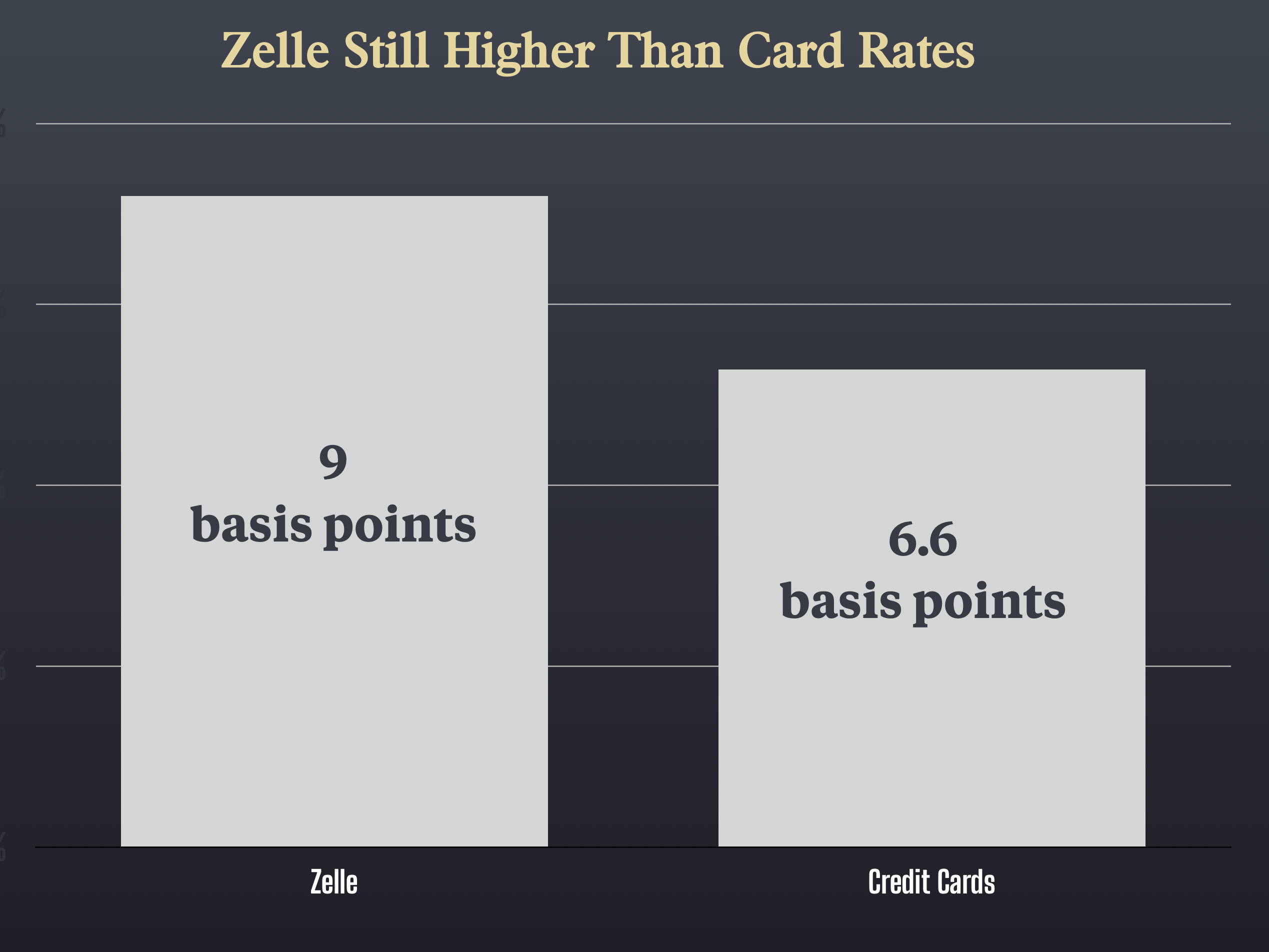

Using math, we can glean that accounts for about nine basis points in total fraud and scams. Zelle also claims that its platform is 99.9% fraud-free, and its self-reported numbers seem to confirm this.

The Math – How Do We Get To $725 Million in Annual Losses

With over $806 Billion in payments on the Zelle last year, the total cost of fraud and scams on the platform is now estimated at $725 million yearly.

Based on the last estimate of $440 million from actual data reported by Zelle for 2021, total fraud and scams exposure has increased about 65% on the platform since then.

To get to the fraud losses, we just multiply the total payments by the average fraud rate across all those transactions.

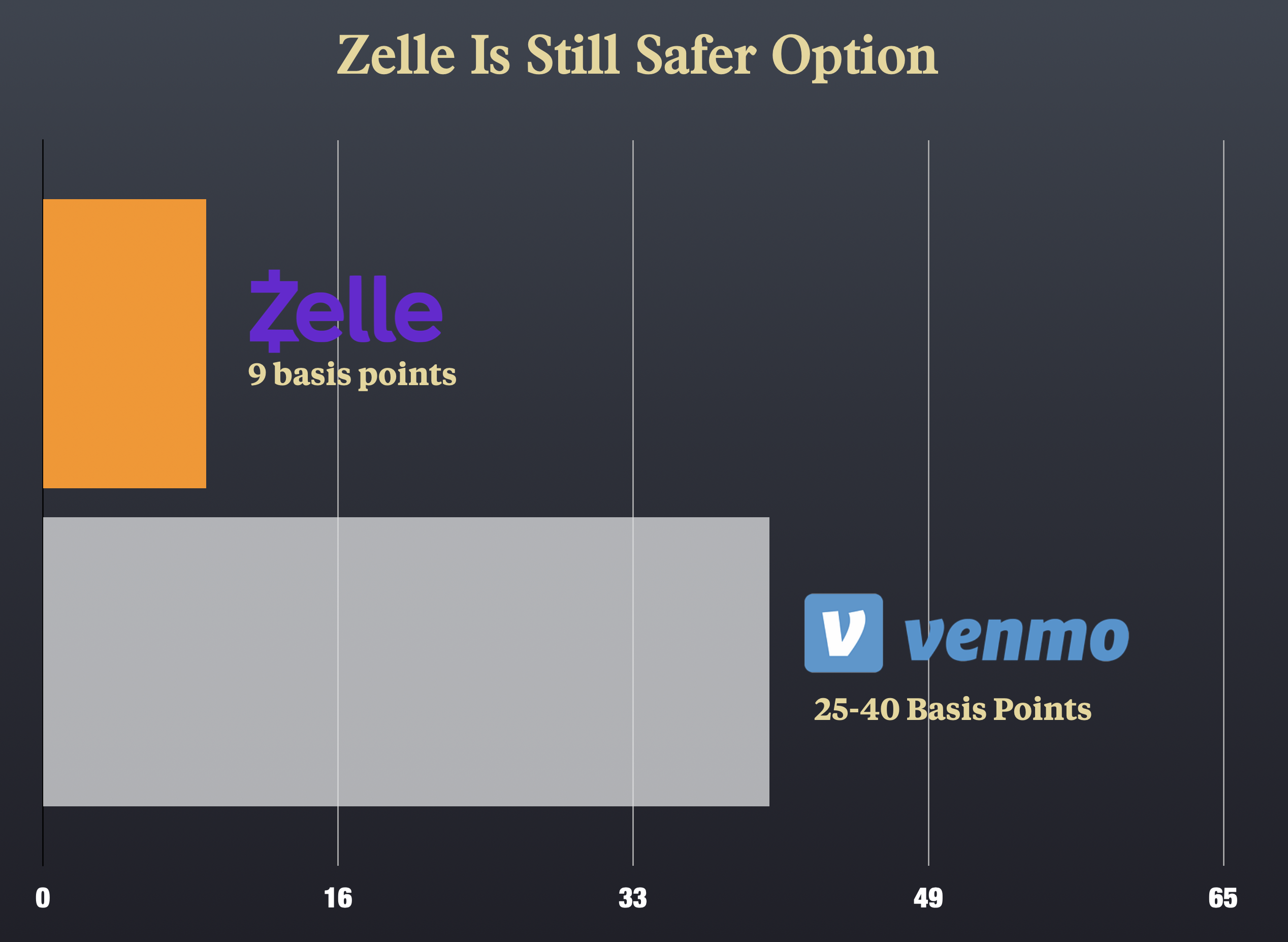

Zelle Is Still Safer Than Venmo And Cash App

In 2018, Venmo reported that its fraud rate increased to 40 basis points from its baseline fraud rate of 25 basis points.

That means that the fraud rate on Venmo could be 2 to 4 times higher than the rate Zelle reports on their platform. Even though scams and fraud are high, they are relatively low compared to other P2P options.

Rates Are Higher Than US Card Fraud Rates However

Now, nine basis points of fraud and scam losses are quite manageable for most banks. If you look at card fraud loss rates, however (which are running at about seven basis points annually), it starts to look a little less optimistic.

If you combine that with the fact that the consumer, in most cases, will bear the brunt of those losses, you can see why they get upset.

Zelle Indicates Fraud Rate Will Likely Fall With New Initiatives

For their part, Zelle is optimistic that fraud and scam rates will fall, not rise. In fact they say that is already happening.

They report that the percentage of fraud and scams on the platform “continues to get smaller due to a layered security approach, including services like Risk Insights for Zelle, which provides network participants with real-time information to assess potentially high-risk transactions.”

In 2023, they said, “Early Warning financial institutions cautioned users more than 700 million times before making payments.”