US online merchants may be stunned to discover that in four months, they will be subject to massive changes in how Visa measures and penalizes them for fraud.

Some large merchants don’t like the new program, complaining that Visa is using a “poison and antidote” approach to sell its fraud solution.

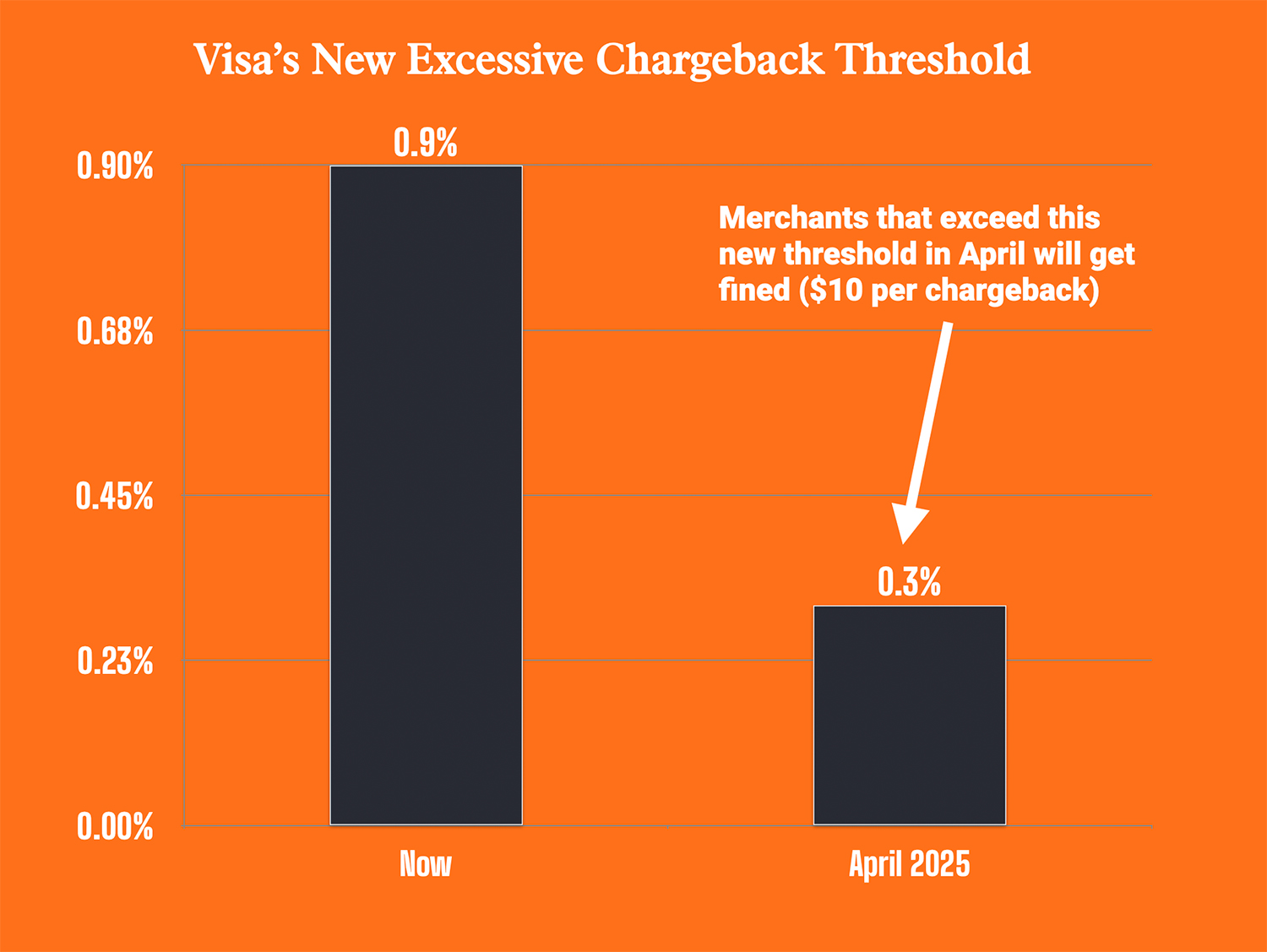

Excessive Chargeback Thresholds Dropping 70%

The change causing the most anxiety is big: Visa is dropping its fraud thresholds by nearly 70%—from 90 to 30 basis points.

Merchants and acquirers that exceed that threshold on their portfolios (probably most merchants in the US) will be subject to fines and penalties. But here is the kicker: If a merchant wants to avoid those penalties, they can sign up for Visa’s pricey fraud service, Order Insight.

While Visa advises that the new program is designed to reduce fraud, it seems that they are poised to profit from fraud through fines levied against merchants or a massive increase in sales of their fraud solution.

Merchants May Be Caught Flat-Footed

The new VAMP program will replace Visa’s existing fraud and dispute monitoring programs, including the Visa Fraud Monitoring Programme (VFMP) and Visa Dispute Monitoring Programme (VDMP).

Karisse Hendrick, creator of the fraudology podcast, covers the significant changes and why most merchants might be caught flat-footed by the stealthy rollout in the coming months.