It’s happening worldwide, and now it may be coming to the US. It’s not scam reimbursement, its something better and more effective.

International Fraud Fighters have found the secret weapon in the war against scams, and they are taking cues from what credit card issuers did back in 1991 when fraud losses soared globally.

The secret is Scam Interdiction. ?

In other words, banks are starting to decline or pause high-risk customer activity until they can confirm it’s not a scam or, in some cases, convince customers that it is.

The Old Time Fraud Fighter Playbook – Falcon Declines Cut Fraud 70%

Scam interdiction will work. And that is because it relies on the old fraud fighters playbook from the 1990’s

In 1991 card fraud rates were soaring, and there was no end in sight. At that precise time, FICO Falcon was introduced, and it changed the fraud paradigm forever.

Card issuers started to decline customer’s transactions using AI before the transaction was approved. The result? Card losses plummeted 70% as it gained widespread adoption.

Now scams are soaring, and banks are dusting off the old playbook again.

Scam interdiction is just one of the three pillars that fraud fighters have used for years. At some point education and reimbursement can only go so far.

Banks will need to interdict and block transactions if they want to develop a robust response.

In Australia, Banks Are Putting Sand In The Gears To Slow Scams

If you want proof, look at Australia. Banks there have agreed to start using a “sand in the gears” approach to slow down instant payments in response to an explosion in scams.

And that is significantly different than the approach that the UK government is taking. Australian banks don’t think the reimbursement model will work. They call that a “honeypot” for scammers since it will create less onus on the entire ecosystem – including customers to avoid scams.

In Australia, banks will have the right to block high-risk crypt transactions at their discretion, and they will also be able to match bank information instantly to block transactions where scammers might be exploiting consumers.

Banks are going to apply friction and hold payments for 24-48 hours. And that friction might piss a few people off, but that is ok, according to industry experts.

David Lacey with IDCare, a company that helps victims of identity theft and cybercrime, actually hopes more interdiction is applied over time, including facial recognition and fingerprinting as payments move through the banks.

In the UK, They’re Using AI To Interdict And Break The Scammers Spell

In the UK, banks are coming up with novel ways to stop scams. And this last week, Revolut appears to be leading the charge.

Their new AI scam feature can help detect if a customer is being scammed so they can break the ‘spell’ of the scammer before they send their money to the criminal.

It’s a significant and exciting development in scams for three reasons

- It’s an excellent application for AI.

- It’s declining payments before losses happen.

- It’s putting more onus on the customer.

Built internally by Revolut’s financial crime team, the new feature can determine if there is a high likelihood that the customer is making a card payment as part of a scam and, if so, decline the payment. The customer is then protected from performing other similar payments and sent through a scam intervention flow in-app.

For David Eborne, who heads up fraud for Revolut, it’s all part of the trend of blocking high-risk activity to protect consumers. He says, “A growing number of banks are increasingly restricting or heavily limiting the ability to make card payments to crypto and investment websites.”

Does It Work? A 30% Reduction in Scam Losses Should Silence Doubters

For those doubters that scam interdiction will work, Revolut’s success might change their minds. Since initial testing began, Revolut has observed a 30% reduction in the fraud losses resulting from card scams where money has been sent for investment opportunities.

While their application of AI is very targeted to investment scams, there is no reason the same approach cannot be applied to romance scams and imposter scams – the two other major scam types causing billions in losses.

A Tough Love Approach May Be The Only Approach

Declining high-risk scam attempts is akin to a tough-love approach to protecting customers from themselves. In the heat of the moment, a victim may feel compelled to send the money and view a bank’s decline as heavy-handed, unfair, or even illegal.

It reminds me of Natalie, an 80-year-old sweet lady I encountered as I was investigating fraud claims for a credit card bank.

Over 60 days, I handled three different fraud claims on her account. Each time, it was the same story: She was befriended by scammers who treated her like she was their mother. They talked to her for hours and finally convinced her to send money for a lottery she had won. They stole over $50,000 from her.

It was tough, but I finally told her I had to close her account. She was crying because she knew that it would mean the end to her friendship with the scammers. It was the only friends she had and she would be all alone.

Scam Interdiction Is Invetible With Where We Are Headed

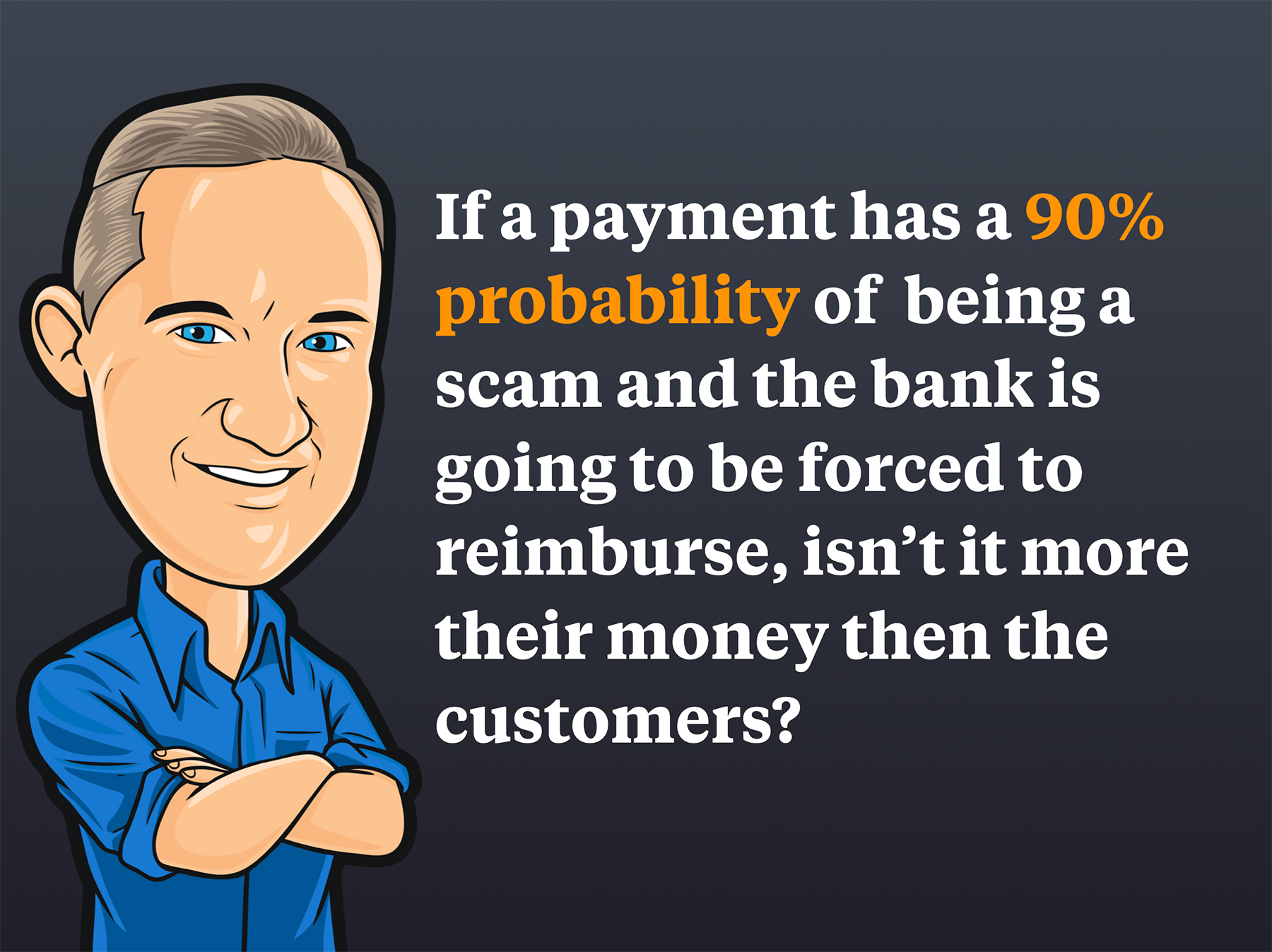

Make no mistake, scam interdiction could be fraught with challenges. Declining a credit card transaction is acceptable because it is the bank’s money. But how do you decline a scam payment that is the customer’s money?

It’s actually not that simple anymore.

The fact is scam interdiction will become an inevitable reality for banks. As regulators force banks to reimburse customers for scams, then it’s only fair that banks should be able to block transactions that represent an extraordinary risk to their bottom line.

Consumers can’t expect banks to reimburse scams without taking on some inconvenience themselves. And that is why you are going to see banks increasingly block high-risk payments. Consumers can’t have it both ways.

Break The Spell Teams – It’s Already A Thing

According to Mary Ann Miller, Vice President at Prove, Break the Spell Teams are already becoming a thing for US banks.

Scam Interdiction is already happening, and pausing money movement during that process is a critical part of the process.

So, what do you think of the trend of Scam Interdiction trend? Do you think customers will stand for it? Or do you think we will see regulators step in and prevent it?

It’s tough to be a bank these days. Everyone loves to beat up the banks, but few solutions are offered to help them avoid scam losses.

Time will tell. But I can tell you this: we will see huge investment and innovation in scam interdiction in the next 24 months.

Let’s go! ✈️