The SBA is making big changes.

Today, Administrator Isabella Casillas Guzman, head of the U.S. Small Business Administration (SBA) and the voice for America’s 32.5 million small businesses in President Biden’s Cabinet, announced an all-hands-on-deck, multi-faceted expansion of efforts to identify and support the SBA Inspector General’s recovery of fraudulently obtained COVID economic relief funds and to prevent potential future theft of taxpayer dollars.

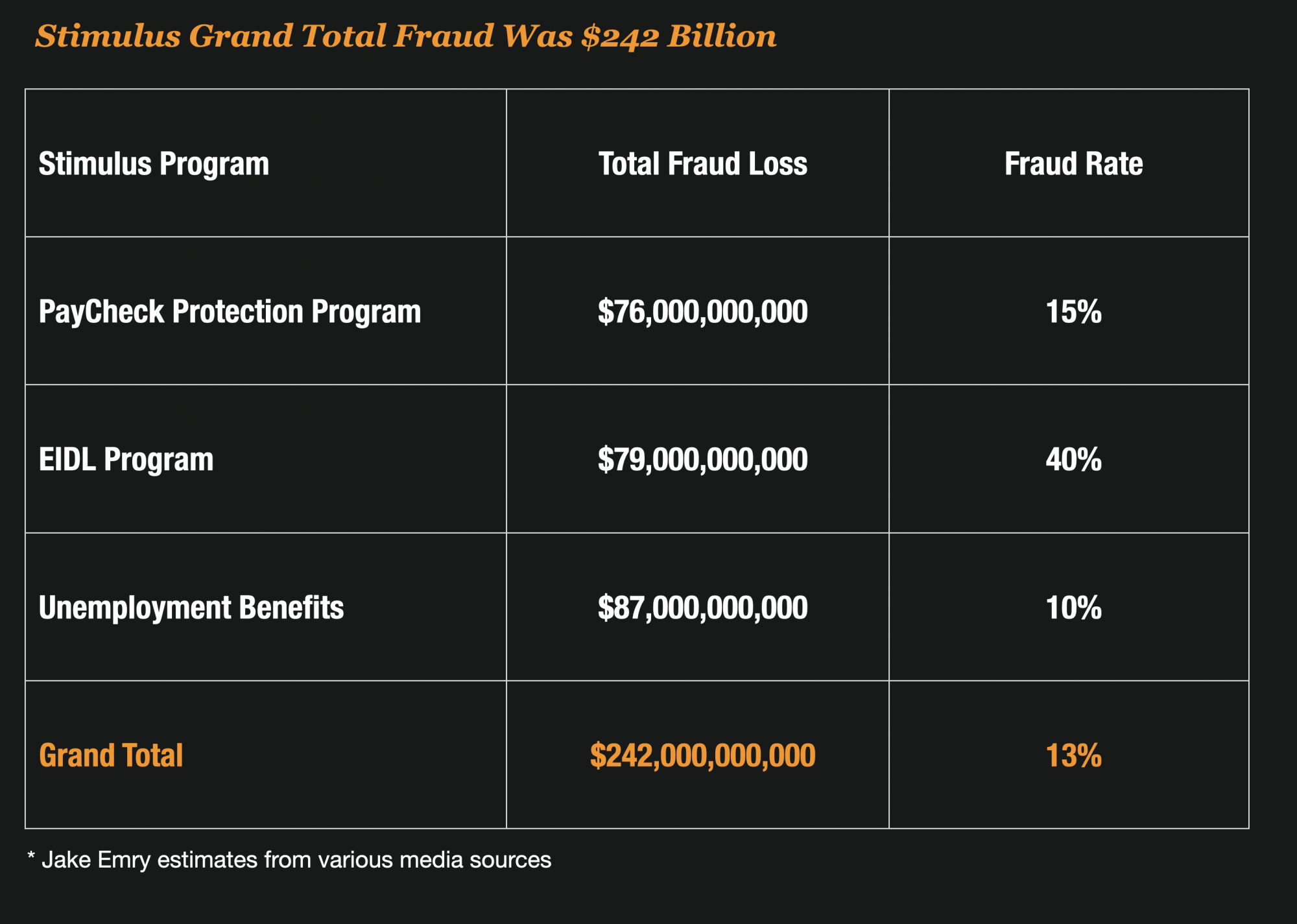

By some estimates, the SBA lost over $150 Billion in government funds due to fraudsters and many people have criticized the Paycheck Protection Loan program as the biggest fraud in US history.

The Program Will Include New Assignments And A Fraud Risk Committee

These new efforts will expand that work as SBA continues to undertake measures to ensure the integrity of its programs.

Key measures being announced today are:

- The designation of Peggy Delinois Hamilton to a new role as SBA Special Counsel for Enterprise Risk to advise Administrator Guzman on fraud and risk management activities across the Agency.

- The creation of the SBA’s Fraud Risk Management Board (FRMB) to provide anti-fraud oversight and coordination.

- Consistent with new efforts to bring bad actors to account for their fraudulent acts, the SBA fully supports the work of the Interagency COVID-19 Fraud Enforcement Taskforce and DOJ’s Chief Pandemic Prosecutor and Director for COVID-19 Fraud Enforcement. The SBA believes these new initiatives can enhance the Agency’s fraud risk framework and further strengthen its fraud risk mitigation efforts.

“Throughout the first year of the Biden-Harris Administration, the SBA has taken important steps to close the door on fraud, waste, and abuse and ensure billions of dollars in taxpayer-funded COVID relief make it into the hands of small business owners,” said SBA Administrator Guzman. “The steps we are announcing today build on that work under the capable watch of Peggy Delinois Hamilton, as our new SBA Special Counsel for Enterprise Risk, and the newly created Fraud Risk Management Board, in coordination with the SBA’s Office of Inspector General and the Department of Justice’s Chief Pandemic Prosecutor. Together, we will hold fraudsters accountable and shut down future pathways to fraud.”

In line with the Biden-Harris Administration and Administrator Guzman’s focus on aggressively rooting out scams targeting government programs, these efforts also reflect Administrator Guzman’s top priority of increasing equity across the programs and leveling the playing field for all entrepreneurs by ensuring eligible small business owners have full access to the capital and resources needed to start and grow their businesses.

Peggy Delinois Hamilton as Special Counsel for Enterprise Risk in the Office of the Administrator

Administrator Guzman has designated Peggy Delinois Hamilton as SBA Special Counsel for Enterprise Risk in the Office of the Administrator. In this role, she will advise the Administrator on risk management activities enterprise-wide and directly support the Administrator in the development of strategies for mitigating the dynamic risks facing the Agency, focusing on potential fraud exposure as a top priority, as well as the development of plans to reduce risks to SBA operations. As a result of her extensive and unique bank regulatory experience and deep knowledge of agency priorities, she will provide strategic insight into potential enterprise-wide risks that have a clear impact on key agency programs. Peggy has served as SBA’s General Counsel since February 2021, and another senior SBA official will take on these duties in the interim.

SBA’s Fraud Risk Management Board

The Fraud Risk Management Board (FRMB) was established to serve as the designated anti-fraud entity responsible for oversight and coordination of SBA’s fraud risk prevention, detection, and response activities. The FRMB is composed of experienced agency executives across the SBA enterprise. They will report to the Enterprise Risk Management Board (ERM Board) and, through the ERM Board, to the Administrator. In coordination with the oversight community, the FRMB will take additional steps to assess and address fraud risk on an agency-wide basis.