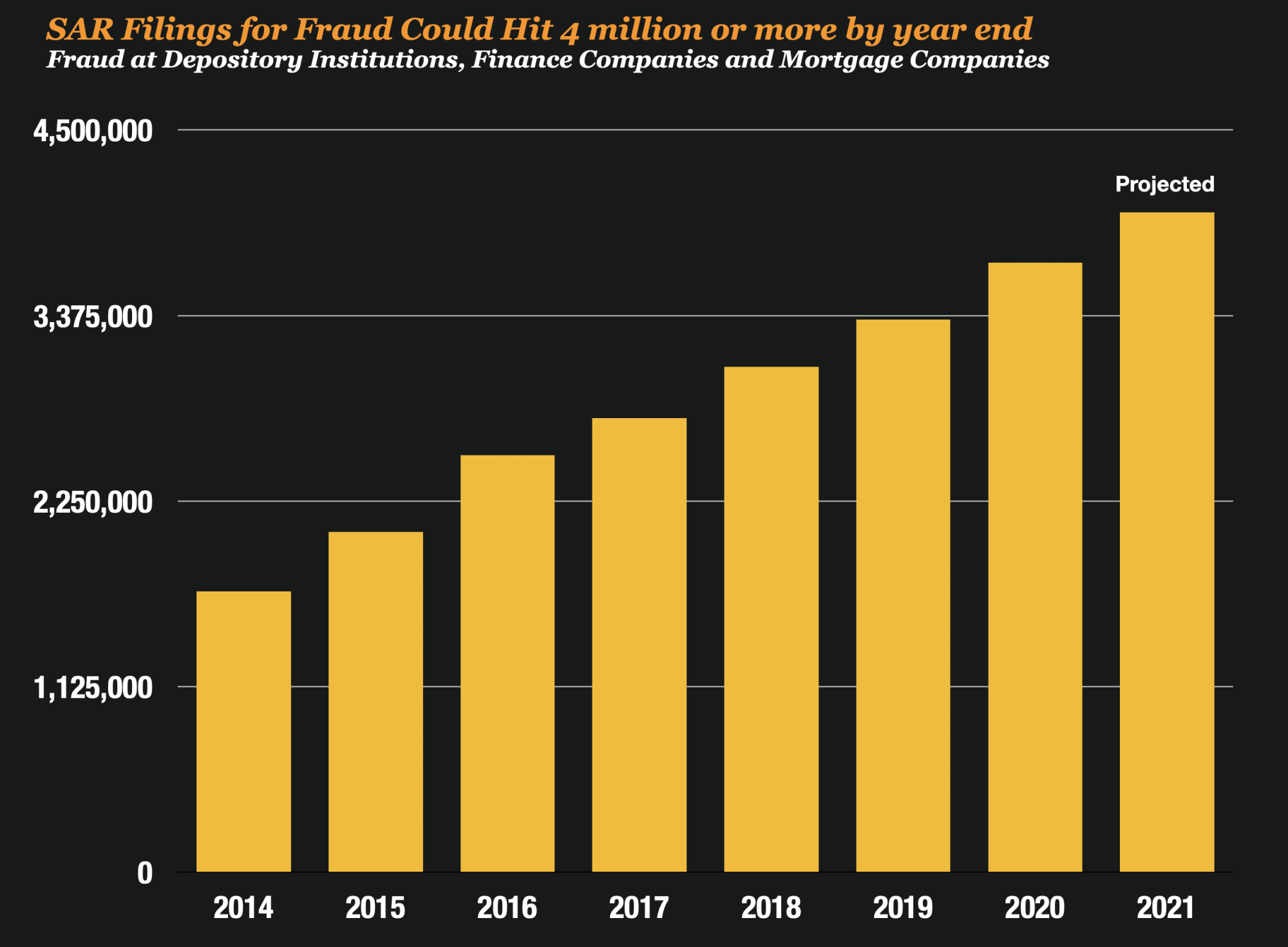

FinCEN updated their annual SAR filings this week and it is becoming increasingly clear that fraud is continuing to grow at a record pace.

The data which includes SAR filings for fraud at depository institutions, finance companies, and mortgage lenders through the first 9 months of 2021, indicates that close to 4 million reports will be filed by the end of the year.

That is an increase of 8% over 2020, and over 100% increase since 2014.

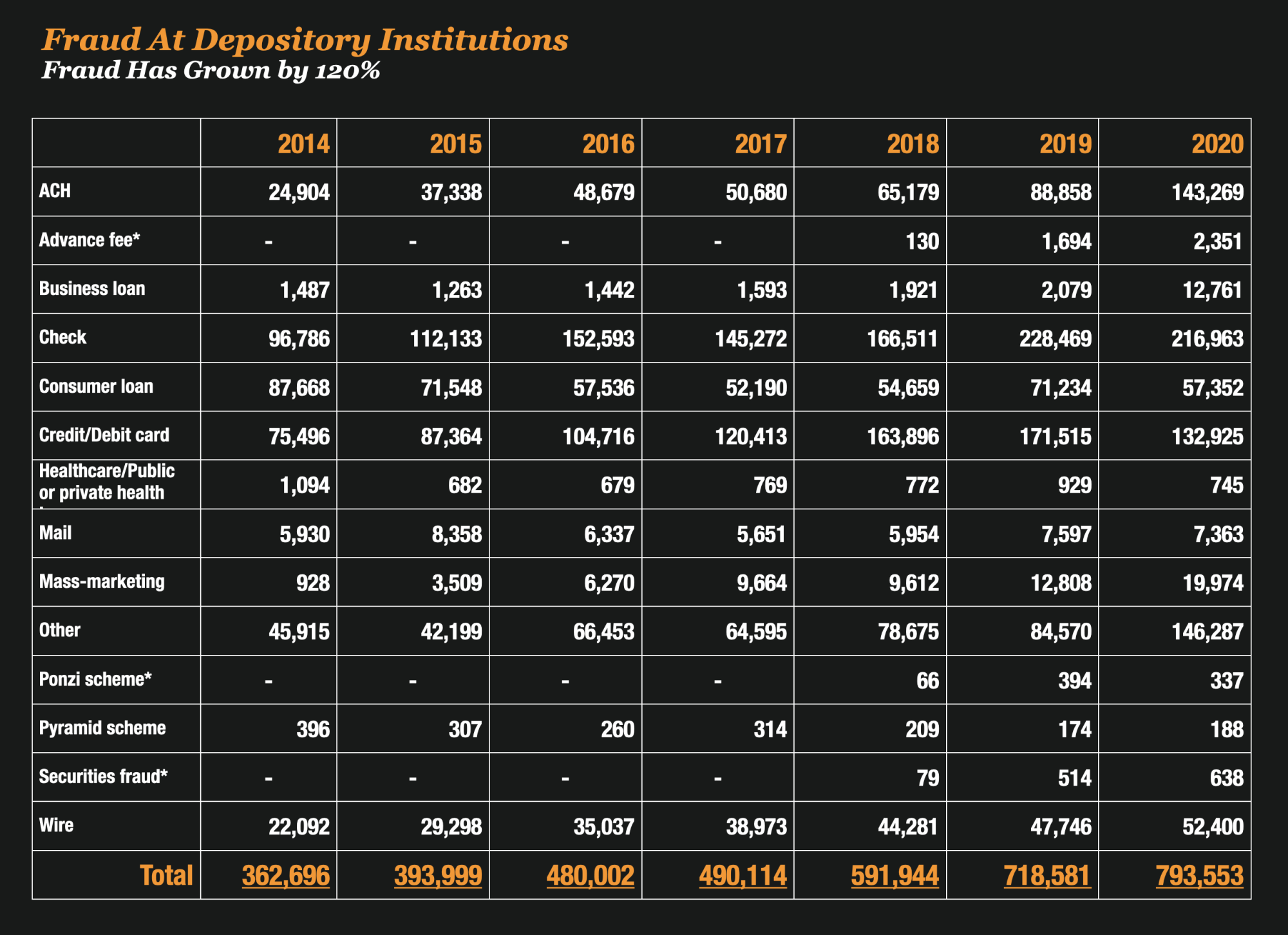

Fraud At Depository Institutions Has Grown By 120% With Checks Fraud The Highest

The growth in fraud is in part fueled by the growth in fraud at Depository Institutions and banking accounts. Not surprisingly, Check Fraud is still the highest category of SAR filings for banks.

Check fraud may not be the most exciting fraud, but it still represents one of the most significant frauds banks fight day to day.

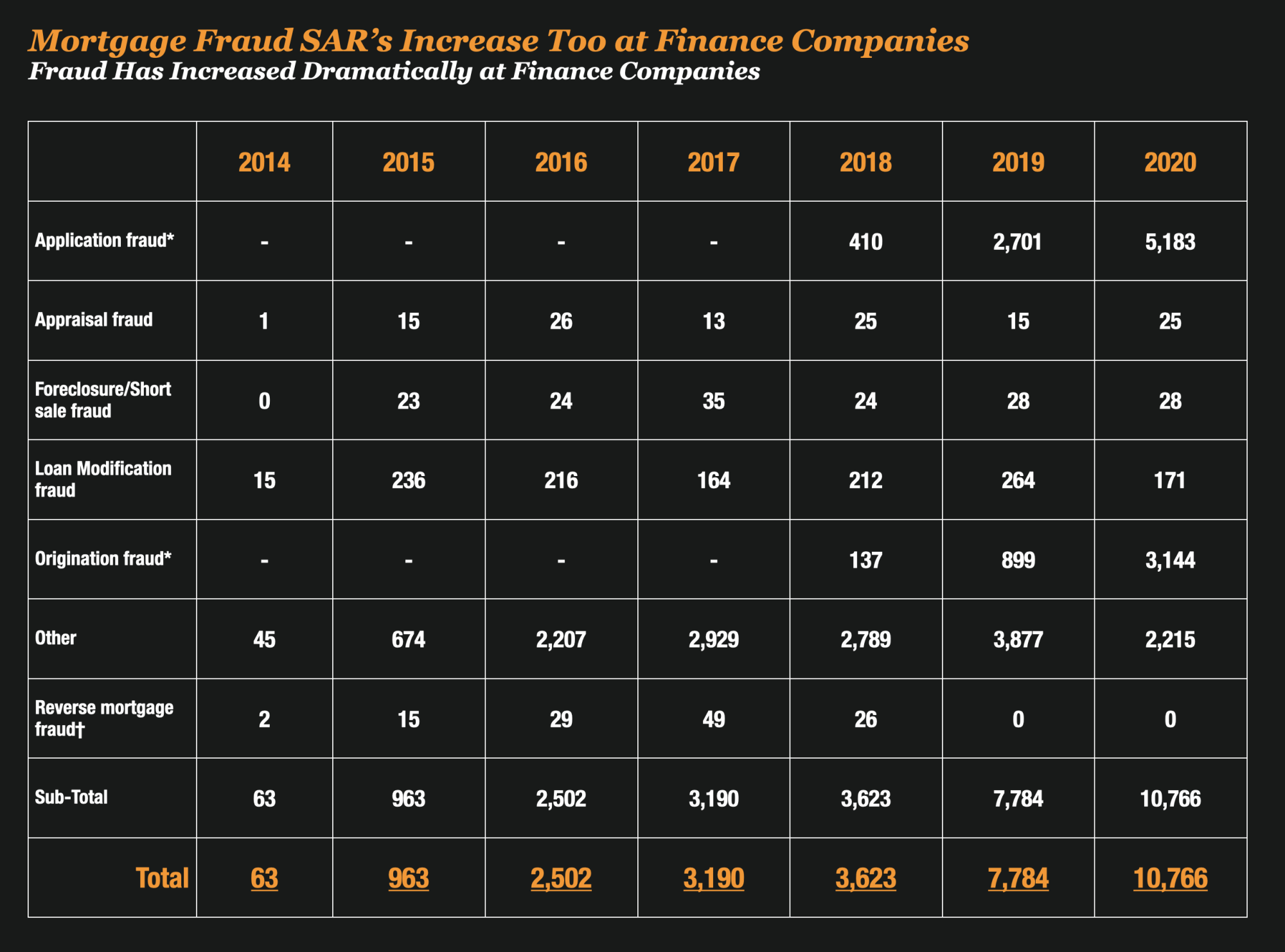

Mortgage Fraud at Finance Companies Is Also Increasing Significantly

You don’t hear too much about mortgage fraud these days, but surprisingly the number of SARS filed by Finance companies for Mortgage Fraud has increased dramatically at finance companies too.

In 2014 there were fewer than 100 SAR’s filed, but that number increased to over 10,766 by 2020. It’s not a large number but does show a surprising increase. This may be driven by the fact that more mortgage lending is taking place by mortgage lenders instead of banks in the last 10 years.

How High Will Fraud Go?

It may sound like a broken record. It certainly seems since I started writing this blog that I am always writing about the increases in fraud.

Sometimes I wonder if I am exaggerating the rise in fraud or if I am biased because I am a fraud fighter. But the fact is, all the reporting keeps suggesting that it is rising and we need to more to fight it.

How high will fraud go? I am not sure we will know the answer to that for awhile.