Check fraud losses are sky-high for banks this year as emboldened thieves have raided mailboxes pilfering checks and then selling them online.

But, there is another method that is driving up check fraud too, and not many people know about it. It’s called- remotely created check fraud.

It’s not something that is highly publicized. That is until now anyway.

Last week the Justice Department sued Altitude Processing, saying that he ran a massive Remote Check Fraud scheme, and then attempted to bury the extent of the scheme through sham microtransactions.

Remote Created Checks Often Function as Authorized Debits Against Bank Accounts

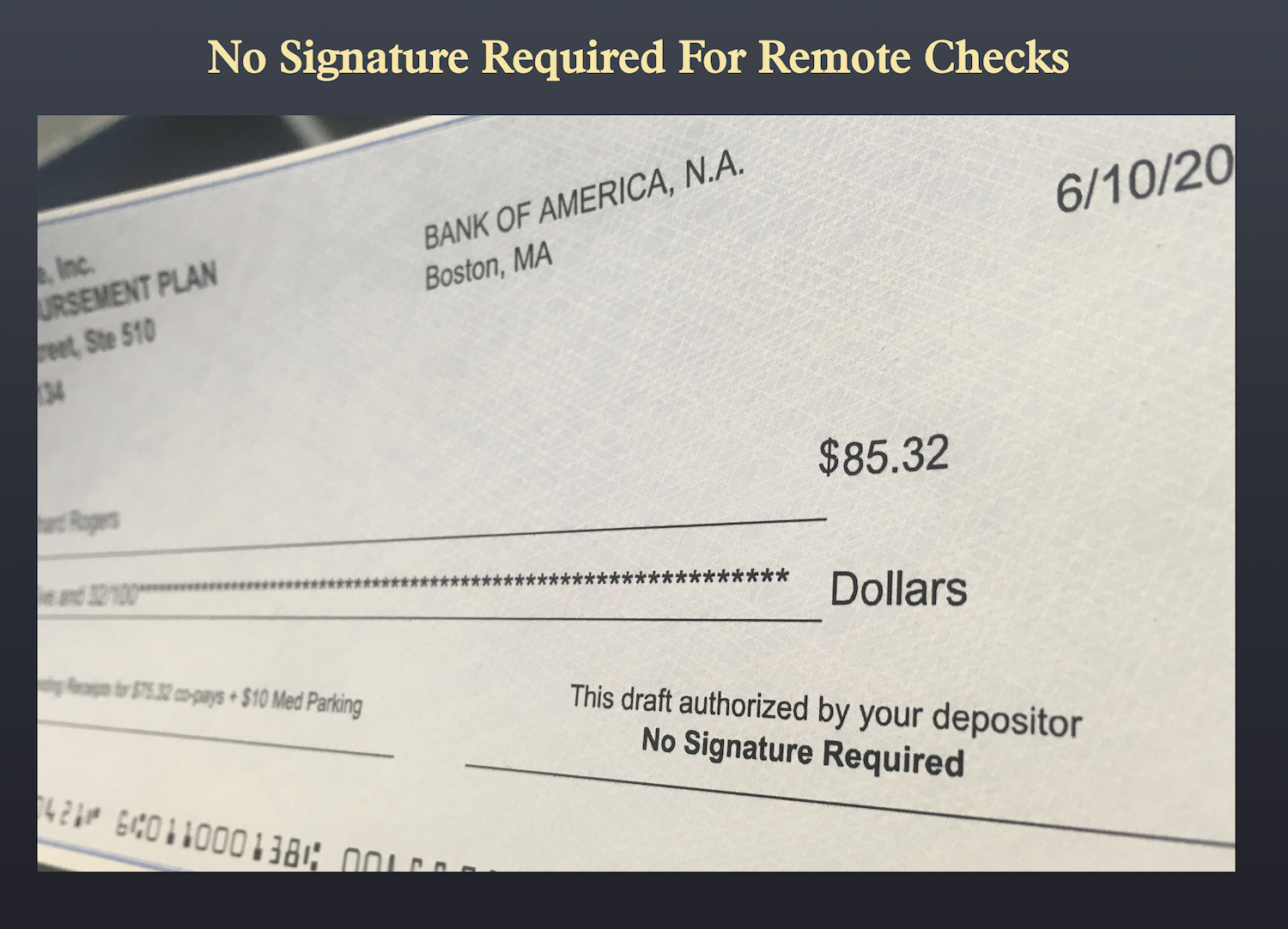

Remote checks are often used instead of credit cards so that a person can pay from their checking account.

Remote checks are not something you write, they are checks that you authorize someone else to create to debit your checking account.

Typically, the checks are created by a merchant and then submitted to the bank for payment. The difference between it and a regular check is the signature line which says “authorized by drawer” (the customer).

Remotely Created Checks Are Subject To High Rates Of Fraud

It’s easy for someone to make a remotely created check. They only need your bank account number and routing information.

Telemarketers and scammy merchants love Remote Checks because the dispute process can be a little more convoluted and puts more onus on the customer to identify the fraud than using a credit card.

Remote checks, unlike credit cards, hit your bank account, so you only have 90 days as a consumer to dispute it before you are liable.

Reportedly, remotely created Checks can have fraud rates of 70% when scammy merchants get involved.

Someday, remotely created checks will probably be banned because the fraud is so high, but for now, they are still legal.

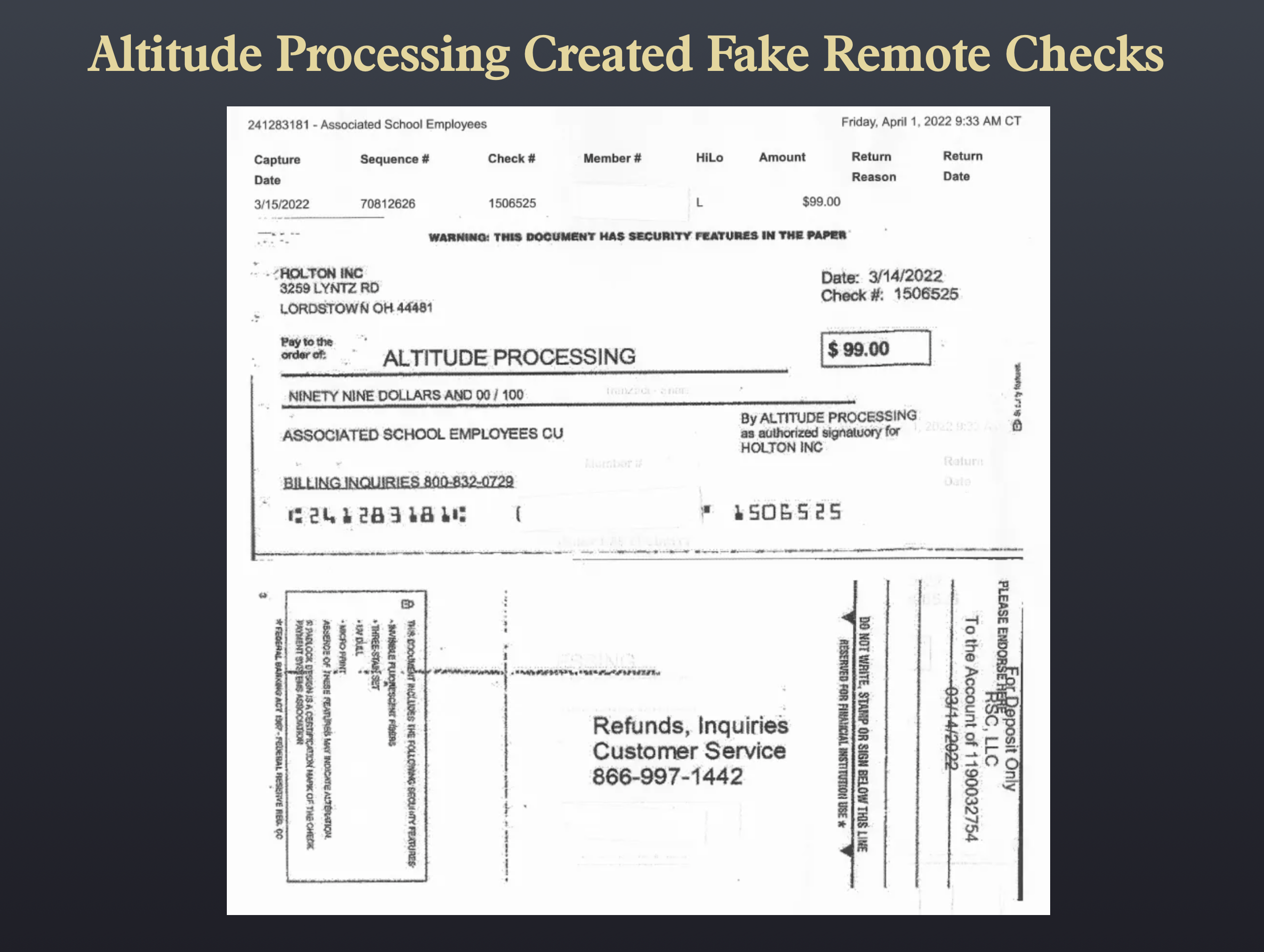

Altitude Processing Ran The Scam Using Checks

According to the Justice Department, Altitude Processing obtained checking account information from Small Businesses, created fraudulent unauthorized remote checks, and then debited the bank accounts of those businesses each month.

They would typically create checks for $99 a month and then push them through a service called “client.runchecks.com,” which posted the checks to their bank accounts.

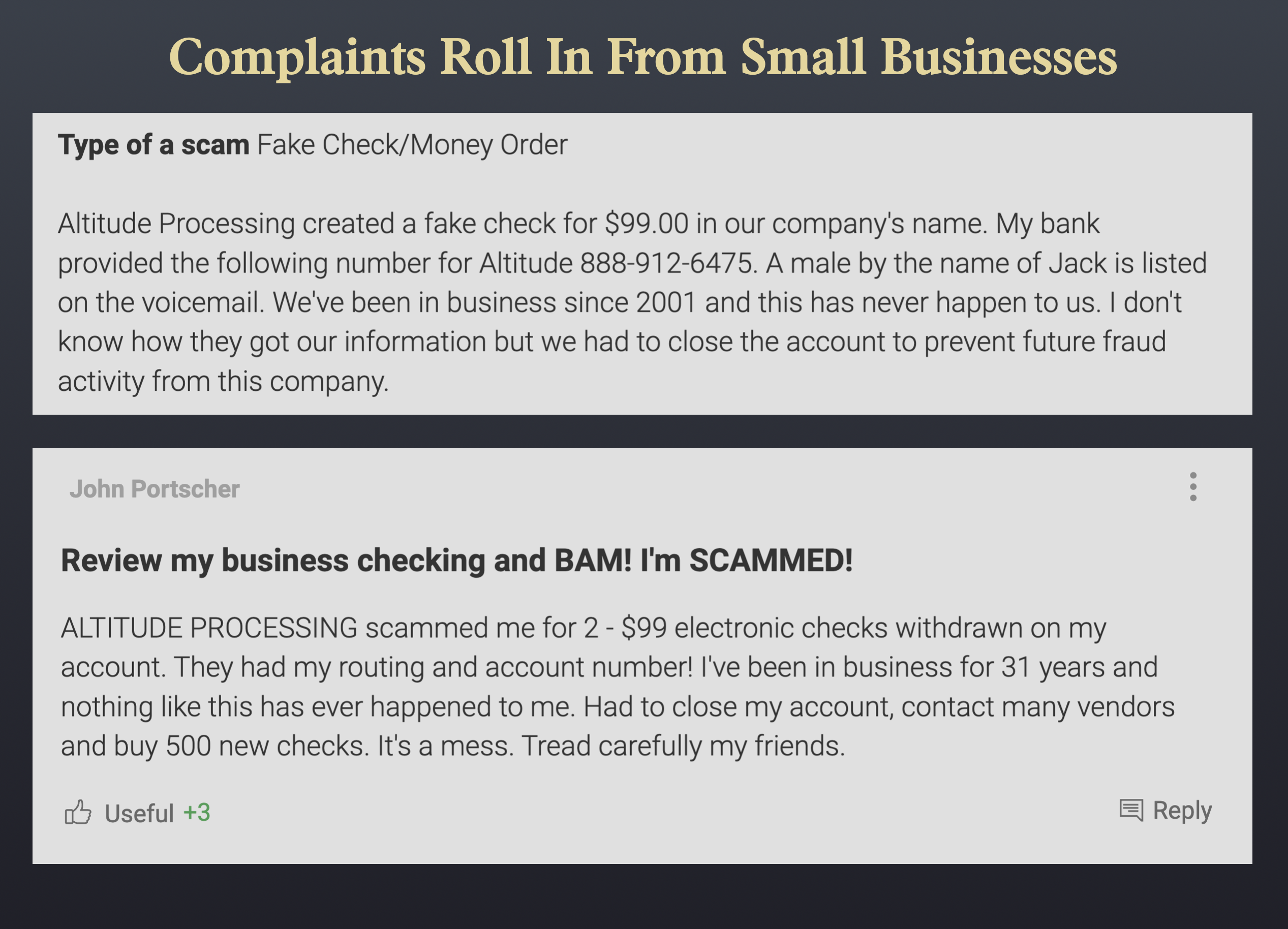

Victims would often not notice these checks until many months later, in many cases after their ability to dispute the checks had expired.

When customers would dispute the checks with their bank, the Justice Department says Altitude would claim that the checks were for “marketing services” that the business signed up for.

That was not the case. The victims never received any marketing services from Altitude Processing.

They used an alias for their business called “ClearMarketing.com” and put up a dummy website so when customers would call; they could take calls and stop the customers from disputing the checks with the bank.

When customers called to complain, the company promised to refund the money to appease them, but instead of refunding it, they would simply hang up the call and continue billing the victim’s bank accounts.

They Solicited Payment Processors To Help “Hide The Business Well”

At one point, the return rate on the remote check scheme was 50%, meaning that half of the customers who had the checks had contacted their banks advising the checks were fraud.

The owner of Altitude Processing – Farhan Khan – decided he wanted to “hide the business well,” so he sought out payment processors.

Eventually, he found a payment processor that liked his business and advised that they could help hide the fraudulent charges by inundating the business with microtransactions to keep the overall refund rate low.

The scheme worked until it didn’t.

Eventually, the degree of complaints against Altitude Processing stacked up, and their gig was exposed.

The government says the whole thing was a sham and that consumers and banks are the losers. This is another tale in the long and growing saga of check fraud.

Read The Whole Case Here

You can read the whole civil case here. The government requested an injunction to keep Altitude Processing from continuing its alleged fraudulent scheme.