Remember 2021 when every startup was seemingly worth a billion dollars?

My oh my, how times have changed, and some of those companies were engaged in fraud – first, there was NS8, then Frank the financial aid startup, and now the high-flying messaging app –IRL.

The company has been closed. 95% of their users were fake. It appears to be a total loss.

From $1.7 Billion Valuation To Zero

Two years ago, the social messaging app IRL claimed to have 20 million active users and raised over $200 million from investors.

At its peak, IRL had over 100 employees.

Even Softbank invested in their Series C and pushed the company’s valuation to $1.7 Billion, making them one of the famed Unicorns of 2021.

And they had zero revenue by the way.

Fast-forward to today, and they are shutting down, admitting that 95% of the users were “automated or from bots,”. This was reported by The Information last week.

Several months ago, employees started to question the company’s claims of 20 million users after they learned the company was using non-standard metrics to evaluate active users. That lead to an SEC investigation and the eventual demise of the company.

Can you hear all that investor money sucking down the drain?

So many fraud fighters knew this startup’s silly money was going to lead to fraud, and here it is.

An Employee Was Fired Earlier This Year When They Raised Concerns; Founder Was Fired

Behind these big frauds, there are always whistleblowers, which appears to be the case here.

According to The Information, a former employee alleged that IRL—the name stands for “in real life”— had fired him after he voiced concerns that many users were bots.

And earlier this year, CEO and Founder Abraham Shafi was fired for misconduct.

Trouble has been brewing for awhile at the company.

The Internet Sounds Off – “There Are More Coming”

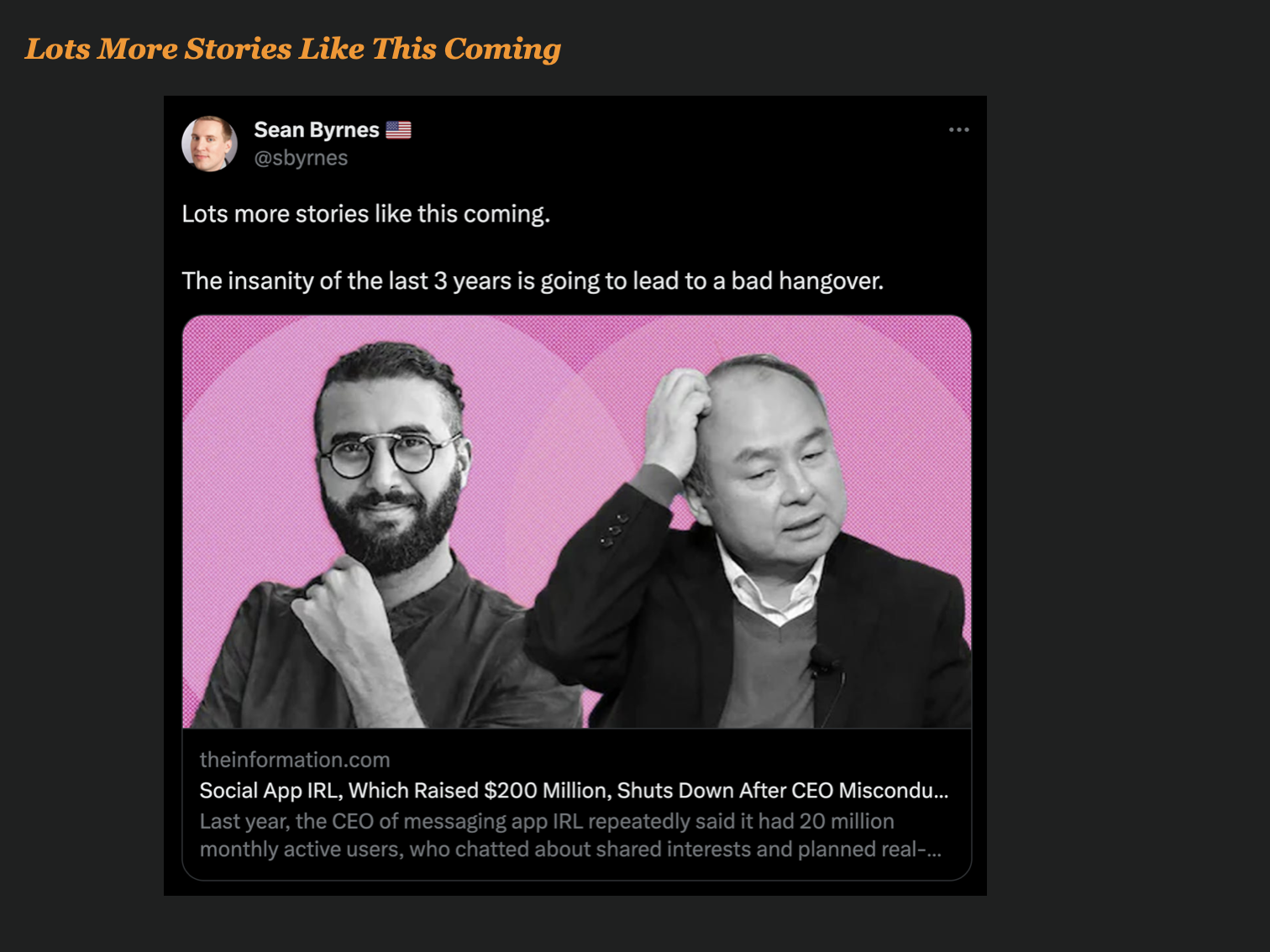

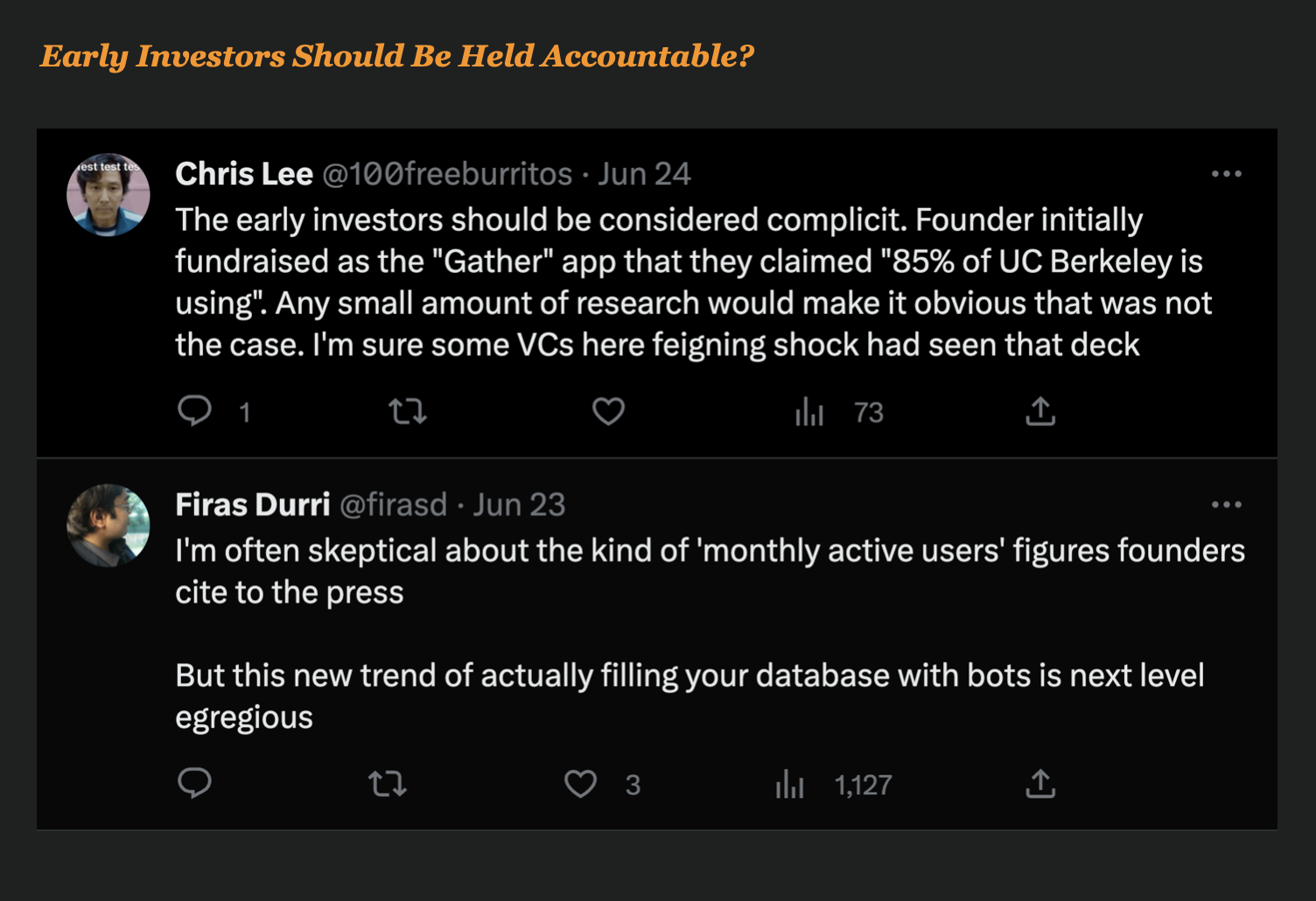

The internet quickly jumped in and offered their perspective on the matter. Some speculated that this is not an isolated incident and that there are more companies that might have this same issue.

Sean Byrnes was quick to point out that “lots more stories like this are coming.”

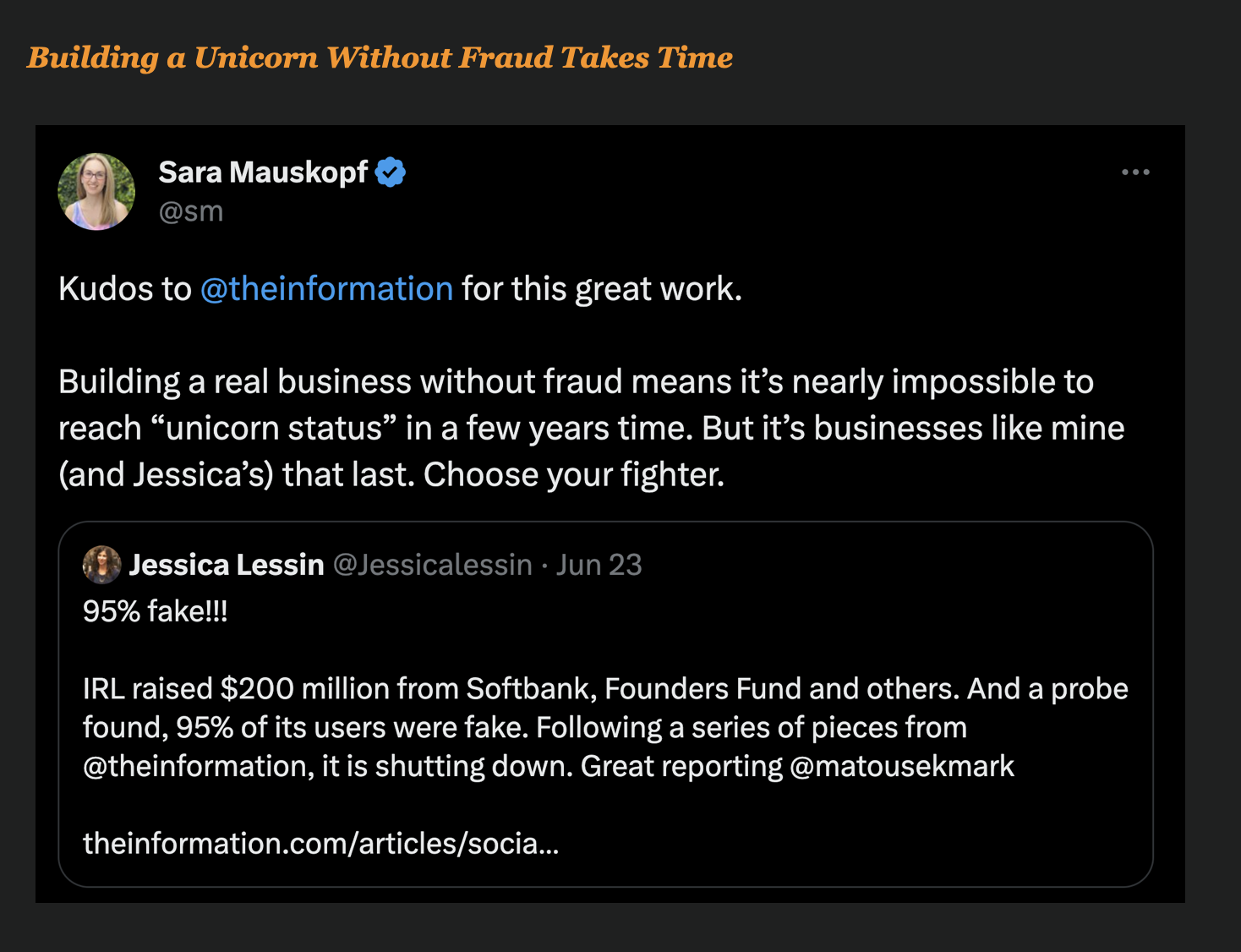

And Sarah Mauskopf, CEO of Winnie.com, expressed that trying to grow a Unicorn without fraud quickly just doesn’t happen.

And Twitter user Chris Lee wrote, “The early investors should be considered complicit. Founder initially fundraised as the “Gather” app that they claimed, “85% of UC Berkeley is using”. Any small amount of research would make it obvious that was not the case. I’m sure some VCs here feigning shock had seen that deck.

Did the investors know that IRL’s growth was too good to be true?

Mary Ann Miller – Investors Should Make Sure Their Portfolio Companies Are Solid

Mary Ann Miller, Vice President at Prove, believes investors in these companies need to ask more questions and dig deeper into their portfolio questions.

“Every investor that is putting money into a company where active users relate directly to the valuation needs to ask questions about the digital identity strategy that company is using,” she said, ” They need to ensure the company is doing enough to establish a true user from fake accounts or bots.”

Mary Ann has been vocal about the problem in the past and has pointed out similar problems that were raised at other large companies like Cash App and PayPal over the past year. “It’s a growing problem,” she said, “And it may take years to figure out how much of all this growth was due to fake accounts and bots. We really don’t know yet.”