Fraudsters love their “money glitches” (aka fraud). And at the heart of it all is check fraud.

The Viral Infinite Chase Money Glitch took social media by storm only two weeks ago. People soon learned it wasn’t a glitch but a massive check fraud scheme that involved depositing fake checks into ATM Machines and quickly wire transferring the money before the checks could be returned.

Chase quickly closed that exploit within a few days, and the viral trend died. However, this week, fraudsters may have discovered a new target to attack—Fidelity—and their check fraud scheme seems suspiciously similar.

In this recently posted video, a couple of guys calling themselves FidelityBoyz throw money like confetti into a crowd yelling, “I Got A Fidelity Boy!”

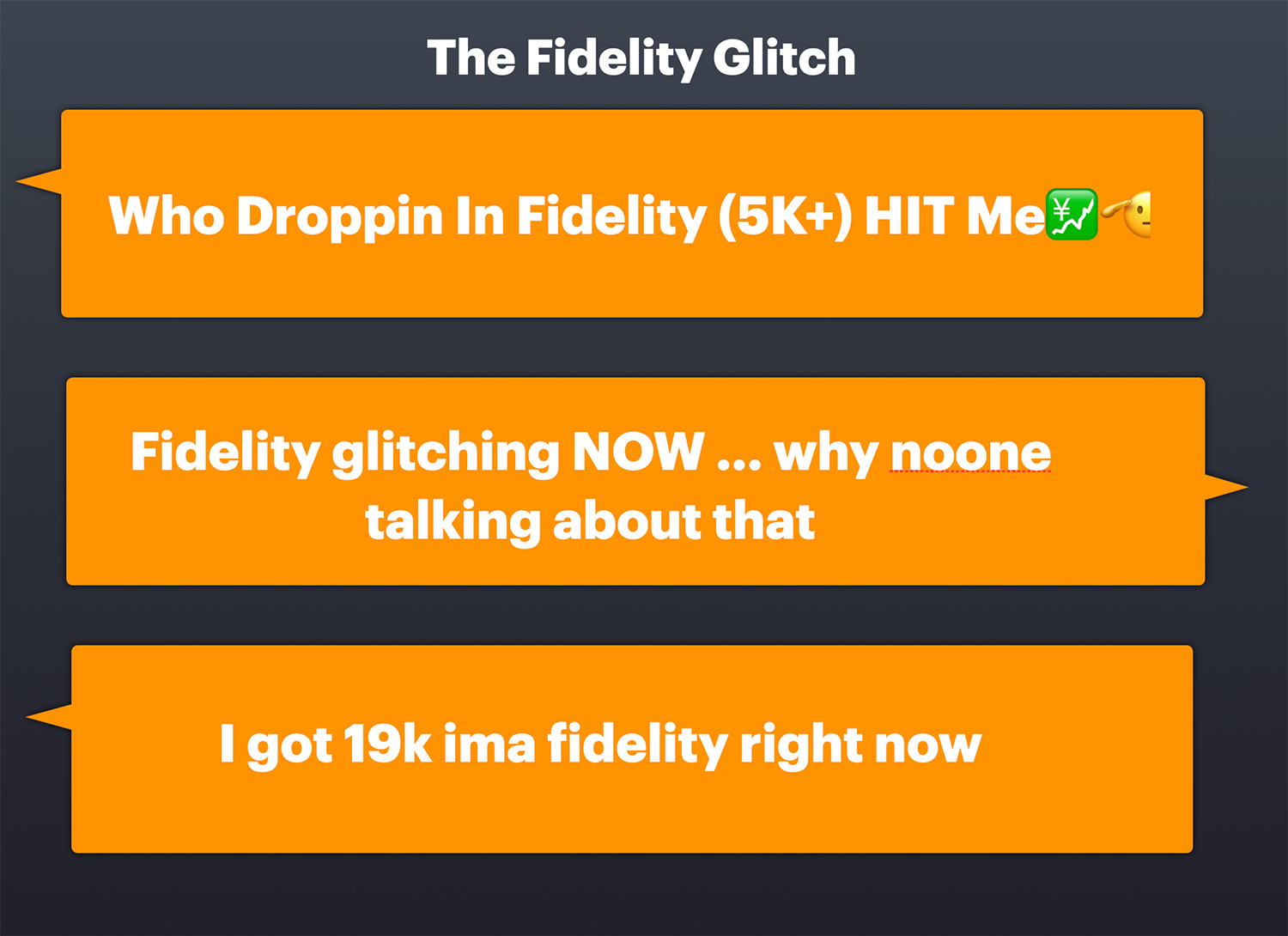

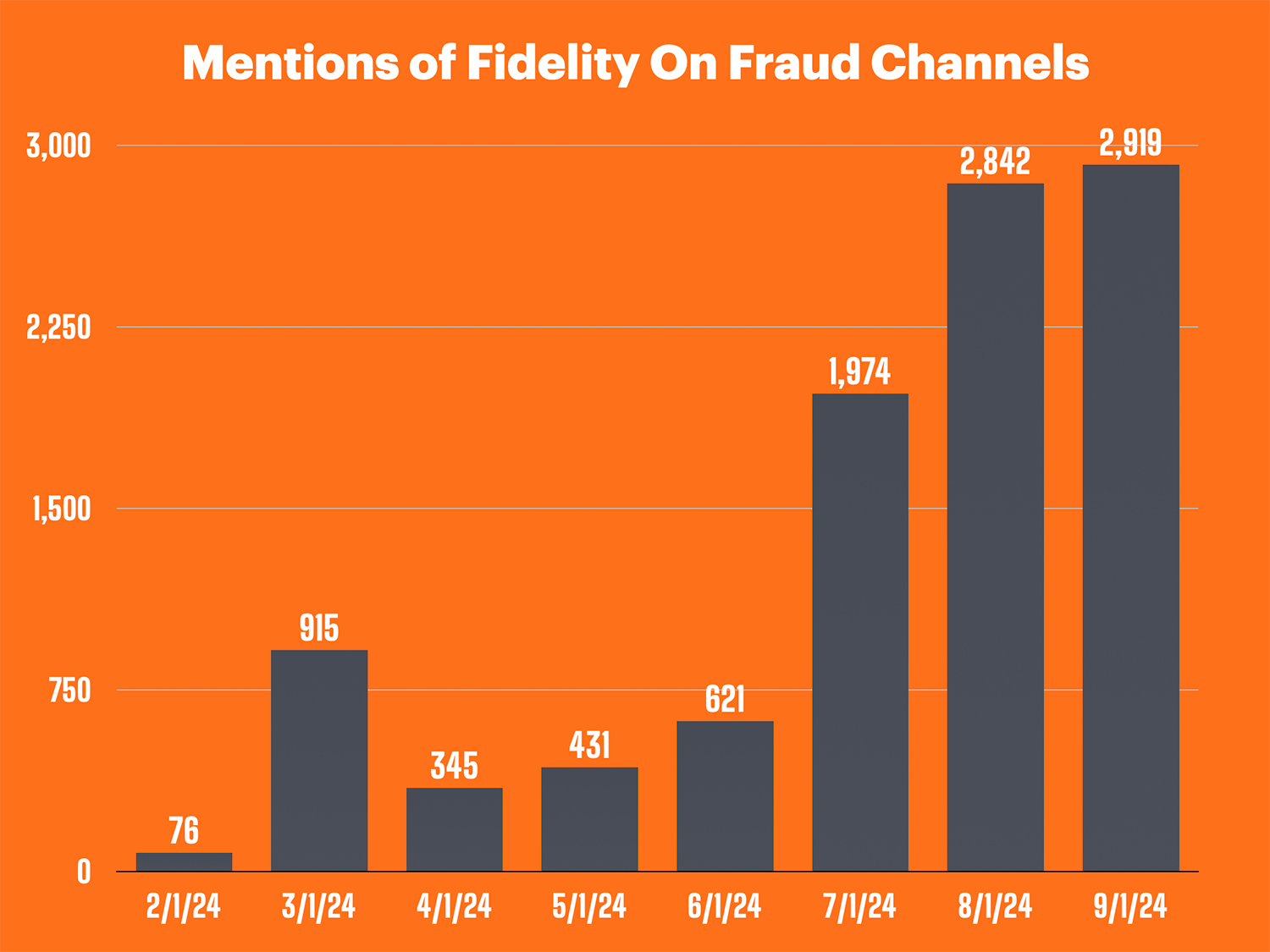

A Spike In Mentions Of Fidelity On Top 25 Telegram Fraud Channels

Telegram is typically one of the first places that new fraud schemes emerge. As fraudsters communicate the latest “fraud waves” with each other, their targets become apparent.

Over the last month, many of those communications have focused on Fidelity.

Where there is smoke, there is fire, so I decided to do a frequency keyword analysis on mentions of “Fidelity” in the top 25 Telegram fraud channels to see when the trend might have started.

I analyzed the frequency of conversations mentioning “Fidelity” in the Top 25 fraud channels in the last six months. The mention rate on criminal channels has spiked by 300% and is on a pace to increase by over 700% by the end of September.

This means that fraudsters are discussing Fidelity much more than they used to, and that’s never a good thing on Telegram.

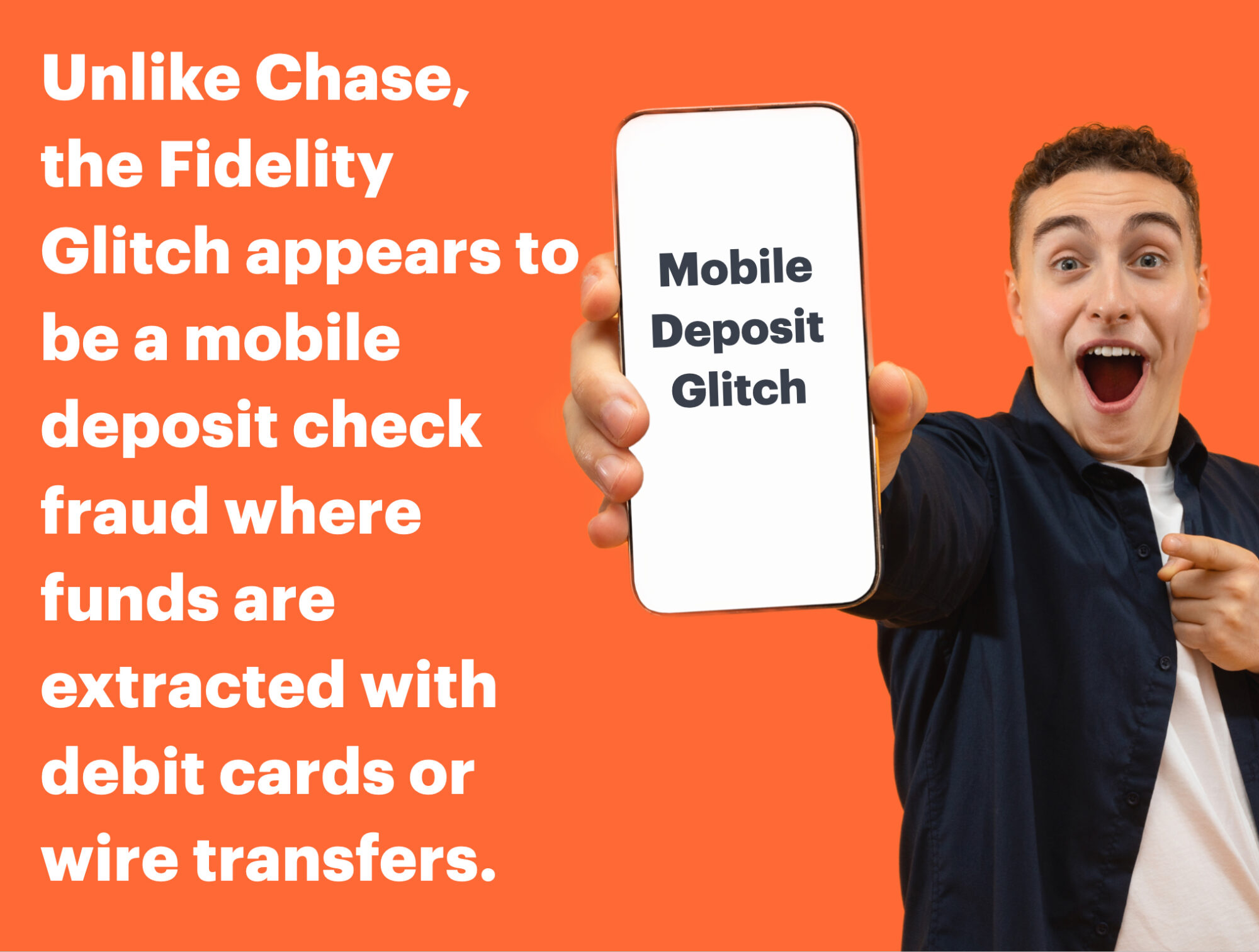

This “Glitch” May Be Different Than Chase And Involves New Accounts Or Mules

While the Chase Glitch involved depositing fake checks into ATMs, the Fidelity Glitch appears to be a mobile deposit attack.

Since Fidelity does not have ATMs, the method seems to focus on depositing fake or altered checks through mobile apps—often on newly opened accounts. After checks are posted, people either use debit cards or wire transfers to extract the money quickly.

The scheme proved very lucrative since Fidelity had mobile deposit limits of $100,000 on Cash Management accounts.

Unlike Chase, this glitch may be similar to the fraud scheme Regions experienced over a year ago involving mobile deposits. At the time, the bank reported approximately $135 million in losses due to check fraud.

Regions reported that every bank was being hit with check fraud, and that they were not being singled out.

“Bring Me Your Fidelity, Let’s Make Some Bag”

The Fidelity Glitch has prompted many to solicit mules to help them deposit bad checks into their “fresh or aged” accounts in exchange for a 50/50 split.

“A surprise deposit will hit your account tomorrow morning if you give me the Fidelity card”, one person explains, an obvious clue that this involves classic mule activity.

The posts imply that if people turn over their cards or accounts, they can split the proceeds with the scammers.

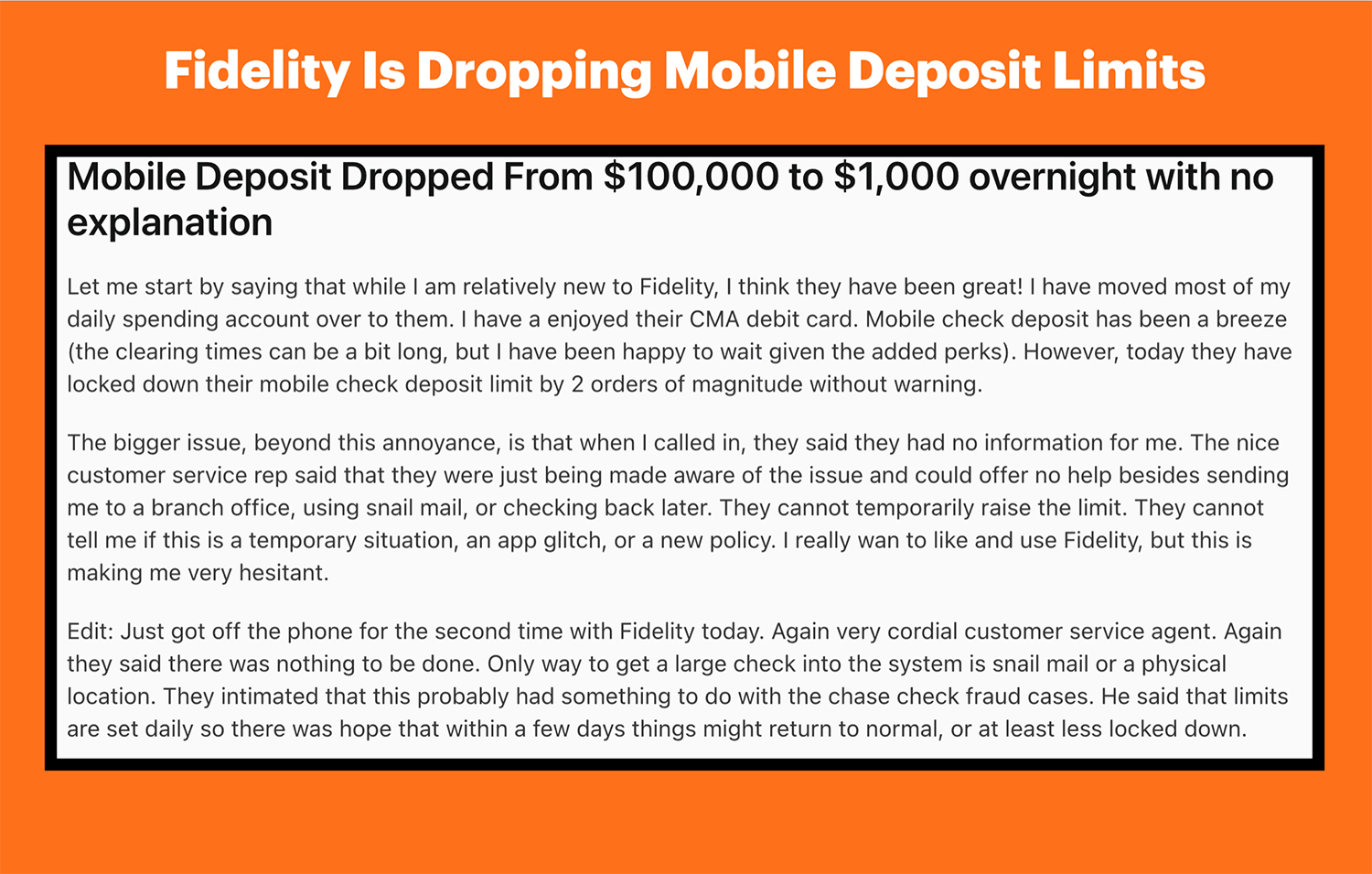

Fidelity Has Reportedly Dropped Their Mobile Limits From $100,000 to $1,000

Fidelity customers themselves are also reporting signs of issues. In a Reddit Post yesterday, one user reported that a Fidelity rep “intimated that this probably had something to do with the chase check fraud cases.”

Customers report that mobile limits have dropped from $100,000 to $1,000, making them unable to deposit larger checks. Fidelity representatives tell them the only way to deposit the checks is through the mail or by bringing them into a branch.

While many customers have had their mobile limits dropped, not all customers are reporting the same issue, so the limit lowering may have been more targeted.

One user reported, “I just checked mine, and my limit is $500k for my CMA. There are other posts on this subreddit about their limit being reduced to $1000, so it’s not just you, but it also (seemingly) not everyone. ??♂️”

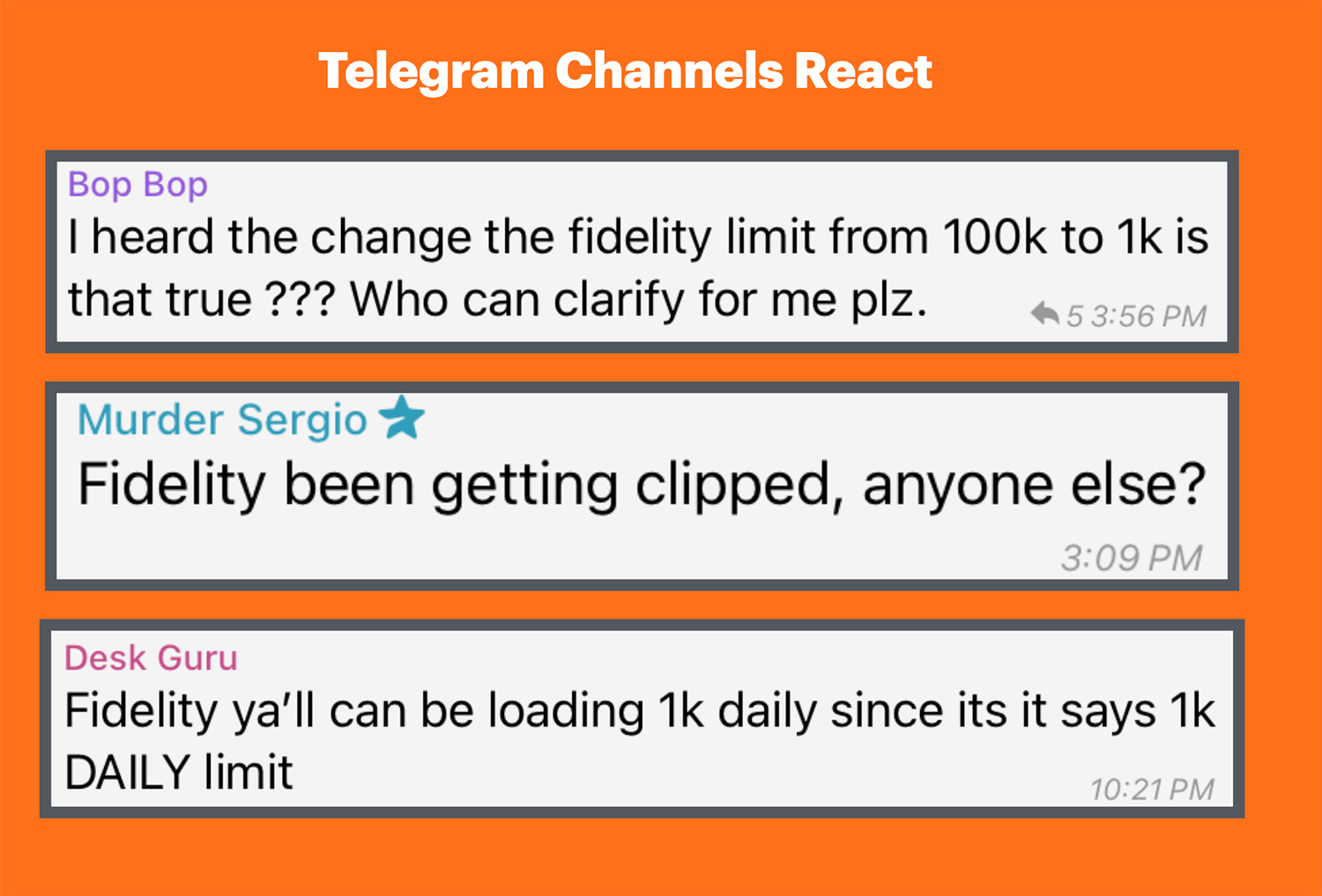

Telegram Fraud Channels React “Fidelity Is Getting Clipped”

The fact that Fidelity dropped their limits may have worked. On Telegram, conversations have immediately shifted to the fact that limits have also dropped.

“Fidelity has been clipped, anyone else?” one user reports.

Another user says “Bring me all banks, EXCEPT Fidelity.”, indicating that the exploit is probably not working anymore.

On Facebook channels, the same frustration is being reported. “1k limit, 16 day hold. I hope y’all saved y’all cheese from that glitch. I hope it was worth it cuz fidelity DEAD”.

One user even shows a picture of their mobile deposit screen and posts, “WTF is this?”

Miller – A Wake-Up Call For Banks

Mary Ann Miller, a fraud expert and Vice President at Prove, thinks the merry-go-round of glitches hitting banks will not end soon.

“These glitches should be a wake-up call to banks,” she says” “they need to keep their portfolios free of complicit money mules and examine their hold policies on new and low activity accounts”.

She goes on, “It’s going to be a cat-and-mouse game for a while, and with social media playing a big part in how the information is disseminated, the damage could be immediate and devastating”

Never-Ending Glitches – This Is Just Beginning

While the Fidelity Glitch may be over, it doesn’t mean that this trend will stop. Chase certainly wasn’t the first glitch, but it opened a Pandora’s box showing the average American how easy it is to commit check fraud.

As one glitch gets shut down, fraudsters move to the next target, probing banks hold policies on check deposits until they strike gold.

This morning, a post on a Reddit Group says it all, “Fidelity Dead- Open a Charles Schwab Acct and Hit Me Up 50/50.”