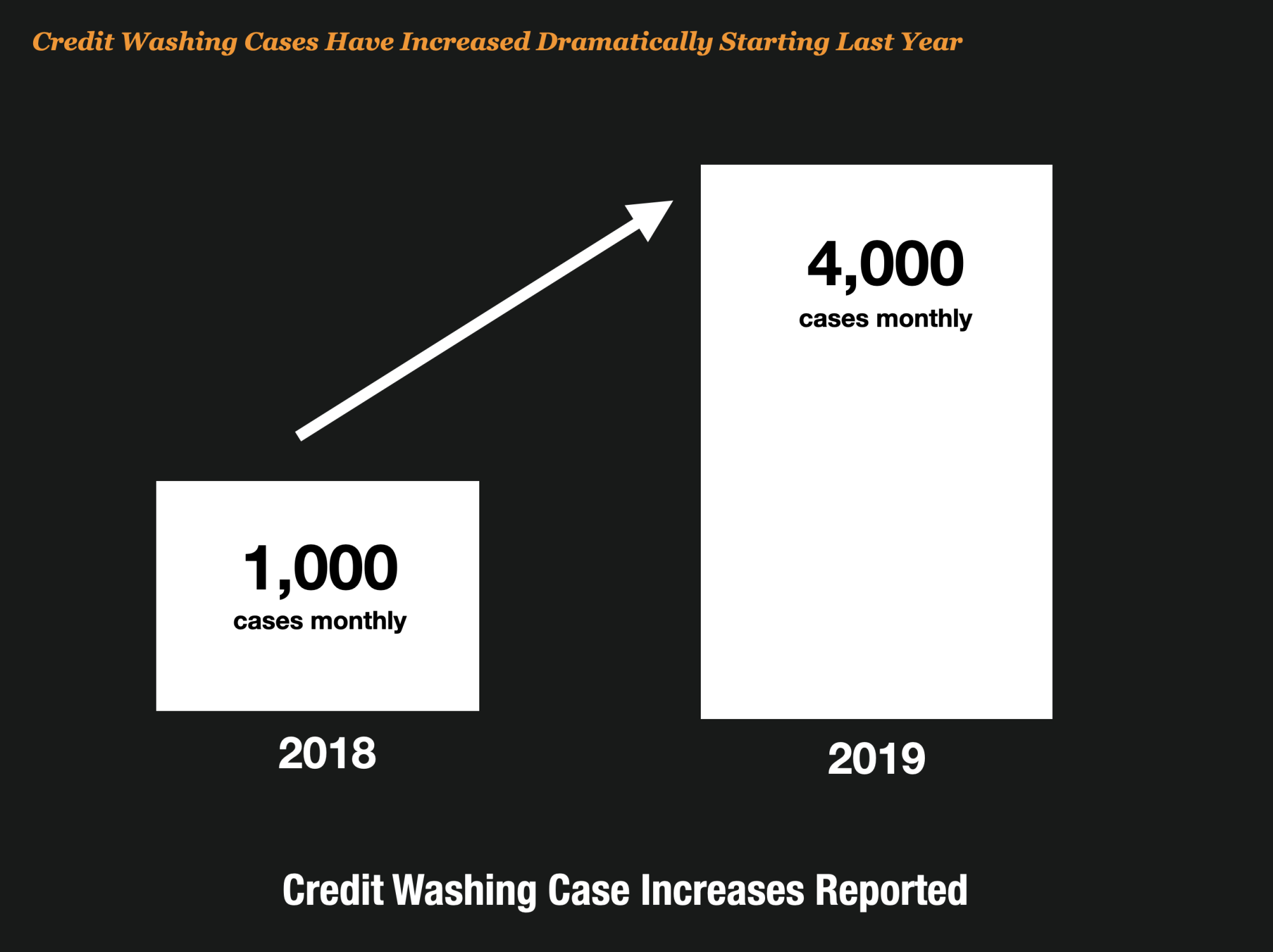

Credit washing is one of the fastest-growing types of fraud impacting lenders across the US. Some lenders have reported a 400% increase in fraudulent identity theft claims, driven largely by shady credit repair companies trying to help consumers remove legitimate loans from their credit reports.

This week, a former Miami Dade cop (Marquies McGirt) pleaded guilty this week to helping a credit repair company obtain false police reports so they could file fraudulent identity theft reports with banks and creditors.

According to the scheme, the credit repair company would provide McGirt with the customers’ names and other identifying information so that McGirt in turn could create Offense-Incident Reports (OIR’S) that claimed those customers had been victims of identity theft.

In the end, McGirt was charged with filing 24 false reports that resulted in cash payments, discounts for family and friends, and lifetime free credit monitoring.

Credit Washers Needed The False Reports To Remove Negative Tradelines

The credit repair business operated by McGirt’s co-conspirator assisted individuals in improving their credit scores, including individuals residing in Miami-Dade County.

The essence of the conspiracy involved McGirt agreeing to assist his co-conspirator’s business by creating police reports known as Offense-Incident Reports (“OIRs”) that alleged certain customers of the co-conspirator’s credit repair business had been victims of identity theft.

The credit repair company would send letters, via the United States Postal Service, to Experian, TransUnion, and Equifax, which were credit reporting agencies that collected and maintained data relevant to the creditworthiness of individual consumers.

In order to induce the credit reporting agencies to remove negative items from the credit histories of the co-conspirator’s customers, the letters would claim that the co-conspirator customers had been victims of identity theft. To support the claims in these letters, the co-conspirator could include a copy of the relevant OIR provided by McGirt.

Credit Washing is a Growing and Dirty Business

Credit washing fraud involves systematically disputing all negative tradelines on a credit report, not as reporting errors but as outright identity theft. Credit repair companies instruct the consumer to file a false affidavit claim with the FTC and to use that document to dispute all their negative tradelines due to the fact they were a victim of identity theft.

Banks and lenders have reported a 500% increase in identity theft claims since 2018.