What happens when a bank gets a fraud report wrong? One man claims it literally ruined his life.

It’s a case of “Friendly Fraud” but with a very interesting twist.

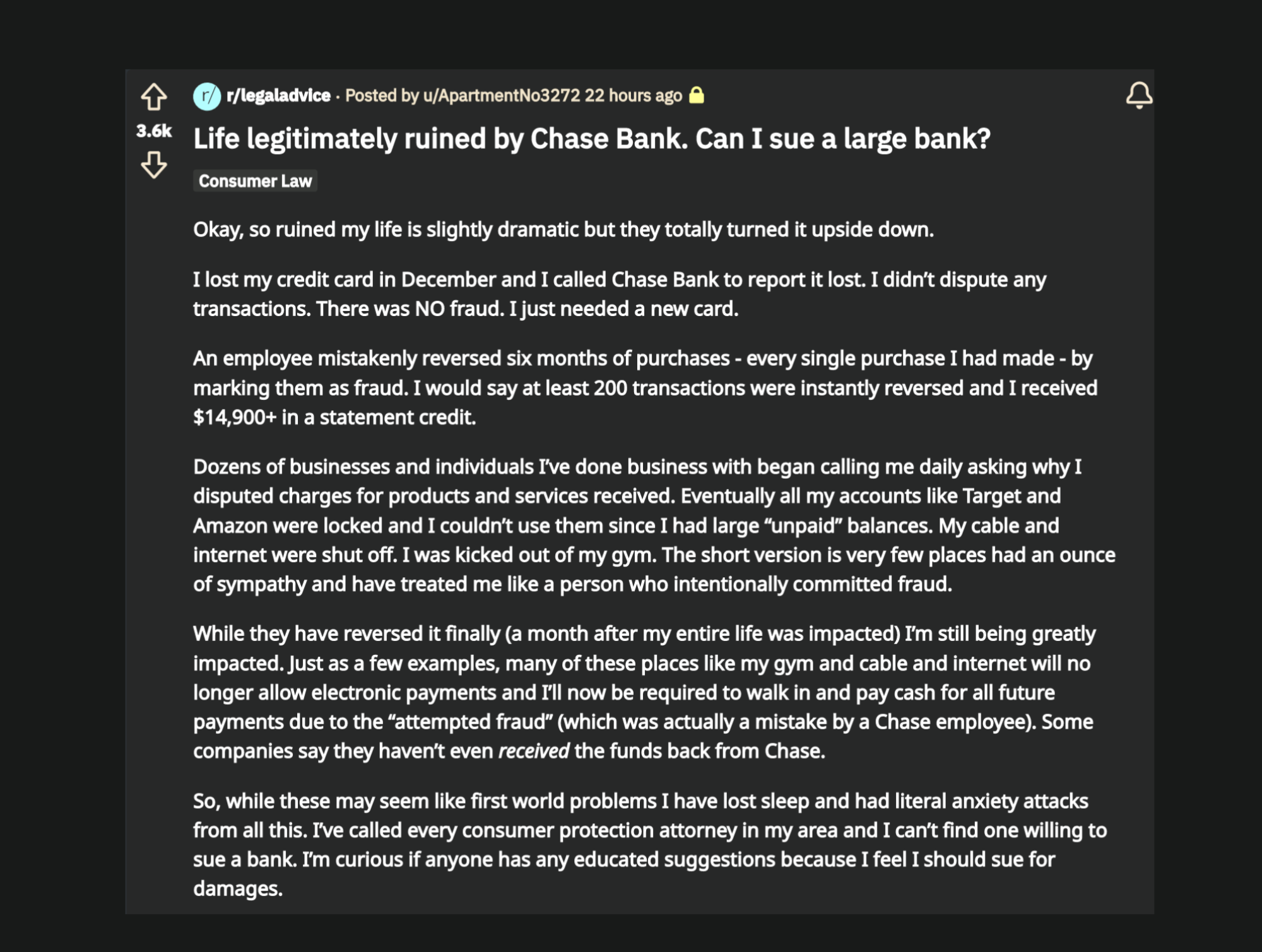

He Called Chase To Report His Card Lost, He Got $14,000 In Credits Instead

Reddit user, ApartmentNo3272 claims that Chase Bank “legitimately ruined his life” when they misreported over 200 transactions to merchants as fraudulent.

“The transactions were valid”, he said. He had only called Chase to report his card lost so he could get a new one. But the Chase representative took it upon themselves to reverse 6 months of charges, crediting him back over $14,000 in the process.

There was NO fraud he said. He just needed a new card.

Dozens Of Businesses Are Calling Him. His Gym Membership Was Cancelled

Imagine his surprise, receiving 6 months of charges for free on his bill. But there was a heavy price to pay for those credits.

Almost immediately, he began receiving phone calls and emails from all those businesses that were now receiving chargeback notices from Chase.

“Dozens of businesses and individuals I’ve done business with began calling me daily asking why I disputed charges for products and services received. Eventually, all my accounts like Target and Amazon were locked and I couldn’t use them since I had large “unpaid” balances. My cable and internet were shut off. I was kicked out of my gym. The short version is that very few places had an ounce of sympathy and treated me like someone who intentionally committed fraud.”

Caught in the Friendly Fraud Cross Fire

Chase Eventually Put The Charges Back on His Account, But His Life is Ruined

Chase eventually reversed the bogus credits but he claims his life was already ruined and could not be repaired.

Many of these places like his gym and cable and internet will no longer allow him to use electronic payments and require him to walk in and pay cash for all future payments due to the “attempted fraud” (which was actually a mistake by a Chase employee).

He claims some companies are still reporting that they have not received the money back from Chase and are still going after him for it.

He Was So Frustrated He Wanted to Sue The Bank, But No One Wanted The Case

The man was so frustrated that he wanted to sue Chase for all the damage they did to his life.

“I have lost sleep and had literal anxiety attacks from all this. I’ve called every consumer protection attorney in my area and I can’t find one willing to sue a bank.”

What do you think of this very strange case of Friendly Fraud? How does a bank representative inadvertently report a total of 6 months of charges as fraudulent? Was this a simple keying error or was there more happening here that we don’t know about?