CNBC reported that the IRS had flagged more than 1 million tax returns by early March as being filed by potential identity thieves.

That number sounds shockingly high. Is tax fraud spiking? Should we be worried?

When you dig into the history of IRS tax fraud, that 1 million counts could actually spell very good news – it’s actually historically low.

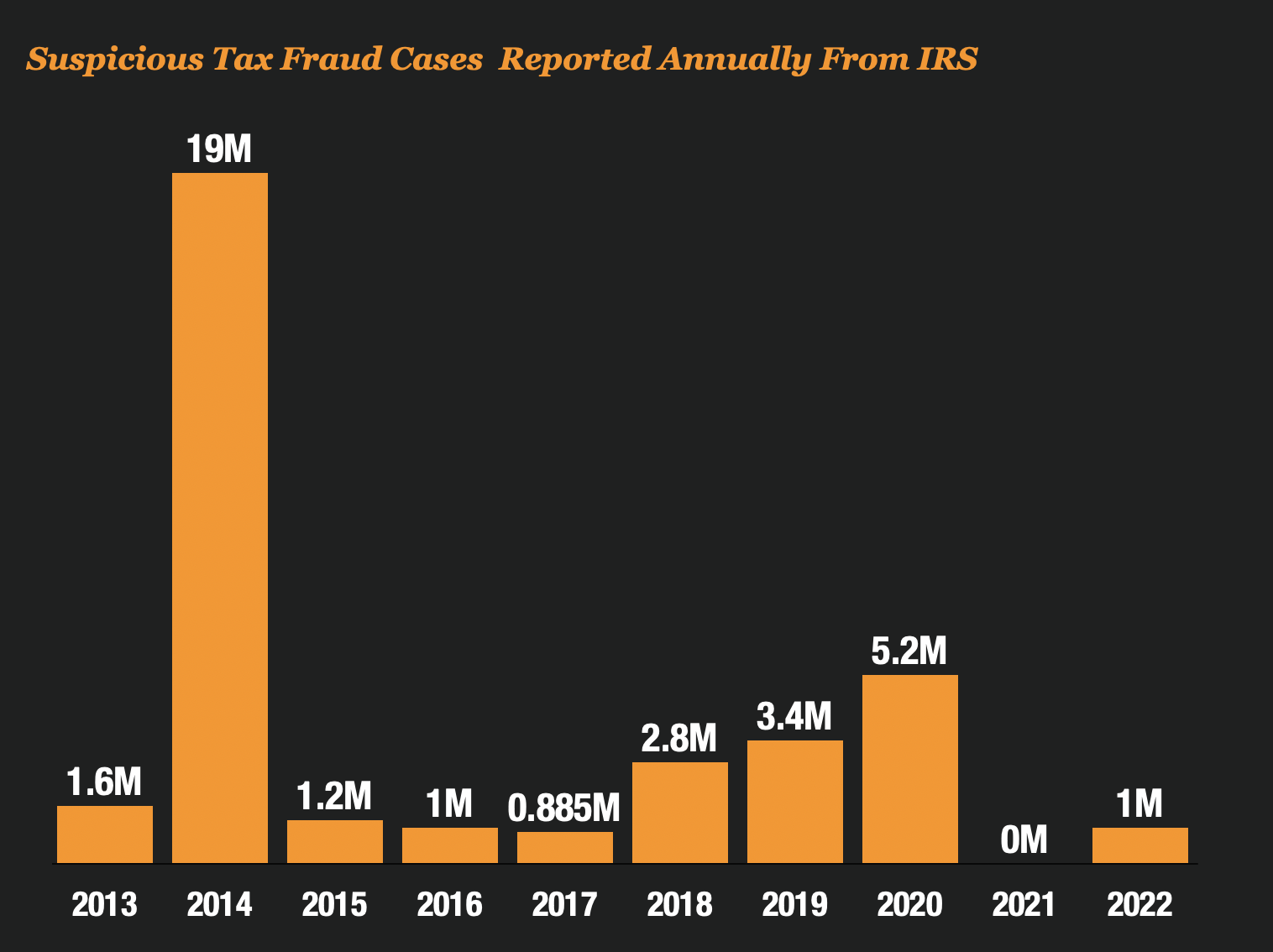

In The Last 10 Years, IRS Flags Between 1 Million and 19 Million Cases

It’s really hard to get accurate numbers on the number of cases the IRS flags each year. There really is no annual reporting, just articles and publications by the IRS on the size of the problem occasionally.

So I searched the internet for a few hours and cobbled together the numbers that I was able to find from the IRS. And you really have to dig to find it.

After finding the data points for each year, I was surprised at what I found.

IRS Identity Theft Tax fraud can range anywhere from a low of 885,000 cases in 2017 to a high of 19 million cases in 2014 when tax fraud was out of control.

Interestingly enough, there was absolutely no reporting on identity tax fraud that I could find last year when identity theft was spiking in other government programs.

It leads me to believe that there is probably a lot more IRS Tax fraud happening than we probably know about.

The IRS Began Implementing Better Technology To Fight Fraud in 2015

Over the last decade, the IRS has been progressively improving its identity theft tax fraud controls. They implemented nine different improvements to the program.

1 – They Developed A Review Program Leveraging Fraud Scoring

After the government lost over $5 billion in 2010, the IRS began implementing fraud scores and alerts to identify suspicious patterns of identity theft in tax refunds.

The program uses predictive analytics, models, business rules, and selection groups to identify and score suspected identity theft and fraudulent tax returns.

The IRS uses hundreds of identifiers in the models and allows them to precisely identify when identity theft is likely to be occurring.

2 – They Developed A Rule-Based Dependent Database Check Program

The IRS developed a rules-based system that incorporates information from many sources that include the Department of Health and Human Services, the Social Security Administration (SSA), and the IRS.

The system includes identity theft rules to identify potentially fraudulent tax returns involving identity theft.

By incorporating external data into the refund review process they were able to better identify discrepancies and anomalies in the tax returns.

3 They Developed a Suspend and Pause Process

In 2019, the IRS implemented a new process to suspend tax returns identified by the IRS’s Return Review Program. The IRS suspends these tax returns to provide additional time for the IRS to receive third-party income documents (i.e., Form W-2, Wage and Tax Statement).

These documents are used to verify the income and withholding reported on the tax returns identified as potentially fraudulent. The suspended tax returns are held until either the IRS receives third-party documents and the income and withholding is verified or the tax return is sent for further review if the income and withholding did not match.

For those tax returns for which no third-party income document(s) are received by June 15, the IRS will send the tax returns to its Integrity and Verification Operations for screening and verification

4- They Created an IRS Fraud Referral and Evaluation Group to Manually Review Suspicious Returns

The IRS created a manual review team which reviews tax returns to identify suspicious patterns and trends that the models, rules and scores or databases do not identify.

This manual review team ensures that the fraud is not missed due to holes or gaps in the models or processes.

5- They Established a Deposit Account Verification Program

The IRS first began this initiative in January 2017 and partnered with a Security Summit industry provider of debit cards.

Under this initiative, when the IRS identifies a potentially fraudulent tax return, in which the refund was to be deposited on a debit card associated with this industry provider, the IRS sends certain information to this provider.

Once received, the debit card provider evaluates the information it has for the individual associated with the debit card account to provide the IRS with a risk level associated with the recipient’s account.

In 2018, they expanded this program to an additional 2 debit card providers and it is expected that they will greatly expand the program after the pilot ends this year.

6- They Developed an External Leads Program

This initiative is a partnership between the IRS and various financial institutions (i.e., banks) to identify questionable Federal tax refunds. A questionable refund can include a name mismatch between the tax return and the bank account receiving the refund or other account characteristics that indicate that the deposit is questionable, invalid, or has been fraudulently obtained.

Once a refund is identified as questionable, the financial institution notifies the IRS and sends the refund back to the IRS for additional review.

As of December 2019, the External Leads Program has resulted in the protection of refunds totaling approximately $294 million, compared to $112 million for the same period in PY 2018. IRS management noted that they are evaluating additional initiatives that could be used to further leverage relationships with financial institutions in detecting fraudulent refunds. These include expanding the use of deposit reject codes used by financial institutions and the deposit account verification program discussed previously.

7- They Initiated a Deceased Tax Account Lock

This initiative blocks fraudulent tax returns from entering the tax processing system. As of December 26, 2019, the IRS has locked the tax accounts of more than 42.9 million deceased individuals. This compares to approximately 36.7 million tax accounts locked as of December 27, 2018. When tax accounts are locked, e-filed tax returns are rejected and paper-filed tax returns are prevented from posting to the Master File.

8- They Increased The Data Inputs Into Their Scores

In July of 2019, new provisions were signed into law which allowed the IRS to begin using additional information in the fraud models and rules.

Specifically, the Act now permits the IRS to share information from potential identity theft tax returns including the Internet Protocol address, device identification, e-mail domain name, speed of completion, method of authentication, refund method, Preparer Taxpayer Identification Number, and Electronic Filer Identification Number, taxpayer name, Taxpayer Identification Number, bank account, and routing number

9 – They Stopped Filtering Out Low Dollar Refunds From Alerts

Against their wishes, the IRS was previously forced to begin eliminating the use of filters for low dollar refunds from alerting.

The IRS had created a filter in 2016, that began selecting the refunds only if the dollar amount was above a specified amount.

An audit in 2018, revealed that this filter was resulting in missed fraud so they were instructed to put stop gaps in place.

In 2019, the IRS selected approximately 130,000 refunds under the dollar amount tolerance. As a result the IRS identified approximately 62,000 confirmed frauds and prevented approximately $12 million in fraudulent refunds from going out the door.