Every week a new internal fraud case is reported. It certainly seems like a growing trend.

This week, however, we have a twist – one of our very own is being accused of participating in an account takeover scheme to defraud bank customers.

This week, Chimere Shanta Mitchell, a Fraud and Claims Operations Specialist at Wells Fargo, is accused of using her position at the bank to steal customer information and provide it to outsiders for use in account takeover schemes.

It’s hard to imagine someone you trust in the fraud department would be accused of such a thing!

Another Network Of Bank Employees Committing Internal Fraud

Chimere was not the only bank employee involved in the scheme; another employee of Regions Bank, Jamila Afhtan Davis, was also charged in the scheme.

Both Chimere and Jamila would allegedly use their system’s access to steal customer information from the system and pass it off to another person outside of the bank.

That individual would either use the data to take over the bank customers’ accounts, or they would sell the data to other fraudsters on Telegram.

Advertising Insider or “Inny” Access At Banks Is A Growing Trend

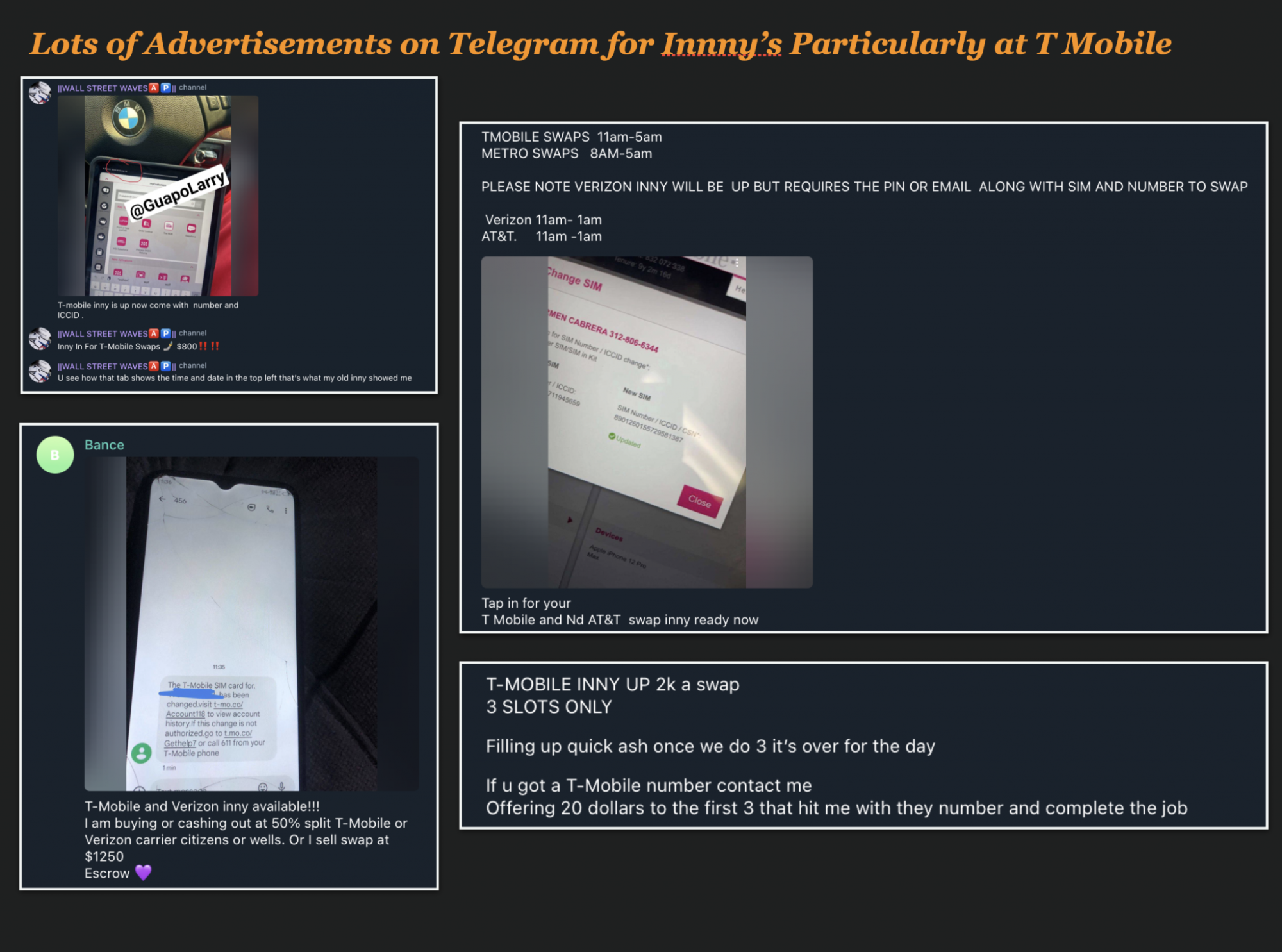

You don’t have to search hard to find that this may not just be a one-off situation at banks. A quick search on Telegram reveals multiple posts in shadowy fraud channels for access to insiders at banks.

Check out these screen-shots with scammers claiming to have an “inny” on hand at Wells Fargo, or searching for an insider.

One can only presume that if these are real, that they are used for the same purpose as Chimere Mitchell’s case.

If Telegram advertising indicates the level of internal fraud that might be happening, no company in the world has a bigger problem than T-Mobile.

Hundreds of Telegram advertisements claim access to T-Mobile insiders to help with SimSwaps.

A Growing Trend Of Internal Fraud At Banks

You may remember it was less than a month ago that two other bank employees in Rhode Island were charged with internal fraud.

In that case, employees from two banks were recruited to work for an outside fraudster who wanted customer information and screenshots from them so he could commit a massive and lucrative fraud.

A former Citizens Bank employee, Savonnah Briggs, from Providence, admitted to a federal judge that she stole banking information from customers and sent screenshots to the leader of a fraud ring.

A second employee, Isha-Lee Savage, 24, admitted that, while employed by Santander Bank, she also accessed customer information and sent screenshots of that information to the same leader of the Fraud Ring.