Bots are being enlisted to help banks fight fraud. And it appears that they just might be a fraud-fighters best friend.

Truist Bank is one of those companies that is achieving massive success with the use of bots to help them automate fraud claims.

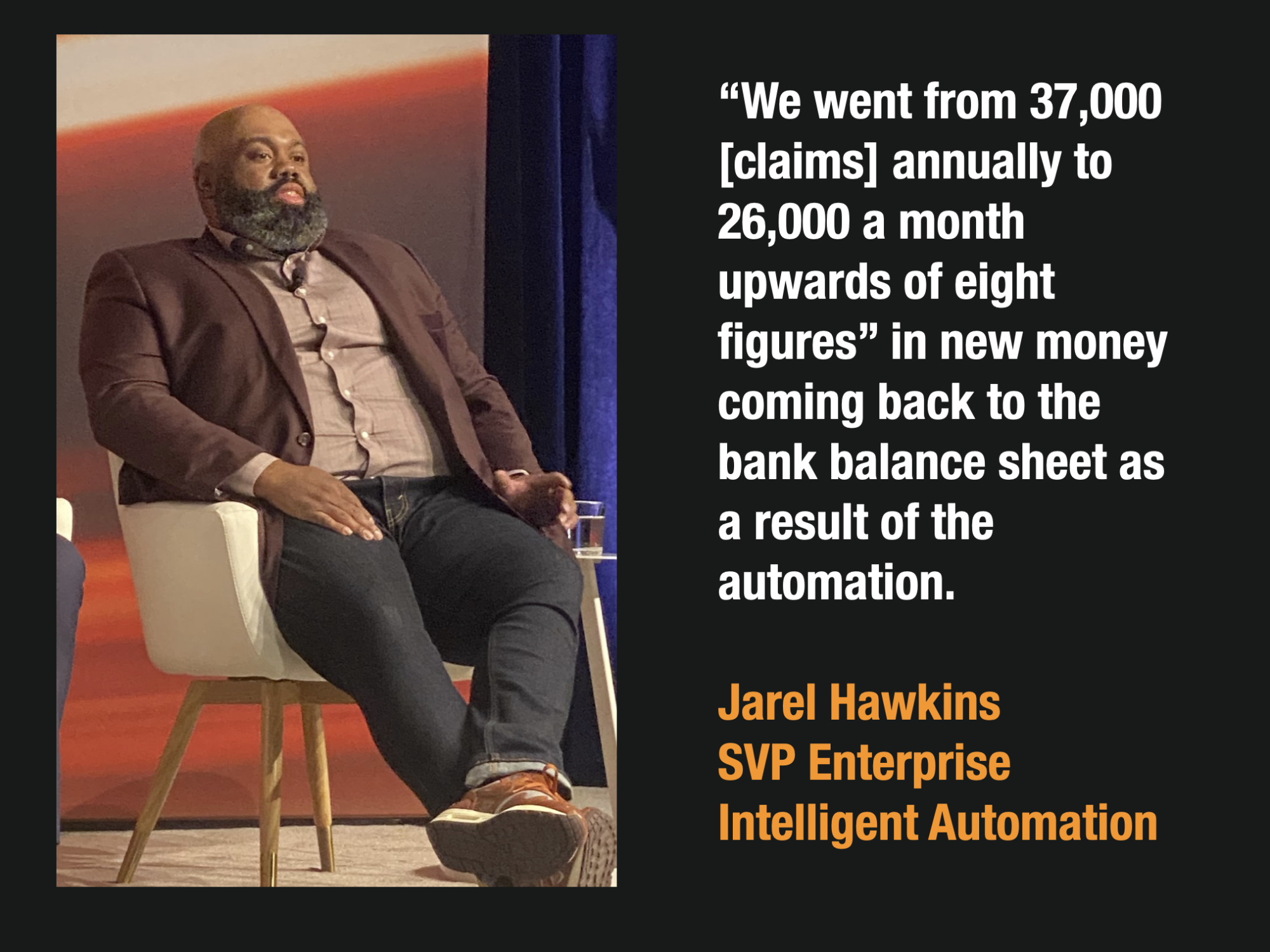

At CNBC’s Technology Executive Council Summit, Jarel Hawkins, senior vice president of enterprise intelligent automation at Truist outlined the massive success Truist is having with them.

According to Hawkins, “Fraud was costing the bank a significant amount of money, but previous to the pandemic, employing a human workforce for every charge was not an efficient or economic way to solve the problem. The costs of the fraud were being refunded to consumers, but the bank was not claiming the costs back from payment processors.”

Fraud Grew Exponentially During Covid

The use of digital banking boomed during the pandemic lockdowns and that in turn led to significant growth in fraud.

Jarel Hawkins explained, “We went from 37,000 [claims] annually to 26,000 a month.” To that end they decided to deploy bots with the help of software called UIPath.

The software helped Truist evaluate low-dollar card fraud claims ($100 or less) and automatically determine how they should be treated. Before, Truist had automatically credited the customer for the transaction and did not even pursue the fraud claim further. With the new bots however they were able to determine how they could automatically recover the money without human intervention.

The result was that they were able to significantly improve their recoveries while allowing the fraud analyst to focus on only high dollar frauds.

Truist claims they delivered over 8 figure results back to the balance sheet.

Watch His Panel Conversation Here

How Robotic Process Automation Can Work For You

They call it RPA and it means Robotic Process Automation. And it is catching steam. If you’re a fraud professional and want to be in the know, you really need to understand what it means to you.

Robotic Process Automation is already in use at many banks across the country. Here are just a few ways that they are being used.

#1 – Auto Blockers Off Batch Queries – RPA’s can be used to batch set temporary blocks on accounts when there has been a point of compromise event that requires immediate safeguards on accounts while customers are being contacted. Instead of having investigators manually key in the blocks on thousands of accounts, RPA’s can be used to do it in a few minutes.

#2 – Block and Reissue – RPA’s can be used to streamline the block and reissue process. Banks often struggle with what do with their list of hundreds or thousands of breached accounts that might have no risk or very high risk. RPA’s can be used with AI or expert rules to determine when a particular set of accounts is highly likely to be used and they can automatically initiate the block and reissue process.

#3 – Micro Customer Mailings – RPA’s can be used to send micro mailing batches to customers to notify them of unique or special activity. For example, if a fraud department wants to notify customers that have traveled in the past year of their capability to pre-notify the bank when they travel, RPA’s can be used to make that determination and send the letters.

#4 – Temporary Block Removals on Aging Blocks – Banks may have accumulated thousands of temporary blocks that have been placed on suspect accounts over many months. These temporary restrictions may have aged out of the queues but the blocks remain. RPA’s can be used to locate these accounts, and then remove the restrictions according to pre-defined criteria.

#5 – Scheduled API Calls for Web Information for Fraud Cases – RPA’s can be extremely effective and pulling information from websites to augment fraud cases. For example, an investigator may want to pre-fill their fraud investigations from information gleaned from Google API’s or a specific set of domains. This data gathering helps to create a better and more efficient tool for investigators.

#6 – Updating Negative List from Websites. (Warning List, Black List, Licensing Information, Negative News) – Banks may have negative files or watch list that they use for fraud processes. RPA’s can be used to automatically scan for updates to certain sites such as state licenses, HUD negative list, and scores of other lists that are available on the internet.

#7 – Mail Merging From Databases for Client Contacts – RPA’s can be used for the old standard mail merge functions used in the dispute and fraud investigations processes. RPA’s can send affidavits, case closure statements, and automated letters throughout the investigation process.

#8 – Clearing Low Value or Aging Fraud or AML Alerts – Alert clearing is a very big opportunity for most banks. The ability to remove low-risk unworked alerts that are bogging down the system is a key capability most banks want. Using scores, AI or rules, a bank can leverage an RPA to assess the account or transaction risk and then clear the alert if it is deemed very low risk.

#9 – Augmenting Queues With Additional Information – RPA’s can help during the high-risk account review process to pull in additional information to be used for the fraud analyst. For example, an RPA could be used to scan the customer’s prior transaction history over the last year and identify just how many times the customer has visited the high-risk transaction location. If the analyst could identify that the customer had been to the same merchant for the same amount 4 months ago, this could save them a few minutes on every fraud case.

The sky is the limit with Fraud Robots, and they can be very powerful.