Not everyone is rich, although many may claim to be on their mortgage applications so they can qualify for their dream homes.

Income fraud is on the rise in the UK and Cifas, the UK’s largest cross-sector fraud database is warning the public that it is becoming increasingly common.

They released a report this week that showed that mortgage fraud has increased 5% in 2019 despite the fact that rates have plummeted.

Their findings included some troubling statistics about how socially acceptable fraud might be:

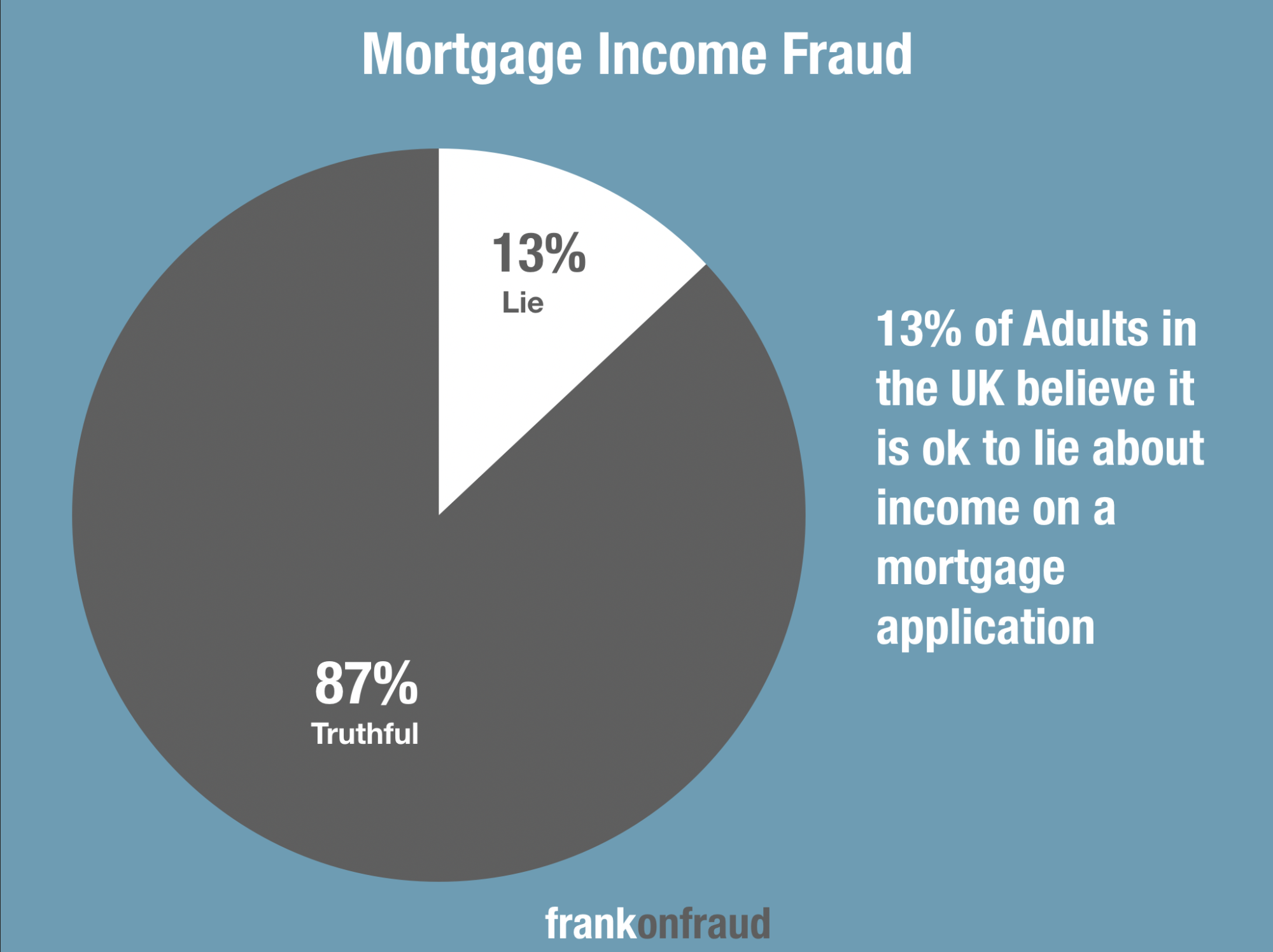

- They found that fraudulent applications were rising and that 13% of British adults believe it is ‘reasonable’ to exaggerate income on a mortgage application.

- They found that 16% of borrowers aged 31-40 were responsible for making fraudulent mortgage applications.

And this finding seems to be showing up in the stats released by other companies that track fraud attempts in the UK.

A Dramatic Rise in Income Fraud According to The Mortgage Verification Scheme

The Mortgage Verification Scheme which opened in 2011 to enable lenders to check information from an application against a borrowers income has seen a dramatic increase in the number of frauds being detected.

In 2011, about 300 cases of income fraud were referred and by 2017 that number skyrocketed to over 11,000 a year.

First party mortgage application fraud is one of the most common forms of fraud filed to the Cifas databases on a daily basis. The fraud is committed by the applicant as they attempt to obtain a mortgage that they know the lender will not sanction or to obtain a mortgage on improved terms. This could be done on their own or in collusion with a 3rd party such as a broker, accountant or employer. Inflated or false income may be supported by altered or fraudulent payslips and P60s to evidence the income.

CIFAS

Mortgage Income Fraud is Not a Victimless Crime

CIFAS has urged anyone in the public that is considering to lie on their mortgage applications to consider just how serious it is. It is not a victimless crime.

They warn that not only will consumers not be able to afford their home, but that they could be blacklisted against future loans and that they could be reported to the police for investigation.

It is a little known fact in the Public that first-party fraud in the UK can be referred and the borrowers can be held responsible and bear out the consequences of their actions.

Most Common Types of Mortgage Income Fraud

According to CIFAS, there are two common types of income fraud that gets reported by lenders and banks

Staged Income – Faking Bank Statements

This occurs when fake payments are made into an applicant’s account for a short period of time to cover the employment period checked by the lender to confirm employment and affordability.

The income is then evidenced by genuine bank statements. These bank statements are manipulated to show that the borrower makes the income they claim but since the income is faked, the borrower cannot afford the loans and often default after being approved for the loan.

The second variation of this occurs when a borrower fakes secondary employment to fraudulently boost their income level on their bank statements.

Employment Fraud – Faking Employment

The second type of employment fraud occurs when a borrower fakes their employer or indicates that they are a full-time employee when they are either a contract or part-time employee of the company.