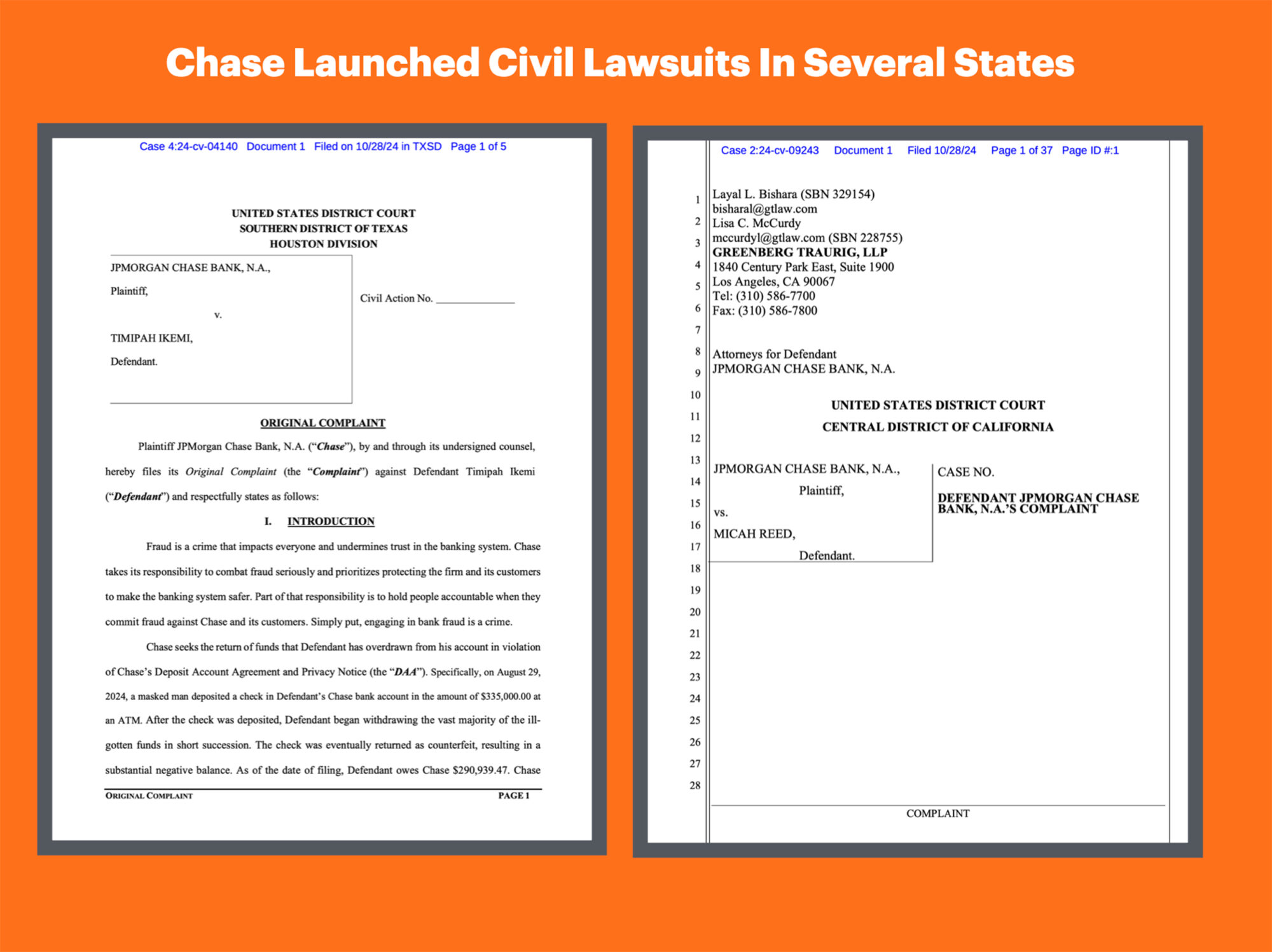

JP Morgan Chase is suing its customers who committed fraud.

On Monday, the bank filed lawsuits in three federal courts, seeking to recover over $661,000 in funds. Lawsuits were filed in Los Angeles, Houston, and Miami against two people and two companies who allegedly kept money from deposited checks, which were later determined to be counterfeit or forged.

A Two-Pronged Approach to Go After Fraudsters

The bank initially indicated last month that it was working with law enforcement and referring cases for prosecution, so they might be taking a two-pronged attack and pursuing cases criminally and civally.

A Los Angeles Glitcher Sued For Over $90,000

In the first lawsuit filed Monday in the U.S. District Court for the Central District of California, JPMorgan Chase Bank accused a Los Angeles resident of orchestrating an alleged check fraud scheme.

According to court documents, Micah Reed allegedly deposited two counterfeit checks totaling approximately $116,000 into his Chase account through ATM deposits on August 27 and 28, 2024. The checks were for $59,223.45 and $56,840.10, and the bank later learned that they were fraudulent.

Before the checks were returned, Reed allegedly transferred the money out of the account, leaving Chase with a loss of 90,794.02

He Ghosted Chase And Is Non Responsive

Perhaps Chase is suing because the man has ghosted them without any response.

According to the suit, “Chase’s Global Security representatives attempted to contact Defendant regarding the counterfeit Checks and his overdraft, but he failed to respond. Chase also sent a letter demanding the return of the Funds. Defendant has not responded to any of Chase’s correspondence”.

Click here to see the lawsuit.

A Man In Texas Did The Glitch For Over $300,000

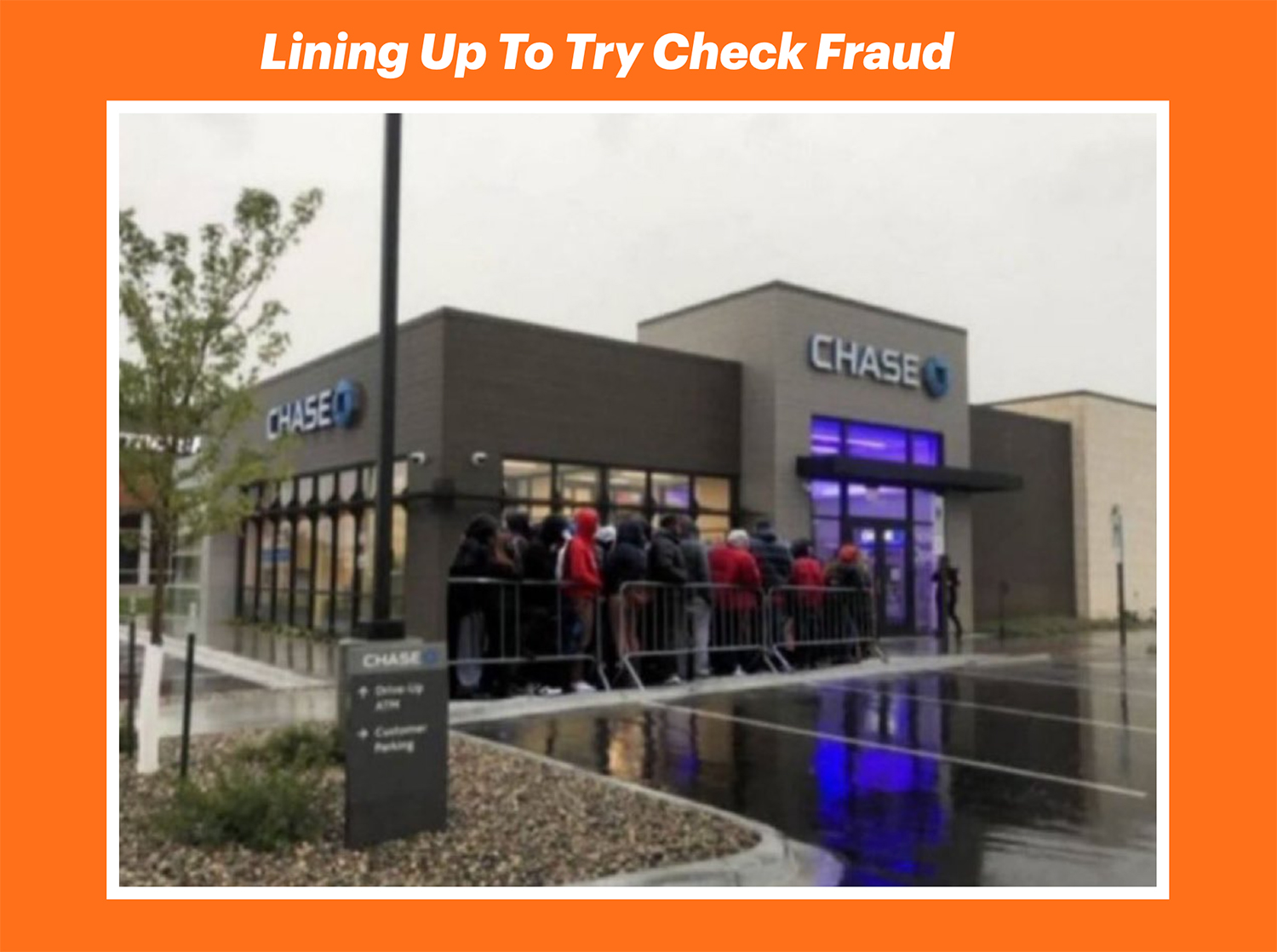

In Texas, Chase is suing a man for the same Chase Glitch scheme. Chase Bank alleges Timipah Ikemi was involved in a $335,000 counterfeit check deposit during the Chase Glitch.

According to court documents, the scheme began on August 29, 2024, when a “masked individual deposited the check at a walk-up ATM at 9:42 p.m”.

The following day, defendant Timipah Ikemi allegedly orchestrated a series of rapid withdrawals across multiple Houston branches: a $10,000 cash withdrawal at 11:10 a.m., followed by a $100,000 wire transfer an hour later, and a $150,000 cashier’s check two hours later.

The pattern continued the next day with two withdrawals of $40,000 and $20,000 made just minutes apart. Chase claims the defendant withdrew or transferred $320,000 of the fraudulent deposit before the check was discovered to be counterfeit on September 4, leaving the bank with a loss of $290,939.47.

Click here to Read The Lawsuit

Another Lawsuit Alleges A $149,000 Forged Check Was Deposited

In another lawsuit filed in Miami, Chase alleges that the defendant, RISKBOSS MUSIQ, LLC, deposited a check into its Chase bank account for $149,000.00 at an ATM.

The check was returned as a forgery, leaving Chase with a significant balance to collect. According to the lawsuit, the defendant owes Chase over $141,000.

In And Out Appliances Sued For $138,000

Another business called “In and Out Appliances” was also sued in Miami. According to Chase, on August 28 and 29th, an individual deposited two checks in Defendant’s Chase bank account in the amounts

of $75,000.00 and $245,999.12 at an ATM.

After the checks were deposited, they began transferring all of the money out of the accounts. The checks were eventually returned as counterfeit, resulting in a significant negative balance. As of the date of filing, they owe Chase $138,680.91

A Man In Atlanta Deposited An $80,000 Counterfeit Check

In Atlanta, a customer named Benjamin Rieves deposited a check from $80,365.28 into an ATM. Chase claims he knew the check was fraudulent when, 24 hours later, he began to extract the money rapidly from the account.

He made withdrawals at different branches across Atlanta, purchased gift cards, and began making payments to third parties.

They called his actions a clear violation of his contract with Chase and a “brazen violation of state law.”

Click to Read the Lawsuit Here.

Going After Fraudsters Civally Has Worked In The Past

Chase appears to have an effective strategy that could deter future attempts like this. In the past, the record companies went after people who downloaded pirated music through Napster. More recently, Amazon has also been going after professional refunders using the court systems.

This is an interesting and, I believe, effective strategy for changing the way people view these glitches.