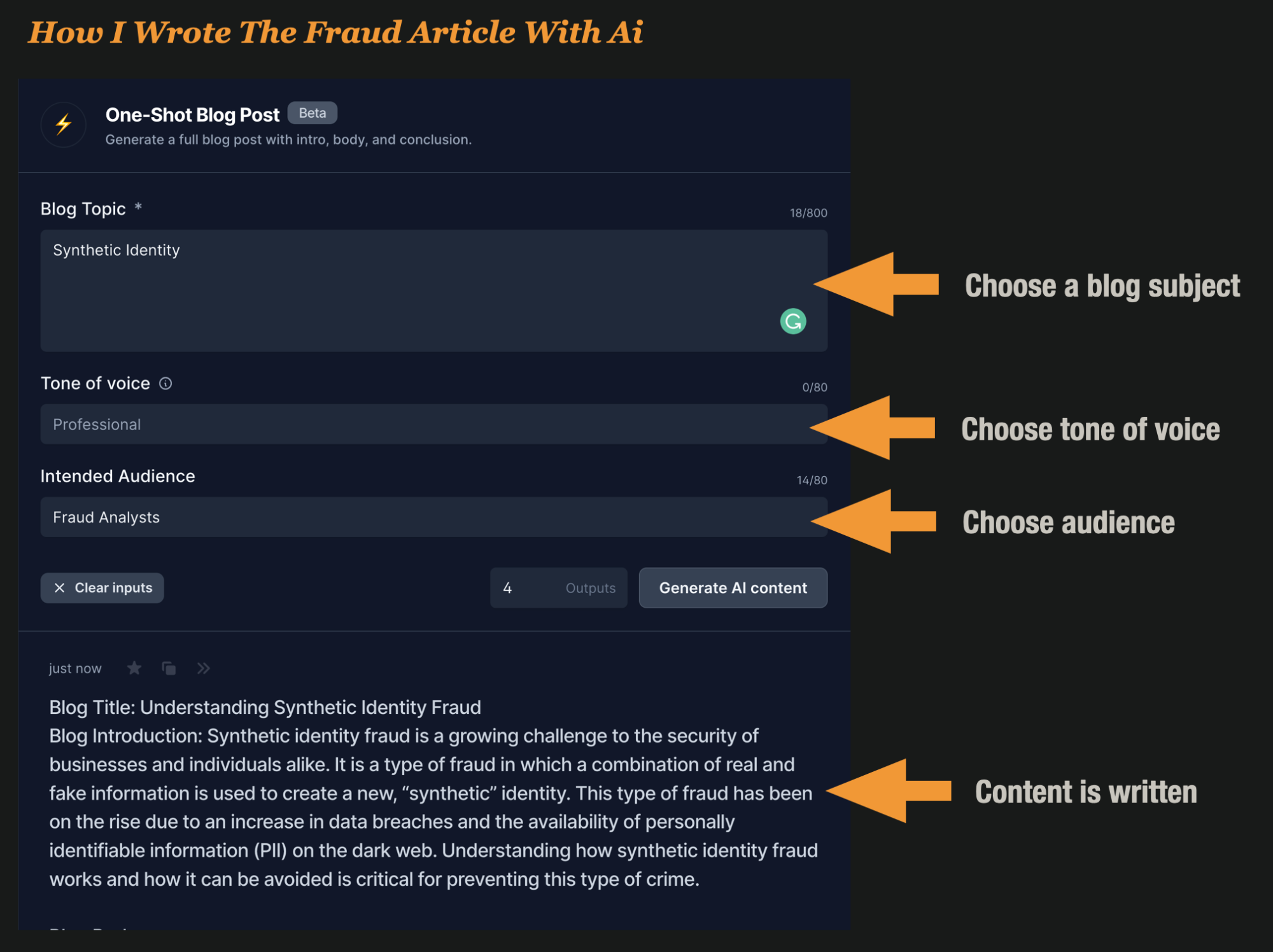

Jasper Ai wrote this article. Jasper is an AI Content Platform that claims to promises to help you create amazing, original content 10X faster. It uses synthetic intelligence to create blog posts for content creators.

Sounds like it could eventually replace humans, maybe?

I decided to test it, so I asked Jasper to write me an article about fraud in the US. After asking me a few questions, Jasper came up with this original 750-word blog post in about 30 seconds.

What do you think? If you ask me, I think it’s pretty generic. But surprisingly, it does remind me of a lot of the content I see being used as clickbait for advertisers.

Synthetic Identity Is The Fastest Growing Financial Crime

Synthetic identity fraud, also known as synthetic identity theft, is one of the fastest-growing forms of financial crime.

Criminals use a combination of real and made-up information to create false identities that they can use to obtain credit in someone else’s name. This sophisticated form of fraud poses an ever-increasing threat to businesses and consumers alike.

How Synthetic Identity Works

Synthetic identity fraud combines real personal information (such as a Social Security number) with false information (such as a fake address or date of birth). By doing this, criminals can create a new profile that appears legitimate but does not actually exist in any government database.

Once the synthetic identity is created, it can be used to open new bank accounts or apply for credit cards in someone else’s name.

The Danger Of Synthetic Identity Fraud

Synthetic identity fraud is particularly dangerous because it is difficult to detect until it is too late. Since the stolen information belongs to real people, it may take months or even years before banks and other institutions realize that they are dealing with a fraudulent entity.

Furthermore, traditional anti-fraud measures such as customer verification may not be effective against synthetic identity fraud since the person associated with the account does not actually exist. As such, organizations must stay vigilant and employ advanced technologies to stay ahead of this evolving form of crime.

Stay On The Lookout For Synthetic Identity

Synthetic identity fraud is one of the most insidious forms of financial crime. While it may take some time for businesses and consumers alike to become aware that their information has been used for criminal activity, taking proactive steps now can help mitigate the risk posed by this growing threat.

Fraud analysts should be on the lookout for suspicious activity involving synthetic identities and employ advanced technologies such as machine learning algorithms to identify potential threats quickly and accurately. With vigilance and preparedness, we can all work together to fight back against this growing form of financial crime.