Even the government isn’t immune to the scourge of synthetic identity fraud. ? In fact, they got conned in a big way.

This week, a group established by the government to oversee the responsible use of pandemic funds, unearthed what might be the largest single case of synthetic identity fraud ever perpetrated against a program.

The Pandemic Response Accountability Committee identified 69,323 questionable Social Security Numbers used to obtain $5.4 billion from PPP and the EIDL loan programs. But the actual attempted fraud synthetic fraud was much higher – by my estimates, over $17 billion!

It’s a shocking discovery because the US Government controls issuing SSNs and could have easily checked those numbers before issuing the loans.

Data Scientists Discovered The Massive Synthetic Identity Fraud Through Data Analysis

The PRAC’s team of data scientists identified the potential fraud and identity theft by using an internal tool called PACE to analyze information from over 33 million COVID-19 EIDL and PPP applications.

The scientist used public SSN Issuance tables on a targeted selection of SSNs used on applications, to find SSNs that may have been invalid or not assigned before 2011.

After finding those loans associated with those randomized SSNs, the scientist went to the Social Security Administration and did a name check of the owner to match it against the application.

The SSA informed the PRAC that 221,427 of the SSNs used on applications in this targeted selection were either not issued by SSA or that identifying information in SSA’s records did not match the name and/or date of birth information.

Of those 221,427 loans, 69,323 were actually funded. This means the government-funded over $5.4 Billion in Synthetic Identity fraud.

What The Data Scientist Asked The SSA To Validate For Them

As part of the analysis, the scientist asked the SSA to validate SSN’s for them. For each of the suspicious SSN’s they asked the SSA 4 questions:

- Is the SSN valid?

- Does the name associated with the SSN on the loan match SSA records?

- Does the date of birth associated with the SSN on the loan match SSA records?

- Is the SSN used on the loan associated with a deceased individual?

After scanning the 221,427 identities, the 69,323 SSNs associated with the $5.4 billion triggered at least one of the following four SSA identity verification codes:

- SSA did not issue the SSN

- The SSN was associated with a different name according to SSA’s records;

- The SSN was associated with a different date of birth at SSA; and

- SSA did not verify the SSN for another reason.

The number of SSNs and applications is not a one-for-one match given that a distinct SSN could have been used across multiple COVID-19 EIDL and/or PPP applications, disbursed and undisbursed.

Total Attempted Theft With Synthetic Identities Probably Closer to $17 Billion

Synthetic Identity thieves were successful in stealing $5.4 billion from the government. But the actual attempted heist was far higher if you do the math.

The average loss on funded synthetic loans was $77,896. With 221,427 applications submitted, the total value of the fraud on those applications is actually $17.2 billion.

This is the largest case of synthetic identity in history.

These Synthetic Identities Are Just Getting Started – They Are Using Those Same Identities In Other Industries

If you think these synthetic identities are one and done, think again. The PRAC warned that many of these synthetic identities could still be actively defrauding other industries.

And they are 100% correct. Point Predictive, my company, did an analysis of confirmed synthetic identity auto loans out of Chicago in 2021.

To identify the link between Covid fraud and fraud hitting auto lenders now, they decided to analyze 287 true synthetic identity loans that were submitted to auto lenders this year that were originating in downtown Chicago.

For each synthetic identity, they assigned a fraud investigator to do a forensic review of the application and determine if the synthetic identity used on the auto loan matched to an identity used on publicly available PPP loan data from Chicago.

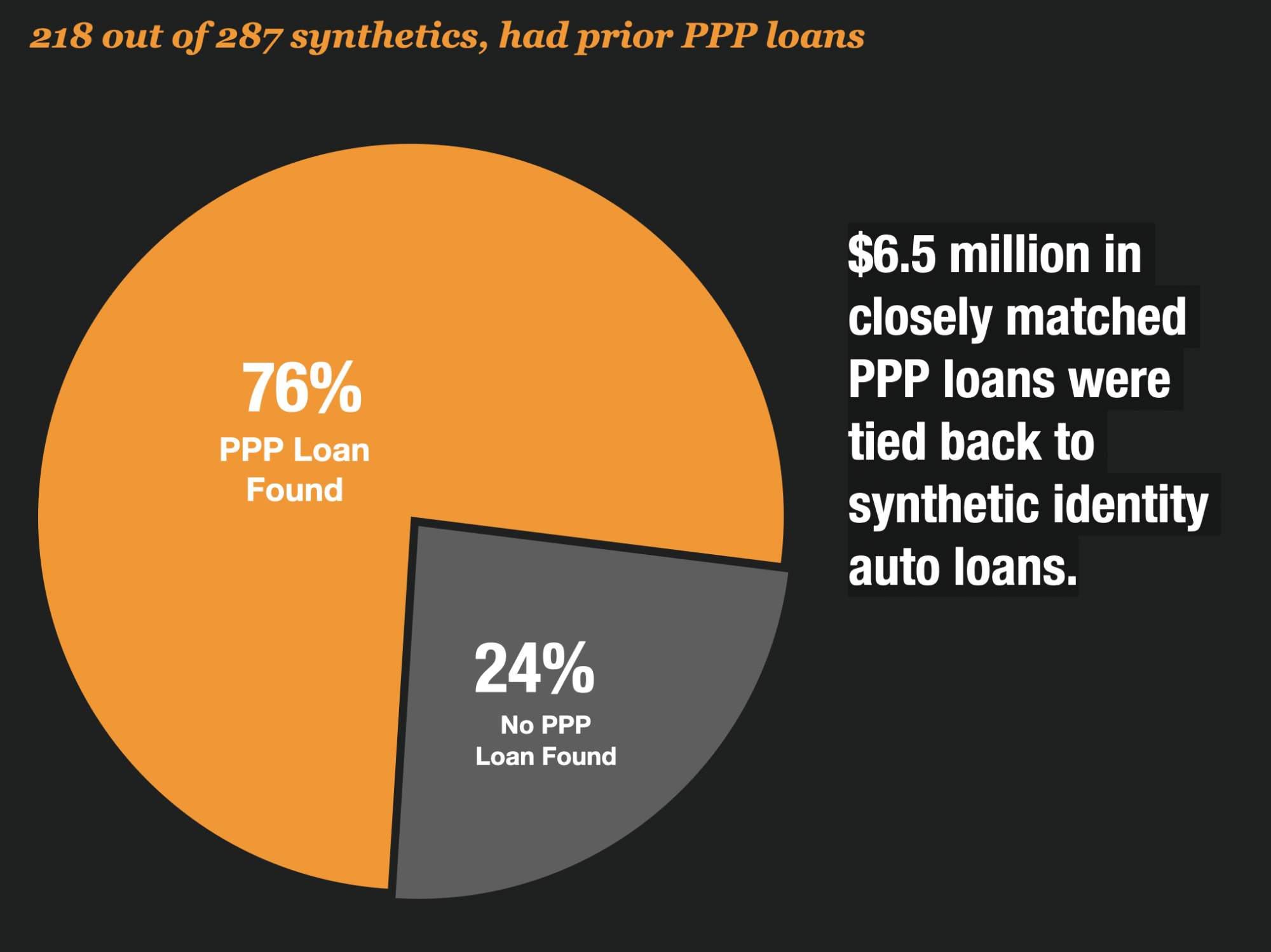

The results of the review surprised everyone. When the research was completed, they determined that 218 of the 287 synthetic identities could be closely matched to a prior PPP loan taken in the Chicago area.

The loans were for every conceivable type of business, including clothing shops, nail shops, and restaurants.

All told, those synthetic identities could be tied back to approximately $6.5 million in PPP loans that were distributed from 2020 to 2021.

Read The Entire Report Here

You can read the entire eye-opening report here.