Don’t cue up the old western music. I’m not talking about actual shotguns here. And I’m not suggesting you buy a gun to protect yourself.

What I am talking about is a very specific type of fraud scam that some in the industry like to refer as “Shotgunning or ShotGun Fraud”. Actually it’s not a fraud per se, rather a technique that fraudsters use to commit a variety of fraud schemes.

By arming yourself, I am suggesting you consider the importance of sharing your fraud data with other banks. Banks that share their fraud data are armed against these types of schemes. Banks that don’t are the victims. It’s that simple.

ShotGun Fraud Can Hurt You

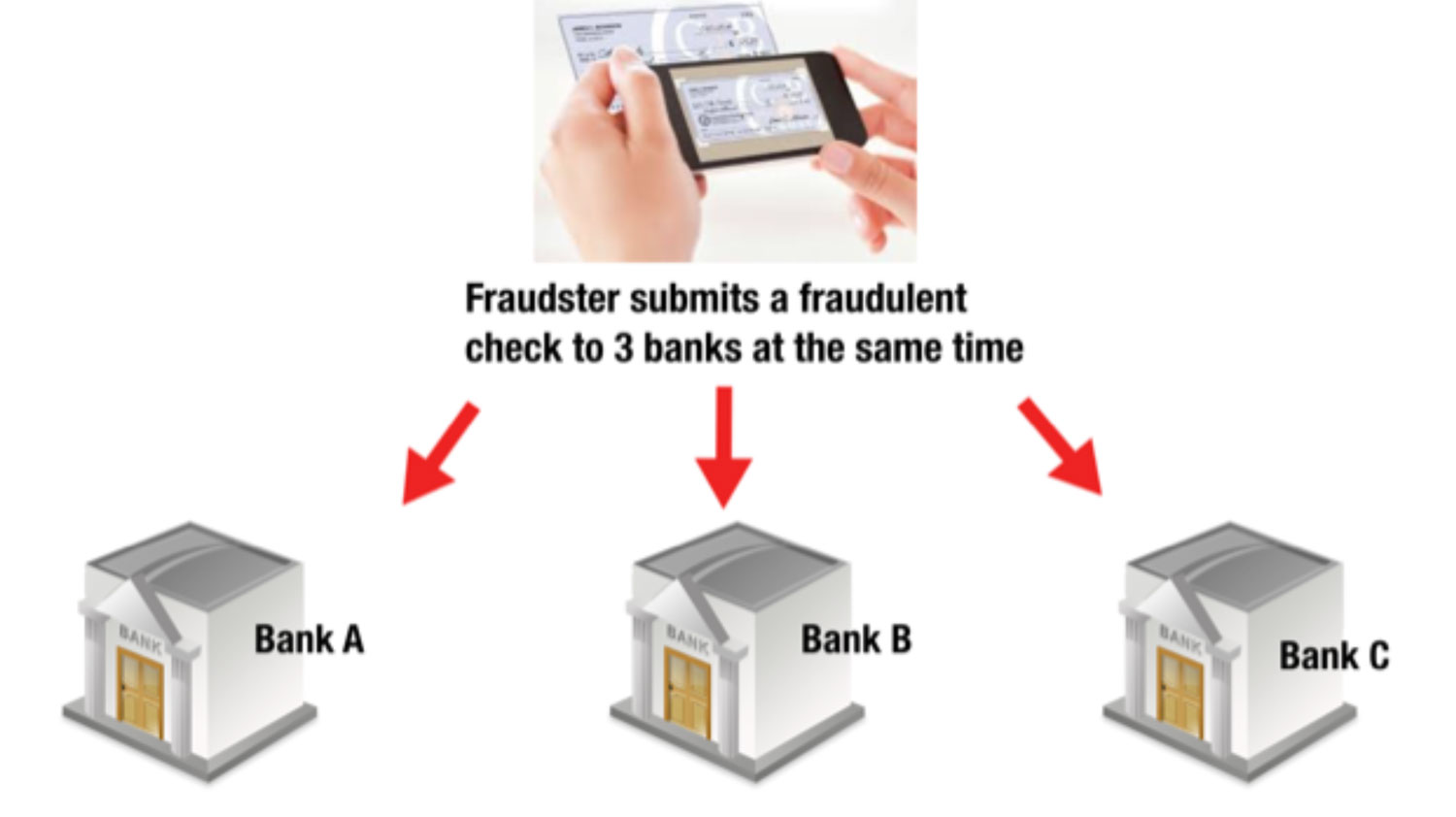

ShotGun Fraud is the technique fraudsters use to rapidly submit fraudulent applications, liar loans, small business loans or even counterfeit checks to multiple banks at the same time in the hopes that banks will simultaneously approve the item.

The scam works because many banking systems and credit bureaus take time to reconcile their systems and post new items. For example, a check may not post to an account immediately rather at midnight of that day so fraudsters could pass that check off to multiple banks or even cash the item at another branch before it is detected.

And credit bureau tradelines will not post to a person’s credit bureau for 30 days giving a fraudster a month to apply for many loans before a bank is notified.

Fraudsters have anywhere from 3 hours to 30 days to carry out a successful ShotGun Fraud Scheme. Fraudster take advantage of slow processing times to steal from banks and lenders.

There are 2 primary ways that criminals use the ShotGun technique to steal from banks.

Check ShotGunning – Depositing the same check rapidly to many different banks through their mobile phone since banks may not post the check until Midnight to the account.

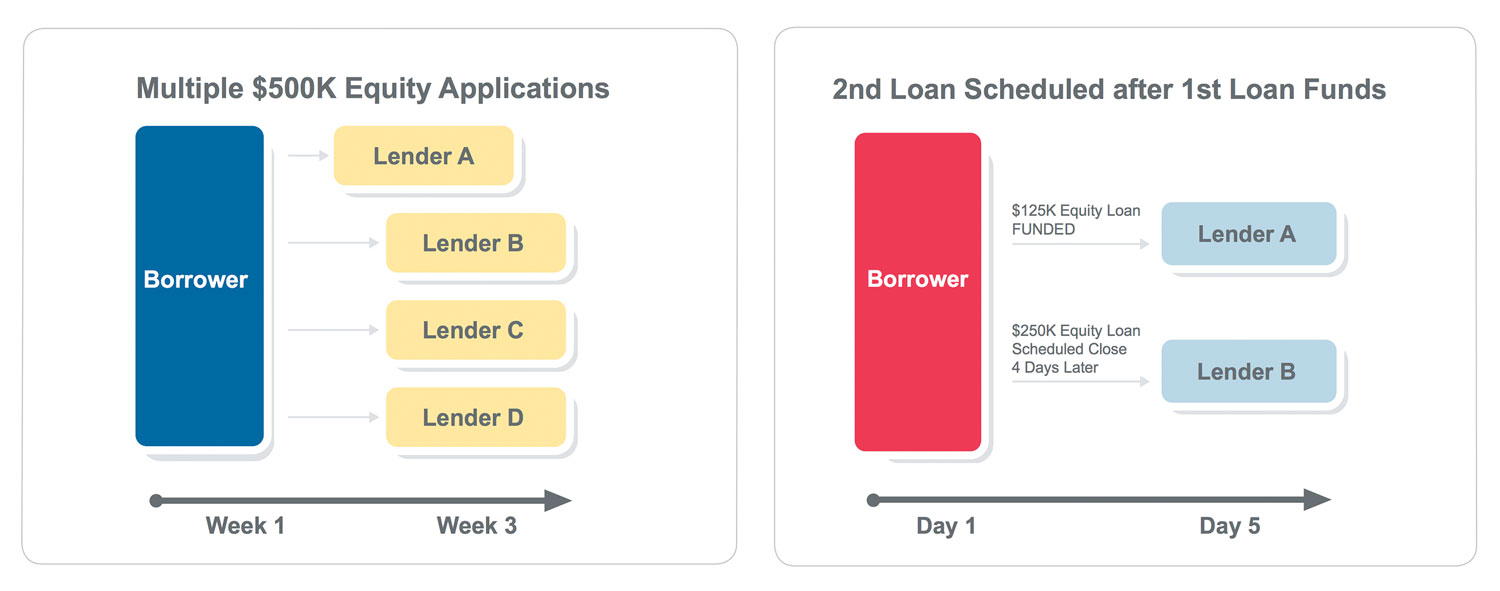

Home Equity ShotGunning– Applying for multiple Home Equity loans from many banks simultaneously to take advantage of the fact that the credit bureau tradeline will not appear for 30 days and banks won’t know the equity in the home has already has a lien against it.

The combined losses from ShotGunning fraud is well over a billion dollars annually here in the United States

Home Equity Loan ShotGunning Emerged in 2004

Home Equity ShotGunning really accelerated in the United States in 2004 at the height of the mortgage boom. Property values were soaring. Millions of homes that were highly leveraged, suddenly had tens and thousands of dollars in equity that could be extracted by borrowers.

The high level of home equity was perfect kindling when combined with the lax lending standards of banks at this time. It was a perfect storm of fraud; lots of eager fraudsters wanting to cash in on new found equity in their home, and greedy banks that were willing to do anything to loan them the money so they could sell the loans off to investors.

Shotgunning emerged when fraudsters realized that Banks and Lenders underwriting processes were ripe to take advantage of. In some cases lenders didn’t even validate that the borrower was the rightful owner of the property and took the borrower’s claim at face value.

In other cases lenders relied on letters from borrowers that the rash of inquiries that appeared on their credit bureaus from other home equity lenders were merely them “shopping around” for the best rates.

CoreLogic a data and analytics company in Orange County was the first company to recognize the problem and educate the industry on the risk associated with this scheme.

Typical Home Equity ShotGun Fraud Flow

When the floodgates of Shotgunning fraud opened it hit the mortgage industry hard with hundreds of millions of fraudulent home equity loans originated.

And lenders were left holding the bag. Since multiple lenders were lending on the same property at the same time some properties had 10-15 separate liens placed on them. Those lender never recouped a penny since the mortgage market tanked, and most homes were underwater.

An individual can easily extract $1 – $2 million on a single $250,000 residence, providing ample incentive to attempt the fraud. CoreLogic

California was the hardest hit as fraud rings in Glendale and San Jose assembled groups of industry insiders including brokers, appraisers and agents that worked in cahoots with straw borrowers to hit the industry for millions of dollars a day in fraud.

The Mortgage Industry Turned to Fraud Consortiums

The only real solution to shotgunning is data sharing. Banks and lenders sharing data with each other to alert other banks when they are receiving applications simultaneously to each other that might cause them both to lose.

So Corelogic created an immensely popular program called the Multi-Closing Alert Program which shut the door on fraudsters almost immediately. The top 9 banks in the country got together and began sharing data with each other on applications that they were about to close and fund. CoreLogic would notify banks when it appeared that other applications for loans were about to close with other lenders.

Lenders could simply pick up the phone and contact the other lender to verify if they were about to close on the same property. It worked beautifully. Shotgunning fraud was eliminated almost entirely by those banks and the fraudster shifted to smaller banks. The consortium grew to most banks in the US until the fraudsters had nowhere else to go.

Fraudsters Shift Their ShotGunning to Mobile Check Deposits in 2011

It’s a good thing for fraudsters that Banks keep coming up with new and innovative ways to make things convenient for customers.

And nothing seems to be more convenient for customers than being able to deposit their checks right from their mobile phones rather than trudging down to the ATM or the Teller window.

According to studies, Mobile Deposits (sometimes called remote deposits) are expected to surpass 1.5 Billion checks in 2016. Proof positive that customer love this service from banks. Mobile Deposit has come along way since USA launched the very first service back in 2009.

In 2011, some banks started seeing fraud creep in on mobile deposits. Since consumers didn’t need to physically pass the check to the bank, rather take a picture of it, the check was able to be deposited multiple times to multiple banks merely by submitting it frequently.

Fraudsters saw this opportunity and quickly moved from Home Equity Shotgunning to Mobile Check Deposit Shotgunning and it was extremely lucrative.

Consumers were the first to notice such as Louise Rosales whose story was told by Bob Sullivan in his article titled “The next fraud wave: When banks cash the same check twice, you might have to pay”

It happened to Louise Moon Rosales of Vermont. Twice in the past year, she wrote checks to pay for small services such as yard work. Both were cashed…and then cashed a second time a few months later. Her bank honored both payments. For example: a $100 check she wrote to a high school student for yard work was cashed in December, and then again in April. How?

The student used a new, popular checking account tool called “remote deposit capture” — he deposited the check with his cell phone. Check recipients who do that get to keep the paper check, rather than hand it over to a teller or an ATM. That means the check can be deposited a second time, a problem known in banking as “double presentment.”

“I totally could have missed it,” Rosales said. “If didn’t use Quicken I would have….I use online Quicken to reconcile the accounts, and that is how I found it.”

Mobile Deposit ShotGunning Fraud Approach $1 Billion in the United States

According to reports, 67% of banks are now experiencing mobile check deposit fraud in 2016. And the growth in Mobile Deposit Fraud Reporting is skyrocketing, approaching 400% in the last year alone as more banks experience this fraud more often.

ShotGunning, the most popular form of Mobile Deposit Check Fraud is one of the largest reported fraud types is estimated to be a whopping $864 Million in Annualized Losses.

Fraud Consortiums Come to the Rescue Again

To solve the problem, banks turned to lessons learned from other industries on how to solve fraud – data sharing.

Two companies lead the charge to fill the need EWS and Fiserv. Each of these companies offered a solution which allowed banks to share information on checks that were deposited with each other anonymously. If it looks like the same check was deposited in another institution, banks could be alerted in realtime when the deposit was being made.

While these solutions are receiving rapid adoption, the fraudsters are quickly adapting their behavior as they did with mortgage lending and are attacking banks that are not sharing their data since they are the weakest link.

Online Lenders Are Now Battling the Same Problem

In 2016, Online Lenders began to notice the problem of ShotGun Fraud from many small businesses. The practice which is called “Loan Stacking” occurs when multiple lenders make the same loan to borrowers in a short period of time without understanding the borrower’s increasing debt obligations and deteriorating credit quality.

As Online Lenders race to get more business, they are using algorithms that can help speed up the underwriting process. Fraudster have figured which credit bureaus the lenders use and they know that information between the credit bureaus may be different. By carefully timing and submitting loans to various online lenders simultaneously, borrowers can manipulate the lenders into lending far more than the borrower qualifies for.

Fraudsters will Never Stop, So You Shouldn’t Either

I think the case of shotgunning fraud is a prime example of why you need to constantly evolve strategies and constantly invest in new tools while relying on data sharing and fraud consortiums.

Fraudsters quickly learned that mortgage lenders were actively sharing data to stop Home Equity Shotgunning and quickly moved to Mobile Check Deposits.

So what’s next? We know the fraudsters are already scheming their next play. So what do you think it is.

I’d love to hear from you.