A new study by ID Analytics finds that a special form of identity theft called “Synthetic Identity Fraud” has doubled in size since 2011.

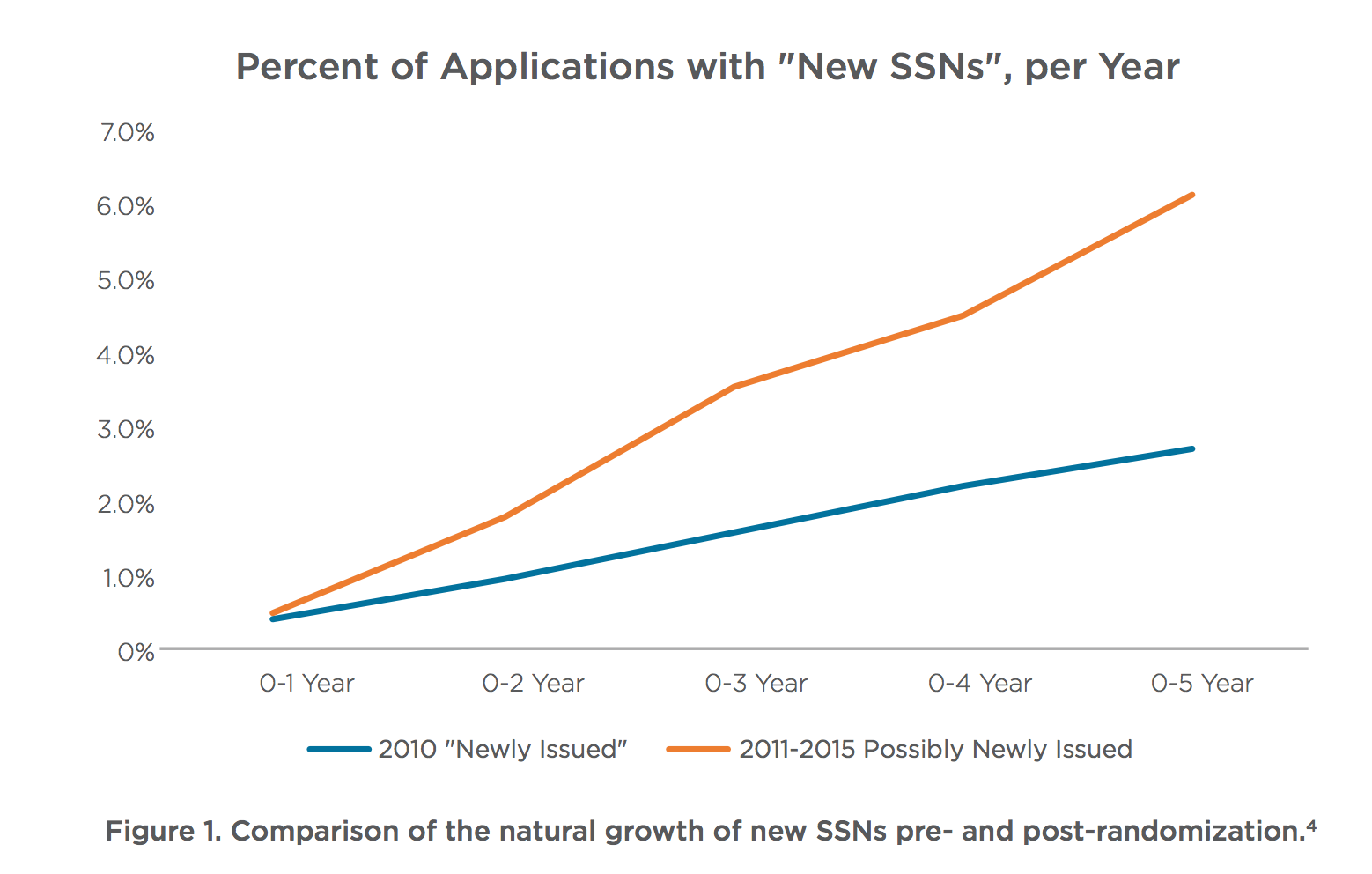

In a press release today, IDAnalytics announced that since the randomization of social security numbers (SSNs) in 2011, the number of new SSNs appearing on applications within their ID Network more than doubled.

The randomization of SSN’s made it harder for banks, lenders and finance companies to verify that an SSN was issued around the time of the borrower’s birth. Since randomization essentially made these algorithms and flags meaningless, the fraudsters took advantage.

It’s another case of fraudsters changing behavior to adjust to new rules designed to prevent fraud in the first place.

ID Analytics Identified 3 Types of Synthetic Identities

ID Analytics identified 3 primary types of synthetic identities in their study.

- Traditional Synthetics: One of the earliest forms of synthetic fraud. Fraudsters create these synthetic identities using valid information taken from multiple real consumer victims – most importantly a real, stolen SSN – and combine the information to create a single fake identity. For example, the synthetic might have a real, “shippable” address and a valid SSN, but the SSN, name, and date of birth combination do not match with any one person.

- Manipulated Synthetics: Synthetic identities based on the applicant’s real identity where only the SSN is changed. These are used by individuals to avoid their past history and gain access to credit. They are true consumers, rather than career criminals, but still, pose a risk to lenders.

- Manufactured Synthetics: A new form of synthetic fraud that remains unsolved. These are synthetic identities composed of invalid information including SSNs which fraudsters choose from the same range of numbers the SSA now uses to randomly issue SSNs, making them impossible to identify as invalid with current techniques. The personally identifiable information (PII) used to create the account does not belong to any known consumers. Fraudsters cultivate the identities, developing credit histories over time—initially appearing as new-to-credit consumers. They can operate for years undetected before they max out their credit lines and disappear without a trace.

Features of Synthetic Identity Within The Network

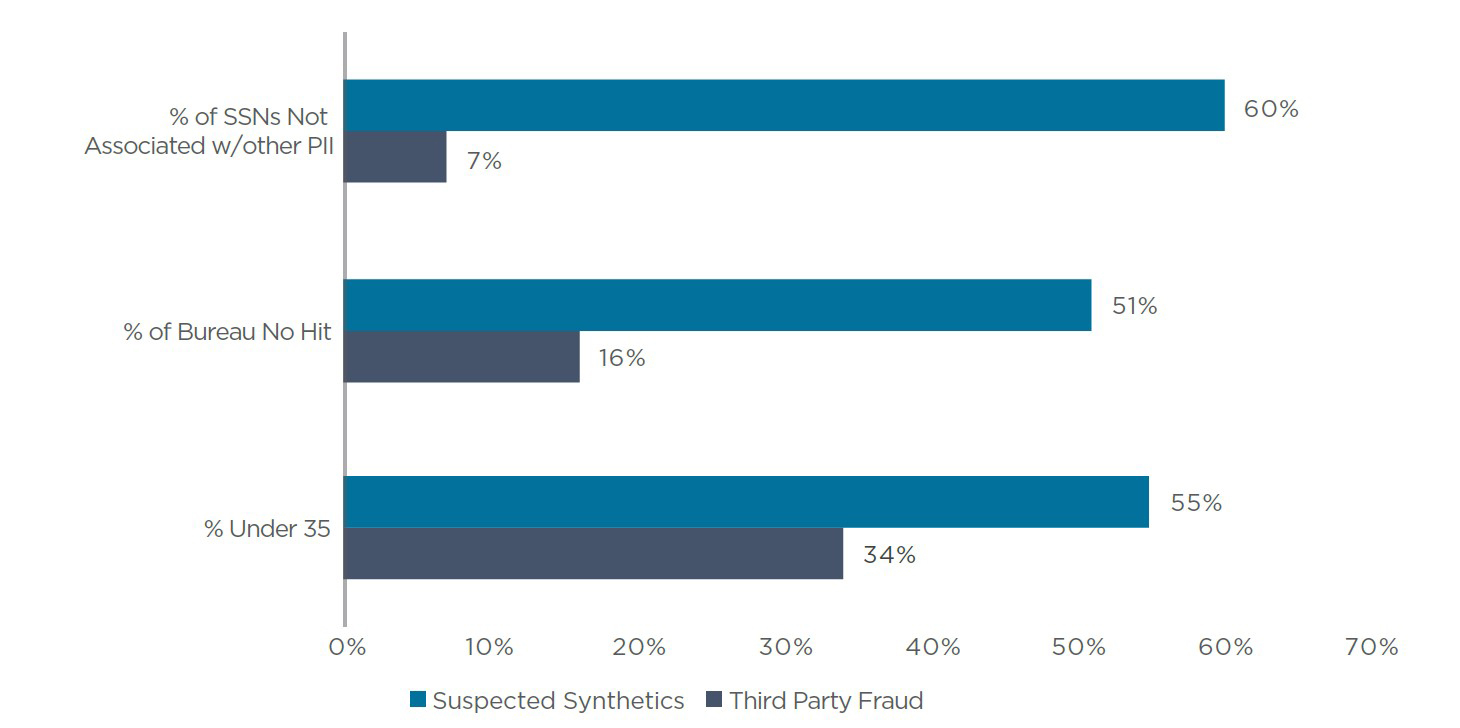

ID Analytics reviewed the patterns of synthetic identities and compared it to traditional identity theft with a social security number and found some marked differences.

Synthetic identities tended to not have any other matching PII information, they did not appear on traditional credit bureaus and the applicants appeared to be much younger.

Download the WhitePaper

I downloaded and read the entire white paper. I found it fascinating with some compelling analysis of this growing fraud trend. I consider ID Analytics the leader in the industry in this space and they offer the most insight into these types of trends and patterns in identity fraud.

You can download the whitepaper here – Changing Pattern of Synthetic Identity Fraud.