There is a property binge in China and people are so afraid of missing out on the gold rush that they are lying on their applications.

Since 2012, property prices have been on a tear as the economy has improved and the government has offered incentives to help people get into homes.

has improved and the government has offered incentives to help people get into homes.

They lowered down payment requirements in certain cities and cut the taxes to buy homes.

That has fueled speculators, investors and anxious buyers who all are vying for the same properties.

The prices just keep going up and the statistics are mind-boggling.

- China home prices have more than tripled from 2000 to 2015

- In 2016 home prices rose 12.4% on average

- Some estimates say house prices have doubled in major cities in the past two years

- 33 cities have price appreciation of over 45% in 2016 alone.

50% of Property Sales Have Some Type of Fraud

In China, mortgage fraud is not called fraud or even misrepresentation – instead, they refer to it as “repackaging” to make it look good.

Income Fraud is Rampant

In China, banks allow buyers to extend their debt to income ratios to over 50%. This creates massive affordability issues and many borrowers make less than in income than their mortgage payments.

As a result, borrowers misrepresent their income by 300% or more and produce fraudulent income certificates from their “employers” to support the exaggerated income.

Banks rarely check income documents even when they are provided in the loan documents.

Multiple Contracts Fraud To Hide Fraudulent Down Payments

In China, borrowers must put down 30% of the purchase price to get a loan with a bank. This has resulted in multiple mortgage contract fraud where the seller and buyer draw up multiple closing contracts – a real one and fake one to fool the bank.

Fraudulent Appraisals and Coaching from Real Estate Agents.

Anxious to keep the bubble going as they make record profits, industry insiders are helping borrowers game the system.

Appraisers and real estate agents report that industry insiders are regularly gaming the system by inflating the values of the homes, coaching borrowers on how to manipulate their income and helping the buyers and sellers draw up multiple contracts.

A property investor surnamed Fu, who declined to give his full name because he was admitting criminal behavior, told Reuters that 20,000 yuan (about $3,000) in a traditional red gift envelope was enough for a valuation company to inflate the price of the apartment he wanted to buy in Shenzhen by 40 percent. Reuters

Everyones Doing It

Property real estate agents indicate that everyone is doing it. In interviews with 12 real estate agents all had admitted to helping borrowers commit fraud. Another indicated that 50% of mortgage deals involve fraud.

When everyone is doing it, it’s hard to arrest everyone.

It Resembles the Housing Crisis in the US

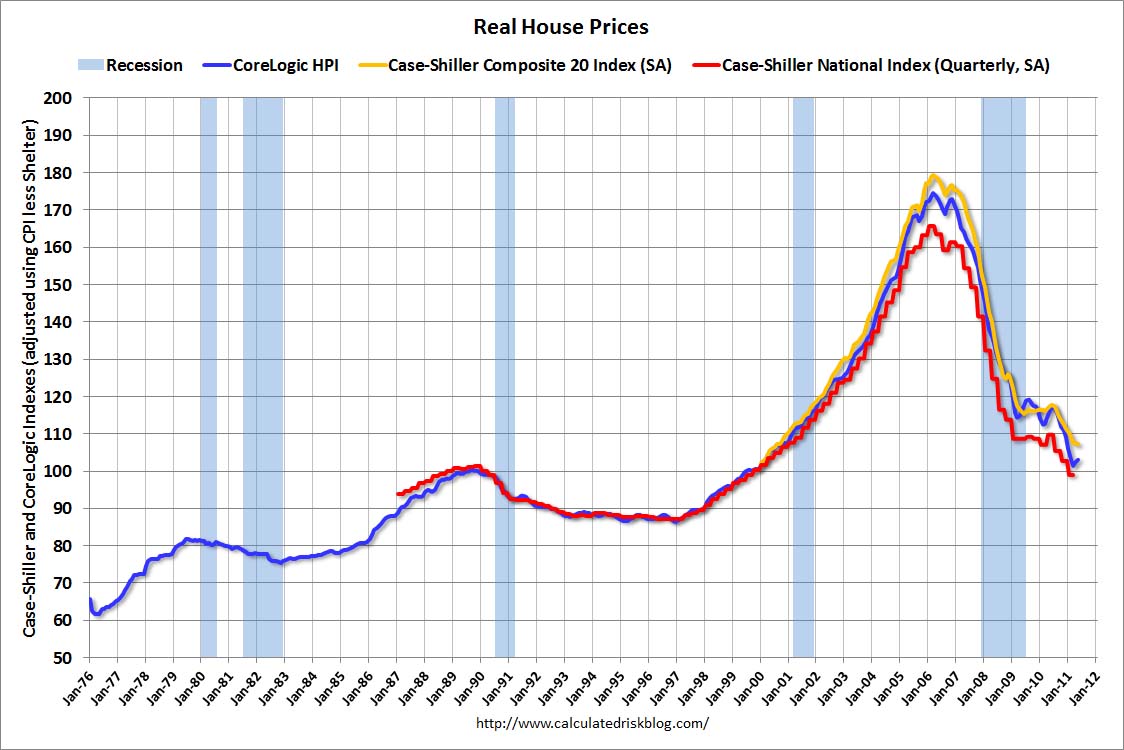

For many, the Chinese housing market and fraud bubble resemble the mortgage crisis that began here in the US in 2007. From 1999 through 2007 the US housing prices increased dramatically.

That 8-year cycle seems very similar to what is currently happening in China now. As housing prices in the US increased lenders loosened their standards, appraisers fraudulently inflated values, and both mortgage brokers and borrowers just about lied on everything on their applications.

It Will Crumble Soon

There are indications that the bubble will burst soon. The overheated market is not sustainable and with so many of the deals involving fraud, the crash will have a devistating impact on the economy.

Borrowers are essentially using banks money to speculate on the housing market. That is gambling and that never works out.

Thanks for Reading!