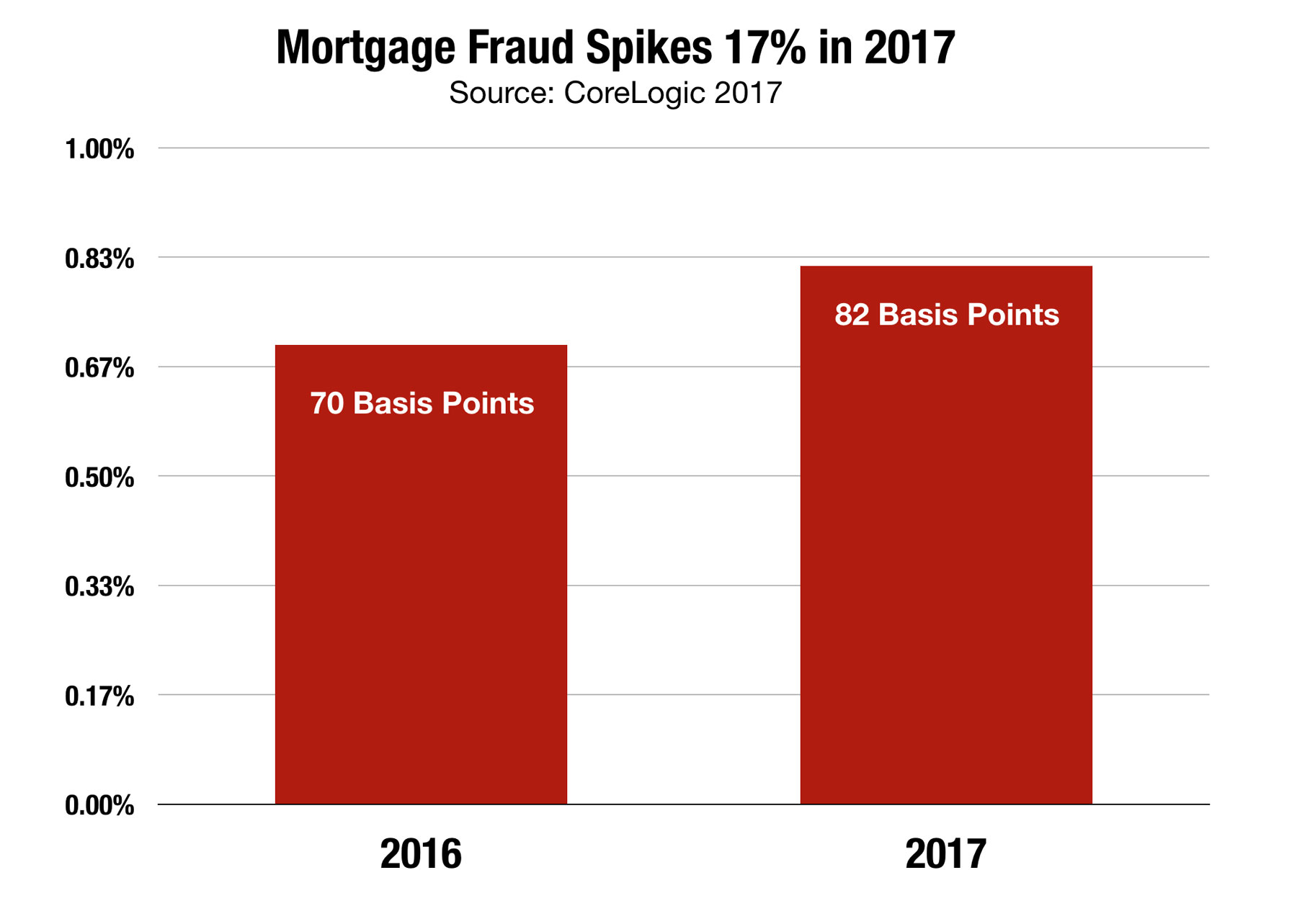

CoreLogic released their latest Mortgage Fraud estimate and determined that a whopping 82 basis points of applications contain some indication of fraud.

That’s surprising, considering just how diligent mortgage lenders are in verifying and scrutinizing just about every piece of information that a borrower files to get a mortgage.

How come borrowers continue to lie on their mortgage applications even when lenders are likely to discover it?

The biggest drivers of the increase in fraud according to CoreLogic where misrepresentations related to occupancy, income and transaction fraud.

With home values soaring, more borrowers are trying to finance investment properties by claiming that they are owner-occupied. As values of the homes increase, investors will flood the market trying to capitalize on flipping and other schemes.

And it doesn’t appear that the increase in fraud due to soaring home values is going to slow anytime soon. Bridget Berg, a highly respected expert in Mortgage Fraud expert advises that Home Equity Fraud may be the next shoe to drop.

This past year we saw a relatively large increase in the CoreLogic National Mortgage Application Fraud Index,” said Bridget Berg, principal for fraud solutions at CoreLogic. “If the factors that influenced the increase continue, including a shift to purchase transactions and growing wholesale-channel origination activity, it is likely that mortgage application fraud risk will continue to rise as well. Fraud on cash-out refinance transactions and home equity loans may become more of a factor in the coming years as home values and equity rise.”

Why is Mortgage Fraud So Hard to Detect?

Mortgage Fraud is notoriously difficult to detect. With advances in technology and the payoff for fraud being so high, fraudsters and unscrupulous borrowers are able to perpetuate their schemes under the radar.

Bridget Berg wrote an interesting article which originally appeared here – 5 Reasons Why Mortgage Fraud is So Hard to Detect.

Mortgage fraud is a relatively rare event.

Less than 1 percent of mortgage applications have material misrepresentations. That makes finding the fraud hard. But even though it is rare, it is costly and lenders can lose hundreds of thousands of dollars everytime it does.

Many mortgage frauds are undetected

In a strong economy with home prices appreciating, borrowers who committed fraud-for-property can probably stay current on their loans. As homes appreciate the borrowers can take out home equity loans to improve the property to increase the value or take out cash to continue to make the monthly payments that they could not afford in the first place.

Mortgage fraud is Cyclical

Bridget Berg indicates that falsified down payment sources, inflated income, and straw buyers were some of the more common issues leading up to the housing crisis. In the aftermath of millions of foreclosures, fraudsters shifted to loss mitigation fraud, such as short sale schemes, REO bid rigging, and loan modification scams. Fraud moves with the market and current opportunity.

No one likes to air their dirty laundry

When fraud is an “inside job,” financial institutions are very cautious about disseminating information about operational fraud issues. Because of this egregious frauds may go unreported and that leads to further losses down the line.

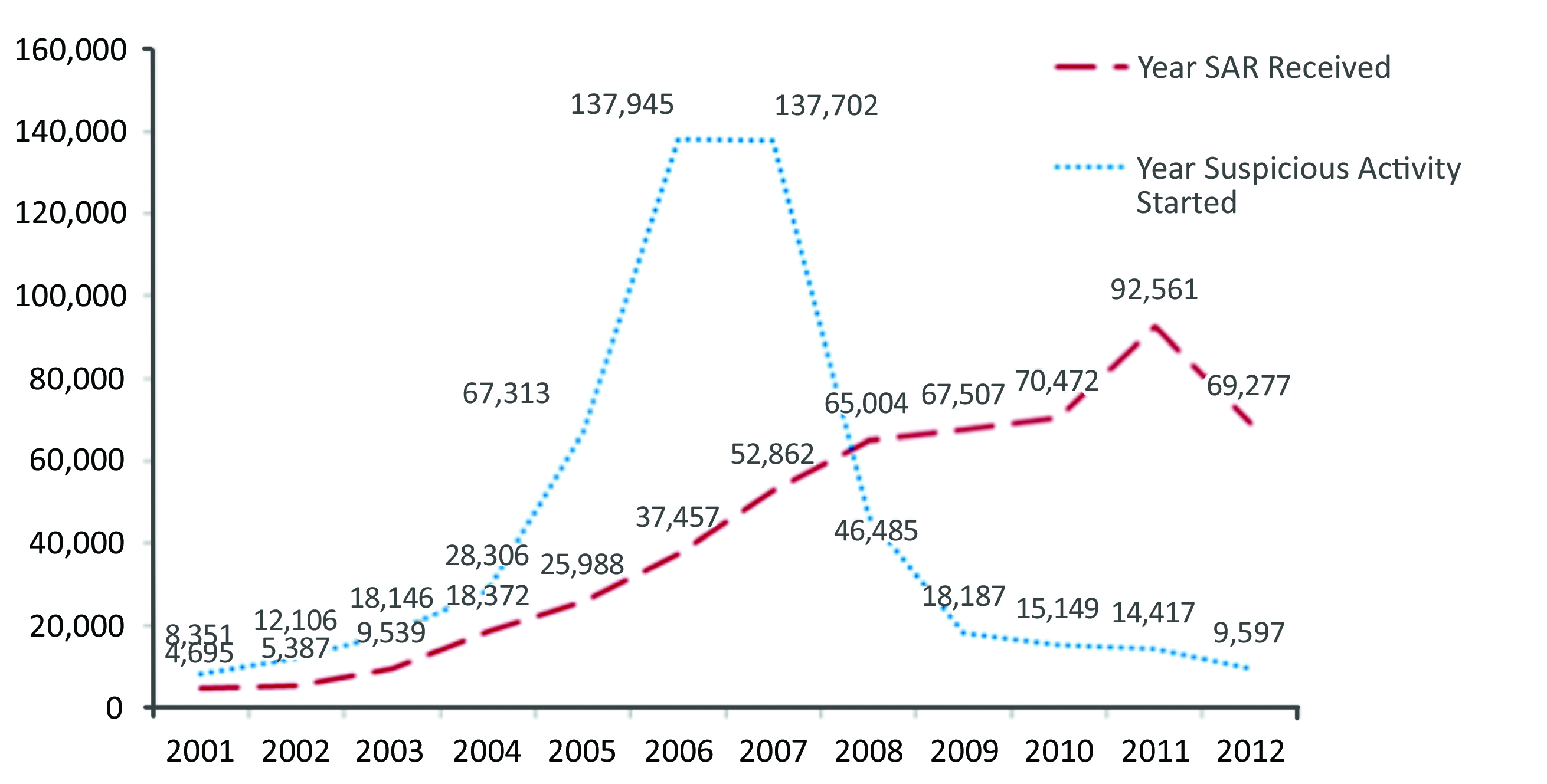

The lag between fraud activity and its discovery can be lengthy

Other types of consumer fraud tend to be “fast-moving.” Stolen credit cards are almost always used immediately. Check kiting is usually discovered in a matter of days. Since most mortgage fraud is “first party fraud” it may go unreported for months and even years. This lag in discovery means that mortgage lenders can be slow to respond to the latest fraud schemes until years later.

The Gap Between Activity and Reporting in Mortgage is Large