Is LifeLock Really Worth It? This is one of the questions I am most frequently asked by people when I tell them I am in Fraud Management.

So, if you don’t want to read any further. Here is my short answer – Yes! But, not absolutely always. The real answer is, it depends. If you want to continue reading on but that is the gist of what I think and I will explain it further.

Now Consumer Reports wrote an article that say’s that you don’t need LifeLock and Identity Protection Services. But I think their rationale was wrong. The said you don’t need it because most of the services you can go out and do yourself for a lot less money. This is flawed. Just because I can make a Big Mac doesn’t mean that I am going to stop going to McDonald’s to get it.

So let me start with the reasons, I think LifeLock is Worth it, then I will give a few at the end of why it is not necessarily needed for everyone.

Reason 1 – You Will Probably Be A Victim of Identity Theft At Some Point.

1 in every 20 US consumers will become victims of identity theft. That’s about the same odds as being a victim of a serious crime and it is higher odds than if you will be involved in a serious car accident.

With high odds like that, taking some precautions is just prudent. If you look high odds of becoming a victim, then yes, LifeLock is worth it. If you buy car insurance (which everyone does) than naturally LifeLock serves a similar purpose in protecting you.

Reason 2 – Hurdles Prevent Fraud. LifeLock is Just Another Hurdle for the Fraudsters.

You never want to be the only house on the street without locks on the door. And the same holds true for identity theft. There is something I like to call the “weekest link in the chain” principal and what it means is that fraudsters will always gravitate to the easiest target.

LifeLock is a hurdle. It makes you one of the houses on the street with a lock on your door so the fraudsters will pass you buy. This is the second reason I think LifeLock is worth it.

Reason 3 – It Actually Works. You’ll Be Less Likely to Be A Victim with It

Victims of Identity Theft are the only ones that understand the horror of being a victim. You can read this poor ladies 16 year struggle with Identity Theft here – Horror Story. It can cost thousands of dollars and more importantly waste hundreds of hours to repair your credit after you are a victim.

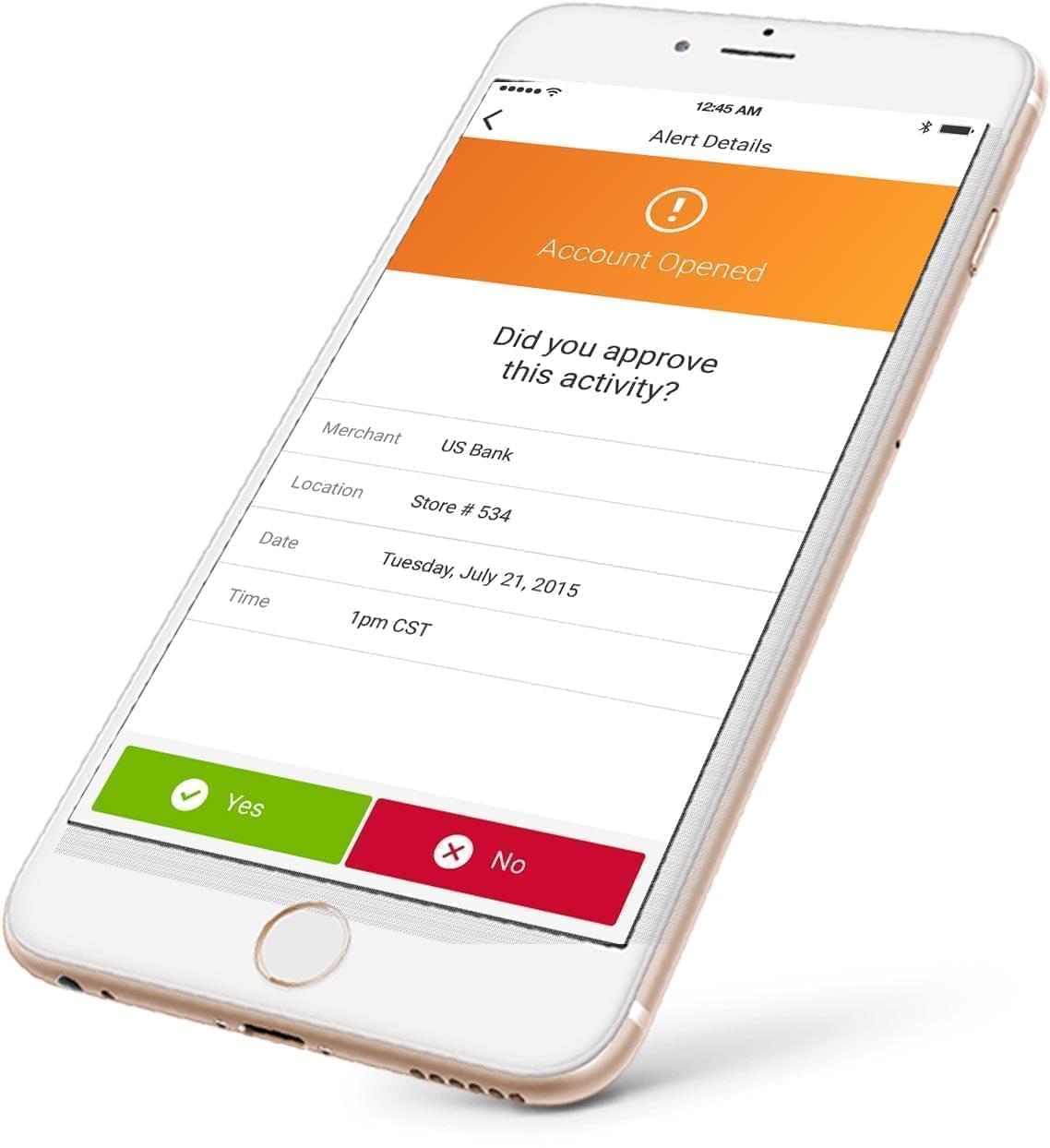

But services like LifeLock actually do work. LifeLock claims to scan 3 trillion data points and are able to immediately notify you when someone is applying for a bank account, credit card account or loan in your name. But the key to the service is not only in detecting the application in credit with your social security number but the alert service that will send you a notification and let you stop the application before the crooks gets away.

Reason 4 – If You Have a Fraud Attempt, How Else Will Banks Know How to Contact You?

This is a big one. My very first job in fraud management was investigating applications for credit card accounts and determining if they were fraudulent.

When an application was filled out by an Identity Thief, they would put their own phone number on the application so I would never know where or how to contact the real person. I had to spend 30 minutes to an hour using tools to try to find the legitimate customers true phone number. Often times I could not, and in those cases I was not able to alert the true customer about the fraud.

LifeLock takes care of that by providing a link between the bank and the consumer. Their slick system can automatically put the bank in touch with the consumer and get instant verification to alert them.

Getting an alert on your iphone that someone applied for a new account? That seems a great service to me.

Reason 5 – Because Even The CEO Uses It Confidently

People hated the ad. People thought it was irresponsible but when Todd Davis plastered his Social Security Number all over the world he was showing confidence in his product. It was one of the most successful ad campaigns in history.

I Thought This Ad Was Genius. It Not Only Caught Your Attention, It Showed You How Confident the CEO Was That the Service worked.

Reason #6 – It’s More Than Just Identity Protection

I had a chance to work with LifeLock about 10 years ago and it has come along way since those days. The service at the time (which cost about the same as it does today) pretty much offered 2 things; 1) they would put a victim’s statement on your credit bureau every year that would force a call from the banks to you and 2) they would give you insurance and assistance in the event you became a victim.

Today LifeLock is far more advanced offering a wide range of services for about the same cost. Some of those include:

- Notifying you of address changes on your accounts

- Notifying you when your data may have been part of a breach

- Searching for your card numbers on black market websites

- Identity Restoration

- Credit Monitoring

Reason #7 – Because You Really Can’t Or Won’t Do This Stuff Yourself

You know you can still go to your credit bureaus and place an alert on your file so banks are forced to call you. You could do that. You could save the $10 a month. But will you. I always say I will but I never do.

So the final reason that LifeLock is worth it is because it is convenient. Most people don’t have the time or willingness to do all the extra work to protect their own identities. With LifeLock you are really paying for the convenience and peace of mind above all else.

With LifeLock you are really paying for the convenience. Sure you could take the time to try to freeze your credit and manage that process every year but for $10 a month, sometimes it’s easier to have someone else manage that process for you.

So Why Would You Not Need LifeLock?

LifeLock isn’t for everyone. I for one thing a savvy consumer with a good bit of discipline can take necessary precautions and reduce their risk of identity theft on their own. So here are reasons that you would not need LifeLock

You’re Willing to Take the Risk – Your odds of becoming a victim are 1 in 20. That means a majority of the time you are safe. If you are ok with that, you are ok not having LifeLock.

You will be Reimbursed – Banks cannot legally charge you for fraud. So if someone applies for a loan in your name, you cannot be held responsible if you had no knowledge and did not participate at all in the transaction. So your financial pain could be minimal in the event you are a victim.

You Freeze Your Credit Bureau – Did you know you can lock your credit? You can, read it here. Although it can be a bit of a hassle it is a pretty good way to keep your credit locked down. Keep in mind though it won’t provide you with some of the auxiliary services that LifeLock and others provide.

But It’s Still a Buy

After all, is said and done though. I still recommend LifeLock. It’s convenient. It works. It protects you and even your kids. And I’m not the only one, Consumer Affairs has LifeLock ranked as the top ID Theft provider as well, Check out their ratings here – Consumer Affairs.

So for that reason, it’s still a buy in my book.