Is facial recognition the answer to the growing problem of Auto Lending Fraud? The largest bank in Brazil – Itau Unibanco – believes that it is and they have just launched a solution designed to drastically reduce their fraud losses.

The new solution, which is being launched this month across over 10,000 locations, is aimed at ensuring a smooth process when it comes to approving and releasing credit for customers who want to buy new and used cars.

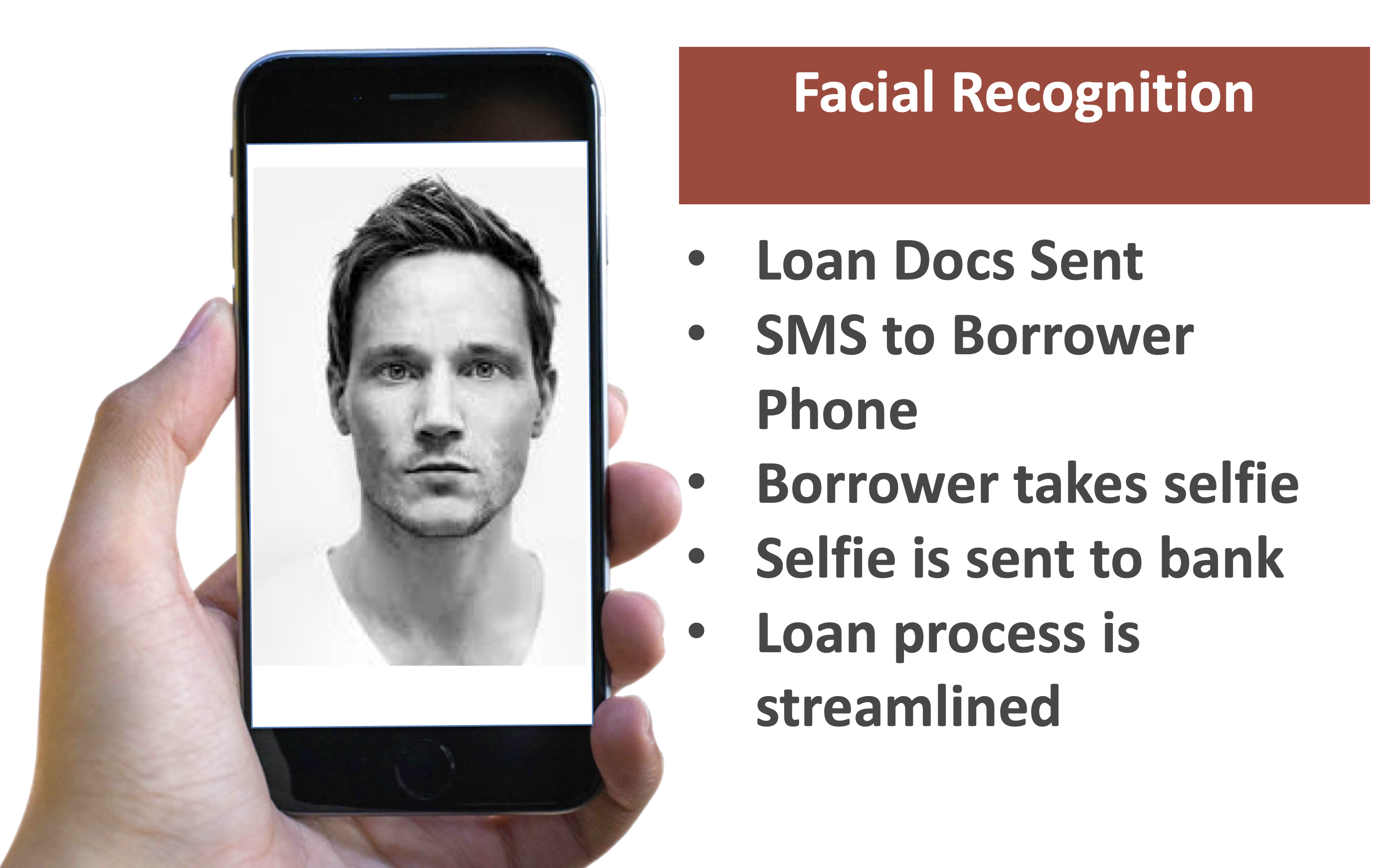

With the new technology, when customers submit their documents for a loan, the bank will send an SMS text message initiating a process for the borrower to take a selfie with their phone and then send the selfie to Unibanco.

When Unibanco receives the selfie, they will use artificial intelligence and AI to identify the legitimacy of the borrower. The process is designed to improve the lending process and to speed up the funding of loans while reducing fraud.

“Investing in technology to develop innovative solutions aims to reduce bureaucracy in the process of buying and selling vehicles, improving the consumer experience and, consequently, the efficiency of the entire automotive chain,” says director at Itaú Unibanco, Rodnei Bernardino de Souza.

Will US auto lenders begin to use this same process? In the next 24 months, we might expect more lenders to adopt similar use cases.