I love it when senior executives take a stand against fraud and try to do something about it.

So when I read this article in Auto Finance Excellence – Roadblocks to Creating a Dealer Fraud Detection Network, I was pretty impressed with CEO Troy Cavallaro and what he has been trying to do.

He has been trying to get lenders to share their patterns of fraud with each other in Dealer Fraud Network. But it’s been hard and he’s been “unable to move the needle”. According to him, “Dealer fraud is more rampant than ever, but it’s really tough to assemble a group of lenders together to form a coalition to share the information,”.

When he say’s Dealer Fraud is up. He really means it. They have found Dealer fraud on 18% of their deals this year, which is up from 12% last year.

And they are not alone, lenders are across the nation are getting hit by massive auto dealer fraud schemes like this $7 Million Dollar Fraud perpetrated by one shady dealer.

As of October, Pelican has seen fraudulent dealer activity on 18% of contracts this year, up from 12% last year, Cavallaro said. The primary reason for the increase is that lenders are beginning to tighten or pull back from the deep-subprime space, leaving independent or smaller dealers with fewer opportunities

When you have 1 out of 5 deals with some sort of dealer manipulation on an application you can see why CEO Tony Cavallaro is interested in sharing fraud patterns.

And he is absolutely spot on correct when he thinks it will help stamp out fraud.

Fraud Consortiums Have Worked for Every Industry

I have spent most of my career working in industries to promote the idea of sharing patterns of fraud.

- Credit Cards -From 1997 until 2004, I worked at FICO in San Diego the company that created the first ever fraud consortium for credit cards that includes 80% of card issuers in US.

- Mortgages – From 2004 until 2011, I co-founded BasePoint Analytics and we created the first Mortgage Fraud Consortium sharing patterns of fraud across the entire lending industries.

- Auto Lending – And for the past 3 years, I have been working with another company we co-founded called PointPredictive to build the fraud consortium for auto lenders on dealer fraud.

So do fraud consortiums work? I let the results speak for themselves. Every industry that has adopted the approach has seen significant reductions in fraud by sharing their data and patterns of fraud.

The Round Robin Effect

The Round Robin Effect

Troy Cavallaro’s rational for creating an auto fraud network for lenders is based on the Round Robin Effect.

Shady Dealers like to hit lenders in sequence based on who they think they can most easily fool. They will round-robin their shady deals until they find one lender that takes the bite.

With a fraud consortium, lenders collectively put a stop to this by working to understand which dealers to more closely scrutinize.

PointPredictive Has Been Working On This Very Problem

I guess the reason I was most interested in this CEO’s fight for fraud prevention is because we have been working toward the very same goal at a company a few of us started called PointPredictive.

We have established an auto fraud network to let lenders share their patterns of fraud and risk with each other. Auto Lending is the only industry left that has not adopted this technique and I feel strongly that it something the industry should move towards.

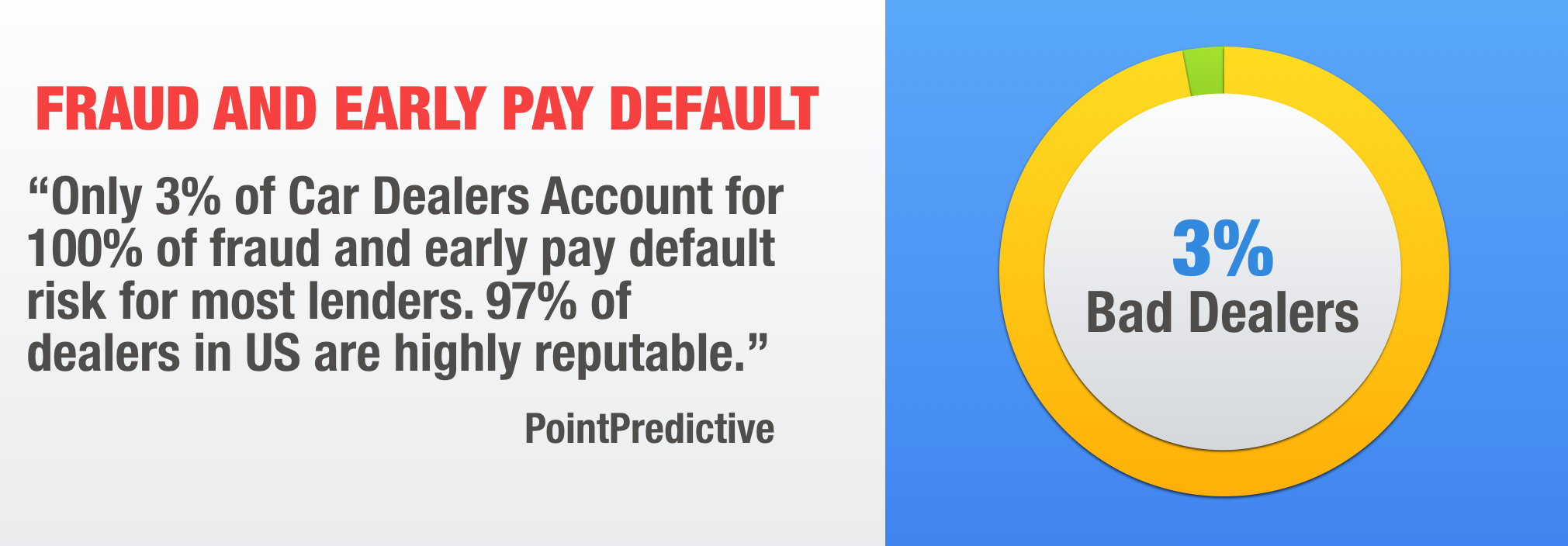

Most interesting to us is just how a handful of shady dealers can be responsible for a majority of the fraud. The most telling statistic is that roughly 3% of the 120,000 used and new car dealers in the US are risky for fraud. That is about 5,000 dealerships in the US and oftentimes that problem is from an individual finance manager working in that dealership.

And many agree with us. Top fraud experts from some of the largest lenders in the nation are banding together to take big steps against these shady fraudsters.

Keep Fighting!

As a fraud fighter myself, I can empathize a bit with something this CEO explained to Auto Finance Excellence, “If lenders don’t have a good defense, and a lot of fraud is getting through their system, they may not realize it’s an issue “They would think, ‘Well, we don’t even have that problem, so why do I need to participate in a lender network?’ They probably do have a problem, they just don’t realize it.”

I’ve been there myself feeling this way sometimes but I know that over time these practices that Tony Cavallaro is championing will become the way the auto industry works someday.

Keep Fighting Against Fraud!

Thank you for reading.