Her name is Maryann Miller. She lives in a small flat in the ultra hip Williamsburg New York but you will rarely find her there. Good luck trying to track her down. She could literally be anywhere in the world, and often is.

Maryann’s travel schedule is so intense that people have compared her to George Clooney in “Up in the Air”. She has traveled millions of miles on planes, camped out in hotels for thousands of days with a singular mission – To Stop Fraud Everywhere and Anywhere it Is.

And that is just one (of many reasons) that Maryann is my fraud hero. She is a Global Fraud Fighter unlike anyone I have ever met.

Maryann travels as frequently as Ryan Bingham, the character George Clooney plays in Up in the Air.

To Become the Voice of Fraud, Sometimes You Need to Stand on the Table and Fight for What you Need

In 1995, Maryann was working for a bank. The bank was starting to feel the pain of credit card fraud. Most of the industry was actually. Between 1991 and 1995 credit card companies watched their fraud losses triple from about 6 basis points to 18 basis points.

Things were getting bad across the industry and Maryann had had enough. She wanted the bank to do something about it. She wanted people to get serious about fraud and wanted the executives to invest money in a new fraud solution. But no one would listen.

Maybe it was because she was new to the bank or maybe it was because she wasn’t making her voice heard. So Maryann said, “What do I have to do to get my voice heard, jump on the table and yell for what I want?!”

As a woman executive in business, sometimes you have to yell louder to make your voice heard.

And so she did just that. To everyone’s amazement she jumped up on the table and said, “We need to get serious about fraud and get this system NOW!”

Maryann got that fraud system and the bank got serious about fraud. Over the next 20 years they prevented hundreds of millions in fraud thanks to Maryann.

We need to get serious about fraud and get this system now! Maryann Miller’s protest were heard and eventually saved the company hundreds of millions of dollars in credit card losses.

Maryann learned as a woman in business sometimes you need to scream extra loud to make your voice heard (particularly when you are talking about fraud which is something not all executives want to hear about)!

A Fraud Consultant is Born

After a few years in the bank, Maryann was offered a job as Fraud Consultant. It was her dream job. She was hired to help other banks figure out the best ways to stop the fraudsters.

Maryann bought her first roller bag suitcase that year. She was about to become a road warrior. Little did she know that she was going to be traveling across the world for the next 30 years literally and figuratively standing on tables to convince people to pay attention to fraud.

She Traced the Fraudsters from the US, to Canada, to the UK, to Latin America, Asia and Then the UK.

If Maryann’s job as a Global Fraud Consultant taught her one thing it was this. “Fraud Always Migrates. It Constantly Moves and Changes”. As fraud moved across the world, so did Maryann.

This not only gave her job security. It gave her triple platinum status on most airlines and large hotel chains. Starting in 1996 and for the next 20 years Maryann spent her days traveling all over the world helping banks, financial services companies, technology firms, solution providers and anyone else to help them stop fraud.

One day she would be helping a large credit card issuer in Canada deploy artificial intelligence algorithms to spot patterns of fraud on gas transactions. The next day she would be on a flight to the Netherlands to help a Bank tackle their growing problem of wire fraud.

Fraud, like wildebeest, migrates constantly. Maryann’s primary objective is to chase the fraudster wildebeest off a cliff and make them disappear.

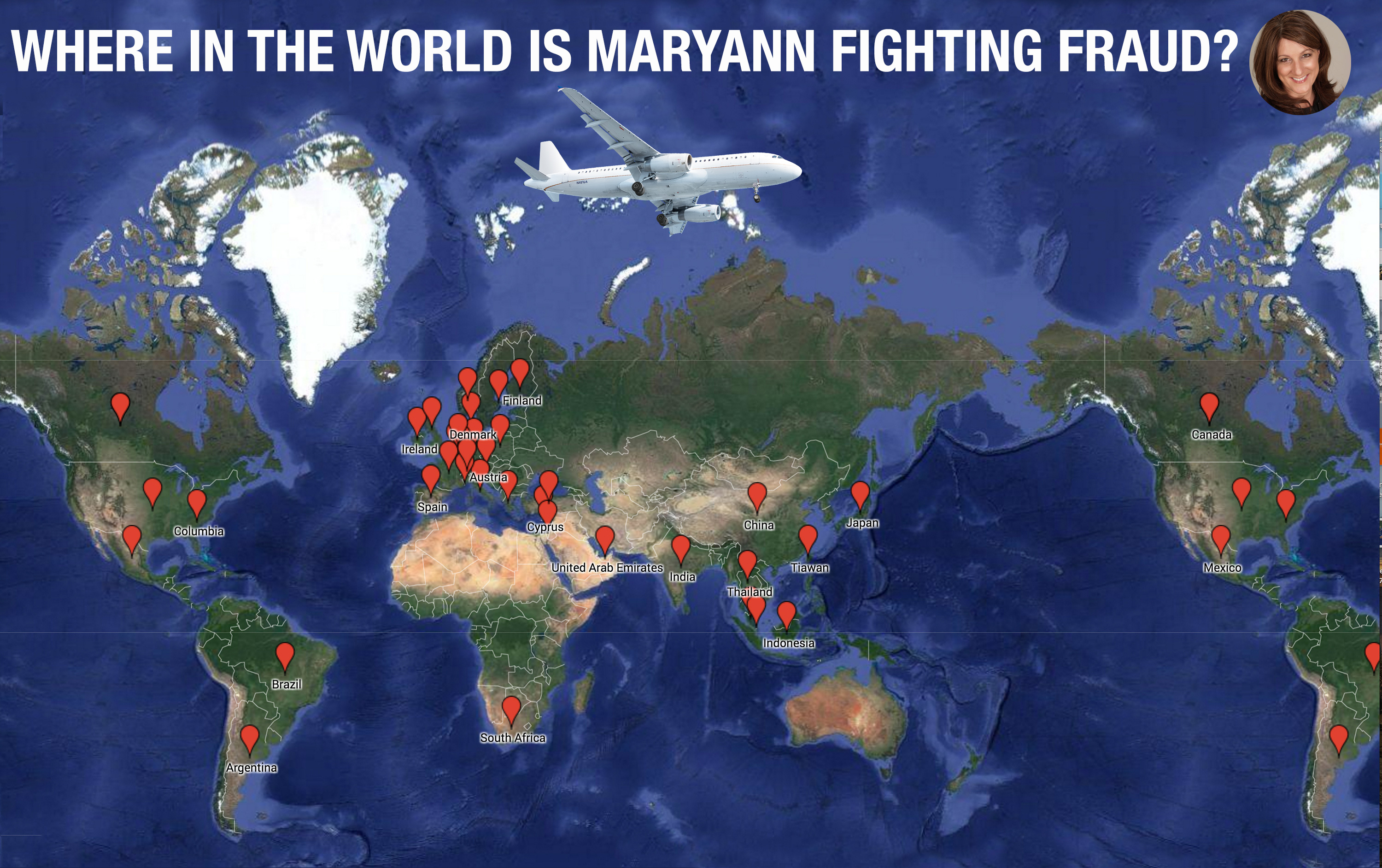

Fraud was growing and so was demand for her services. I always would laugh because when I would call her, I would ask myself, “Where in the World is Maryann”. It was always somewhere new and exciting.

By last count, Maryann had consulted with hundreds and hundreds of banks across 38 separate countries, often spending weeks and months in each country.

The countries she has fought fraud include (Australia, Argentina, Austria, Belgium, Brazil, Canada, China, Cyprus, Colombia, Denmark, Finland, France, Germany, Greece, India, Indonesia, Ireland, Israel, Italy, Japan, Luxembourg, Malaysia, Mexico, Monaco, Netherlands, Norway, Poland, Singapore, Spain, Sweden, Switzerland, South Africa, Taiwan, Thailand, Turkey, United Arab Emirates, UK and United States). That’s quite a list!

Currently, Maryann Thinks the Biggest Threat is Faster Payments and She is Telling it to Anyone That Will Listen

I always trust Maryann’s keen insight on where fraud is heading and she wasn’t afraid to let me know her next projection. Her next big battle is Faster Payments. The move to instant payments will have the greedy fraudsters licking their chops.

While she believes it is a natural progression for banks and countries to make the transition she is gravely concerned with the fraud epidemic that is about to be unleashed.

You can’t blame her really. She along with the rest of the UK banks lived through the nightmare of Faster Payments there in 2008. She watched UK banking losses double across the industry within months of their migration to faster payments.

Faster Payments Make it So Convenient for Consumers to Get Their Money Quickly But Oftentimes the Big Beneficiaries of Faster Payments are the Crooks and Fraudsters that take advantage of the banks inexperience.

Maryann thinks the Swift cyber attacks and the Small Business Wire Fraud Scams are just the tip of the iceberg and that banks have no idea what may hit them when global faster payments hits critical mass.

“There is going to be a day of reckoning” Maryann told me, “And it is going to hit some banks very hard. The level of sophistication and social engineering is growing every single day”.

Maryann typically doesn’t have to stand on tables anymore for people to listen.

The Three Pitfalls Maryann See’s When She Visits Banks

I often consult with Maryann myself to keep a pulse on what is happening in fraud. I asked her once, what were the common pitfalls that she see’s in organizations that are having problems with fraud.

She told me there are typically a few pitfalls that she see’s banks making.

Pitfall 1 – Senior Executives Not Understanding Fraud

Maryann says one of her biggest warnings is this, “Too often, I see executives pointing the finger and blaming fraud managers when they have losses. This is a mistake since fraud management is the collective responsibility of the organization. Executives often fail to see their part in it. They need to partner with their fraud leaders to make change” When senior executives don’t embrace fraud management in the organizational culture, the bank has problems.

Pitfall 2 -Banks Not Realizing They are in the Trust Business

Banks don’t realize it but they are in the trust business now. Consumers know about fraud. They are afraid of it. If banks can’t protect them, they will move. There is simply too many options to bank with an organization that cannot protect them adequately.

Pitfall 3 – Over Focus on Marketing and Credit Risk as The Only Drivers of Business Success

Banks are so focused on the big drivers marketing and credit risk that they so often ignore the silent giant – Fraud. Fraud can ruin any marketing business case and it can drive credit risk losses through the roof like we saw with the mortgage lenders here in the US. The impact of fraud is always missed because when it is managed correctly the losses are almost negligible. When they are not however, the results can be a disaster for a bank.

A Role Model for Women in Business

Maryann’s latest passion is not just fraud but in helping woman break the glass ceilings. Maryann was mentored by Peniah Thompson who authored “Every Woman in the BoardRoom”. Peniah helped Maryann navigate the waters of executive leadership which can be a daunting task for female executives.

You can read about her here – Terry Dial Terry moved up the ranks from the humble beginnings as a teller into one of the most noted bankers of her generation. Maryann wants to continue helping woman in business just as she was helped by her mentors.

The Voice of Fraud

To me, Maryann represents exactly what I like to refer to as the “Voice of Fraud”. That person that stands up and tells it like it is. It may not always be popular. So often it is not in fast growing sales organizations. But they do it anyway. Because it’s the right thing to do.

Thanks for reading the blog. Thanks for reading this story on my good friend and one of the most respected fraud people out there – Maryann Miller (Global Fraud Fighter)! You can check out her linkedin profile and connect with her here – Linkedin.