Fannie Mae has a program to alert lenders to employers that Mortgage Brokers use to facilitate their fraud schemes.

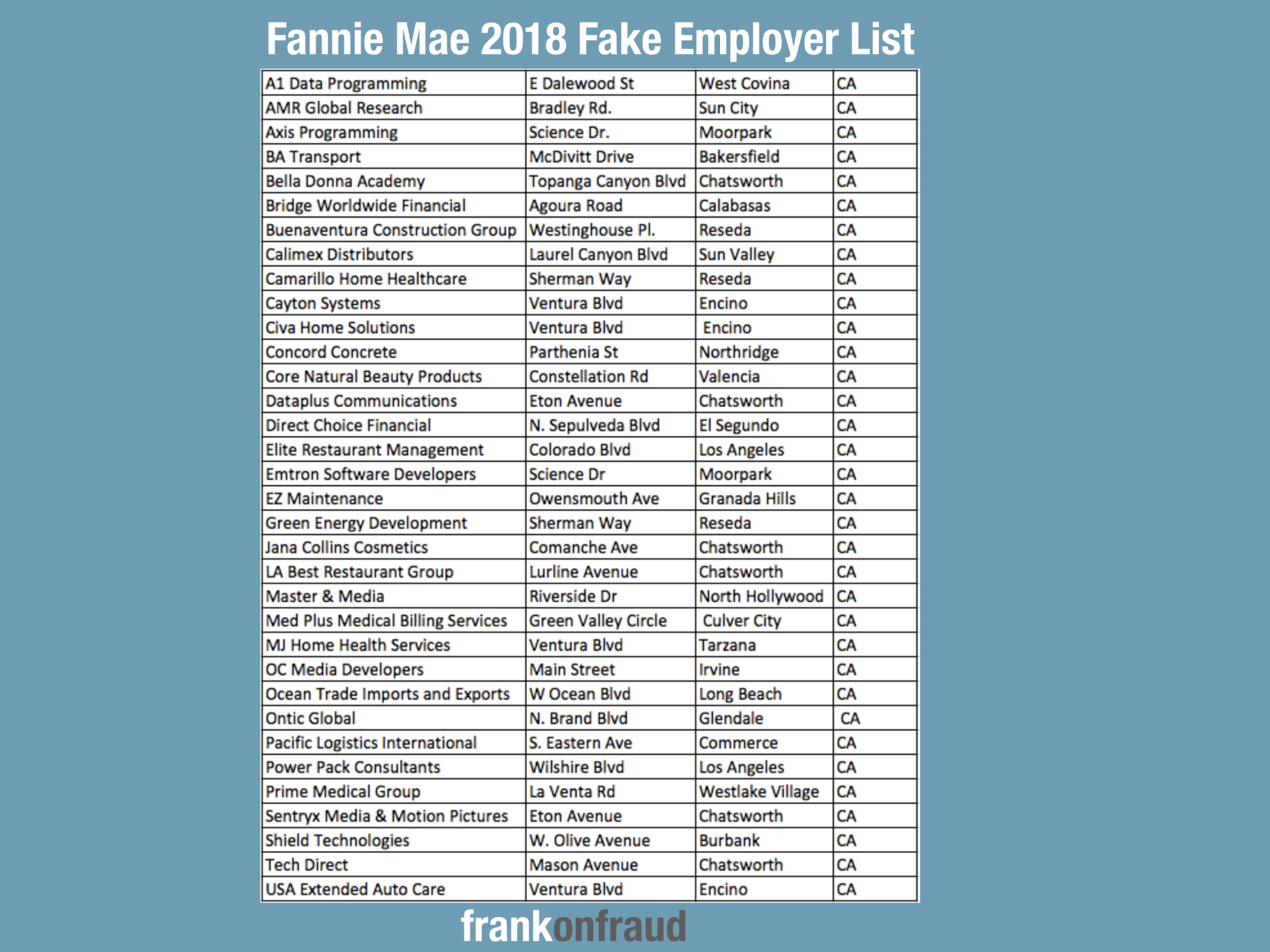

In 2018, they reported a list of over 30 employers that were involved in known fraud schemes and warned lenders to watch out for these employers on incoming applications.

Fannie Mae warned that if one of the above companies is listed as a borrower’s place of employment, lenders should exercise extra caution while reviewing the entire loan file.

“Lenders must exercise caution in these situations and take appropriate steps to prevent the institution from being the victim of fraud,” Fannie Mae said in its fraud alert.

Some of the red flags they warned, included TPO and broker loans, loans originated from 2015 to 2018, when an occupation does not seem to comply with a borrower’s profile, such as age or experience and loans originated in Los Angeles county.

The List Is Growing Now as New Employers Are Detected

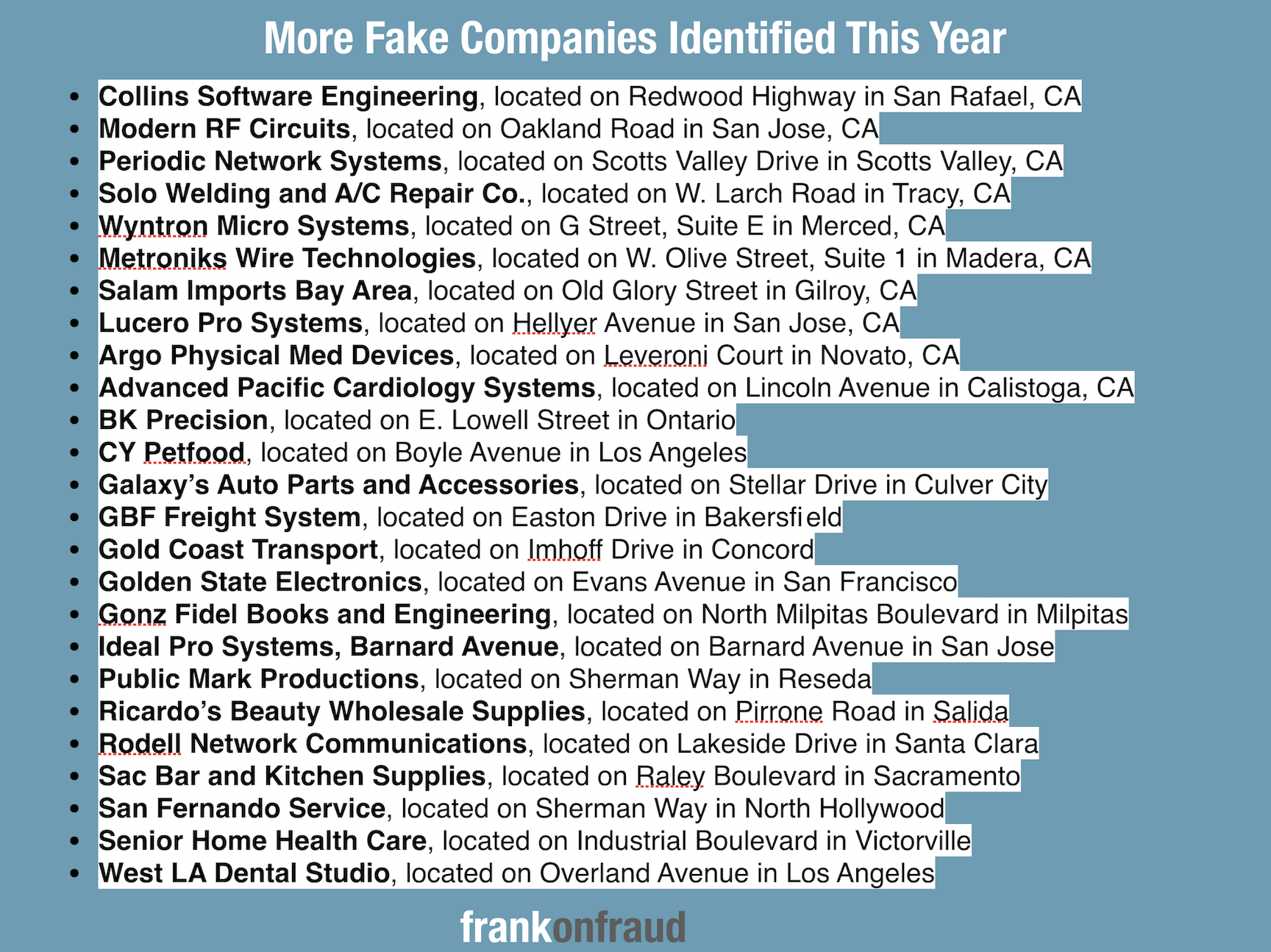

Fraud investigators at Fannie Mae have been busy. And they have identified another rash of fake employers that are being used on applications since their last posting.

To keep lenders alerted, they have issued a series of press releases and a new list. There are now over 65 fake employers that they have identified. They published this last in the last 2 weeks.

The list includes employers that are located in California. The vast majority are in Southern California, but they are now finding more employers in Northern California as well.

Red Flags Fannie Recommends Looking for Fake Employer Applications

In addition to scanning for these employers on every new application, Fannie recommends looking for other red flags that they have found to be associated with the employers:

- Third-party originated/broker loans

- Originated 2015–2019 (present)

- Employment (occupation) does not “sensibly” coincide with borrower’s profile (age or experience)

- California (geographic common denominator)

- Borrower on current job for short period of time

- Prior borrower employment shows “Student”

- Starting salary appears high

- Purported employer does not exist

- Employer’s purported location cannot be ascertained

- Paystub templates are similar for various employers across other (involved) loan files

- Paystubs sometimes lack typical withholdings (health, medical, 401(k), etc.)

- Gift letters are substantial and are not (or cannot be) supported through re-verification

“Verify that the borrower’s place of employment actually exists and obtain supporting documentation. If one of these entities is disclosed as the borrower’s place of employment, exercise due diligence in reviewing the entire loan file,” Fannie Mae continued. “Lenders must exercise caution in these situations and take appropriate steps to prevent the institution from being the victim of fraud.”