Imagine if you made $1 million dollars a year. You could probably finance any car you want if you could show your bank balance to the lender. Well thanks to new app its now possible, even if you only make $10 a year.

Auto lenders and car dealerships are the primary targets of these new apps which help borrowers fake deposits and balances and even credit scores to get approved for loans they shouldn’t.

Fake Deposits, Credit Scores and More

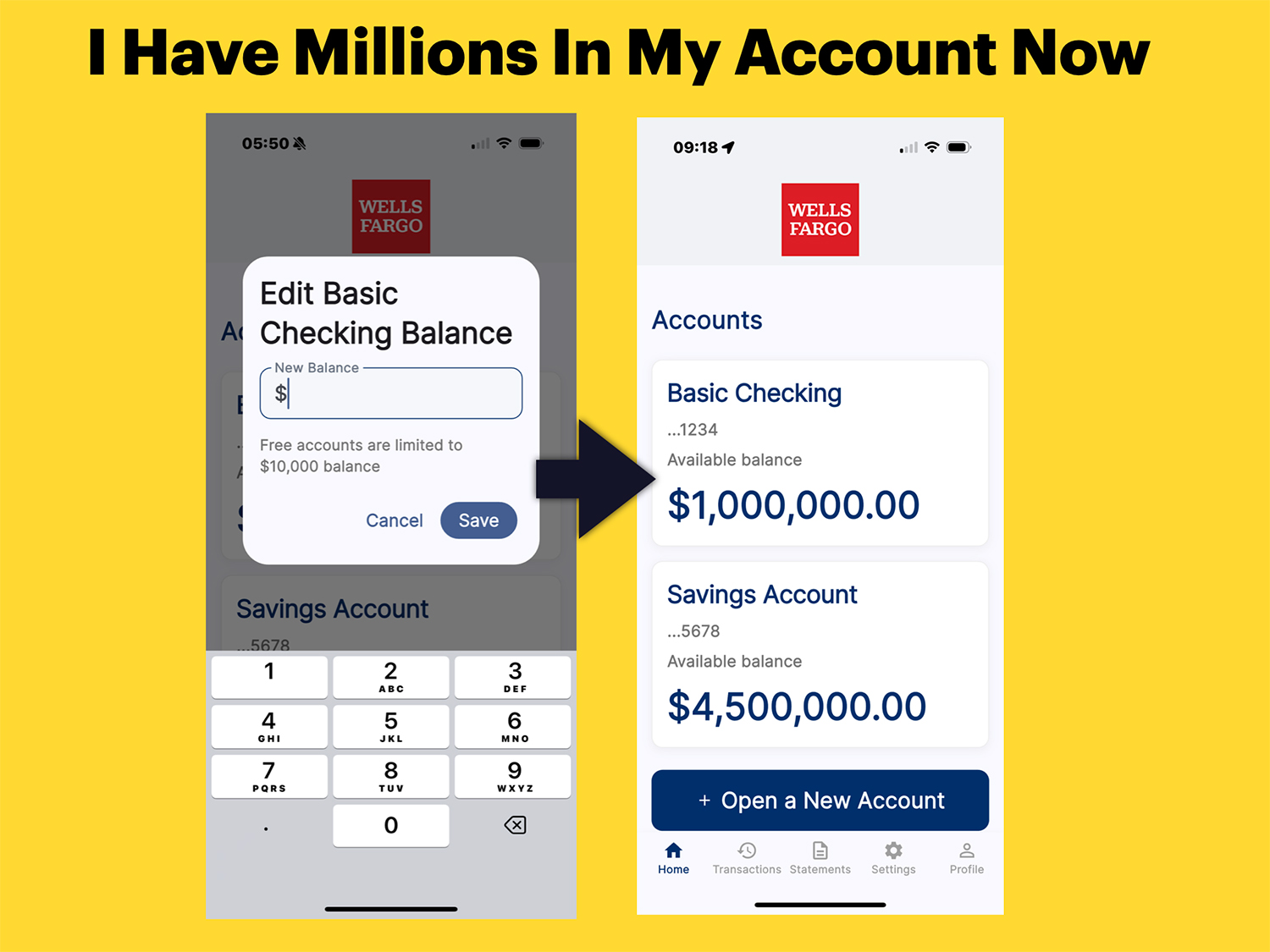

It’s called CustomBank and for the moment, it’s available on the App Store, and soon it will be available on Android.

The application enables anyone to upload a logo of any bank and then edit bank balances, deposits, withdrawals, statements and even their credit scores so they can use it to qualify for loans.

The app is technically free. But if a person wants to edit any of the screens or adjust the logo, they will need to pay $1.99 a month.

Within 5 minutes, I was able to create a realistic Wells Fargo app on my phone and manipulate it to make it appear that I had $1 million in my checking account, and $4.5 million in my savings account. The Wells Fargo logo gives it all an air of legitimacy.

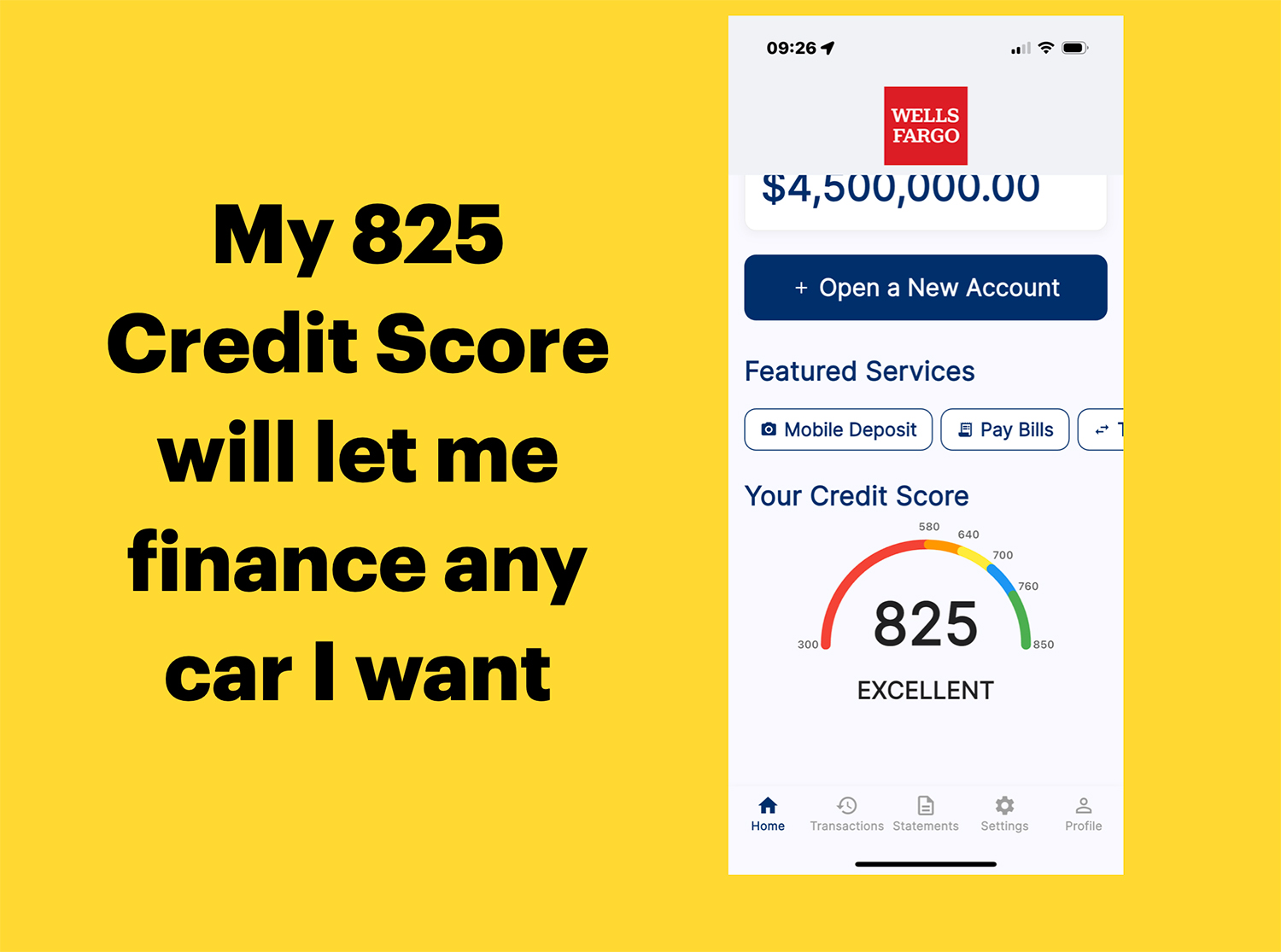

There are many other edits that a borrower can make to improve their financial health. Like updating their credit score. Imagine showing the dealer your 825 FICO score? You can be assured that you will get the white glove treatment.

Sure, the dealership will pull the persons actual credit and discover its not true, but there is no reason a criminal couldn’t flash this to the dealer and test drive the Lambo before stealing it.

Lenders and Dealers Are Already Reporting Income And Employment Fraud

Fake mobile apps are already on the streets, and car dealers and lenders are reporting a spike in use of these apps to get loan approvals.

Armed with the App borrowers are using the screenshots and PDF downloads that are available within the application to falisify their income and employment. A borrower can simply edit a payroll direct deposit for any amount from any company they create.

Lenders and dealers can no longer completely trust screen shots or bank statements that come directly from a borrower.

What Red Flags Lenders And Dealers Should Look For

With fake mobile banking apps gaining traction, auto dealers and lenders should be on high alert. There are several red flags and recommendations I would make.

#1 – Don’t Accept ScreenShots

If a borrower tries to send you screenshots of their mobile banking app as proof of income or employment that is a red flag. Don’t accept these screenshots. Insist the borrower uses solutions like Plaid or TurboPass where the documentation comes directly from the bank.

#2 Scrutinize Bank Statements Carefully

Bank statements provided directly from a borrower should be scrutinized carefully. There are tell tale signs of fakes. They are often generic looking and often contain mistakes related to dates, fonts or even amounts. Watch for any red flag and request direct proof from the bank when suspicious.

#3 – Watch for Shifty Activity

Borrowers using these fake apps will exhibit other tell-tale signs of fraud. They will very often be using out of state drivers licenses, have inflated claims of income, shop too quickly for cars and try to complete transactions as fast as possible.

When in doubt, verify. These apps are taking fraud to a new level!