We’re still bleary-eyed from the hangover of massive pandemic fraud, and here comes COVID Fraud 2.0.

The Employee Retention Credit (ERC) – sometimes called the Employee Retention Tax Credit, is a tax credit for businesses that were impacted by COVID shutdowns.

But the program is also becoming a big money grab by fraudsters and scammers.

Welcome to COVID Fraud 2.0. ?

Millions in Fraud Facilitated By Unscrupulous Players

The ERC program, much like the PPP and EIDL programs did, has spawned a cottage industry of accounting and tax firms that are trying to help Americans get some of that government money.

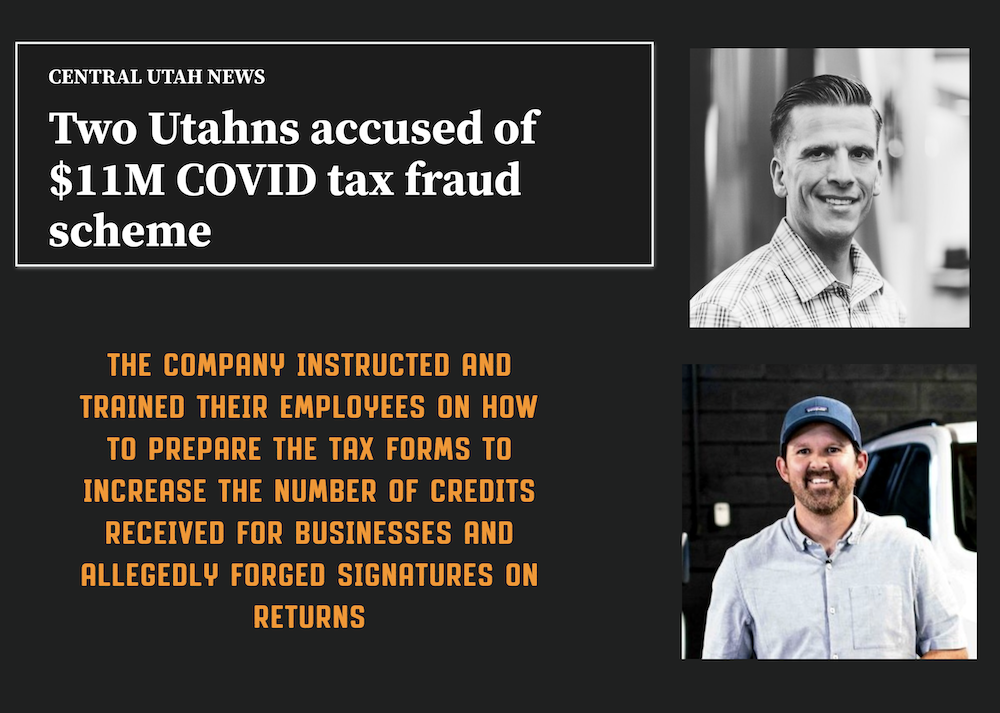

And some of those firms have been accused of fraud. In February of this year, COS Accounting and Tax was accused of submitting more than 1,000 fraudulent tax returns on behalf of businesses trying to claim pandemic-era stimulus funds.

The company allegedly solicited single member LLCs, including independent contractors, rideshare drivers, sole proprietors, and other Form 1099 workers to convert their businesses into LLCs taxed as S corporations in order to claim the ERC.

The owners then instructed and trained their employees on how to prepare the tax forms to increase the number of credits received for businesses. They would increase the number of employees, the paid wages, the sick leave wages and other factors to fraudulently boost the checks of the companies.

In some case, they would forge the signatures. All told they were able to get $11 million in ERC credits as part of the scheme.

A Scammers Delight – Have You Received A Robocall Lately?

If you are like me, you’re probably getting lots of robocalls these days – many of which are from scammers claiming to help you get $26,000 per employee.

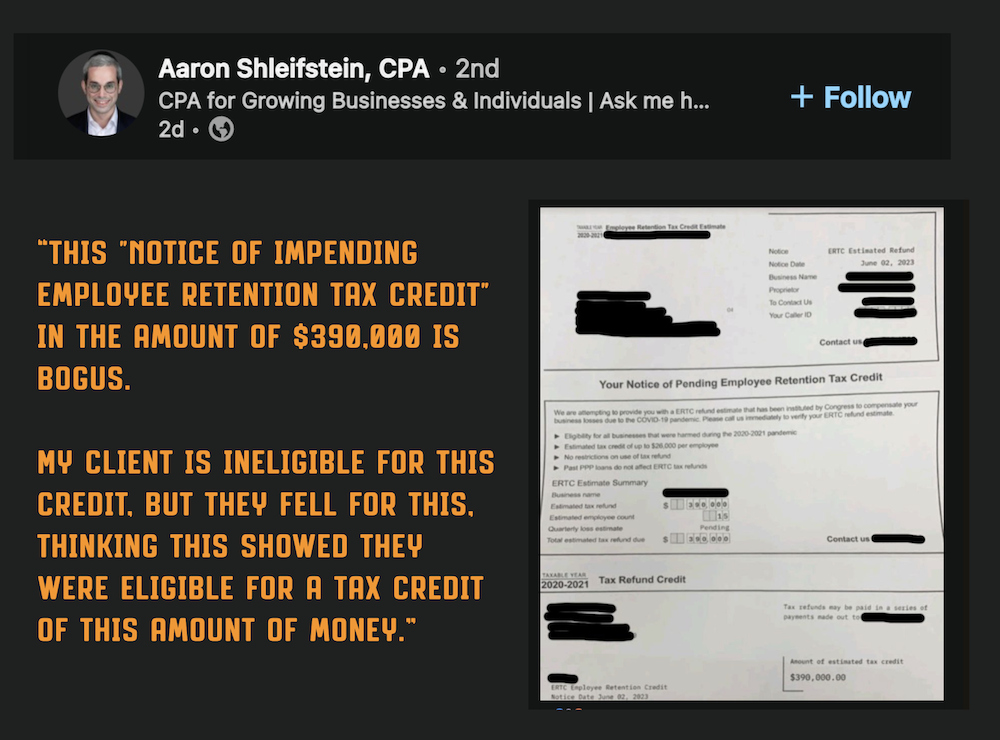

A Linkedin Post by CPA Aaron Shleifstein caught my eye this week and shows just how ubiquitous these scams are.

In his post he highlights that many of his clients are receiving completely bogus claims from companies trying to get their money. The notices are cleverly disguised to look like they come from government agencies and they make outlandish claims.

They Are After Fees or A Cut Of The Refund But Victims Are On The Hook

Ads about the ERC have exploded across all media formats with advertisers claiming businesses can receive $26,000 per employee.

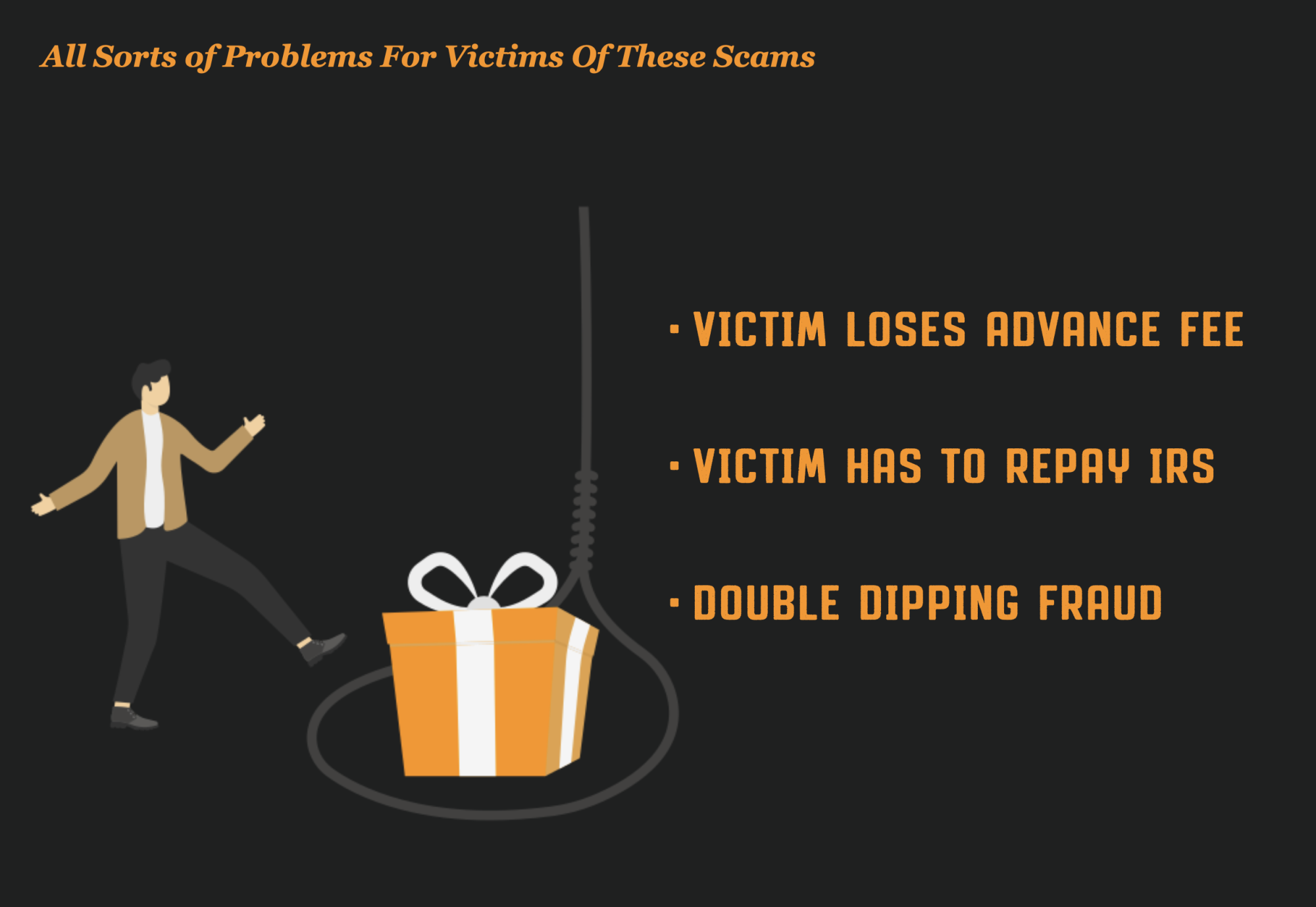

The way these companies are making money however is by charging large upfront fees, or for taking a percentage of the refund that they are able to get the victim.

What the victims don’t understand however is that even if they get the money, they could be on the hook later to repay it, along with penalties and interest if it is deemed to be fraud.

They could also be in hot water for double dipping if they took a PPP loan.

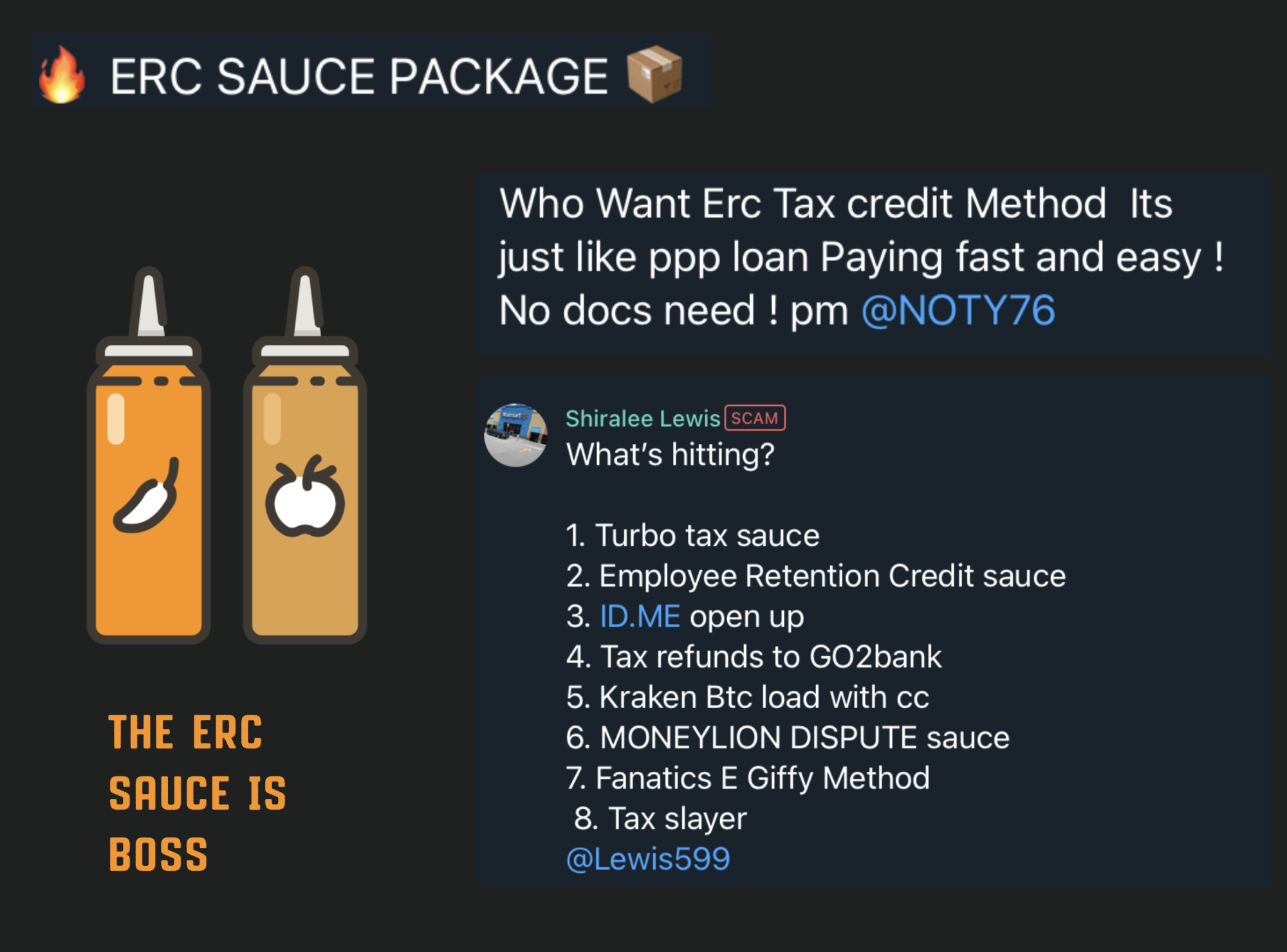

Lots of Sauce – It’s Not Only Scammers But Fraudsters Filing False Claims Too

But the problem doesn’t appear to be limited to just scammers. Telegram is lit up with advertisements and methods to tap into this goldmine of money.

ERC Methods, ERC Sauce and even comparisons to how the ERC is paying “fast and easy” just like PPP.

The IRS Is On High Alert and Says Fraud Is Rampant

The IRS has no idea how much fraud is happening and how many fraudulent returns have been filed, but it’s a lot, and they say businesses are unknowingly double-dipping if they have already received PPP loans from the government.

The IRS says fraud is “rampant” and that “taxpayers waiting for their amended returns will experience a longer than usual delay in processing.”

The I.R.S. said it had already paid out $152 billion in refunds associated with the tax credit and had a backlog of about 800,000 applications that it was trying to process.

The IRS issued a warning last month that “tax professionals continue to see a barrage of aggressive broadcast advertising, direct mail solicitations and online promotions involving the Employee Retention Credit. While the credit is real, aggressive promoters are wildly misrepresenting and exaggerating who can qualify for the credits.”

The IRS has stepped up audit and criminal investigation work involving these claims. Businesses, tax-exempt organizations and others considering applying for this credit need to carefully review the official requirements for this limited program before applying. Those who improperly claim the credit face follow-up action from the IRS.