Mortgage Fraud Risk Falls to Historic Low

First American today released the First American Loan Application Defect Index for January 2020, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The index, which is released each quarter, shows that mortgage fraud risk has dropped to its lowest level in the last 9 years in large part […]

Fannie Mae Warns Lenders of Fake Employers Used in Fraud

Fannie Mae has a program to alert lenders to employers that Mortgage Brokers use to facilitate their fraud schemes. In 2018, they reported a list of over 30 employers that were involved in known fraud schemes and warned lenders to watch out for these employers on incoming applications. Fannie Mae warned that if one of […]

Shark in The Housing Pool – A Mortgage Fraud Story

During the last three years, I’d swindled most of America’s biggest banks out of more than $15 million using fake and stolen identities, forgeries and my knowledge of the mortgage industry. I’d manipulated public records, all three credit bureaus, defeated the security procedures of six states’ department of motor vehicles and the U.S. State Department’s […]

Former Mortgage Broker Exposes His Fraud Methods

Matthew Cox is a former mortgage fraud broker and admitted fraudster. He falsified documents to make it appear that he owned properties, and then fraudulently obtained mortgages on them for five to six times their actual worth. He was so brazen that he perpetrated fraud over many years and was convicted several different times. By […]

In 2019 Mortgage Fraud Risk is Declining in the US

In fraud, the drivers behind the numbers are sometimes more important than the numbers themselves. This is particularly true when examining the complex nature of mortgage fraud risk which is driven by a number of underlying factors including the economy, interest rates, property values and, general market conditions. Some people believe you would have to […]

In the UK, Only 3% of Property Fraud is Prevented

A new study released by ABC Finance has determined that only 3% of total property fraud cases in the UK are proactively prevented by fraud controls. Property fraud occurs when fraudsters take out fraudulent mortgages on a consumer’s property through identity theft. Since all property titles in the UK are published online, it is not […]

Mortgage Fraud Rises to Highest Level in Years

Fraud on new mortgage applications took a dramatic spike over the last quarter resulting in the highest level of fraud in over 7 years. CoreLogic released their quarterly fraud index which tracks the fraud risk of applications submitted by lenders that use their fraud detection systems. According to the Mortgage Fraud Report, there was a […]

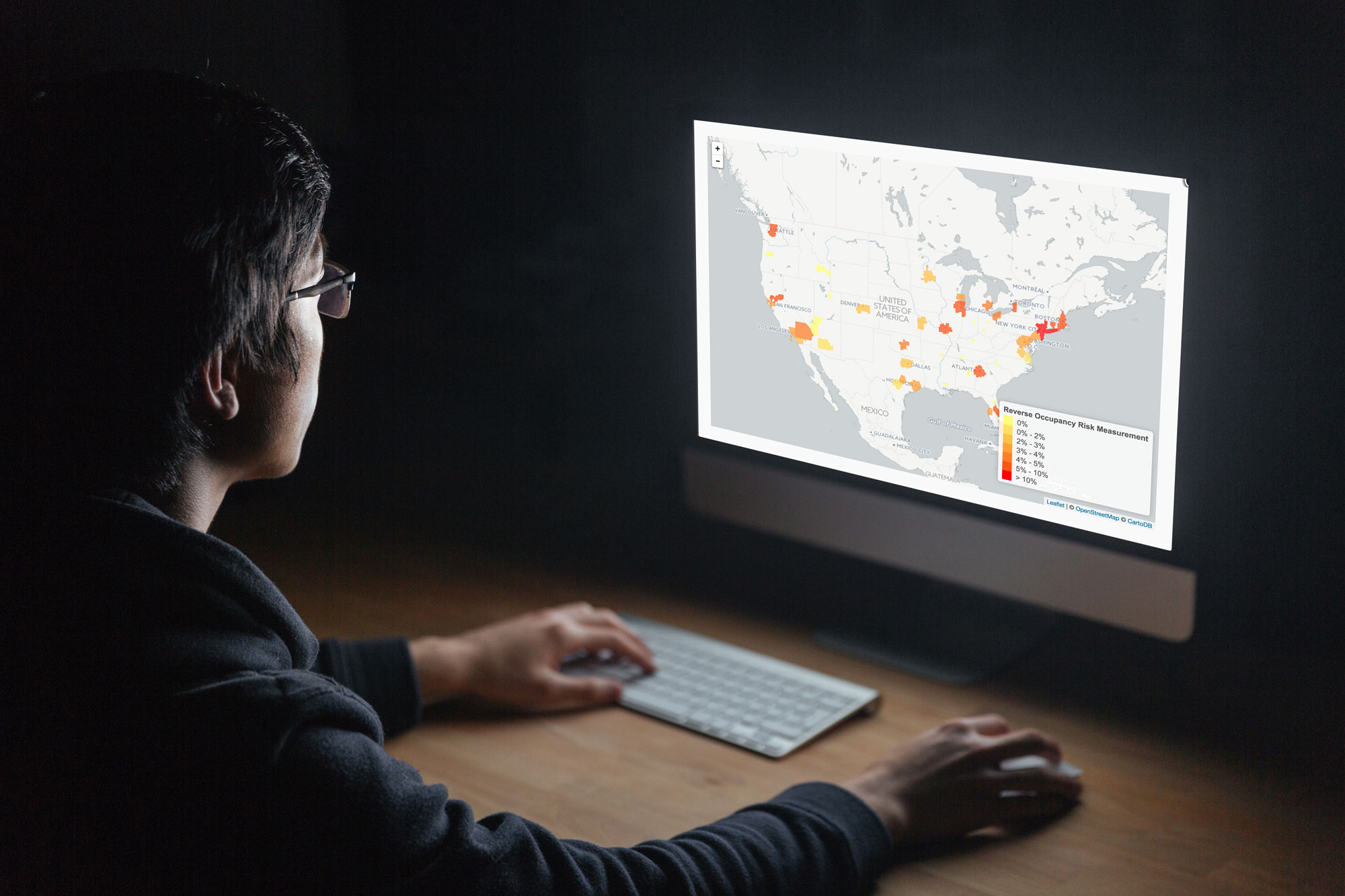

Fraud Scientists Uncover Reverse Occupancy Fraud

Liang Tian, a Fraud Scientist with CoreLogic in San Diego, has proved that fraudsters will do anything to fool mortgage lenders into approving fraudulent applications. And that includes doing a complete 180 on their fraud schemes to avoid detection. The latest scam? Reverse Occupancy Fraud where a borrower buys a home as an investment property […]