Auto Lenders should beware. Borrowers using false Social Security Numbers and so-called Credit Privacy Numbers (CPN’s) to apply for auto loans is on the rise and wreaking more havoc than ever.

Borrowers use false social security numbers to establish new credit profiles to disguise their true identities so that they can qualify for loans that they otherwise would not be able to.

Fraudsters are using these Frankenstein identities to purchase high-end cars that can net them hundreds of thousands in cash in as little as a single day.

Synthetic Identity Rate is Trending Up Sharply This Year

PointPredictive tracks millions of auto lending applications each month and is reporting a strong uptick in fraud attempts that appear to have the markers of potential synthetic identity.

In the last 90 days, fraud analyst have noticed a significant increase in fraud activity typically associated with synthetic identity. The strongest patterns of recent synthetic identity include:

- Use of ITIN’s that have not been issued by the SSA and that are invalid formats.

- Use of CPN’s or stolen social security numbers issued after 2011.

- Use of SSN’s where the SSN was issued before the borrower was born.

- Excessive use of authorized tradelines to artificially inflate borrowers credit scores

- Credit washing credit bureaus that appear to be missing tradeline activity for older borrowers

The strong uptick in detected synthetic identity fraud is an indicator that synthetic identity attempts are ticking up quickly for auto lenders nationwide.

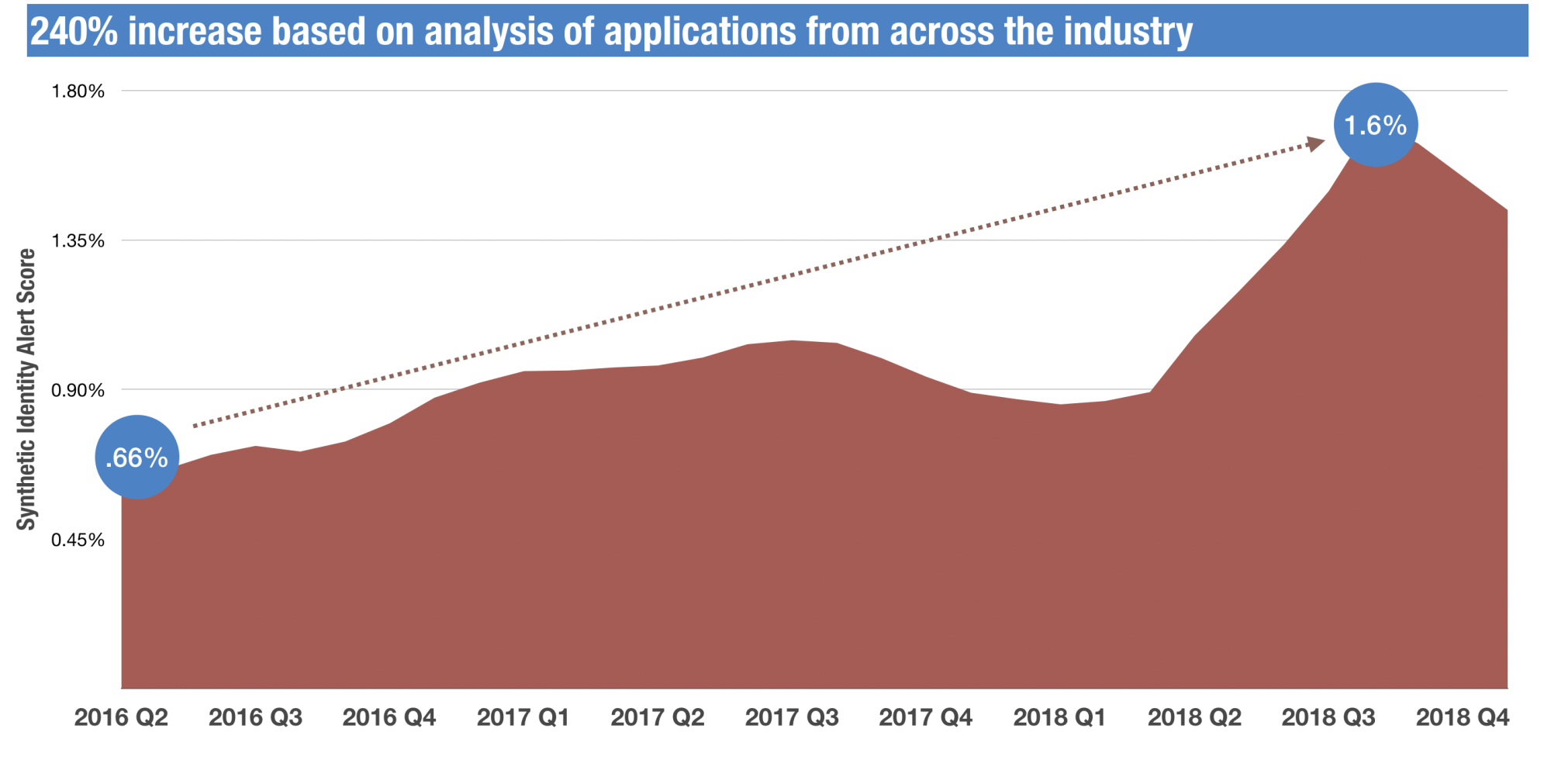

Synthetic Identity Has Increased 240% Since 2016

The sharp increase in synthetic fraud is nothing new, in fact, the increase in synthetic identity risk is something that PointPredictive has tracked since 2016.

From 2016 through 2018, Synthetic Identity Risk increased 240% as measured by the PointPredictive synthetic identity models.

The following chart shows the rate of high-risk synthetic identity applications on millions of loans analyzed between 2016 and 2018. The models appear to be indicating that approximately 1.6% of all applications to auto lenders contain markers of potential synthetic identity risk.

What Can You Do To Prevent The Increase?

Auto Lenders should engage in the following 5 activities to help identify and prevent synthetic identities.

#1 – Use Screening Tools that Specifically Look for Synthetic Risk

Traditional alerts will not identify synthetic identity so lenders need to leverage fraud models that can identify the specific patterns of synthetic identity risk.

#2 – Create a Fraud Analyst Team

Lenders without fraud teams are losing ground. Most large auto lenders have spent the last 2 years building up their fraud capabilities by having dedicated analyst review high-risk applications each day. If you don’t have a dedicated fraud team, you need one.

#3 – Train Underwriters on How to Spot Synthetic Identity

Underwriters should be well versed on what a synthetic identity application looks like. Fraud analyst can help create alerts and training guides to assist underwriters in identifying fraud.

#4 – Stop Approving Synthetic Identity Loans

Synthetic identity is growing rapidly in auto because fraudsters have figured out it works. And it works because many lenders choose to ignore synthetic identity risk because many times those loans end up being profitable. If the auto lending industry wants to reduce the risk of synthetic identity, lenders will need to take a hard stance and stop approving the loans just because they will perform.

Thanks for reading and hope you have a great day!