A report released today from Point Predictive estimates the auto lending industry now faces a historically high $9.2 billion in fraud exposure.

This represents a significant jump from the $7.9 billion reported in 2023, despite efforts by lenders to target deceptive practices by dealers, borrowers and unscrupulous credit repair companies.

The analysis was conducted across 256 million auto applications covering $4 trillion in loan submissions and billions of dollars in reported fraud and default by lenders.

The report highlights that the increase in fraud exposure is caused by more first party fraud schemes by borrowers, aided in part by credit repair companies and in some cases unscrupulous car dealerships.

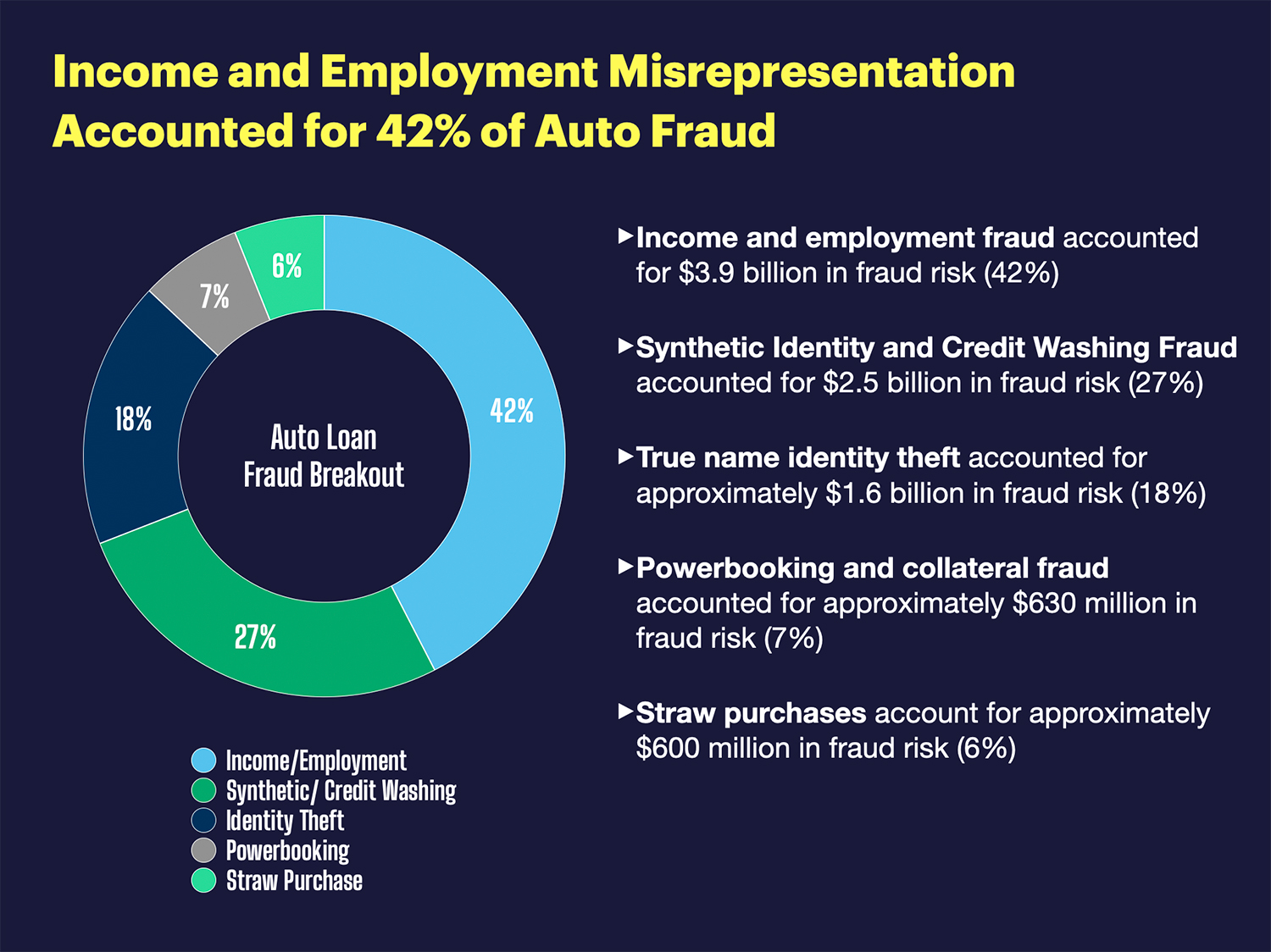

42% Of Auto Fraud Involves Misrepresentation of Income and Employment

Over two-thirds of the risk experienced by auto lenders was due to income and employment misrepresentation, and first party synthetic identity and credit washing.

These misrepresentations are typically associated with first-party fraud, where the borrower commits the fraud rather than a criminal using a stolen identity. Income and employment fraud accounted for 42% of all fraud experienced by auto lenders.

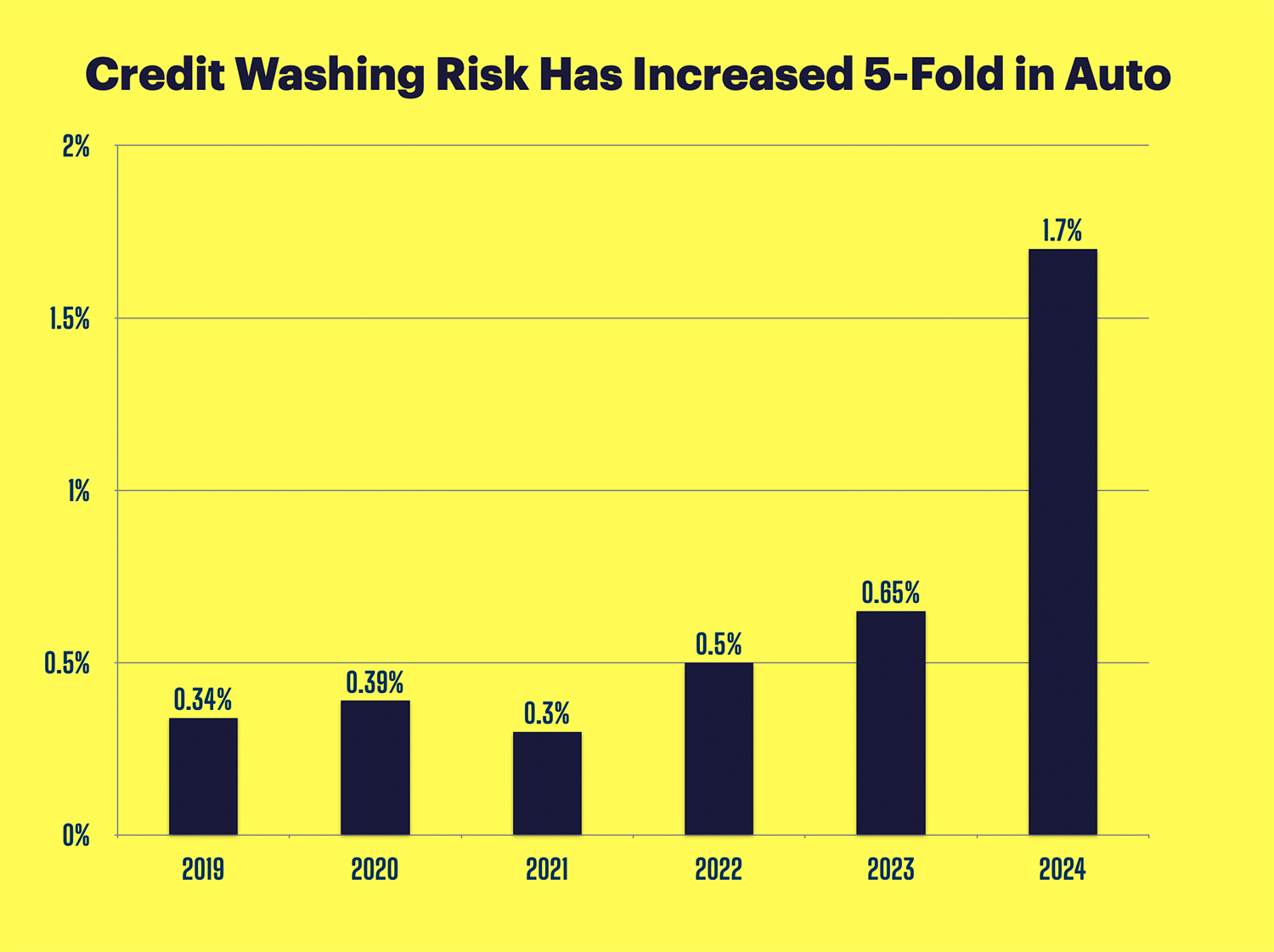

Credit Washing Fraud Has Exploded At Auto Lenders

Most surprising is the growth in rate of credit washing. Credit washing – where individuals systematically erase legitimate negative items from their credit reports by falsely claiming identity theft – saw the most dramatic increase of all fraud types. From t 0.34% of applications in 2019, credit washing alerts have skyrocketed to 1.7% in 2024 – a five-fold increase in just five years.

This fraud scheme begins when credit repair companies convince clients to file fraudulent identity theft reports with credit bureaus or the Federal Trade Commission. These official-looking documents are then used as “proof” to dispute every negative item on their credit reports.

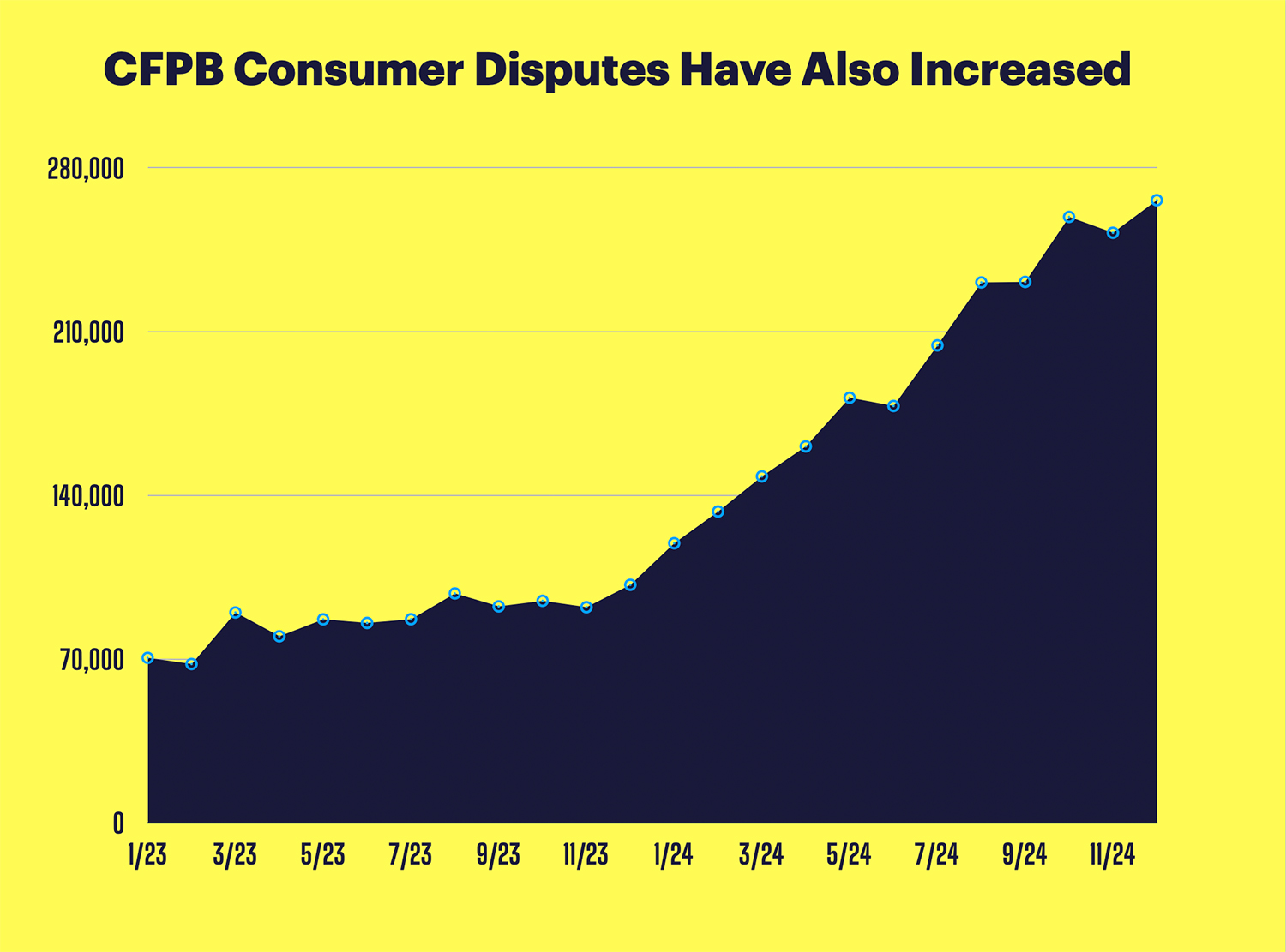

The CFPB Consumer Complaints data shows a similar trend, indicating a huge explosion in credit disputes. What began as roughly 70,000 monthly complaints in early 2023 skyrocketed to nearly 270,000 by December 2024 – a massive 285% increase in just two years.

1 in Every 114 Auto Applications Has Synthetic Identity Risk

The synthetic identity attack rate on auto lenders reached historic highs, hitting 88 basis points in 2024 – meaning nearly 1 in every 114 auto loan applications now involves a fabricated identity. This represents a dramatic increase from just 0.4% in 2020, more than doubling in just four years.

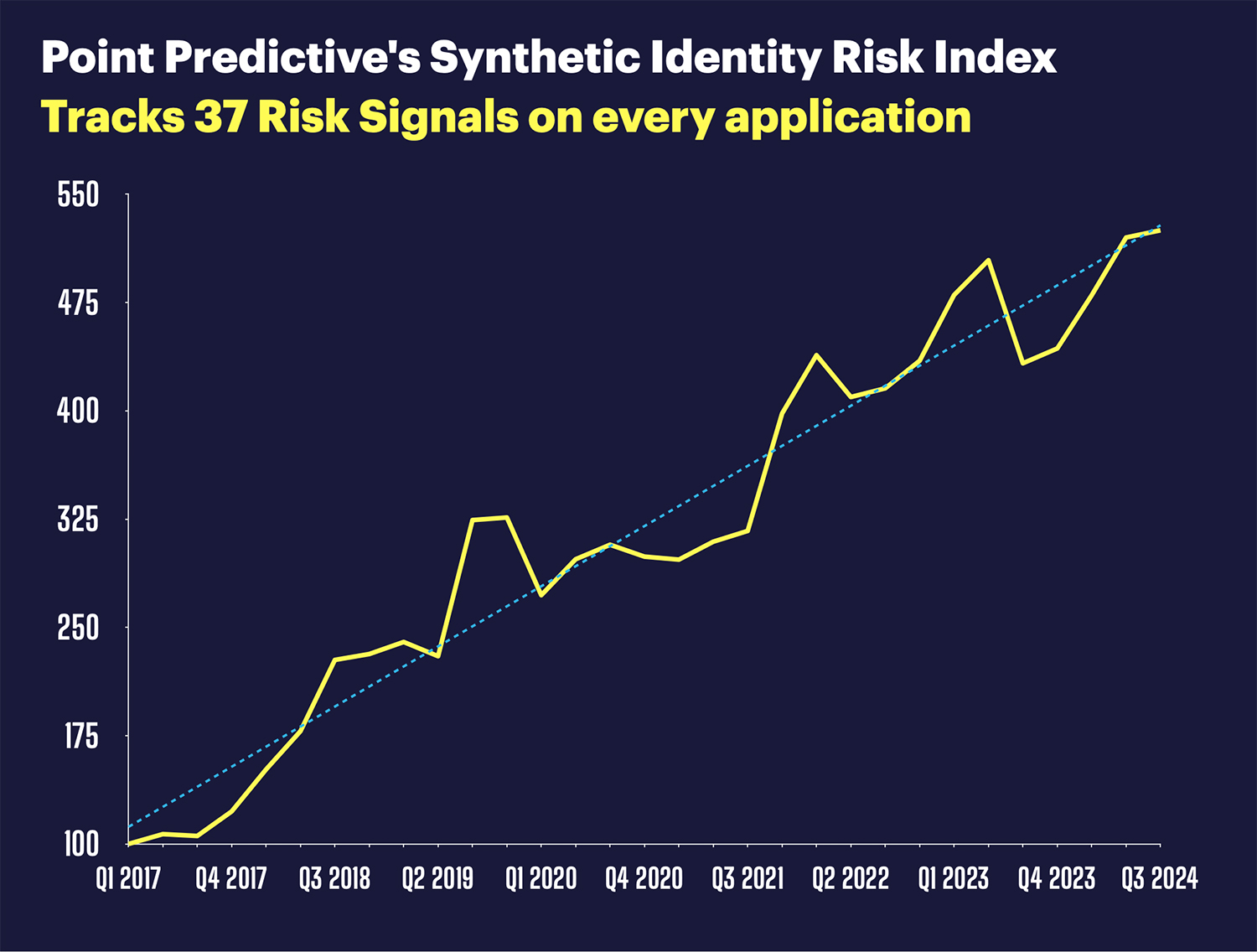

Point Predictive’s Synthetic Identity Risk Index, which tracks 37 separate synthetic identity risk signals, has skyrocketed from its baseline of 100 in early 2017 to a record 525 by Q3 (July) 2024 – more than a five-fold increase in just seven years.

According to TransUnion (cited in the report), lenders now face approximately $3.2 billion in potential losses from synthetic identities, with auto loans suffering the highest exposure – approximately double that of credit cards.

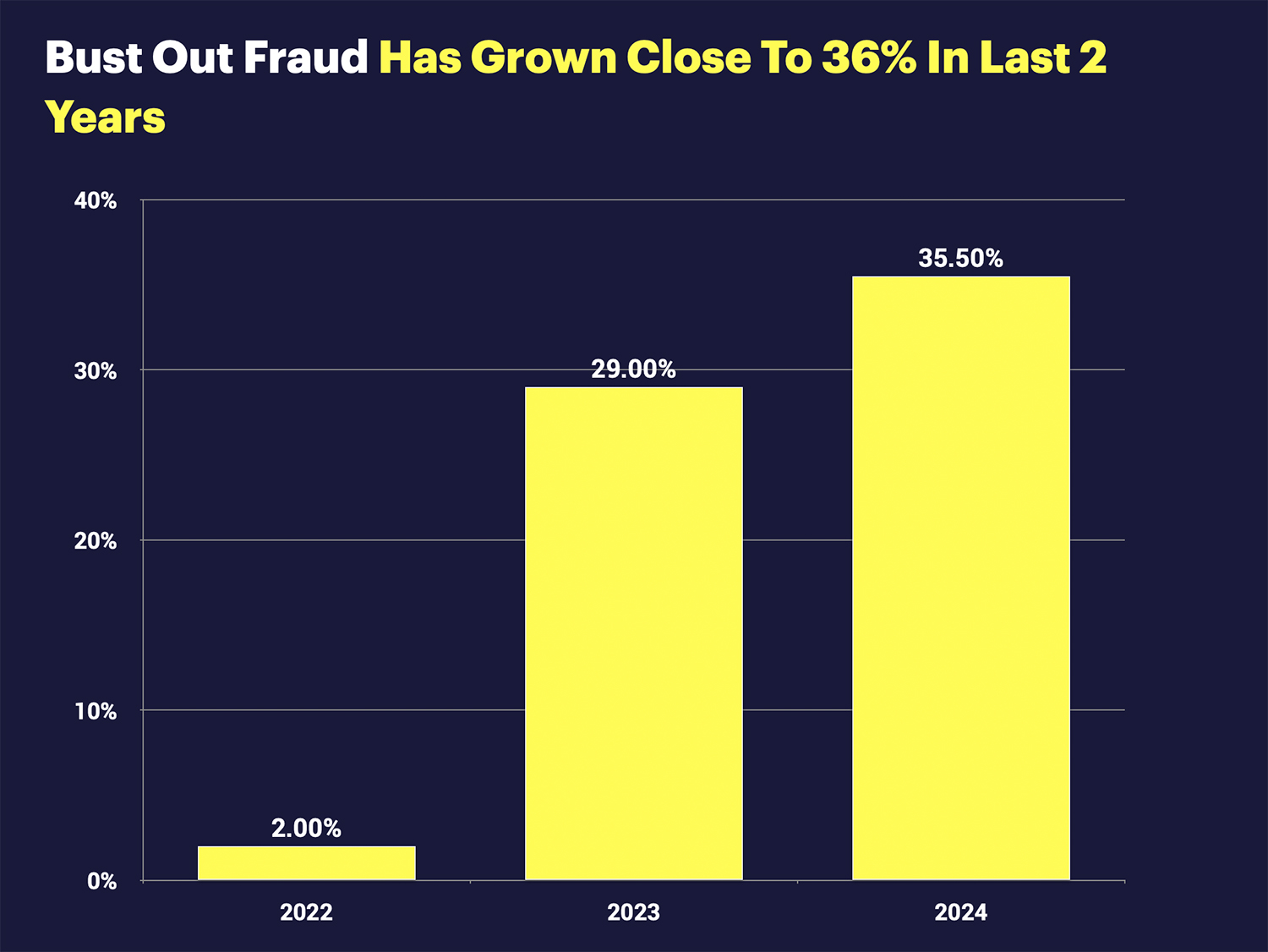

Bust Out Fraud Has Increased 36% In Auto Loan Applications In Last Two Years

Bust out fraud is a scheme that involves criminals creating multiple synthetic identities or in some cases people use their own identities to simultaneously apply for numerous car loans with no intention of making payments.

Point Predictive data revealed a surge in 2023, when bust out fraud incidents jumped from 2% growth to 29% growth year-over-year.

The trend continued into 2024, though at a more moderate pace, with a 6.5% increase from 2023. The growth demonstrates how fraudsters have increasingly targeted auto lenders with sophisticated bust out schemes.

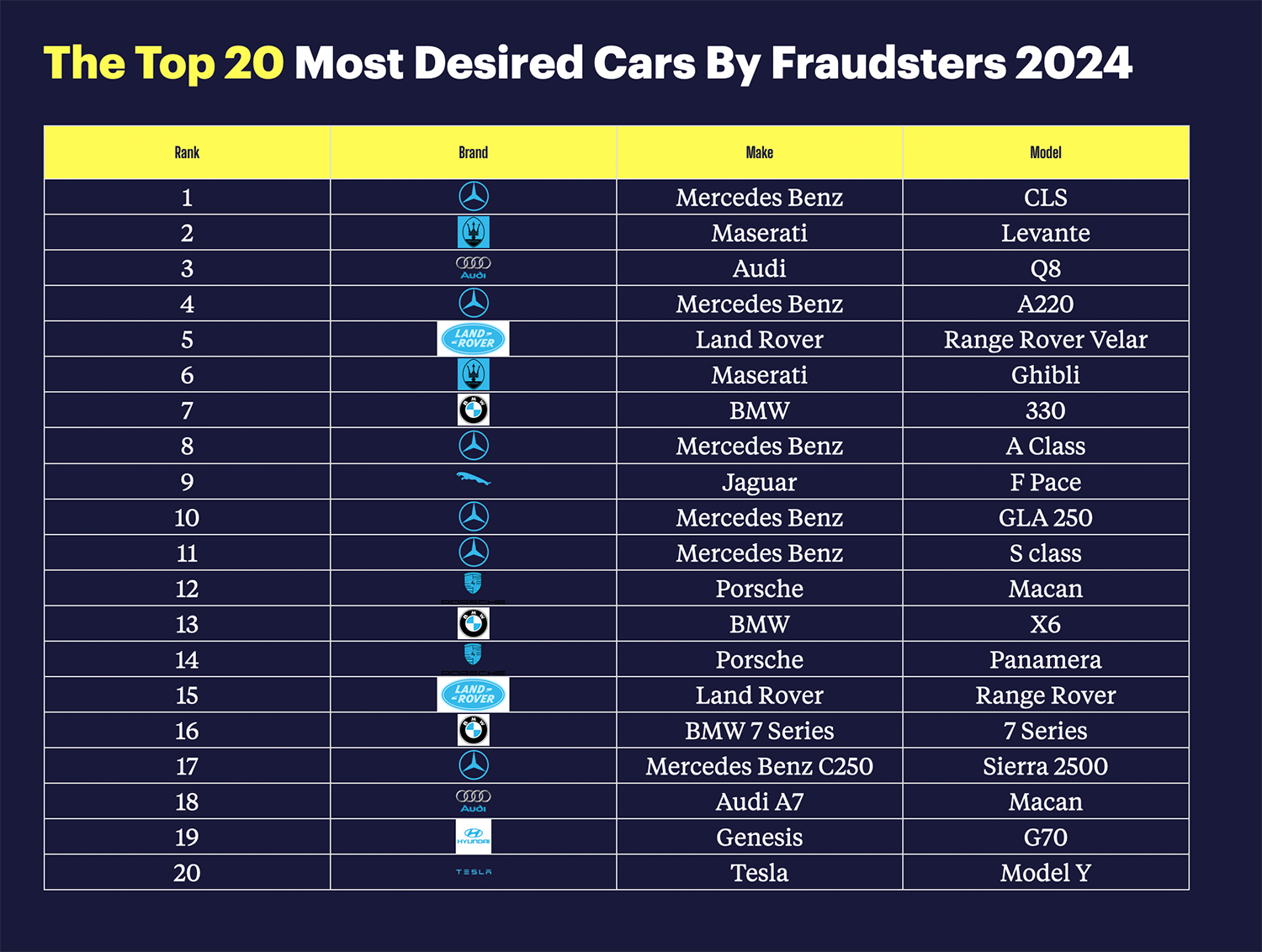

Fraudsters Prefer Luxury, Who Doesn’t?

Fraudsters overwhelmingly favor high-end European luxury vehicles, with Mercedes Benz dominating the list of most targeted models. The German automaker appears six times among the top 20 risky vehicles list.

Get More Insights Into Auto Lending Fraud Here

If you would like to receive a copy of the report so you can peruse more statistics and insights into Auto Lending Fraud click this link here.